|

市場調查報告書

商品編碼

1876808

全膝關節置換市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Total Knee Replacement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

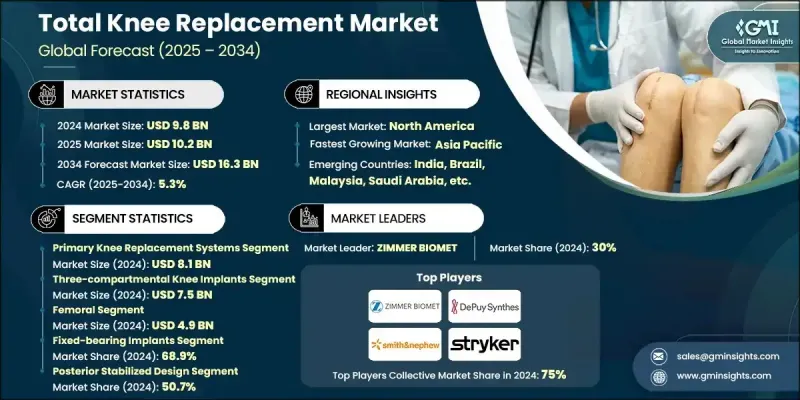

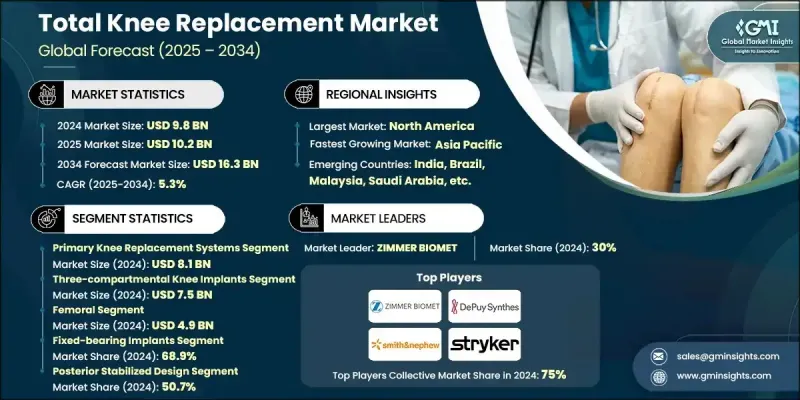

2024 年全球全膝關節置換市場價值為 98 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長至 163 億美元。

市場成長主要受骨關節炎和骨質疏鬆症盛行率上升、關節感染率增加導致翻修手術需求上升以及外科技術的不斷進步所推動。門診和日間手術中心的擴張進一步提高了手術的可近性。退化性關節疾病會降低活動能力並導致慢性疼痛,尤其是在老年族群中,這推動了對全膝關節置換手術的需求,以恢復關節功能並提高生活品質。外科醫生和醫療器材製造商正利用先進的影像和數位化規劃工具,透過創新的植入物設計和病患客製化解決方案來應對這項需求。這些技術提高了植入物的貼合度、舒適度和長期性能,同時減少了術後併發症。此外,對精密設計和可自訂植入物的需求也在不斷成長,這促使製造商開發能夠滿足患者特定解剖結構需求並最佳化康復效果的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 163億美元 |

| 複合年成長率 | 5.3% |

2024年,初次膝關節置換系統市場規模預計將達81億美元。肥胖率上升、智慧植入技術的應用以及3D列印技術的創新是推動該市場成長的主要因素。由於其臨床可靠性和長期耐用性,初次膝關節置換術仍然是首選的第一線手術方案。

2024 年,三腔膝關節植入物市場規模達 75 億美元。這些植入物旨在修復膝關節的三個腔室,廣泛推薦用於關節嚴重退化的患者,提供全面的關節修復。

2024年,北美全膝關節置換市場佔54.1%的市佔率。該地區的成長主要得益於先進的醫療基礎設施、人口老化以及機器人輔助手術和智慧植入物的應用,這些技術提高了手術精準度和復健效果。微創手術和門診手術服務也得到了完善的醫療保險報銷機制的支持,進一步促進了市場擴張。

全膝關節置換市場的主要企業包括Allegra、B BRAUN、Corin、Depuy Synthes(強生公司)、enovis、Exactech、Medacta International、MicroPort Orthopedics、ORTHO Development、Restor3D、Smith+Nephew、Stryker、Waldemar LINker、ZIMMER BIOK和Amplitude。這些領導企業正透過加大研發投入,致力於開發病患客製化的植入物和新一代手術系統,進而提升市場地位。許多企業正在採用數位化規劃和機器人輔助技術,以提高手術精度和改善手術效果。與醫院、手術中心和醫療機構建立策略夥伴關係,有助於擴大市場覆蓋範圍並促進產品推廣。此外,企業也正在高需求地區建立生產設施和分銷網路,從而拓展地域市場。智慧植入物和3D列印組件的創新是企業的優先事項,有助於提高植入物的耐用性和功能性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 關節炎和骨質疏鬆症的盛行率不斷上升

- 需要個人化和患者專用的植入物

- 感染率上升導致膝關節翻修手術增多

- 保留雙十字韌帶的全膝關節置換術越來越受歡迎

- 單髁膝關節手術的使用日益增多

- 產業陷阱與挑戰

- 膝關節植入物召回數量增加

- 手術費用高昂

- 機會

- 智慧植入物和物聯網整合

- 新興市場的擴張

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 報銷方案

- 手術失敗/成功率概況

- 2021-2034年價格分析

- 膝關節手術概況

- 測量切除技術

- 差距平衡技術

- 平衡尺寸

- 測量尺寸

- 患者人口統計和流行病學趨勢

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 初次膝關節置換系統

- 部分膝關節置換系統

- 翻修膝關節置換系統

第6章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 三腔室膝關節假體

- 雙腔膝關節假體

- 單髁膝關節假體

第7章:市場估計與預測:依組件分類,2021-2034年

- 主要趨勢

- 股骨

- 脛骨

- 髕骨

第8章:市場估算與預測:依植體類型分類,2021-2034年

- 主要趨勢

- 固定軸承式植體

- 活動性軸承式植入物

- 內側樞軸植入物

- 其他植入體類型

第9章:市場估算與預測:依設計分類,2021-2034年

- 主要趨勢

- 後穩定設計

- 十字韌帶固定設計

- 其他設計

第10章:市場估計與預測:依手術類型分類,2021-2034年

- 主要趨勢

- 傳統手術類型

- 技術輔助手術類型

第11章:市場估價與預測:依固定材料分類,2021-2034年

- 主要趨勢

- 水泥

- 無水泥

- 混合

第12章:市場估算與預測:依材料分類,2021-2034年

- 主要趨勢

- 金屬對塑膠

- 陶瓷對塑膠

- 金屬對金屬

- 陶瓷對陶瓷

第13章:市場估算與預測:依聚乙烯嵌件分類,2021-2034年

- 主要趨勢

- 抗氧化聚乙烯嵌件

- 高交聯聚乙烯嵌件

- 傳統聚乙烯襯墊

第14章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第15章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第16章:公司簡介

- Allegra

- amplitude

- B BRAUN

- Corin

- Depuy Synthes (Johnson & Johnson)

- enovis

- exactech

- Medacta International

- MicroPort Orthopedics

- ORTHO Development

16.11. 恢復3 d

- 史密斯和內普

- 史特瑞克

- 瓦爾德馬爾·林克

- 齊默生物

The Global Total Knee Replacement Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 16.3 billion by 2034.

The market's growth is largely fueled by the rising prevalence of osteoarthritis and osteoporosis, increasing rates of joint infections necessitating revisions, and continuous advancements in surgical techniques. The expansion of outpatient and ambulatory surgical centers has further contributed to higher procedure accessibility. Degenerative joint diseases reduce mobility and cause chronic pain, particularly in aging populations, driving the demand for total knee replacement procedures to restore function and improve quality of life. Surgeons and medical device manufacturers are responding with innovative implant designs and patient-specific solutions using advanced imaging and digital planning tools. These technologies enhance implant fit, comfort, and long-term performance while reducing postoperative complications. Additionally, demand for precision-engineered and customizable implants is growing, encouraging manufacturers to develop solutions that meet patient-specific anatomical requirements and optimize recovery outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 5.3% |

The primary knee replacement systems segment generated USD 8.1 billion in 2024. Rising obesity rates, the adoption of smart implant technologies, and 3D printing innovations are driving the segment. Primary knee replacements remain the preferred first-line procedure due to their established clinical reliability and long-term durability.

The three-compartmental knee implants segment generated USD 7.5 billion in 2024. These implants are designed to resurface all three compartments of the knee and are widely recommended for patients with extensive joint degeneration, offering comprehensive joint restoration.

North America Total Knee Replacement Market accounted for a 54.1% share in 2024. Growth in the region is driven by advanced healthcare infrastructure, an aging population, and the adoption of robotic-assisted surgery and smart implants that enhance precision and rehabilitation outcomes. Minimally invasive procedures and outpatient surgical care are supported by established reimbursement mechanisms, further encouraging market expansion.

Key companies operating in the Total Knee Replacement Market include Allegra, B BRAUN, Corin, Depuy Synthes (Johnson & Johnson), enovis, Exactech, Medacta International, MicroPort Orthopedics, ORTHO Development, Restor3D, Smith+Nephew, Stryker, Waldemar LINK, ZIMMER BIOMET, and Amplitude. Leading companies in the Total Knee Replacement Market are enhancing their presence by investing in research and development to produce patient-specific implants and next-generation surgical systems. Many are incorporating digital planning and robotic-assisted technologies to improve surgical precision and outcomes. Strategic partnerships with hospitals, surgical centers, and healthcare providers are strengthening market reach and facilitating product adoption. Firms are also expanding geographically by establishing manufacturing facilities and distribution networks in high-demand regions. Innovation in smart implants and 3D-printed components is a priority, supporting improved durability and functionality.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Device type trends

- 2.2.4 Component trends

- 2.2.5 Implant type trends

- 2.2.6 Design trends

- 2.2.7 Surgery type trends

- 2.2.8 Fixation material trends

- 2.2.9 Material trends

- 2.2.10 Polyethylene inserts trends

- 2.2.11 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of arthritis and osteoporosis

- 3.2.1.2 Need for personalized and patient specific implants

- 3.2.1.3 Growing infection rates contributing to rise in knee revisions

- 3.2.1.4 Surging preference for bicruciate-retaining total knee arthroplasty

- 3.2.1.5 Increasing usage of unicondylar knee procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increased number of knee implant recalls

- 3.2.2.2 High cost associated with the surgery

- 3.2.3 Opportunities

- 3.2.3.1 Smart implants and IoT integration

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Procedure failure/success rate landscape

- 3.8 Pricing analysis, 2021-2034

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Knee surgery landscape

- 3.9.1 Measured resection technique

- 3.9.2 Gap balancing technique

- 3.9.3 Balanced sizer

- 3.9.4 Measured sizer

- 3.10 Patient demographics and epidemiological trends

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Primary knee replacement systems

- 5.3 Partial knee replacement systems

- 5.4 Revision knee replacement systems

Chapter 6 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn and Units)

- 6.1 Key trends

- 6.2 Three-compartmental knee implants

- 6.3 Bicompartmental knee implants

- 6.4 Unicompartmental knee implants

Chapter 7 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Femoral

- 7.3 Tibial

- 7.4 Patellar

Chapter 8 Market Estimates and Forecast, By Implant Type, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 Fixed-bearing implants

- 8.3 Mobile-bearing implants

- 8.4 Medial pivot implants

- 8.5 Other implant types

Chapter 9 Market Estimates and Forecast, By Design, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 Posterior stabilized design

- 9.3 Cruciate retaining design

- 9.4 Other designs

Chapter 10 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn and Units)

- 10.1 Key trends

- 10.2 Traditional surgery type

- 10.3 Technology assisted surgery type

Chapter 11 Market Estimates and Forecast, By Fixation Material, 2021 - 2034 ($ Mn and Units)

- 11.1 Key trends

- 11.2 Cemented

- 11.3 Cementless

- 11.4 Hybrid

Chapter 12 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn and Units)

- 12.1 Key trends

- 12.2 Metal-on-plastic

- 12.3 Ceramic-on-plastic

- 12.4 Metal-on-metal

- 12.5 Ceramic-on-ceramic

Chapter 13 Market Estimates and Forecast, By Polyethylene Inserts, 2021 - 2034 ($ Mn and Units)

- 13.1 Key trends

- 13.2 Antioxidant polyethylene inserts

- 13.3 Highly cross-linked polyethylene inserts

- 13.4 Conventional polyethylene inserts

Chapter 14 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn and Units)

- 14.1 Key trends

- 14.2 Hospitals

- 14.3 Ambulatory surgery centers

- 14.4 Other End Use

Chapter 15 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Spain

- 15.3.5 Italy

- 15.3.6 Netherlands

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 Japan

- 15.4.3 India

- 15.4.4 Australia

- 15.4.5 South Korea

- 15.4.6 Thailand

- 15.4.7 Malaysia

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.5.3 Argentina

- 15.6 MEA

- 15.6.1 South Africa

- 15.6.2 Saudi Arabia

- 15.6.3 UAE

Chapter 16 Company Profiles

- 16.1 Allegra

- 16.2 amplitude

- 16.3 B BRAUN

- 16.4 Corin

- 16.5 Depuy Synthes (Johnson & Johnson)

- 16.6 enovis

- 16.7 exactech

- 16.8 Medacta International

- 16.9 MicroPort Orthopedics

- 16.10 ORTHO Development

16.11. restor3 d

- 16.12 Smith+Nephew

- 16.13 stryker

- 16.14 Waldemar LINK

- 16.15 ZIMMER BIOMET