|

市場調查報告書

商品編碼

1755274

非骨水泥部分膝關節植入物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cementless Partial Knee Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

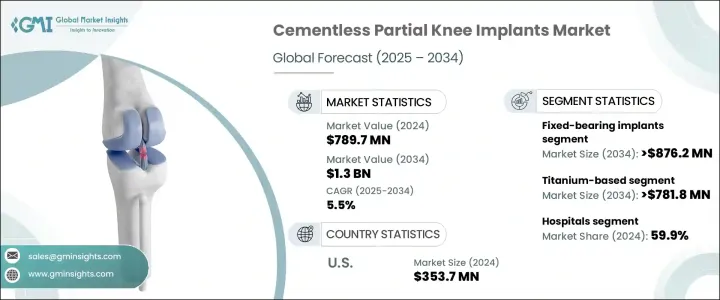

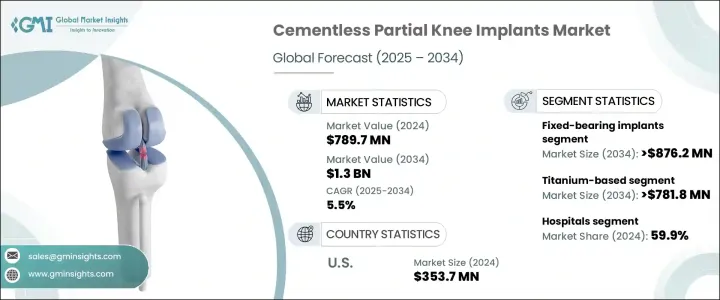

2024年,全球非骨水泥型部分膝關節植入物市場規模達7.897億美元,預計年複合成長率為5.5%,到2034年將達到13億美元。推動這一成長的關鍵因素包括:感染率上升導致膝關節翻修手術增多;骨關節炎和類風濕性關節炎盛行率上升;以及人們對微創手術的偏好增加。老年骨關節炎患者數量的增加,以及對更有效、微創手術方案的需求,是該市場的關鍵促進因素。非骨水泥型部分膝關節植入物用於單髁膝關節置換術(UKA),僅替換膝關節的患側,從而保留更多天然骨骼和韌帶。

這些植入物無需骨水泥,而是以生物固定取代。這種方法促進了植入物周圍骨組織的自然生長,從而使植入物與骨骼之間的結合更加牢固持久。無需骨水泥不僅可以最大限度地降低植入物隨時間推移鬆動的風險,還能降低骨水泥相關感染和發炎等併發症的可能性。此外,生物固定可以增強植入物的整體穩定性,從而可能延長其使用壽命並改善患者的長期預後。因此,非骨水泥植入物具有更自然的癒合過程,並且可能需要更少的修復,使其成為骨科手術中越來越受歡迎的選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.897億美元 |

| 預測值 | 13億美元 |

| 複合年成長率 | 5.5% |

固定軸承植入物市場預計將以 5.3% 的複合年成長率成長,到 2034 年達到 8.762 億美元。與活動軸承系統相比,這些植入物機械結構更簡單,且不易發生故障,因此更受外科醫師的歡迎。對於低需求患者,它們十年的長期存活率超過 90%。此外,活動軸承系統通常更昂貴、更複雜,這限制了它們的接受度和廣泛應用。因此,在許多情況下,固定軸承系統是首選,這加速了它們的普及,並鞏固了其市場主導地位。

預計鈦基植入物市場將達到5.4%的成長率,到2034年將達到7.818億美元。鈦的生物相容性使其成為非骨水泥植入物的理想選擇,因為它能夠促進骨整合,而骨整合對於此類植入物的成功至關重要。與鈷鉻合金相比,鈦植入物與骨組織的黏附性更強,抗鬆動性更強,從而提高了植入物的穩定性和使用壽命。鈦合金的輕量特性加上其強度,使其特別適合年輕、活躍且術後需要更大活動能力的患者。此外,鈦合金也是金屬敏感患者的理想選擇,這進一步推動了個人化膝關節置換術的需求。

2024年,美國非骨水泥部分膝關節植入物市場規模達3.537億美元。美國人口老化是全球成長最快的群體之一,這推動了膝關節置換手術的需求不斷成長。骨關節炎,尤其是內側單髁骨關節炎,是推動部分膝關節置換需求的主要疾病之一。此外,由於麻醉時間短、失血量少、恢復更快等優勢,美國的門診骨科手術數量正在增加,尤其是在門診手術中心。此外,美國擁有完善的報銷體系,私人保險公司和聯邦醫療保險(Medicare)越來越認知到,對於合適的患者,部分膝關節置換比全膝關節置換更具成本效益。

全球非骨水泥型部分膝關節植入物市場的領導者包括史賽克 (Stryker)、Medacta、Amplitude Surgical、全錄輝 (Smith+Nephew)、Waldemar Link、GRUPPO BIOIMPIANTI、ZIMMER BIOMET、Lepine、Just Medical 和 Medacta。為了鞏固市場地位,非骨水泥型部分膝關節植入物產業的企業正專注於多種策略。他們投資於持續創新,以改善植入物的設計和功能,例如增強植入物的生物相容性和骨整合性能。此外,他們還與醫療服務提供者、診所和醫院建立合作夥伴關係,以擴大產品覆蓋範圍並確保更高的採用率。此外,企業也注重區域擴張,尤其是在骨科手術需求日益成長的新興市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 感染率上升導致膝關節翻修手術增多

- 骨關節炎和類風濕性關節炎盛行率不斷上升

- 微創手術日益受到青睞

- 非骨水泥固定方法的技術進步

- 產業陷阱與挑戰

- 非骨水泥型膝關節植入物成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按植入物類型,2021 - 2034 年

- 主要趨勢

- 固定軸承植入物

- 活動軸承植入物

- 內側樞軸植入物

- 其他植入物類型

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鈦基

- 鈷鉻合金

- 聚乙烯成分

- 其他材料

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 骨科中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- amplitude SURGICAL

- GRUPPO BIOIMPIANTI

- JUST MEDICAL

- lepine

- Medacta

- Smith+Nephew

- Stryker

- Waldemar Link

- ZIMMER BIOMET

The Global Cementless Partial Knee Implants Market was valued at USD 789.7 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 1.3 billion by 2034. The key factors contributing to this growth include the rising infection rates leading to an increase in knee revision surgeries, the growing prevalence of osteoarthritis and rheumatoid arthritis, and a greater preference for minimally invasive procedures. The increasing number of elderly individuals with osteoarthritis and the demand for more effective, less invasive surgical options are crucial drivers for this market. Cementless partial knee implants, used in unicompartmental knee arthroplasty (UKA) procedures, only replace the affected portion of the knee joint, preserving more natural bone and ligaments.

These implants eliminate the need for bone cement, facilitating biological fixation instead. This method encourages the natural growth of bone tissue around the implant, leading to stronger and more durable integration between the implant and the bone. The absence of bone cement not only minimizes the risk of implant loosening over time but also reduces the likelihood of complications such as cement-related infections and inflammation. Moreover, biological fixation can enhance the overall stability of the implant, potentially extending its lifespan and improving long-term patient outcomes. As a result, cementless implants offer a more natural healing process and may require fewer revisions, making them an increasingly preferred option in orthopedic procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $789.7 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 5.5% |

Fixed-bearing implants segment is expected to grow at a CAGR of 5.3% to reach USD 876.2 million by 2034. These implants are mechanically simpler and less prone to failure than mobile-bearing systems, making them more popular among surgeons. They offer long-term survival rates of over 90% at ten years in low-demand patients. Additionally, mobile-bearing systems are typically more expensive and complex, which limits their acceptance and widespread use. As a result, fixed-bearing systems are the preferred choice in many cases, accelerating their adoption and contributing to their market dominance.

The titanium-based segment is anticipated to experience a growth rate of 5.4%, reaching USD 781.8 million by 2034. Titanium's biocompatibility makes it ideal for cementless implants, as it promotes osseointegration, which is crucial for the success of these devices. Titanium implants offer better adhesion to bone tissue and greater resistance to loosening compared to cobalt-chromium alloys, enhancing their stability and lifespan. The lightweight nature of titanium alloys, combined with their strength, makes them particularly suitable for younger, more active patients who require greater mobility post-surgery. Additionally, titanium is ideal for individuals with metal sensitivities, further driving demand for personalized knee arthroplasty.

U.S. Cementless Partial Knee Implants Market was valued at USD 353.7 million in 2024. The aging population in the U.S. is one of the fastest-growing demographics globally, contributing to the rising demand for knee replacement procedures. Osteoarthritis, especially medial unicompartmental osteoarthritis, is one of the primary conditions driving the need for partial knee replacements. Additionally, outpatient orthopedic surgeries are on the rise in the U.S., particularly in ambulatory surgical centers, due to the advantages of shorter anesthesia times, minimal blood loss, and quicker recovery. Moreover, the U.S. benefits from a robust reimbursement system, with both private insurers and Medicare increasingly recognizing the cost-effectiveness of partial knee replacements over total knee replacements for suitable patients.

The leading players in the Global Cementless Partial Knee Implants Market include Stryker, Medacta, Amplitude Surgical, Smith+Nephew, Waldemar Link, GRUPPO BIOIMPIANTI, ZIMMER BIOMET, Lepine, Just Medical, and Medacta. To strengthen their market presence, companies in the cementless partial knee implants industry are focusing on several strategies. They are investing in continuous innovation to improve implant designs and functionality, such as enhancing the biocompatibility and osseointegration properties of the implants. Partnerships with healthcare providers, clinics, and hospitals are also being forged to expand product reach and ensure higher adoption rates. Additionally, companies are focusing on regional expansion, particularly in emerging markets where the demand for orthopedic procedures is increasing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising infection rates contributing to the rise in knee revisions

- 3.2.1.2 Increasing prevalence of osteoarthritis and rheumatoid arthritis

- 3.2.1.3 Growing preference for minimally invasive procedures

- 3.2.1.4 Technological advancements in cementless fixation methods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with cementless knee implants

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Implant Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fixed-bearing implants

- 5.3 Mobile-bearing implants

- 5.4 Medial pivot implants

- 5.5 Other implant types

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium-based

- 6.3 Cobalt-chromium alloys

- 6.4 Polyethylene components

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Orthopedic centres

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 amplitude SURGICAL

- 9.2 GRUPPO BIOIMPIANTI

- 9.3 JUST MEDICAL

- 9.4 lepine

- 9.5 Medacta

- 9.6 Smith+Nephew

- 9.7 Stryker

- 9.8 Waldemar Link

- 9.9 ZIMMER BIOMET