|

市場調查報告書

商品編碼

1876786

鐵電隨機存取記憶體(FeRAM)市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Ferroelectric Random Access Memory (FeRAM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

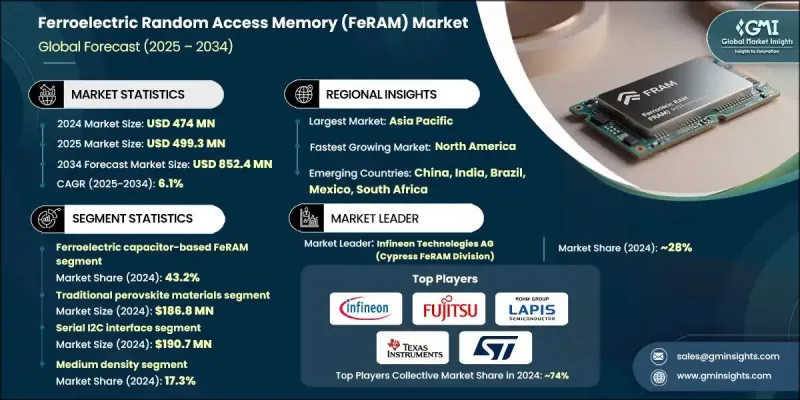

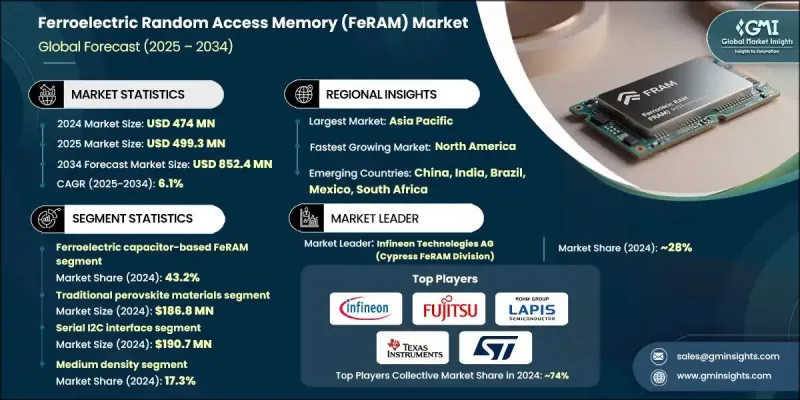

2024 年全球鐵電隨機存取記憶體 (FeRAM) 市場價值為 4.74 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長至 8.524 億美元。

現代電子產品對低功耗、高速和高可靠性儲存解決方案的需求日益成長,推動市場向前發展。隨著物聯網感測器、穿戴式科技和攜帶式醫療儀器等小型化設備日益複雜,傳統的快閃記憶體和EEPROM等儲存方案在效率和效能方面已無法滿足需求。 FeRAM憑藉其快速讀寫週期、非易失性和超低功耗等優勢脫穎而出。它無需刷新操作即可即時存儲資料,從而延長了電池壽命並提高了設備響應速度。這些優勢使得FeRAM成為工程師設計需要高耐久性和即時資料處理的嵌入式系統的首選。此外,汽車和工業應用也開始採用FeRAM,用於先進駕駛輔助系統、感測器記憶體和連續資料記錄等領域,這些領域對極端條件下的耐久性和可靠性要求極高。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.74億美元 |

| 預測值 | 8.524億美元 |

| 複合年成長率 | 6.1% |

2024年,基於鐵電電容器的FeRAM市佔率達到43.2%。該細分市場憑藉其穩定的性能、卓越的寫入速度和低能耗,持續保持領先地位。 FeRAM技術的可靠性已得到驗證,使其成為嵌入式運算、工廠自動化和汽車電子領域的基石。該領域的市場成長取決於旨在提高耐久性、增強資料保持能力和提升可擴展性的創新。持續投資於製造流程以及與CMOS技術的整合,將確保FeRAM在工業和汽車行業尋求高效、關鍵任務型儲存解決方案的過程中保持其重要性。

2024年,傳統鈣鈦礦材料市場規模達1.868億美元,持續維持其市場主導地位。這些材料因其優異的鐵電性能、製程穩定性以及與現有鐵電隨機存取記憶體(FeRAM)架構的兼容性而廣受認可。其可靠的性能使其成為汽車、消費性電子和工業系統等需要穩定耐用非揮發性記憶體的應用領域不可或缺的組件。為了保持競爭力,製造商正致力於提升鈣鈦礦基技術的可擴展性和改進製程整合,以開發面向未來的裝置。

2024年,北美鐵電隨機存取記憶體(FeRAM)市佔率達29.4%。該地區受益於有利的監管環境、強勁的資本投資和先進的研發基礎設施。美國作為創新中心,得益於頂尖學術機構、研究實驗室和科技公司之間的合作。這個生態系統正在加速產品開發,並促進FeRAM設計和製造技術的進步。

全球鐵電隨機存取記憶體 (FeRAM) 市場的主要參與者包括富士通半導體有限公司、三星電子有限公司、鐵電記憶體公司 (FMC)、英飛凌科技股份公司(賽普拉斯 FeRAM 事業部)、松下控股株式會社、意法半導體公司、Nantero 公司、德州儀器公司、東芝 M Technologies M Technologiesk Technologies 階段、Tamk、Maku Technologies.公司、美光科技公司、台積電 (TSMC)、RAMXEED 有限公司和羅姆集團旗下的 LAPIS 半導體有限公司。為了鞏固市場地位,鐵電隨機存取記憶體 (FeRAM) 市場的企業正積極推行以技術創新和生態系統合作為核心的策略。各公司正大力投資先進製造程序,以提升性能、可擴展性以及與 CMOS 和混合半導體平台的整合度。與汽車和工業設備製造商的合作項目正在推動針對特定應用場景的客製化 FeRAM 解決方案的開發。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 對低功耗、高速記憶體解決方案的需求日益成長

- FeRAM在汽車和工業系統中的整合度日益提高

- 鐵電材料工程和製造過程的進展

- 智慧卡和安全應用中非揮發性記憶體的應用日益廣泛

- 政府推出支持節能半導體技術的政策和資金。

- 產業陷阱與挑戰

- 高昂的製造成本和材料成本

- 與新興的非揮發性記憶體相比,其儲存密度有限。

- 市場機遇

- 物聯網和邊緣運算設備的擴展

- 汽車電子和ADAS系統的發展

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前趨勢

- 新興技術

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 基於鐵電電容器的 FeRAM

- 鐵電場效電晶體

- 鐵電隧道結

第6章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 傳統鈣鈦礦材料

- 摻雜氧化鉿

- 氮化鋁鈧

第7章:市場估算與預測:依介面類型分類,2021-2034年

- 主要趨勢

- 序列 I2C 介面

- 串行SPI介面

- 平行介面

第8章:市場估算與預測:依密度範圍分類,2021-2034年

- 主要趨勢

- 低密度

- 中等密度

- 高密度

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 汽車

- 工業自動化

- 基礎設施和智慧電網

- 醫療保健

- 消費性電子產品

- 網路與通訊

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Infineon Technologies AG (Cypress FeRAM Division)

- Fujitsu Semiconductor Limited

- LAPIS Semiconductor Co., Ltd. (ROHM Group)

- Texas Instruments Incorporated

- STMicroelectronics NV

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Micron Technology, Inc.

- Panasonic Holdings Corporation

- Toshiba Electronic Devices & Storage Corporation

- RAMXEED Limited

- Radiant Technologies, Inc.

- Ferroelectric Memory Company (FMC)

- Advanced Memory Technologies

- SK Hynix Inc.

- Samsung Electronics Co., Ltd.

- Nantero, Inc.

The Global Ferroelectric Random Access Memory (FeRAM) Market was valued at USD 474 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 852.4 million by 2034.

The rising demand for low-power, high-speed, and reliable memory solutions in modern electronics is driving the market forward. As compact devices like IoT sensors, wearable technology, and portable medical instruments become more sophisticated, conventional memory options such as Flash and EEPROM fall short in delivering both efficiency and performance. FeRAM stands out due to its combination of fast read/write cycles, non-volatility, and ultra-low power consumption. Its capability to instantly store data without refresh operations extends battery life and enhances device responsiveness. These advantages have made FeRAM a preferred choice for engineers designing embedded systems that require durability and real-time data processing. Additionally, automotive and industrial applications are adopting FeRAM for use in advanced driver assistance systems, sensor memory, and continuous data logging fields where endurance and reliability under extreme conditions are essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $474 Million |

| Forecast Value | $852.4 Million |

| CAGR | 6.1% |

The ferroelectric capacitor-based FeRAM segment held a 43.2% share in 2024. This segment continues to lead due to its stable performance, superior write speed, and low energy demands. The technology's proven reliability has made it a cornerstone in embedded computing, factory automation, and automotive electronics. Market growth in this area depends on innovations aimed at improving endurance, enhancing data retention, and advancing scalability. Continued investment in fabrication processes and integration with CMOS technology will ensure its relevance as industrial and automotive sectors seek efficient, mission-critical memory solutions.

The traditional perovskite materials segment generated USD 186.8 million in 2024, maintaining its dominance across the market. These materials are widely recognized for their strong ferroelectric properties, process stability, and compatibility with existing FeRAM architectures. Their dependable performance makes them indispensable for applications in automotive, consumer electronics, and industrial systems that demand consistent and durable non-volatile memory. To remain competitive, manufacturers are emphasizing enhanced scalability and improved process integration of perovskite-based technologies for future-generation devices.

North America Ferroelectric Random Access Memory (FeRAM) Market held a 29.4% share in 2024. The region benefits from a favorable regulatory landscape, strong capital investment, and advanced R&D infrastructure. The U.S. serves as a hub for innovation, supported by collaboration between leading academic institutions, research labs, and technology companies. This ecosystem is accelerating product development and fostering advancements in FeRAM design and manufacturing.

Key players operating in the Global Ferroelectric Random Access Memory (FeRAM) Market include Fujitsu Semiconductor Limited, Samsung Electronics Co., Ltd., Ferroelectric Memory Company (FMC), Infineon Technologies AG (Cypress FeRAM Division), Panasonic Holdings Corporation, STMicroelectronics N.V., Nantero, Inc., Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation, Radiant Technologies, Inc., SK Hynix Inc., Advanced Memory Technologies, Micron Technology, Inc., Taiwan Semiconductor Manufacturing Company (TSMC), RAMXEED Limited, and LAPIS Semiconductor Co., Ltd. (ROHM Group). To strengthen their market foothold, companies in the Ferroelectric Random Access Memory (FeRAM) Market are pursuing strategies focused on technological innovation and ecosystem partnerships. Firms are investing heavily in advanced manufacturing processes to enhance performance, scalability, and integration with CMOS and hybrid semiconductor platforms. Collaborative projects with automotive and industrial equipment manufacturers are enabling customized FeRAM solutions for specialized use cases.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Material trends

- 2.2.4 Interface trends

- 2.2.5 Density trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for low-power, high-speed memory solutions

- 3.2.1.2 Rising integration of FeRAM in automotive and industrial systems

- 3.2.1.3 Advancements in ferroelectric material engineering and fabrication processes

- 3.2.1.4 Increasing adoption of non-volatile memory in smart cards and security applications

- 3.2.1.5 Supportive government policies and funding for energy-efficient semiconductor technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and material costs

- 3.2.2.2 Limited storage density compared to emerging NVM

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in IoT and edge computing devices

- 3.2.3.2 Growth of automotive electronics and ADAS systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ferroelectric capacitor-based FeRAM

- 5.3 Ferroelectric field-effect transistor

- 5.4 Ferroelectric tunnel junction

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Traditional perovskite materials

- 6.3 Doped hafnium oxide

- 6.4 Aluminum scandium nitride

Chapter 7 Market Estimates and Forecast, By Interface Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Serial I2C interface

- 7.3 Serial SPI interface

- 7.4 Parallel interface

Chapter 8 Market Estimates and Forecast, By Density Range, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Low density

- 8.3 Medium density

- 8.4 High density

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Industrial automation

- 9.4 Infrastructure & smart grid

- 9.5 Medical & healthcare

- 9.6 Consumer electronics

- 9.7 Networking & communications

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Infineon Technologies AG (Cypress FeRAM Division)

- 11.2 Fujitsu Semiconductor Limited

- 11.3 LAPIS Semiconductor Co., Ltd. (ROHM Group)

- 11.4 Texas Instruments Incorporated

- 11.5 STMicroelectronics N.V.

- 11.6 Taiwan Semiconductor Manufacturing Company (TSMC)

- 11.7 Micron Technology, Inc.

- 11.8 Panasonic Holdings Corporation

- 11.9 Toshiba Electronic Devices & Storage Corporation

- 11.10 RAMXEED Limited

- 11.11 Radiant Technologies, Inc.

- 11.12 Ferroelectric Memory Company (FMC)

- 11.13 Advanced Memory Technologies

- 11.14 SK Hynix Inc.

- 11.15 Samsung Electronics Co., Ltd.

- 11.16 Nantero, Inc.