|

市場調查報告書

商品編碼

1876791

基因合成市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Gene Synthesis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

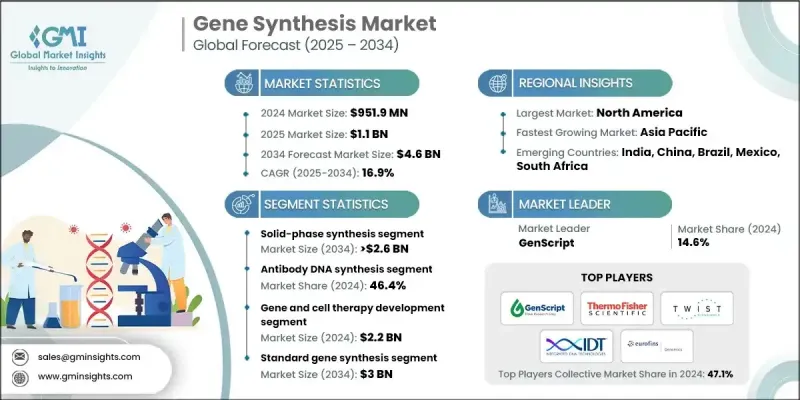

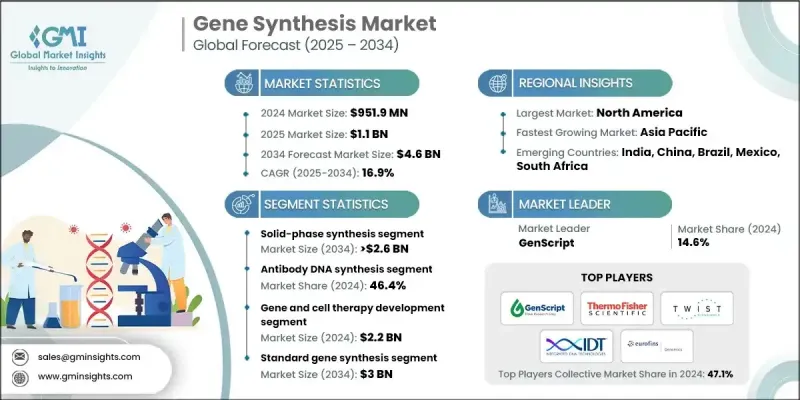

2024 年全球基因合成市場價值為 9.519 億美元,預計到 2034 年將以 16.9% 的複合年成長率成長至 46 億美元。

合成生物學的興起、DNA合成技術的不斷進步以及全球基因組學研究投資的不斷成長推動了市場擴張。個人化醫療和生物標記開發的日益普及也增加了對高精度基因建構工具的需求。基因合成產業透過提供客製化基因合成、DNA文庫建構和高級克隆服務,為製藥公司、生物技術公司、學術研究中心和醫療技術開發商提供至關重要的解決方案。這些解決方案提高了基因工程工作流程、藥物發現研究和分子診斷的效率。自動化合成平台和先進的糾錯技術提高了準確性,同時降低了成本和周轉時間,使基因合成得以廣泛應用。政府和私人對大規模基因組學計畫的投入不斷增加,支持了基因合成在疾病建模、農業和工業生物技術領域的應用。合成基因在抗體工程、疫苗開發和治療設計中的日益廣泛的應用,持續推動著該行業向前發展。後疫情時代進一步凸顯了快速合成基因生產對於加速治療創新的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.519億美元 |

| 預測值 | 46億美元 |

| 複合年成長率 | 16.9% |

固相合成技術在2024年佔據了58.6%的市場佔有率,這主要得益於其可擴展性、高精度以及適用於產生用於科研和商業用途的長DNA序列。其逐步添加核苷酸的方法提高了可靠性和純化效率,使其成為一種首選的合成技術。

2024年,抗體DNA合成領域佔了46.4%的市場佔有率,預計在預測期內將達到22億美元。成長的主要驅動力是單株抗體療法需求的不斷成長,這些療法廣泛應用於癌症治療、免疫系統疾病、傳染病以及各種罕見疾病。這種需求的激增也增加了對客製化抗體基因的需求,以加速治療藥物的研發進程。

預計到2024年,北美基因合成市場將佔據40.3%的佔有率。該地區的領先地位得益於大型生物技術和製藥公司、強大的研究生態系統以及在基因組學和合成生物學領域的大量投資。完善的監管體系和先進的臨床研究能力也持續推動基因合成技術的應用。

全球基因合成市場的主要參與者包括Azenta, Inc. (GENEWIZ)、BIOMATIK、Bio Basic Inc.、BIONEER CORPORATION、Gene Universal Inc.、Eurofins Scientific SE、Integrated DNA Technologies, Inc.、GenScript、Macrogen, Inc.、ProMcium Biotechnologies, Inc.、OGenemo Technologiesp. Inc.和Twist Bioscience Corporation。這些公司正透過擴大自動化合成平台規模、提升糾錯能力以及拓展客製化基因設計服務來鞏固其競爭優勢。許多公司正與製藥和生物技術公司建立策略合作夥伴關係,將合成技術直接整合到藥物發現和抗體工程工作流程中。對高通量系統和雲端序列設計工具的投資,能夠加快專案週轉速度並提升產能。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- DNA合成技術的快速發展

- 對基因合成專案和合成生物學研發的投資不斷成長

- 遺傳性疾病和慢性病盛行率增加

- 基因療法的日益普及

- 產業陷阱與挑戰

- 缺乏熟練的專業人員

- 複雜的基因合成技術和高額的製程成本

- 市場機遇

- 基於 CRISPR 的基因編輯應用程式擴展

- 基於RNA的疫苗和療法的開發

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興科技及其影響

- 未來市場趨勢

- 定價分析

- 投資和融資環境

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新服務上線

- 擴張計劃

第5章:市場估計與預測:依方法分類,2021-2034年

- 主要趨勢

- 固相合成

- 基於PCR的酶合成

- 基於晶片的合成

第6章:市場估計與預測:依服務業分類,2021-2034年

- 主要趨勢

- 抗體DNA合成

- 病毒DNA合成

- 其他服務

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 基因和細胞療法開發

- 疾病診斷

- 疫苗研發

- 其他應用

第8章:市場估算與預測:依複雜程度分類,2021-2034年

- 主要趨勢

- 標準基因合成

- 複雜基因合成

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 生物製藥公司

- 學術和研究機構

- 合約研究機構

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Azenta, Inc. (GENEWIZ)

- Bio Basic Inc.

- BIOMATIK

- BIONEER CORPORATION

- Eurofins Scientific SE

- Gene Universal Inc.

- GenScript

- Integrated DNA Technologies, Inc.

- Macrogen, Inc.

- OriGene Technologies, Inc.

- ProMab Biotechnologies, Inc.

- ProteoGenix

- Synbio Technologies

- Thermo Fisher Scientific Inc.

- Twist Bioscience Corporation

The Global Gene Synthesis Market was valued at USD 951.9 million in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 4.6 billion by 2034.

Market expansion is propelled by the rise of synthetic biology, continual progress in DNA synthesis technologies, and growing investments in genomics research worldwide. The expanding use of personalized medicine and biomarker development is also increasing the demand for high-precision gene construction tools. The gene synthesis industry provides essential solutions for pharmaceutical companies, biotechnology firms, academic research centers, and healthcare technology developers by offering custom gene synthesis, DNA library creation, and advanced cloning services. These solutions improve the efficiency of genetic engineering workflows, drug discovery studies, and molecular diagnostics. Automated synthesis platforms and sophisticated error-correction technologies have enhanced accuracy while reducing cost and turnaround time, making gene synthesis widely accessible. Increased government and private funding for large-scale genomics initiatives supports applications in disease modeling, agriculture, and industrial biotechnology. Growing utilization of synthetic genes in antibody engineering, vaccine development, and therapeutic design continues to push the industry forward. The post-pandemic landscape has further reinforced the importance of rapid synthetic gene production for accelerated therapeutic innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $951.9 Million |

| Forecast Value | $4.6 Billion |

| CAGR | 16.9% |

The solid-phase synthesis segment held 58.6% share in 2024, driven by its scalability, high precision, and suitability for generating long DNA sequences for both research and commercial use. Its stepwise nucleotide addition method enhances reliability and purification efficiency, making it a preferred synthesis technique.

The antibody DNA synthesis segment accounted for a 46.4% share in 2024 and is projected to reach USD 2.2 billion during the forecast period. Growth is driven by rising demand for monoclonal antibody therapies used across cancer treatment, immune system disorders, infectious diseases, and various rare conditions. This surge has increased the need for custom-designed antibody genes to accelerate therapeutic development pipelines.

North America Gene Synthesis Market held a 40.3% share in 2024. The region's leadership is supported by major biotechnology and pharmaceutical companies, strong research ecosystems, and significant investment in genomics and synthetic biology. Supportive regulatory structures and advanced clinical research capabilities continue to elevate the adoption of gene synthesis technologies.

Prominent companies participating in the Global Gene Synthesis Market include Azenta, Inc. (GENEWIZ), BIOMATIK, Bio Basic Inc., BIONEER CORPORATION, Gene Universal Inc., Eurofins Scientific SE, Integrated DNA Technologies, Inc., GenScript, Macrogen, Inc., ProMab Biotechnologies, Inc., OriGene Technologies, Inc., ProteoGenix, Synbio Technologies, Thermo Fisher Scientific Inc., and Twist Bioscience Corporation. Companies in the Gene Synthesis Market are strengthening their competitive position by scaling up automated synthesis platforms, improving error-correction capabilities, and expanding their custom gene design services. Many firms are forming strategic partnerships with pharmaceutical and biotechnology companies to integrate synthesis technologies directly into drug discovery and antibody engineering workflows. Investments in high-throughput systems and cloud-based sequence design tools are enabling faster project turnaround and greater volume capacity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Method trends

- 2.2.3 Services trends

- 2.2.4 Application trends

- 2.2.5 Complexity trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid advancements in DNA synthesis technology

- 3.2.1.2 Growing investments in gene synthesis projects and synthetic biology R&D

- 3.2.1.3 Increased prevalence of genetic disorders and chronic disease

- 3.2.1.4 Rising adoption of gene therapy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 Complex gene synthesis techniques and high process cost

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of CRISPR-based gene editing applications

- 3.2.3.2 RNA-based vaccines and therapeutics development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies and their impacts

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Investment and funding landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Solid-phase synthesis

- 5.3 PCR-based enzyme synthesis

- 5.4 Chip-based synthesis

Chapter 6 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antibody DNA synthesis

- 6.3 Viral DNA synthesis

- 6.4 Other services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Gene and cell therapy development

- 7.3 Disease diagnosis

- 7.4 Vaccine development

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Complexity, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Standard gene synthesis

- 8.3 Complex gene synthesis

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Biopharmaceutical companies

- 9.3 Academic and research institutes

- 9.4 Contract research organizations

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Azenta, Inc. (GENEWIZ)

- 11.2 Bio Basic Inc.

- 11.3 BIOMATIK

- 11.4 BIONEER CORPORATION

- 11.5 Eurofins Scientific SE

- 11.6 Gene Universal Inc.

- 11.7 GenScript

- 11.8 Integrated DNA Technologies, Inc.

- 11.9 Macrogen, Inc.

- 11.10 OriGene Technologies, Inc.

- 11.11 ProMab Biotechnologies, Inc.

- 11.12 ProteoGenix

- 11.13 Synbio Technologies

- 11.14 Thermo Fisher Scientific Inc.

- 11.15 Twist Bioscience Corporation