|

市場調查報告書

商品編碼

1885812

碳捕獲利用化學品市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Carbon Capture Utilization Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

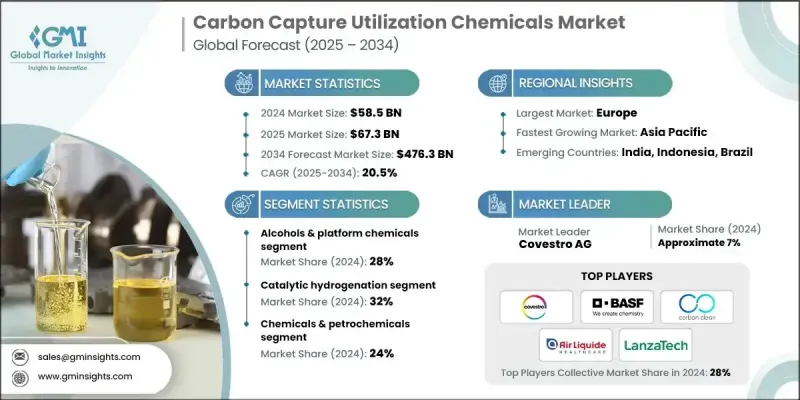

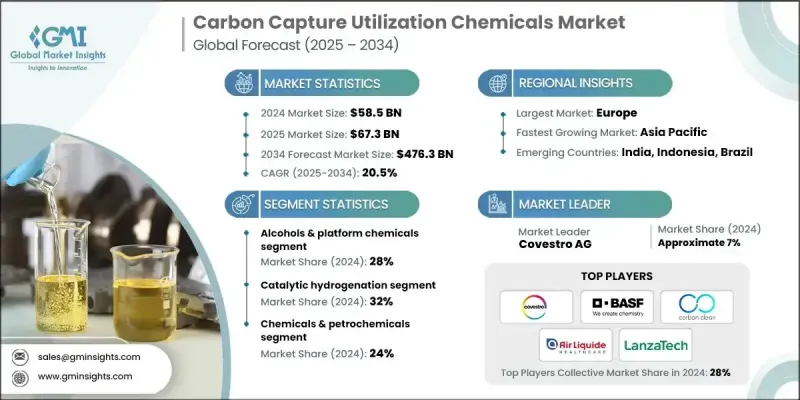

2024 年全球碳捕獲利用化學品市場價值為 585 億美元,預計到 2034 年將以 20.5% 的複合年成長率成長至 4,763 億美元。

全球企業正將低碳和負碳材料作為其長期淨零排放策略的優先考慮因素,這導致對利用捕獲的二氧化碳生產的解決方案的需求不斷成長。製造商正在擴大低排放材料的採購目標,多個行業正在採用二氧化碳基產品來減少供應鏈排放。催化、電解和系統整合技術的加速發展正在降低成本並提高性能,而新興催化劑技術的出現則進一步提升了二氧化碳轉化的效率和穩定性。高效能電解系統實現了更高的電流密度,並透過緊湊的系統設計降低了資本投資。市場也正從小型示範轉向全面商業化營運,將可再生氫、高濃度二氧化碳源和生物能源系統相結合的整合生產模式正在為部署創造強力的途徑。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 585億美元 |

| 預測值 | 4763億美元 |

| 複合年成長率 | 20.5% |

2024年,醇類和平台化學品市佔率為28%,預計到2034年將以23%的複合年成長率成長。這一成長前景與利用捕獲的二氧化碳和可再生氫生產甲醇和乙醇的規模擴大密切相關。多個地區的商業設施已開始生產再生甲醇,這是化學和燃料市場的重要原料。

2024年,催化加氫領域佔據了32%的市場佔有率,預計到2034年將以22.5%的複合年成長率成長。成熟的催化劑系統、完善的製程設計和成熟的工業應用為其商業潛力提供了支撐。新一代甲醇合成催化劑,以Cu、ZnO和Al₂O₃為主要成分,選擇性可達99%以上,同時產率與傳統製程相當。基於鈷和鐵的催化劑系統能夠將二氧化碳衍生的合成氣轉化為合成烴,並透過調整操作條件來控制產率。

2024年,建築業佔據20%的市場佔有率,預計將以25%的複合年成長率成長。需求成長主要得益於二氧化碳減排混凝土材料和低碳水泥的廣泛應用。各大地區基礎設施投資的增加,使得建築材料對低排放的要求更加嚴格,進一步增強了市場成長動能。

2024年,歐洲碳捕獲利用化學品市場佔有率達到32%,這得益於旨在促進大規模碳管理的重大氣候政策。區域性措施的目標是到2030年將二氧化碳儲存能力擴大到每年5000萬噸,同時制定了到2040年發展跨境二氧化碳商品市場的長期計劃,目標是每年捕獲2.8億噸二氧化碳。

全球碳捕獲利用化學品市場的主要企業包括:Climeworks AG、Aker Carbon Capture ASA、Carbon Upcycling Technologies Inc.、Covestro AG、Air Liquide SA、Liquid Wind AB、Econic Technologies Ltd.、Blue Planet Systems Corporation、Carbon Recycling International (CRI)、SK Innovation Co., Ltd.、Alix Systems Corporation、Cercling International (CRI)、SK Innovation Co., SESF、EnbonC. Inc.、Solidia Technologies, Inc.、Avantium NV、Carbon Clean Solutions Ltd.、三菱化學集團、Novomer Inc. 和 SABIC。這些碳捕獲利用化學品市場的領導者正透過擴大商業產能、建立貫穿整個產業鏈的長期合作夥伴關係以及大力投資下一代催化劑和電解技術來鞏固其競爭地位。許多公司也正在最佳化將捕獲的二氧化碳與可再生氫氣結合的整合系統,以降低生產成本並提高系統效率。與能源、化學和建築公司進行策略合作有助於簡化承購協議並確保穩定的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 醇類和平台化學品

- 聚合物和塑膠

- 烯烴和碳氫化合物

- 合成氣及中間體

- 建築材料和骨材

- 特種化學品及其他化學品

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 電化學轉化

- 催化氫化

- 氣體發酵和生物轉化

- 熱化學轉化

- 礦化作用和碳酸化作用

- 直接化學合成

第7章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 汽車

- 內部組件

- 外部元件

- 引擎蓋下的應用

- 建築施工

- 住宅建築

- 商業建築

- 基礎建設與土木工程

- 包裝

- 食品飲料包裝

- 工業包裝

- 消費品包裝

- 化學品和石油化工產品

- 基礎化學品生產

- 特種化學品

- 農業化學品

- 航空

- 商業航空

- 貨物及貨運

- 軍事與國防

- 衛生保健

- 醫療器材

- 藥品包裝

- 醫院及臨床用品

- 農業

- 農作物生產

- 肥料和土壤改良劑

- 農業設備

- 電子產品和消費品

- 消費性電子產品

- 家用電器

- 體育用品

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Air Liquide SA

- Aker Carbon Capture ASA

- Avantium NV

- BASF SE

- Blue Planet Systems Corporation

- Carbon Clean Solutions Ltd.

- Carbon Recycling International (CRI)

- Carbon Upcycling Technologies Inc.

- CarbonCure Technologies Inc.

- Climeworks AG

- Covestro AG

- Econic Technologies Ltd.

- LanzaTech Global, Inc.

- Liquid Wind AB

- Mitsubishi Chemical Group Corporation

- Novomer Inc.

- SABIC

- SK Innovation Co., Ltd.

- Solidia Technologies, Inc.

- TotalEnergies SE

- Others

The Global Carbon Capture Utilization Chemicals Market was valued at USD 58.5 billion in 2024 and is estimated to grow at a CAGR of 20.5% to reach USD 476.3 billion by 2034.

Companies across the world are prioritizing low-carbon and carbon-negative materials as part of their long-term net-zero strategies, leading to rising demand for solutions produced from captured carbon dioxide. Manufacturers are broadening procurement goals for lower-emission materials, and multiple industries are adopting CO2-based products to cut supply-chain emissions. Accelerated advancements in catalysis, electrolysis, and system integration are lowering costs and improving performance, supported by emerging catalyst technologies that deliver stronger efficiency and stability in CO2 conversion. High-performance electrolysis systems are achieving increased current densities, which reduces capital investment through compact system design. The market is also shifting from small-scale demonstrations to full commercial operations, with integrated production models combining renewable hydrogen, concentrated CO2 sources, and bioenergy systems to create powerful pathways for deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.5 Billion |

| Forecast Value | $476.3 Billion |

| CAGR | 20.5% |

The alcohols and platform chemicals segment held 28% share in 2024 and is projected to grow at a 23% CAGR by 2034. This outlook is linked to expanding production of methanol and ethanol derived from captured CO2 and renewable hydrogen. Commercial facilities in multiple regions are already producing renewable methanol that serves as a key feedstock for chemical and fuel markets.

The catalytic hydrogenation segment accounted for 32% share in 2024 and is anticipated to grow at a CAGR of 22.5% through 2034. Its commercial potential is supported by mature catalyst systems, well-defined process designs, and proven industrial implementation. Next-generation methanol synthesis catalysts featuring Cu, ZnO, and Al2O3 compositions are reaching selectivity levels above 99% while achieving yields like conventional processes. Catalyst systems based on cobalt and iron enable the conversion of CO2-derived syngas into synthetic hydrocarbons, with output tailored by adjusting operating conditions.

The construction segment held 20% share in 2024 and is projected to grow at a CAGR of 25%. Demand growth is driven by expanding adoption of CO2-enhanced concrete materials and low-carbon cement. Increasing investments in infrastructure across major regions are incorporating stricter specifications for lower-emission building inputs, which is strengthening market momentum.

Europe Carbon Capture Utilization Chemicals Market held 32% share in 2024, supported by major climate policies designed to promote large-scale carbon management. Regional initiatives aim to expand CO2 storage capacity to 50 million tons per year by 2030, alongside long-term plans to develop a cross-border CO2 commodity market by 2040 targeting 280 million tons in annual capture.

Prominent companies operating in the Global Carbon Capture Utilization Chemicals Market include Climeworks AG, Aker Carbon Capture ASA, Carbon Upcycling Technologies Inc., Covestro AG, Air Liquide S.A., Liquid Wind AB, Econic Technologies Ltd., Blue Planet Systems Corporation, Carbon Recycling International (CRI), SK Innovation Co., Ltd., TotalEnergies SE, CarbonCure Technologies Inc., BASF SE, LanzaTech Global, Inc., Solidia Technologies, Inc., Avantium N.V., Carbon Clean Solutions Ltd., Mitsubishi Chemical Group Corporation, Novomer Inc., and SABIC. Leading players in the Carbon Capture Utilization Chemicals Market are strengthening their competitive position by scaling commercial production capacity, forming long-term partnerships across industrial value chains, and investing heavily in next-generation catalyst and electrolysis technologies. Many companies are also optimizing integrated systems that combine captured CO2 with renewable hydrogen to reduce production costs and improve system efficiency. Strategic collaborations with energy, chemical, and construction firms help streamline offtake agreements and secure stable demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Technology

- 2.2.4 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alcohols & platform chemicals

- 5.3 Polymers & plastics

- 5.4 Olefins & hydrocarbons

- 5.5 Syngas & intermediates

- 5.6 Building materials & aggregates

- 5.7 Specialty & other chemicals

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Electrochemical conversion

- 6.3 Catalytic hydrogenation

- 6.4 Gas fermentation & biological conversion

- 6.5 Thermochemical conversion

- 6.6 Mineralization & carbonation

- 6.7 Direct chemical synthesis

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Interior components

- 7.2.2 Exterior components

- 7.2.3 Under-the-hood applications

- 7.3 Construction & building

- 7.3.1 Residential construction

- 7.3.2 Commercial buildings

- 7.3.3 Infrastructure & civil engineering

- 7.4 Packaging

- 7.4.1 Food & beverage packaging

- 7.4.2 Industrial packaging

- 7.4.3 Consumer goods packaging

- 7.5 Chemicals & petrochemicals

- 7.5.1 Base chemicals production

- 7.5.2 Specialty chemicals

- 7.5.3 Agrochemicals

- 7.6 Aviation

- 7.6.1 Commercial aviation

- 7.6.2 Cargo & freight

- 7.6.3 Military & defense

- 7.7 Healthcare

- 7.7.1 Medical devices

- 7.7.2 Pharmaceutical packaging

- 7.7.3 Hospital & clinical supplies

- 7.8 Agriculture

- 7.8.1 Crop production

- 7.8.2 Fertilizers & soil amendments

- 7.8.3 Agricultural equipment

- 7.9 Electronics & consumer goods

- 7.9.1 Consumer electronics

- 7.9.2 Home appliances

- 7.9.3 Sporting goods

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Air Liquide S.A.

- 9.2 Aker Carbon Capture ASA

- 9.3 Avantium N.V.

- 9.4 BASF SE

- 9.5 Blue Planet Systems Corporation

- 9.6 Carbon Clean Solutions Ltd.

- 9.7 Carbon Recycling International (CRI)

- 9.8 Carbon Upcycling Technologies Inc.

- 9.9 CarbonCure Technologies Inc.

- 9.10 Climeworks AG

- 9.11 Covestro AG

- 9.12 Econic Technologies Ltd.

- 9.13 LanzaTech Global, Inc.

- 9.14 Liquid Wind AB

- 9.15 Mitsubishi Chemical Group Corporation

- 9.16 Novomer Inc.

- 9.17 SABIC

- 9.18 SK Innovation Co., Ltd.

- 9.19 Solidia Technologies, Inc.

- 9.20 TotalEnergies SE

- 9.21 Others