|

市場調查報告書

商品編碼

1755258

展示包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Display Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

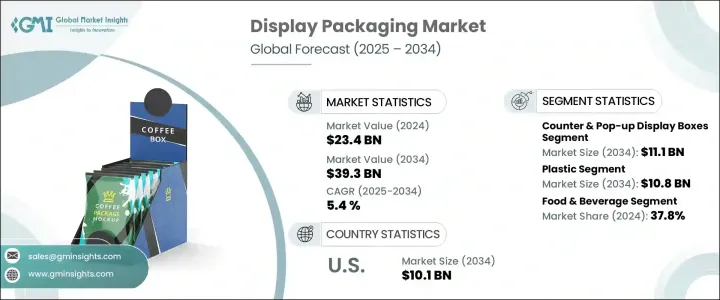

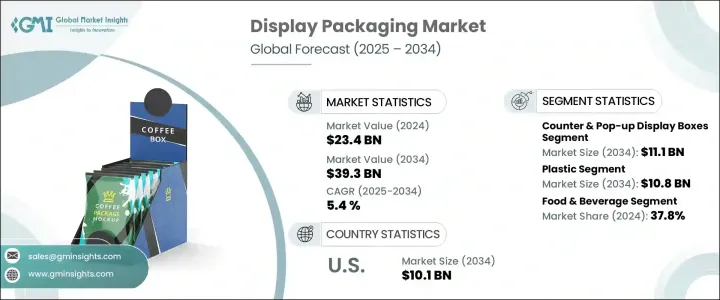

2024年,全球展示包裝市場規模達234億美元,預計到2034年將以5.4%的複合年成長率成長,達到393億美元。這得益於電子商務的快速成長,該領域持續對視覺吸引力強的包裝的需求,以提升產品曝光度並促進消費者參與。隨著越來越多的消費者選擇線上購物,創意和品牌化的展示包裝已成為推動銷售的關鍵因素。社群媒體趨勢,尤其是開箱內容,更凸顯了美觀包裝的重要性。

然而,全球貿易緊張局勢和關稅——尤其是川普政府時期發起的關稅——擾亂了供應鏈,導致紙板和塑膠等原料成本上漲。這些擾亂導致生產延誤,對製造商和供應商都產生了影響。客製化仍然是展示包裝成功的關鍵,因為它有助於品牌脫穎而出,並與消費者建立情感聯繫。市場的發展與永續性密切相關,人們對可回收材料和環保設計的興趣日益濃厚。隨著企業轉向更環保的解決方案,展示包裝領域的創新也不斷湧現,以應對不斷變化的消費者偏好和環境法規。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 234億美元 |

| 預測值 | 393億美元 |

| 複合年成長率 | 5.4% |

展示包裝產業涵蓋旨在提升產品展示效果和提升消費者參與度的各種形式,包括端蓋式展示架、托盤式展示架、透明包裝、落地式展示架以及櫃檯式和彈出式展示盒。每種類型在零售環境中都有其獨特的用途。預計到2034年,櫃檯式和彈出式展示盒市場規模將達到111億美元,成為最具影響力和商業成功的形式之一。這些展示方式兼具視覺吸引力和多功能性。品牌青睞將這些裝置放置在銷售點,因為其鮮明的圖形、富有創意的形狀和策略性的擺放位置會顯著影響購買決策。

從材料使用情況來看,塑膠仍然是整個產業的首選,預計到2034年其市場價值將達到108億美元。消費者對透明包裝的日益成長的偏好推動了這一成長,因為消費者更傾向於購買可見的產品。這種透明度能夠建立信任並提升貨架吸引力。同時,該行業正在向更環保的塑膠替代品轉型。為了滿足日益嚴格的環保標準和消費者對永續包裝的需求,各大品牌紛紛採用可回收和可生物分解的塑膠。

預計到2034年,德國展示包裝市場的複合年成長率將達到4.9%。德國在工程和製造領域根深蒂固的專業知識正在推動包裝解決方案的創新,尤其是在輕盈耐用的紙板材料方面。德國公司專注於緊湊型展示設計,以在不佔用過多空間的情況下提供最大的可視性。自動化和數位印刷技術的整合可實現快速客製化和可擴展生產,進一步鞏固德國在歐洲展示包裝領域的領先地位。

塑造競爭格局的關鍵參與者包括 Smurfit Kappa、Mondi Group、DS Smith、International Paper 和 WestRock Company。為了鞏固市場地位,領先的展示包裝公司正在實施以創新、策略合作夥伴關係和永續實踐為重點的策略。他們投資研發,開發符合全球環保標準的環保包裝解決方案。與零售商和品牌所有者的合作,使其能夠提供滿足不斷變化的消費者偏好的客製化設計。各公司也透過收購和設施升級來擴大其全球影響力,從而提高生產效率和地理覆蓋範圍。擁抱智慧包裝和自動化生產線等數位技術,是提升快速變化的零售環境中可擴展性和回應能力的另一個核心舉措。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 電子商務零售的成長

- 消費者對增強產品可見度的需求不斷成長

- 轉向永續包裝材料

- 消費者偏好方便易用的包裝

- 包裝解決方案的技術進步

- 產業陷阱與挑戰

- 客製化和創新成本高

- 設計複雜性和消費者期望

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 櫃檯和彈出式展示盒

- 落地式展示架

- 托盤展示

- 端蓋顯示器

- 透明包裝

第6章:市場估計與預測:依材料類型,2021-2034 年

- 主要趨勢

- 塑膠

- 紙和紙板

- 玻璃

- 金屬

- 其他

- 靈活的

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 食品和飲料

- 化妝品和個人護理

- 製藥

- 電子產品和家用電器

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- alphaglobalpackaging

- Amcor plc

- CustomBoxline

- DS Smith

- Graphic Packaging International, LLC

- Ibex Packaging

- International Paper

- Mondi Group

- Orora Visual

- Packaging Corporation of America

- PakFactory

- Rengo Co.

- Salazar Packaging

- Smurfit Kappa

- Stora Enso

- WestRock Company

The Global Display Packaging Market was valued at USD 23.4 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 39.3 billion by 2034, driven by the rapid growth in e-commerce continues to demand visually appealing packaging that enhances product visibility and encourages consumer engagement. As more shoppers opt for online purchases, the appeal of creative and branded display packaging becomes a key sales driver. Social media trends, particularly unboxing content, have amplified the importance of aesthetic packaging.

However, global trade tensions and tariffs-especially those initiated during the Trump administration-have disrupted supply chains by increasing the cost of raw materials like paperboard and plastic. These disruptions have resulted in production delays, impacting manufacturers and suppliers alike. Customization remains central to the success of display packaging as it helps brands differentiate and connect emotionally with consumers. The market's evolution is closely tied to sustainability, with rising interest in recyclable materials and eco-friendly design. As companies shift toward greener solutions, innovations in display packaging continue to emerge in response to changing consumer preferences and environmental regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.4 Billion |

| Forecast Value | $39.3 Billion |

| CAGR | 5.4% |

The display packaging industry encompasses formats designed to enhance product presentation and drive consumer engagement. These include endcap displays, pallet displays, transparent packaging, floor stand displays, and counter & pop-up display boxes. Each type serves a distinct purpose within the retail environment, The counter & pop-up display boxes segment is projected to reach USD 11.1 billion by 2034, emerging as one of the most impactful and commercially successful formats. These displays are driven by their ability to combine visual appeal with functional versatility. Brands favor these units for point-of-sale locations, where vibrant graphics, creative shapes, and strategic placement significantly influence purchase decisions.

Based on material usage, the plastic segment remains a leading choice across the industry and is expected to achieve a market value of USD 10.8 billion by 2034. The growing preference for transparent packaging has been instrumental in this growth, as consumers are more inclined to purchase items when the product is visible. This transparency builds trust and enhances shelf appeal. Simultaneously, the industry is undergoing a transition toward more eco-friendly plastic alternatives. Brands adopt recyclable and biodegradable plastics to meet tightening environmental standards and consumer demand for sustainable packaging.

Germany Display Packaging Market is forecasted to grow at a CAGR of 4.9% through 2034. The country's deep-rooted expertise in engineering and manufacturing is fueling innovation in packaging solutions, especially in lightweight yet durable cardboard materials. German companies focus on compact display designs that deliver maximum visibility without occupying excessive floor space. Integrating automation and digital printing technologies allows for rapid customization and scalable production, further solidifying Germany's position as a leader in the European display packaging landscape.

Key players shaping the competitive landscape include Smurfit Kappa, Mondi Group, DS Smith, International Paper, and WestRock Company. To solidify their market presence, leading display packaging companies are implementing strategies focused on innovation, strategic partnerships, and sustainable practices. They invest in R&D to develop eco-friendly packaging solutions that align with global environmental standards. Collaboration with retailers and brand owners allows for tailored designs that meet evolving consumer preferences. Companies are also expanding their global footprint through acquisitions and facility upgrades, enhancing production efficiency and geographic reach. Embracing digital technologies, such as smart packaging and automated production lines, is another core move to boost scalability and responsiveness in the fast-changing retail landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of e-commerce retailing

- 3.3.1.2 Rising consumer demand for enhanced product visibility

- 3.3.1.3 Shift towards sustainable packaging materials

- 3.3.1.4 Consumer preference for convenience and easy-to-use packaging

- 3.3.1.5 Technological advancements in packaging solutions

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of customization and innovation

- 3.3.2.2 Design complexity and consumer expectations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Counter & pop-up display boxes

- 5.3 Floor stand displays

- 5.4 Pallet displays

- 5.5 Endcap displays

- 5.6 Transparent packaging

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper & paperboard

- 6.4 Glass

- 6.5 Metal

- 6.6 Others

- 6.7 Flexible

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Cosmetics & personal care

- 7.4 Pharmaceuticals

- 7.5 Electronics & appliances

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 alphaglobalpackaging

- 9.2 Amcor plc

- 9.3 CustomBoxline

- 9.4 DS Smith

- 9.5 Graphic Packaging International, LLC

- 9.6 Ibex Packaging

- 9.7 International Paper

- 9.8 Mondi Group

- 9.9 Orora Visual

- 9.10 Packaging Corporation of America

- 9.11 PakFactory

- 9.12 Rengo Co.

- 9.13 Salazar Packaging

- 9.14 Smurfit Kappa

- 9.15 Stora Enso

- 9.16 WestRock Company