|

市場調查報告書

商品編碼

1876788

數位病理市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Digital Pathology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

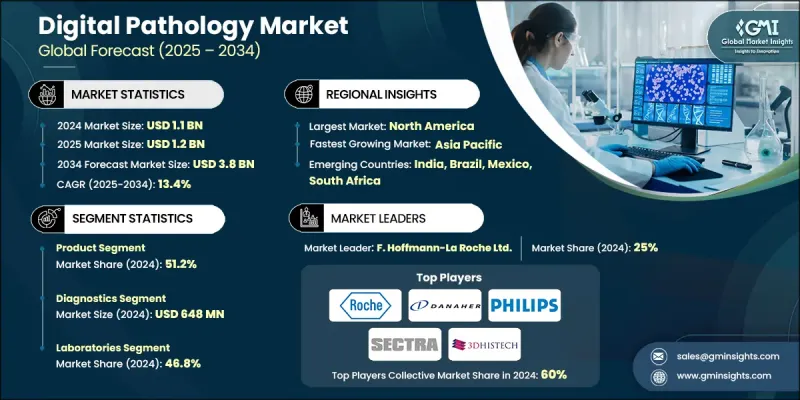

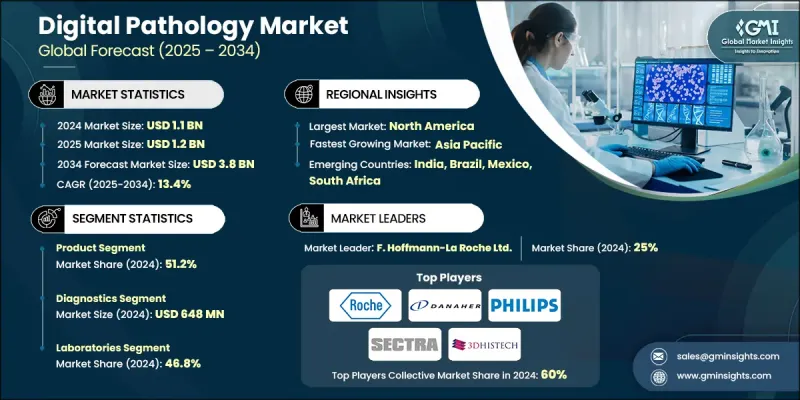

2024 年全球數位病理市場價值為 11 億美元,預計到 2034 年將以 13.4% 的複合年成長率成長至 38 億美元。

數位病理學市場的成長得益於數位化解決方案的日益普及、診斷基礎設施的現代化、與電子健康記錄 (EHR) 的整合,以及在藥物研發和伴隨診斷領域應用的不斷擴大。數位病理學利用數位影像技術掃描、分析和管理病理切片及相關資料,從而實現遠端診斷、人工智慧輔助解讀和與 EHR 的無縫整合。組織樣本數位化能提高診斷準確性,提升病理學家的工作流程效率,並支援研發工作。該市場涵蓋用於獲取、儲存、檢索、共享和分析病理切片資料的硬體和軟體解決方案。持續的技術創新,尤其是在腫瘤診斷領域,正在推動市場向前發展,因為製藥和研究機構擴大利用數位病理學來簡化藥物研發流程並改善精準醫療方法。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 13.4% |

由於該產品能夠最佳化工作流程並提高診斷精度,預計到2024年,其市佔率將達到51.2%。掃描儀支援遠端診斷和遠端病理學,減少了實體切片的運輸需求。切片管理系統簡化了資料處理,改善了跨地域協作,並提高了整體效率。其他產品則可實現日常任務自動化,最大限度地減少人為錯誤,並加快診斷速度,這在高流量的臨床環境中至關重要。

2024年,診斷領域的市場估值達到6.48億美元。該領域專注於解讀數位化組織切片,以在臨床工作流程中檢測疾病。病理學家依靠數位影像(通常藉助人工智慧分析工具增強)來識別腫瘤、感染或發炎等異常情況,從而取代傳統的基於顯微鏡的工作流程。

2024年,北美數位病理市場佔33.4%的佔有率。美國市場的成長主要得益於藥物研發、伴隨診斷以及研究機構對更快、更精準的組織分析方法的需求不斷成長。聯邦政府對生物醫學研究和藥物開發的投入也進一步推動了數位病理技術在該地區的應用。

全球數位病理市場的主要參與者包括3DHISTECH、Dedalus、CellaVision、丹納赫公司、羅氏製藥、富士膠片控股株式會社、Glencoe Software Inc.、濱松光子學株式會社、Huron Digital Pathology、Ibex Medical Analytics、Indica Labs Inc.、皇家飛利浦公司、Mikroscan Technologies Inc. AI、PathAI、PHC Holding Corporation(Epredia)、Proscia, Inc.、Sectra AB和Visiopharm A/S。這些公司正透過實施多項策略措施來鞏固其市場地位。他們投資於先進的高解析度成像設備和人工智慧驅動的分析軟體,以提高診斷準確性。許多公司正與醫院、研究機構和製藥公司建立合作關係,以擴大其在臨床和藥物開發工作流程中的應用。此外,他們還透過併購來整合技術並拓展產品組合。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 數位化解決方案的採用率不斷提高

- 數位病理診斷基礎設施的日益現代化

- 將數位病理系統與電子健康記錄(EHR)整合

- 在藥物發現和伴隨診斷的應用日益廣泛

- 產業陷阱與挑戰

- 數位病理學缺乏標準指南

- 硬體或軟體的實施和整合成本很高

- 市場機遇

- 對遠端病理和遠端病理解決方案的需求日益成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 報銷方案

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 產品

- 掃描儀

- 幻燈片管理系統

- 其他產品

- 軟體

- 類型

- AI增強型影像分析軟體

- 資料管理軟體

- 其他軟體

- 部署模式

- 基於雲端的

- 現場

- 類型

- 服務

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 診斷

- 研究

- 教育和培訓

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 研究機構

- 實驗室

- 病理實驗室

- 細胞學實驗室

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- 3DHISTECH

- CellaVision

- Danaher Corporation

- Dedalus

- F. Hoffmann-La Roche Ltd

- Fujifilm Holdings Corporation

- Glencoe Software Inc.

- Hamamatsu Photonics KK

- Huron Digital Pathology

- Ibex Medical Analytics

- Indica Labs Inc.

- Koninklijke Philips NV

- Mikroscan Technologies Inc.

- Olympus Corporation

- Paige AI

- PathAI

- PHC Holding Corporation

- Proscia, Inc.

- Sectra AB

- Visiopharm A/S

The Global Digital Pathology Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 3.8 billion by 2034.

The growth is fueled by the rising adoption of digital solutions, modernization of diagnostic infrastructure, integration with electronic health records (EHRs), and increasing utilization in drug discovery and companion diagnostics. Digital pathology involves using digital imaging technologies to scan, analyze, and manage pathology slides and related data. It enables remote diagnostics, AI-assisted interpretations, and seamless EHR integration. Digitizing tissue samples enhances diagnostic accuracy, accelerates workflow efficiency for pathologists, and supports research and development. The market encompasses both hardware and software solutions for acquiring, storing, retrieving, sharing, and analyzing pathology slide data. Continuous technological innovations, particularly in oncology diagnostics, are driving the market forward, as pharmaceutical and research institutions increasingly leverage digital pathology to streamline drug development and improve precision medicine approaches.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 13.4% |

The product segment held a 51.2% share in 2024 owing to its ability to optimize workflow and enhance diagnostic precision. Scanners enable remote diagnostics and telepathology, reducing the need to transport physical slides. Slide management systems simplify data handling, improve collaboration across locations, and increase overall efficiency. Other product offerings automate routine tasks, minimize human error, and accelerate diagnosis, which is crucial in high-volume clinical environments.

The diagnostics segment was valued at USD 648 million in 2024. This segment focuses on interpreting digitized tissue slides for disease detection within clinical workflows. Pathologists rely on digital images, often enhanced with AI-based analysis tools, to identify abnormalities such as tumors, infections, or inflammatory conditions, replacing traditional microscope-based workflows.

North America Digital Pathology Market held a 33.4% share in 2024. Growth in the U.S. is driven by increased adoption in drug discovery, companion diagnostics, and research institutions seeking faster, more accurate tissue analysis methods. Federal investment in biomedical research and drug development further supports the expansion of digital pathology technologies across the region.

Key players in the Global Digital Pathology Market include 3DHISTECH, Dedalus, CellaVision, Danaher Corporation, F. Hoffmann-La Roche Ltd, Fujifilm Holdings Corporation, Glencoe Software Inc., Hamamatsu Photonics K.K., Huron Digital Pathology, Ibex Medical Analytics, Indica Labs Inc., Koninklijke Philips N.V., Mikroscan Technologies Inc., Olympus Corporation (Evident Scientific, Inc.), Paige AI, PathAI, PHC Holding Corporation (Epredia), Proscia, Inc., Sectra AB, and Visiopharm A/S. Companies in the Global Digital Pathology Market are strengthening their foothold by implementing several strategic initiatives. They are investing in advanced, high-resolution imaging devices and AI-powered analysis software to improve diagnostic accuracy. Many are forming partnerships with hospitals, research institutions, and pharmaceutical firms to expand adoption in clinical and drug development workflows. Mergers and acquisitions are being used to consolidate technologies and broaden product portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trend

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of digital solutions

- 3.2.1.2 Growing modernization in diagnostic infrastructure in digital pathology

- 3.2.1.3 Integration of digital pathology systems with electronic health records (EHRs)

- 3.2.1.4 Increasing application in drug discovery and companion diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standard guidelines for digital pathology

- 3.2.2.2 High cost associated with the implementation and integration of hardware or software

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for remote pathology and telepathology solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Scanners

- 5.2.2 Slide management systems

- 5.2.3 Other products

- 5.3 Software

- 5.3.1 Type

- 5.3.1.1 AI enhanced image analysis software

- 5.3.1.2 Data management software

- 5.3.1.3 Other software

- 5.3.2 Deployment mode

- 5.3.2.1 Cloud-based

- 5.3.2.2 On-premises

- 5.3.1 Type

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.3 Research

- 6.4 Education and training

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Research institutes

- 7.3 Laboratories

- 7.3.1 Pathology labs

- 7.3.2 Cytology labs

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3DHISTECH

- 9.2 CellaVision

- 9.3 Danaher Corporation

- 9.4 Dedalus

- 9.5 F. Hoffmann-La Roche Ltd

- 9.6 Fujifilm Holdings Corporation

- 9.7 Glencoe Software Inc.

- 9.8 Hamamatsu Photonics K.K.

- 9.9 Huron Digital Pathology

- 9.10 Ibex Medical Analytics

- 9.11 Indica Labs Inc.

- 9.12 Koninklijke Philips N.V.

- 9.13 Mikroscan Technologies Inc.

- 9.14 Olympus Corporation

- 9.15 Paige AI

- 9.16 PathAI

- 9.17 PHC Holding Corporation

- 9.18 Proscia, Inc.

- 9.19 Sectra AB

- 9.20 Visiopharm A/S