|

市場調查報告書

商品編碼

1876785

牙科植體及基台系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Dental Implants and Abutment Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

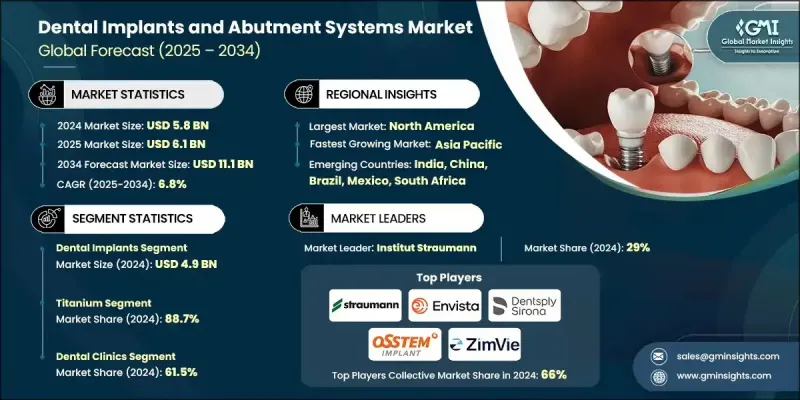

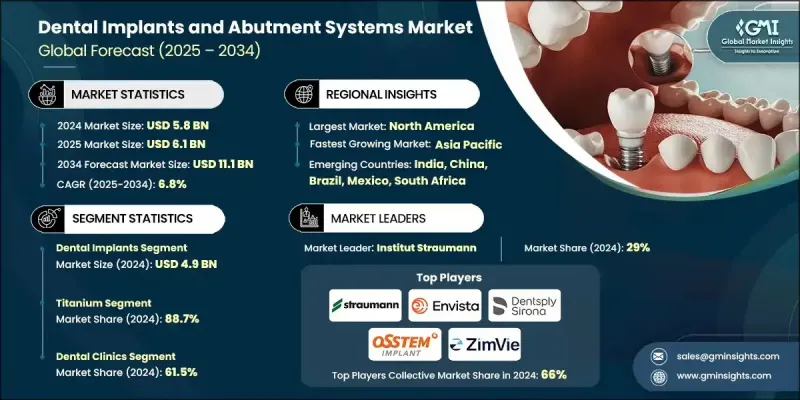

2024 年全球牙科植體和基台系統市場價值為 58 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長至 111 億美元。

全球老齡人口的成長、牙科疾病盛行率的上升以及人們對美容牙科需求的日益成長,共同推動了植牙市場的發展。已開發地區植體材料和技術的進步也促進了市場擴張。隨著年齡的成長,人們面臨牙齒脫落、牙齦疾病和骨質疏鬆等風險,因此對修復性牙科解決方案的需求也越來越大。植牙和基台系統旨在取代缺失的牙齒,恢復牙齒的功能和美觀。植體是一種由鈦或氧化鋯製成的人工牙根,透過手術植入下顎骨,用於支撐牙冠、牙橋或義齒。基台將義齒與植體連接起來,為缺失的牙齒提供持久、穩定且外觀自然的替代方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 58億美元 |

| 預測值 | 111億美元 |

| 複合年成長率 | 6.8% |

牙植體市場分為植體和基台系統兩大類。由於植體具有優異的生物相容性和與骨組織整合的能力,預計到2024年,植體市場規模將達到49億美元。植體為牙科修復體提供穩定的基礎,能夠複製天然牙齒的功能和外觀。

到2024年,牙科診所市佔率將達到61.5%。它們是植牙手術的主要場所,並且正日益整合數位化工作流程和客製化植牙解決方案。患者對個人化護理和高品質治療的期望不斷提高,使得牙科診所在植牙和基台系統的推廣和成功應用方面發揮著至關重要的作用。

2024年北美牙科植體和基台系統市場規模為23億美元,預計2034年將達42億美元。該地區市場成長的主要促進因素包括牙科疾病的高發生率、口腔健康意識的提高以及創新牙科技術的應用。數位化工作流程、微創技術和客製化基台的進步正在推動北美地區牙科植體和基台系統的普及。

牙科植體和基台系統市場的主要參與者包括Cortex、AB Dental Devices、Bicon、Envista Holdings Corporation、Biotem、Dentsply Sirona、Osstem Implant、ZimVie、Adin Dental Implant Systems、Dentalpoint、Ziacom、HenryCos. Solutions、BioHorizons、Ditron Dental和BioThread Dental Implant Systems。這些公司正採取多種策略來鞏固其市場地位。他們專注於持續的研發,以改善植體材料、設計和手術技術,從而提升產品性能和患者療效。與牙科診所、醫院和分銷商的策略合作有助於擴大市場覆蓋範圍並改善服務交付。此外,各公司也正在投資數位化技術,以提供客製化和微創解決方案。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 全球老年人口基數不斷擴大

- 全球牙科疾病盛行率不斷上升

- 全球對美容牙科的需求不斷成長

- 已開發國家植入技術的進步

- 產業陷阱與挑戰

- 有限的報銷政策

- 植牙治療費用高昂

- 市場機遇

- 轉向微創手術

- 新興國家牙科旅遊的擴張

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 報銷方案

- 2024年定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 植牙

- 錐形植體

- 平行壁植體

- 橋台系統

- 股票橋墩

- 客製化基台

- 基台固定螺絲

第6章:市場估算與預測:依材料分類,2021-2034年

- 主要趨勢

- 鈦

- 鋯

- 其他材料

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 牙醫診所

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Dentsply Sirona

- AB Dental Devices

- Adin Dental Implant Systems

- Bicon

- Cortex

- AVINENT Science and Material

- Envista Holdings Corporation

- Henry Schein

- Institut Straumann

- Osstem Implant

- ZimVie

- Biotem

- Dentium USA

- Ziacom

- Dynamic Abutment Solutions

- Keystone Dental Group

- BHI Implants

- Dentalpoint

- Ditron Dental

- Cowellmedi

- TAV Dental

- BioHorizons

- National Dentex Labs

- Glidewell

- BioThread Dental Implant Systems

The Global Dental Implants and Abutment Systems Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 11.1 billion by 2034.

The growth is fueled by the rising elderly population worldwide, the increasing prevalence of dental disorders, and the growing demand for cosmetic dentistry. Technological advancements in implant materials and procedures in developed regions are also contributing to market expansion. As individuals age, they face greater risks of tooth loss, gum disease, and bone degradation, creating a strong demand for restorative dental solutions. Dental implants and abutment systems are designed to replace missing teeth, restoring both function and aesthetics. A dental implant serves as an artificial tooth root made from titanium or zirconia, surgically positioned in the jawbone to support crowns, bridges, or dentures. The abutment connects the prosthetic tooth to the implant, providing a durable, stable, and natural-looking replacement for lost teeth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 6.8% |

The market is divided into dental implants and abutment systems, with dental implants generating USD 4.9 billion in 2024 owing to their excellent biocompatibility and ability to integrate with bone tissue. Dental implants act as stable foundations for dental prosthetics, replicating the function and appearance of natural teeth.

The dental clinics segment held a 61.5% share in 2024. They serve as the primary point for implant procedures and are increasingly integrating digital workflows and customized implant solutions. Rising patient expectations for personalized care and high-quality treatments make dental clinics central to the adoption and success of dental implants and abutment systems.

North America Dental Implants and Abutment Systems Market generated USD 2.3 billion in 2024 and is projected to reach USD 4.2 billion by 2034. Growth in this region is driven by the high prevalence of dental disorders, growing oral health awareness, and the adoption of innovative dental technologies. Advances in digital workflows, minimally invasive techniques, and customized abutments are boosting the uptake of dental implants and abutment systems across North America.

Key players in the Dental Implants and Abutment Systems Market include Cortex, A.B. Dental Devices, Bicon, Envista Holdings Corporation, Biotem, Dentsply Sirona, Osstem Implant, ZimVie, Adin Dental Implant Systems, Dentalpoint, Ziacom, Henry Schein, TAV Dental, Institut Straumann, Glidewell, Keystone Dental Group, Cowellmedi, Dentium USA, Dynamic Abutment Solutions, BioHorizons, Ditron Dental, and BioThread Dental Implant Systems. Companies in the Dental Implants and Abutment Systems Market are pursuing several strategies to strengthen their market position. They focus on continuous research and development to improve implant materials, designs, and surgical techniques, enhancing product performance and patient outcomes. Strategic collaborations with dental clinics, hospitals, and distributors help expand market reach and improve service delivery. Companies are also investing in digital technologies for customized and minimally invasive solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding elderly population base across the globe

- 3.2.1.2 Growing prevalence of dental disorders worldwide

- 3.2.1.3 Rising demand for cosmetic dentistry across the world

- 3.2.1.4 Advancements in implant technology in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of dental implant treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Shift towards minimally invasive procedures

- 3.2.3.2 Expansion of dental tourism in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dental implants

- 5.2.1 Tapered implants

- 5.2.2 Parallel-walled implants

- 5.3 Abutment systems

- 5.3.1 Stock abutments

- 5.3.2 Custom abutments

- 5.3.3 Abutments fixation screws

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Zirconium

- 6.4 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Dental clinics

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Dentsply Sirona

- 9.2 A.B. Dental Devices

- 9.3 Adin Dental Implant Systems

- 9.4 Bicon

- 9.5 Cortex

- 9.6 AVINENT Science and Material

- 9.7 Envista Holdings Corporation

- 9.8 Henry Schein

- 9.9 Institut Straumann

- 9.10 Osstem Implant

- 9.11 ZimVie

- 9.12 Biotem

- 9.13 Dentium USA

- 9.14 Ziacom

- 9.15 Dynamic Abutment Solutions

- 9.16 Keystone Dental Group

- 9.17 BHI Implants

- 9.18 Dentalpoint

- 9.19 Ditron Dental

- 9.20 Cowellmedi

- 9.21 TAV Dental

- 9.22 BioHorizons

- 9.23 National Dentex Labs

- 9.24 Glidewell

- 9.25 BioThread Dental Implant Systems