|

市場調查報告書

商品編碼

1876794

人工耳蝸市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Cochlear Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

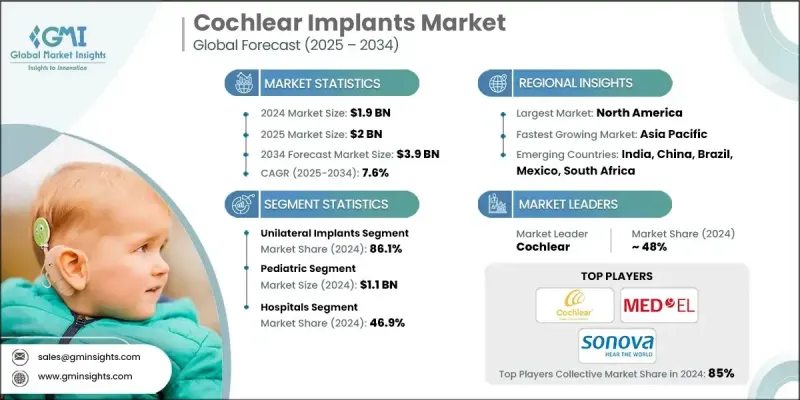

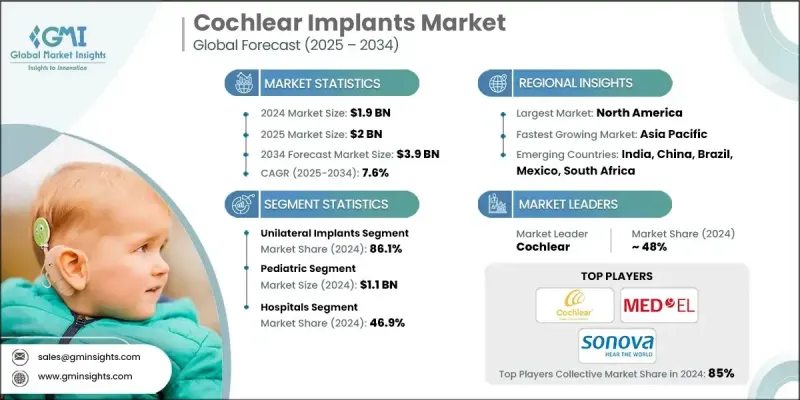

2024 年全球人工耳蝸市場價值為 19 億美元,預計到 2034 年將以 7.6% 的複合年成長率成長至 39 億美元。

市場擴張的促進因素包括聽力障礙盛行率的上升、植入技術的創新、兒童和老年人群體接受度的提高,以及公眾意識的增強和廣泛的聽力篩檢計畫。人工耳蝸是一種先進的電子設備,旨在繞過受損的內耳毛細胞,直接刺激聽覺神經,使用戶能夠感知聲音。它由內部和外部組件構成,用於收集、處理和傳輸聲音訊號。與放大聲音的助聽器不同,人工耳蝸將聲音轉換為電脈衝,從而部分恢復聽力。學校和醫院進行的宣傳活動和早期篩檢有助於儘早發現合適的植入對象,而聽力協會、醫療保健機構和植入體製造商之間的合作則加強了患者教育,提高了手術的接受度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 39億美元 |

| 複合年成長率 | 7.6% |

由於單側植入成本更低、手術更簡單、恢復更快,且更受臨床醫生青睞,預計到2024年,單側植入市場佔有率將達到86.1%。單側植入因其成本優勢,尤其是在發展中市場,更容易被病患和醫療機構接受。這種經濟實惠的條件促使許多希望改善聽力但又不想承擔雙側植入費用的患者選擇單側植入。

2024年,醫院業務佔據了46.9%的市場佔有率,預計在2025年至2034年間將達到17億美元。人口老化、長期暴露於噪音環境以及先天性疾病等因素導致感音神經性聽力損失病例增加,使得更多患者選擇在醫院接受治療。醫院透過將人工耳蝸植入手術整合到耳鼻喉科和聽力科服務中,可以提升病患照護水準並增加收入來源。

2024年,北美人工耳蝸市場佔41.2%的比重。該地區人口面臨較高的感音神經性聽力損失發病率,包括年齡相關性和先天性病例,因此需要進行早期診斷和干涉計畫。這些舉措大大提升了對人工耳蝸的需求,並推動了市場的穩定成長。

人工耳蝸市場的主要公司包括MED-EL、Cochlear、Sonova、Envoy Medical和Nurotron。全球人工耳蝸市場的參與者正採取多種策略來鞏固其市場地位。各公司正加大研發投入,以提升植入體的功能性、舒適度及與先進聲音處理技術的兼容性。他們透過有針對性的宣傳活動和醫療專業人員的教育計劃,擴大兒童和老年人群的接受度。與醫院和聽力中心的合作有助於改善手術流程,並提升病患的信任度。拓展至發展中市場有助於挖掘潛在需求,而與保險公司和政府的策略合作則有助於提高人工耳蝸的可負擔性和普及率。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 聽力損失盛行率增加

- 技術進步

- 提高公眾意識和早期診斷

- 政府的便利支持與改進的報銷方案

- 產業陷阱與挑戰

- 人工耳蝸植入費用高昂

- 缺乏關於聽力損失的知識

- 市場機遇

- 人工智慧驅動的聲音處理與機器學習

- 成長促進因素

- 成長潛力分析

- 報銷方案

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 消費者路徑

- 2024年定價分析

- 消費者洞察

- 政策環境

- 風險管理分析

- 研究與開發

- 營運

- 行銷和銷售

- 品質

- 智慧財產

- 監管

- 資訊科技

- 氣候

- 金融的

- 未來市場趨勢

- 供應鏈動態與製造分析

- 管道分析

- 波特的分析

- PESTEL 分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 單側植入

- 雙側植入

第6章:市場估計與預測:依病患類型分類,2021-2034年

- 主要趨勢

- 成人

- 兒科

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 耳鼻喉科診所

- 門診手術中心

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Cochlear

- Envoy Medical

- MED-EL

- Nurotron

- Sonova

The Global Cochlear Implants Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 3.9 billion by 2034.

Market expansion is driven by the rising prevalence of hearing impairment, innovations in implant technology, increasing adoption among children and the elderly, and heightened awareness coupled with widespread hearing screening programs. Cochlear implants are advanced electronic devices designed to bypass damaged inner ear hair cells and directly stimulate the auditory nerve, enabling users to perceive sound. They consist of internal and external components that collect, process, and transmit sound signals. Unlike hearing aids that amplify sound, cochlear implants convert sound into electrical impulses to partially restore hearing. Growing awareness campaigns and early screening in schools and hospitals are helping identify candidates sooner, while collaborations among audiology associations, healthcare providers, and implant manufacturers have enhanced patient education, driving higher procedural acceptance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 7.6% |

The unilateral implants segment held 86.1% share in 2024 due to its lower cost, simpler surgery, quicker recovery, and preference among clinicians over bilateral implants. Unilateral implants remain more accessible to patients and healthcare providers because of their cost advantage, particularly in developing markets. This affordability encourages adoption among individuals seeking improved hearing without the expense of dual implantation.

The hospitals segment generated a 46.9% share in 2024 and is expected to reach USD 1.7 billion during 2025-2034. An increase in sensorineural hearing loss cases, driven by aging populations, prolonged exposure to noise, and congenital conditions, has resulted in more patients seeking treatment in hospitals. Hospitals benefit by integrating cochlear implant procedures into their ENT and audiology services, enhancing patient care and revenue streams.

North America Cochlear Implants Market held a 41.2% share in 2024. The region's population faces high rates of sensorineural hearing loss, including age-related and congenital cases, prompting early diagnosis and intervention programs. These initiatives have substantially boosted the demand for cochlear implants, driving steady market growth.

Key companies in the Cochlear Implants Market include MED-EL, Cochlear, Sonova, Envoy Medical, and Nurotron. Market players in the Global Cochlear Implants Market are employing several strategies to strengthen their market foothold. Companies are investing in research and development to enhance implant functionality, comfort, and compatibility with advanced sound processing technologies. They are expanding pediatric and geriatric adoption through targeted awareness campaigns and educational initiatives for healthcare professionals. Partnerships with hospitals and audiology centers improve procedural access and patient trust. Geographic expansion into developing markets helps capture untapped demand, while strategic collaborations with insurance providers and governments increase affordability and adoption rates.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Patient type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in prevalence of hearing loss

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising awareness and early diagnosis

- 3.2.1.4 Facilitative government support and improving reimbursement scenario

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cochlear implants

- 3.2.2.2 Lack of knowledge regarding hearing loss

- 3.2.3 Market opportunities

- 3.2.3.1 AI-driven sound processing & machine learning

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 LAMEA

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Market size in terms of volume, 2021 - 2034 (Units)

- 3.7.1 Global

- 3.7.2 North America

- 3.7.3 Europe

- 3.7.4 Asia Pacific

- 3.7.5 Latin America

- 3.7.6 MEA

- 3.8 Consumer pathway

- 3.9 Pricing analysis, 2024

- 3.10 Consumer insights

- 3.11 Policy landscape

- 3.11.1 Risk management analysis

- 3.11.2 Research and development

- 3.11.3 Operations

- 3.11.4 Marketing and sales

- 3.11.5 Quality

- 3.11.6 Intellectual property rights

- 3.11.7 Regulatory

- 3.11.8 Information technology

- 3.11.9 Climate

- 3.11.10 Financial

- 3.12 Future market trends

- 3.13 Supply chain dynamics & manufacturing analysis

- 3.14 Pipeline analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

- 3.17 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Unilateral implants

- 5.3 Bilateral implants

Chapter 6 Market Estimates and Forecast, By Patient Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 ENT clinics

- 7.4 Ambulatory surgical centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cochlear

- 9.2 Envoy Medical

- 9.3 MED-EL

- 9.4 Nurotron

- 9.5 Sonova