|

市場調查報告書

商品編碼

1885800

消費品零售包裝及展示盒市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Retail Packaging and Display Boxes for Consumer Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

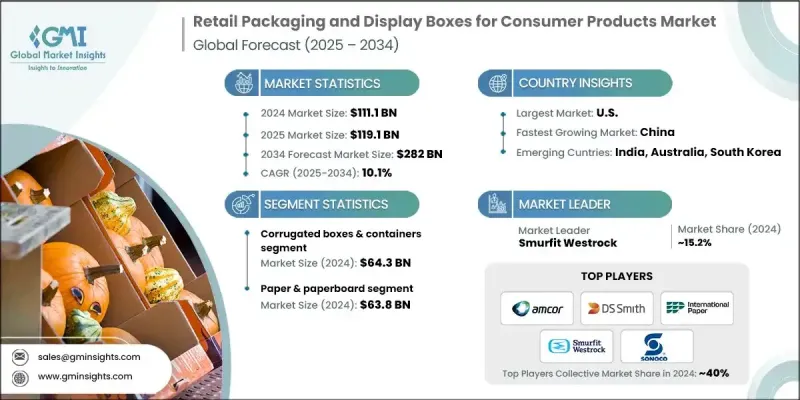

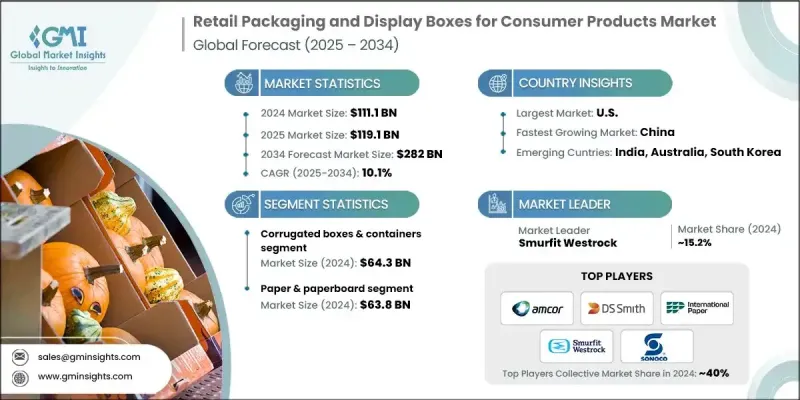

2024 年全球消費品零售包裝和展示盒市場價值為 1,111 億美元,預計到 2034 年將以 10.1% 的複合年成長率成長至 2,820 億美元。

包裝產業正經歷變革性的轉變,這主要受不斷變化的環境法規、消費者期望以及技術創新的驅動。包裝企業正在適應日益複雜的監管環境,面臨對可回收性、廢棄物管理和化學品安全更嚴格的要求。同時,在物聯網 (IoT) 技術的推動下,智慧互聯包裝正在興起,使包裝能夠在整個供應鏈中即時傳遞訊息。原料供應商生產的軟性基材、導電油墨和相容感測器的材料,在保持傳統包裝功能的同時,融入了數位化特性。品牌正擴大利用這些創新技術,在保持成本效益和可擴展性的同時,提供互動體驗、提升產品可見度並強化永續發展承諾,所有這些都將惠及全球零售和電商通路。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1111億美元 |

| 預測值 | 2820億美元 |

| 複合年成長率 | 10.1% |

2024年,瓦楞紙箱及包裝容器市場規模達到643億美元,預計到2034年將以9.7%的複合年成長率成長。其受歡迎的原因在於其多功能性、成本效益以及在零售和電商領域的廣泛應用。瓦楞紙材料具有高度可回收性和生物分解性,既符合永續發展目標,也滿足了消費者的需求。印刷和模切技術的進步使品牌能夠打造出個人化、引人注目且極具貨架吸引力的包裝。

2024年,紙和紙板產業產值達638億美元。紙質包裝因其可回收性和可生物分解性而備受青睞,既符合監管要求,也符合消費者環保意識。其可靈活應用於折疊紙盒、硬紙盒和展示包裝等多種形式,使其成為包括食品、化妝品、電子產品和服裝在內的眾多產品的理想包裝選擇。

2024年,美國消費品零售包裝與展示盒市場規模將達223億美元。這一成長得益於美國強大的零售和電子商務基礎設施,以及消費者對永續和個人化包裝的需求。監管支持和消費者環保意識的提高,促使製造商更加重視可回收和可堆肥包裝,從而提升品牌聲譽並符合環保法規。

全球消費品零售包裝和展示盒市場的主要參與者包括:Graphic Packaging International、Stora Enso、DS Smith、Amcor、Mondi Group、Bennett Packaging、BW Packaging Systems、Weedon Direct、Sonoco Products Company、Karl Knauer Group、Georgia-Pacific、Barry-Wehmiller Corporation、Ashtonco Products Company.各公司正透過拓展永續產品線、投資先進的印刷和模切技術以及提高供應鏈效率等策略來鞏固其市場地位。策略合作和收購有助於擴大地域覆蓋範圍和客戶群。此外,各公司也致力於智慧互動包裝的創新、開發環保且經濟高效的材料以及增強品牌客製化選項。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 2024年定價分析

- 按地區和產品類型

- 原料成本

- 未來市場趨勢

- 風險評估與緩解

- 監理合規風險

- 產能限制影響分析

- 技術轉型風險

- 價格波動和成本上漲風險

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 瓦楞紙箱和貨櫃

- 單層瓦楞紙箱

- 雙層瓦楞紙箱

- 三層壁重型容器

- 特殊笛型配置(E調、F調、微型笛)

- 折疊紙板箱

- 折疊式紙箱

- 自動底部紙箱

- 反向折疊式

- 特殊閉合系統

- 剛性安裝盒

- 伸縮盒

- 磁性閉合系統

- 抽屜式盒子

- 書本式及翻蓋式包裝盒

- 可直接用於展示的包裝

- 貨架即用包裝(SRP)

- 零售包裝(RRP)

- 銷售點展示

- 獨立式展示單元(FSDU)

- 模切展示容器

- 櫃檯展示

- 落地展示

- 促銷道具

- 季節性展示方案

第6章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 塑膠

- 紙和紙板

- 玻璃

- 金屬

- 其他(永續替代方案等)

第7章:市場估計與預測:依價格分類,2021-2034年

- 主要趨勢

- 經濟

- 中檔

- 優質的

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 食品和飲料

- 新鮮農產品和易腐品

- 加工食品和零食

- 飲料及液體產品

- 乳製品和冷藏產品

- 化妝品及個人護理

- 美容保養產品

- 香水和奢侈化妝品

- 個人衛生用品

- 專業美容工具

- 醫藥與醫療保健

- 非處方藥

- 醫療器材及設備

- 保健品及營養保健品

- 診斷和檢測試劑盒

- 電子產品和消費品

- 小家電和小玩意

- 消費性電子配件

- 技術產品及組件

- 遊戲及娛樂產品

- 其他(服裝和時尚、工具和五金等)

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第11章:公司簡介

- Amcor

- Ashtonne Packaging

- Barry-Wehmiller Corporation

- Bennett Packaging

- BW Packaging Systems

- DS Smith

- Georgia-Pacific

- Graphic Packaging International

- International Paper Company

- Karl Knauer Group

- Mondi Group

- Smurfit Westrock

- Sonoco Products Company

- Stora Enso

- Weedon Direct

The Global Retail Packaging and Display Boxes for Consumer Products Market was valued at USD 111.1 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 282 billion by 2034.

The sector is undergoing transformative changes driven by evolving environmental regulations, shifting consumer expectations, and technological innovations. Packaging companies are adapting to a complex regulatory landscape, with stricter requirements on recyclability, waste management, and chemical safety. Simultaneously, smart and connected packaging is emerging, enabled by Internet of Things (IoT) technologies, allowing packages to communicate real-time information across the supply chain. Raw material suppliers produce flexible substrates, conductive inks, and sensor-compatible materials that maintain traditional packaging functionality while integrating digital features. Brands are increasingly leveraging these innovations to deliver interactive experiences, enhance product visibility, and reinforce sustainability commitments, all while maintaining cost efficiency and scalability across global retail and e-commerce channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $111.1 Billion |

| Forecast Value | $282 Billion |

| CAGR | 10.1% |

In 2024, the corrugated boxes and containers segment generated USD 64.3 billion and is expected to grow at a CAGR of 9.7% through 2034. Its popularity stems from versatility, cost-effectiveness, and applicability across retail and online commerce. Corrugated materials are highly recyclable and biodegradable, supporting sustainability goals and meeting consumer preferences. Advances in printing and die-cutting technologies allow brands to create personalized, eye-catching packaging with strong shelf appeal.

The paper and paperboard segment generated USD 63.8 billion in 2024. Paper-based packaging is valued for its recyclability and biodegradability, aligning with both regulatory requirements and eco-conscious consumer behavior. Its adaptability across folding cartons, rigid boxes, and display-ready packaging makes it ideal for a wide range of products, including food, cosmetics, electronics, and apparel.

U.S. Retail Packaging and Display Boxes for Consumer Products Market reached USD 22.3 billion in 2024. Growth is driven by the country's robust retail and e-commerce infrastructure, along with consumer demand for sustainable and personalized packaging. Regulatory support combined with heightened consumer awareness is prompting manufacturers to focus on recyclable and compostable formats, enhancing both brand reputation and environmental compliance.

Key players in the Global Retail Packaging and Display Boxes for Consumer Products Market include Graphic Packaging International, Stora Enso, DS Smith, Amcor, Mondi Group, Bennett Packaging, BW Packaging Systems, Weedon Direct, Sonoco Products Company, Karl Knauer Group, Georgia-Pacific, Barry-Wehmiller Corporation, Ashtonne Packaging, Smurfit Westrock, and International Paper Company. Companies are strengthening their presence through strategies such as expanding sustainable product lines, investing in advanced printing and die-cutting technologies, and improving supply chain efficiency. Strategic partnerships and acquisitions help broaden geographic reach and customer base. Firms are also focusing on innovation in smart and interactive packaging, developing eco-friendly and cost-effective materials, and enhancing brand customization options.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Material Type trends

- 2.2.3 Price trends

- 2.2.4 End Use trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 Risk-adjusted ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.4.1 By region and product type

- 3.4.2 Raw material cost

- 3.5 Future market trends

- 3.6 Risk assessment and mitigation

- 3.6.1 Regulatory compliance risks

- 3.6.2 Capacity constraint impact analysis

- 3.6.3 Technology transition risks

- 3.6.4 Pricing volatility and cost escalation risks

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Corrugated boxes & container

- 5.2.1 Single-wall corrugated boxes

- 5.2.2 Double-wall corrugated boxes

- 5.2.3 Triple-wall heavy-duty containers

- 5.2.4 Specialty flute configurations (E, F, micro-flute)

- 5.3 Folding paperboard boxes

- 5.3.1 Tuck-end cartons

- 5.3.2 Auto-bottom cartons

- 5.3.3 Reverse-tuck configurations

- 5.3.4 Specialty closure systems

- 5.4 Rigid set-up boxes

- 5.4.1 Telescopic boxes

- 5.4.2 Magnetic closure systems

- 5.4.3 Drawer-style boxes

- 5.4.4 Book-style & clamshell boxes

- 5.5 Display-ready packaging

- 5.5.1 Shelf-ready packaging (SRP)

- 5.5.2 Retail-ready packaging (RRP)

- 5.5.3 Point-of-purchase displays

- 5.5.4 Free-standing display units (FSDU)

- 5.6 Die-cut display containers

- 5.6.1 Counter displays

- 5.6.2 Floor displays

- 5.6.3 Promotional fixtures

- 5.6.4 Seasonal display solutions

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper & paperboard

- 6.4 Glass

- 6.5 Metal

- 6.6 Others (sustainable alternatives, etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Economy

- 7.3 Mid-range

- 7.4 Premium

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Fresh produce & perishables

- 8.2.2 Processed foods & snacks

- 8.2.3 Beverages & liquid products

- 8.2.4 Dairy & refrigerated products

- 8.3 Cosmetics & personal care

- 8.3.1 Beauty & skincare products

- 8.3.2 Fragrances & luxury cosmetics

- 8.3.3 Personal hygiene products

- 8.3.4 Professional beauty tools

- 8.4 Pharmaceuticals & healthcare

- 8.4.1 Over-the-counter medications

- 8.4.2 Medical devices & equipment

- 8.4.3 Health supplements & nutraceuticals

- 8.4.4 Diagnostic & testing kits

- 8.5 Electronics & consumer goods

- 8.5.1 Small appliances & gadgets

- 8.5.2 Consumer electronics accessories

- 8.5.3 Technology products & components

- 8.5.4 Gaming & entertainment products

- 8.6 Others (apparel and fashion, tools and hardware, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Amcor

- 11.2 Ashtonne Packaging

- 11.3 Barry-Wehmiller Corporation

- 11.4 Bennett Packaging

- 11.5 BW Packaging Systems

- 11.6 DS Smith

- 11.7 Georgia-Pacific

- 11.8 Graphic Packaging International

- 11.9 International Paper Company

- 11.10 Karl Knauer Group

- 11.11 Mondi Group

- 11.12 Smurfit Westrock

- 11.13 Sonoco Products Company

- 11.14 Stora Enso

- 11.15 Weedon Direct