|

市場調查報告書

商品編碼

1876799

餐車市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Food Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

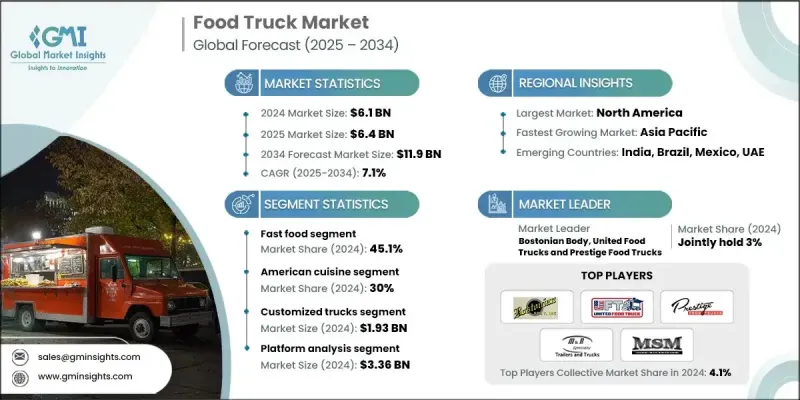

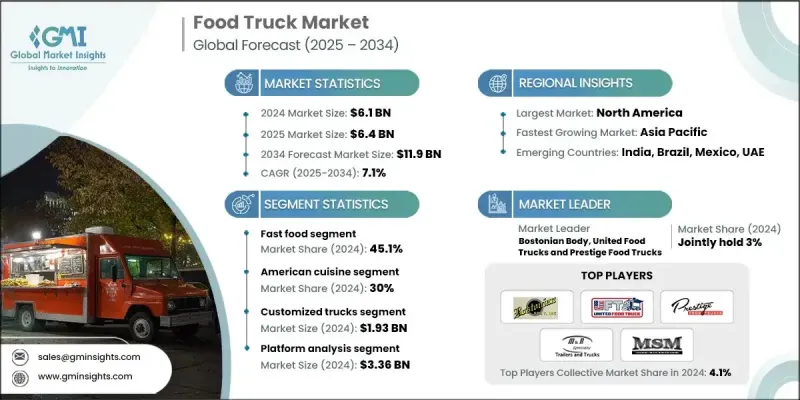

2024 年全球餐車市場價值為 61 億美元,預計到 2034 年將以 7.1% 的複合年成長率成長至 119 億美元。

科技在這一成長過程中扮演關鍵角色,經營者擴大利用GPS定位、行動支付解決方案和社群媒體行銷來提升知名度並提高營運效率。數位化工具使餐車能夠分享地點、簡化服務流程、建立品牌忠誠度,同時最佳化在各個大都市地區的收入機會。消費者偏好轉向便攜、體驗式和多樣化的餐飲選擇,也是推動市場擴張的因素之一。經營者提供融合了精緻美食、融合菜餚和健康餐食的菜單選擇,以滿足千禧世代、X世代和遊客的需求,這反映了全球休閒露天用餐體驗的普遍趨勢。餐車正在重新定義便利性和美食探索,同時兼顧營運效率和客戶互動。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 61億美元 |

| 預測值 | 119億美元 |

| 複合年成長率 | 7.1% |

到2024年,速食市佔率將達到45.1%,市價約28億美元。快餐市場蓬勃發展的關鍵在於其與餐車相同的優勢,例如速度快、方便快速和價格實惠。創新產品,例如精緻三明治和融合菜餚,透過優質食材和創意烹飪方式提升了傳統速食的品質。中餐市佔率為15.3%,複合年成長率為7.3%,這主要得益於消費者對正宗口味和多樣化食材的需求。移動中餐服務專注於提供精簡的經典菜餚,力求在確保菜餚品質、口感和溫度的同時,方便顧客隨時隨地享用。

2024年,美國餐車市場佔85%的市場佔有率,擁有超過48,400輛活躍餐車,平均每輛餐車年收入達346,000美元。 2024年,美國餐車市場估值達210萬美元,預計2025年至2034年間將維持強勁成長。試點區域和公園式計畫正在將經營機會拓展到傳統城區之外,促進創業精神,同時也需要明確的市政衛生和分區框架,以確保攤販的安全和公平准入。

全球餐車市場的主要參與者包括 Bostonian Body、Futuristo Trailers、Food Truck Company、M&R Trailers、MRA、MSM Catering Trucks Manufacturing、Prestige Food Trucks、The Fud Trailer Company、United Food Trucks 和 VS Veicoli Speciali。這些餐車公司正透過採取多元化策略來鞏固其市場地位,包括投資先進的客製化餐車設計、整合數位化支付和追蹤系統,以及利用社群媒體進行精準行銷。許多公司正在豐富菜單,提供高階美食和融合菜餚,以吸引更廣泛的受眾。與市政專案和活動組織者的策略合作有助於拓展營運地點,而與供應商的協作則確保了高效的供應鏈。此外,各公司還專注於品牌差異化、客戶體驗和會員忠誠度計劃,以保持競爭優勢,並在不斷成長的城市和休閒娛樂市場中佔據更大的市場佔有率。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 都市化和快節奏的生活方式

- 啟動和營運成本低

- 技術整合

- 不斷變化的消費者偏好

- 活動和節慶活動的成長

- 產業陷阱與挑戰

- 監管和許可障礙

- 操作限制和天氣依賴性

- 市場機遇

- 拓展新興市場

- 環保永續營運

- 技術創新與智慧營運

- 菜單多樣化及健康食品供應

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 專利分析

- 價格趨勢分析

- 按組件

- 按地區

- 成本分解分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 消費者行為與人口統計

- 季節性需求模式

- 城市與農村市場動態

- 數位轉型的影響

- 社群媒體與行銷的演變

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 速食

- 飲料

- 烘焙食品和糖果

- 其他

第6章:市場估算與預測:依菜系分類,2021-2034年

- 主要趨勢

- 美國人

- 墨西哥

- 中國人

- 日本人

- 義大利語

- 亞洲

- 其他

第7章:市場估價與預測:依車輛類型分類 2021-2034 年

- 主要趨勢

- 可擴充

- 盒子

- 公車和麵包車

- 客製化卡車

- 其他

第8章:市場估算與預測:依平台分類,2021-2034年

- 主要趨勢

- 隨時隨地服務

- 餐飲服務

- 線上配送

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 新加坡

- 泰國

- 越南

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- AMOBOX

- Bostonian Body

- Concession Nation

- Cousins Maine Lobster

- Custom Concessions

- Deliverect

- Elite Mobile Kitchens

- Food Truck Builder

- Food Truck Company

- Futuristo Trailers

- Hoshizaki America

- Kona Ice

- M&R Trailers

- MRA

- MSM Catering Trucks Manufacturing

- Pacific Food Truck Manufacturing

- Prestige Food Trucks

- Revel Systems

- The Fud Trailer Company

- The Grilled Cheese Truck

- Toast

- True Manufacturing

- United Food Trucks

- VS Veicoli Speciali

- 區域玩家

- Roy Choi Enterprises

- The Halal Guys

- 新興企業/新創公司

- Electric Food Truck Conversions

The Global Food Truck Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 11.9 billion by 2034.

Technology plays a key role in this growth, with operators increasingly using GPS tracking, mobile payment solutions, and social media marketing to enhance visibility and improve operational efficiency. Digital tools allow food trucks to share their location, streamline service, and build brand loyalty while optimizing revenue opportunities across diverse metropolitan areas. Changing consumer preferences toward portable, experiential, and diverse food options are also driving market expansion. Operators are offering a mix of gourmet, fusion, and healthy menu options to cater to Millennials, Gen X, and tourists, reflecting a broader global trend toward casual and open-air dining experiences. Food trucks are redefining convenience and culinary exploration while balancing operational efficiency and customer engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 7.1% |

The fast food segment held 45.1% share in 2024, valued at approximately USD 2.8 billion. This segment thrives on the same attributes that food trucks provide, including speed, convenience, and affordability. Innovative offerings, such as gourmet sandwiches and fusion dishes, elevate traditional fast food through premium ingredients and creative preparation. Chinese cuisine represents a 15.3% market share with a CAGR of 7.3%, driven by demand for authentic flavors and versatile ingredients. Mobile Chinese food operations focus on a concise menu of staple dishes that maintain quality, texture, and temperature while being easily served on the go.

US Food Truck Market held an 85% share in 2024, supported by over 48,400 active units generating average annual revenues of USD 346,000 per truck. The US market was valued at USD 2.1 million in 2024 and is expected to experience robust growth between 2025 and 2034. Pilot zones and park-based programs are expanding operating opportunities beyond traditional urban areas, fostering entrepreneurship while requiring clear municipal health and zoning frameworks to ensure safety and equitable access for vendors.

Leading players in the Global Food Truck Market include Bostonian Body, Futuristo Trailers, Food Truck Company, M&R Trailers, MRA, MSM Catering Trucks Manufacturing, Prestige Food Trucks, The Fud Trailer Company, United Food Trucks, and VS Veicoli Speciali. Companies in the Food Truck Market are strengthening their presence by adopting multi-faceted strategies, including investing in advanced, customizable truck designs, integrating digital payment and tracking systems, and leveraging social media for targeted marketing. Many are diversifying menus with gourmet and fusion options to appeal to wider audiences. Strategic partnerships with municipal programs and event organizers help expand operational locations, while collaborations with suppliers ensure efficient supply chains. Companies are also focusing on brand differentiation, customer experience, and loyalty programs to maintain a competitive advantage and capture larger market shares in growing urban and recreational segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Offering

- 2.2.2 Cuisine

- 2.2.3 Vehicle

- 2.2.4 Platform

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & busy lifestyles

- 3.2.1.2 Low startup & operational costs

- 3.2.1.3 Technological integration

- 3.2.1.4 Evolving consumer preferences

- 3.2.1.5 Growth of events & festivals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory & licensing barriers

- 3.2.2.2 Operational limitations & weather dependency

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Eco-friendly & sustainable operations

- 3.2.3.3 Technological innovation & smart operations

- 3.2.3.4 Menu diversification & health-focused offerings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

- 3.14 Consumer Behavior & Demographics

- 3.15 Seasonal Demand Patterns

- 3.16 Urban vs Rural Market Dynamics

- 3.17 Digital Transformation Impact

- 3.18 Social Media & Marketing Evolution

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Fast Food

- 5.3 Beverages

- 5.4 Bakery & confectionary

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Cuisine, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 American

- 6.3 Mexican

- 6.4 Chinese

- 6.5 Japanese

- 6.6 Italian

- 6.7 Asian

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Vehicle 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Expandable

- 7.3 Boxes

- 7.4 Buses & vans

- 7.5 Customized trucks

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 On-the-Go service

- 8.3 Catering services

- 8.4 Online delivery

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AMOBOX

- 10.1.2 Bostonian Body

- 10.1.3 Concession Nation

- 10.1.4 Cousins Maine Lobster

- 10.1.5 Custom Concessions

- 10.1.6 Deliverect

- 10.1.7 Elite Mobile Kitchens

- 10.1.8 Food Truck Builder

- 10.1.9 Food Truck Company

- 10.1.10 Futuristo Trailers

- 10.1.11 Hoshizaki America

- 10.1.12 Kona Ice

- 10.1.13 M&R Trailers

- 10.1.14 MRA

- 10.1.15 MSM Catering Trucks Manufacturing

- 10.1.16 Pacific Food Truck Manufacturing

- 10.1.17 Prestige Food Trucks

- 10.1.18 Revel Systems

- 10.1.19 The Fud Trailer Company

- 10.1.20 The Grilled Cheese Truck

- 10.1.21 Toast

- 10.1.22 True Manufacturing

- 10.1.23 United Food Trucks

- 10.1.24 VS Veicoli Speciali

- 10.2 Regional players

- 10.2.1 Roy Choi Enterprises

- 10.2.2 The Halal Guys

- 10.3 Emerging Players / Startups

- 10.3.1 Electric Food Truck Conversions