|

市場調查報告書

商品編碼

1876781

牙科植體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Dental Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

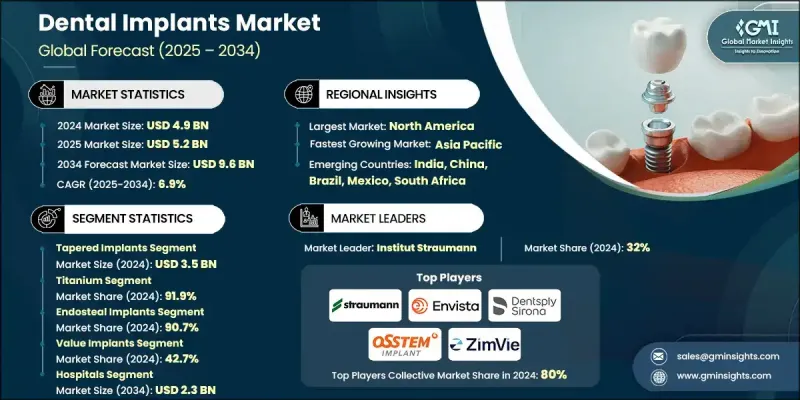

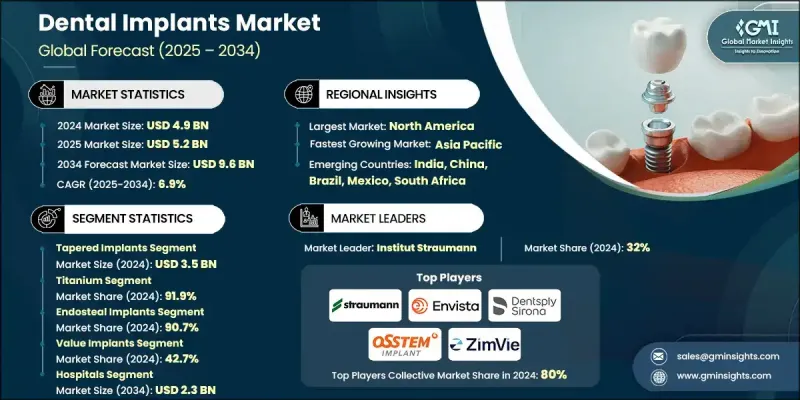

2024 年全球牙科植體市場價值為 49 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長至 96 億美元。

全球牙科疾病盛行率的上升是推動牙科需求的主要因素。生活方式的改變、口腔衛生不良以及糖分攝取量的增加等因素都會導致齲齒、牙齦疾病和口腔損傷。牙齒脫落在老年人中尤其常見,通常是由於多年的磨損或糖尿病等慢性疾病造成的,這些疾病會促進口腔液中細菌的滋生。牙科植體以手術植入顎骨,用於支撐牙冠、牙橋、義齒或臉部假體等修復體,也可作為矯正支抗。近年來,植體技術的創新,包括使用鈦合金和氧化鋯等生物相容性材料,提高了美觀性、顎骨整合性和長期耐用性,進一步推動了植體在牙科領域的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 49億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 6.9% |

2024 年,錐形植體創造了 35 億美元的收入,預計到 2034 年將以 7.3% 的複合年成長率成長。其錐形設計在狹窄的齒槽嵴或低品質的骨骼等複雜情況下提供了更高的穩定性,使得在植入後不久即可立即對牙冠或義齒等修復體進行負重。

2024年,鈦植體市佔率佔比高達91.9%,預計到2034年將達到87億美元。鈦能形成一層保護性氧化層,有效抵抗體液侵蝕,確保長期穩定性,並減少修復手術的需求。這種耐用性使其在全球牙科領域中廣泛應用。

預計到2034年,美國牙科植體市場規模將達到33億美元,主要得益於美國擁有大量技術精湛的植牙專業牙科人員。此外,植牙技術的進步和美國牙科教育水平的提高也進一步推動了市場擴張。

全球牙科植體市場的主要參與者包括 Mega'gen Implant、MIS Implants Technologies、Cortex Dental Implants Industries、Bicon、Dentsply Sirona、Henry Schein、Osstem Implant、AVINENT Implant System、NucleOSS、AB Dental Devices、Envista Holdings Corporation、StrINENT Implant System、NucleOSS、AB Dental Devices、Envista Holdings Corporation、Straumann Holding、Glideal牙科植體市場的企業正透過多種策略措施鞏固其市場地位。他們大力投資研發,以開發先進的植體設計和生物相容性材料,從而提高植體的成功率和美學效果。拓展分銷網路並與牙科診所和醫院建立合作關係,有助於確保穩定的市場准入。許多企業正著力推廣數位化牙科解決方案,包括電腦導引植和 CAD/CAM 支援的義齒製作。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 全球老年人口不斷增加

- 全球牙科疾病發生率不斷上升

- 已開發國家植入技術的進步

- 對美容牙科的需求不斷成長

- 產業陷阱與挑戰

- 有限的報銷政策

- 植牙治療費用高昂

- 市場機遇

- 轉向微創手術

- 新興國家牙科旅遊的擴張

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 報銷方案

- 2024年定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略儀錶板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 錐形植體

- 平行壁植體

第6章:市場估算與預測:依材料分類,2021-2034年

- 主要趨勢

- 鈦

- 鋯

第7章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 骨內植入物

- 骨膜下植入物

- 骨內植體

- 黏膜內植體

第8章:市場估算與預測:依價格分類,2021-2034年

- 主要趨勢

- 高階植入物

- 價值植入物

- 折扣植入物

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 牙醫診所

- 牙科服務機構

- 其他最終用途

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第11章:公司簡介

- AB Dental Devices

- Adin Dental Implant Systems

- AVINENT Implant System

- Bicon

- Cortex Dental Implants Industries

- Dentsply Sirona

- Envista Holdings Corporation

- Glidewell

- Henry Schein

- Mega'gen Implant

- MIS Implants Technologies

- NucleOSS

- Osstem Implant

- Straumann Holding

- ZimVie

The Global Dental Implants Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 9.6 billion by 2034.

The rising prevalence of dental disorders worldwide is a major factor driving demand. Factors such as shifting lifestyles, poor oral hygiene, and increased sugar consumption are contributing to tooth decay, gum disease, and oral injuries. Tooth loss is particularly common in older adults, often resulting from years of wear, tear, or chronic conditions like diabetes, which promote bacterial growth in oral fluids. Dental implants are surgically placed in the jawbone to support prosthetics such as crowns, bridges, dentures, or facial prostheses, and can also serve as orthodontic anchors. Recent innovations in implant technologies, including the use of biocompatible materials like titanium alloys and zirconia, are enhancing aesthetics, jawbone integration, and long-term durability, further fueling adoption in dental care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 6.9% |

The tapered implants generated USD 3.5 billion in 2024 and are projected to grow at a CAGR of 7.3% through 2034. Their conical design provides higher stability in challenging cases such as narrow ridges or low-quality bone, enabling immediate loading of prostheses like crowns or dentures shortly after placement.

The titanium implants segment held 91.9% share in 2024 and is expected to reach USD 8.7 billion by 2034. Titanium forms a protective oxide layer that resists reactions with bodily fluids, ensuring long-term stability and reducing the need for revision surgeries. This durability underpins its widespread adoption across dental applications globally.

U.S. Dental Implants Market is forecasted to reach USD 3.3 billion by 2034, driven by the presence of highly skilled dental professionals specializing in implantology. Technological advancements in implant techniques and enhanced dental education in the country are further supporting market expansion.

Key players in the Global Dental Implants Market include Mega'gen Implant, MIS Implants Technologies, Cortex Dental Implants Industries, Bicon, Dentsply Sirona, Henry Schein, Osstem Implant, AVINENT Implant System, NucleOSS, A.B. Dental Devices, Envista Holdings Corporation, Straumann Holding, Glidewell, Adin Dental Implant Systems, and ZimVie. Companies in the Dental Implants Market are strengthening their positions through multiple strategic approaches. They are investing heavily in R&D to develop advanced implant designs and biocompatible materials that improve success rates and aesthetic outcomes. Expanding distribution networks and establishing partnerships with dental clinics and hospitals help secure consistent market access. Many players are emphasizing digital dentistry solutions, including computer-guided implant placement and CAD/CAM-supported prosthetics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Type trends

- 2.2.5 Price trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing elderly population worldwide

- 3.2.1.2 Growing prevalence of dental disorders across the globe

- 3.2.1.3 Advancements in implant technologies in developed countries

- 3.2.1.4 Rising demand for cosmetic dentistry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of dental implant treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Shift towards minimally invasive procedures

- 3.2.3.2 Expansion of dental tourism in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tapered implants

- 5.3 Parallel-walled implants

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Zirconium

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Endosteal implants

- 7.3 Subperiosteal implants

- 7.4 Transosteal implants

- 7.5 Intramucosal implants

Chapter 8 Market Estimates and Forecast, By Price, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Premium implants

- 8.3 Value implants

- 8.4 Discounted implants

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Dental clinics

- 9.4 Dental service organization

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 A.B. Dental Devices

- 11.2 Adin Dental Implant Systems

- 11.3 AVINENT Implant System

- 11.4 Bicon

- 11.5 Cortex Dental Implants Industries

- 11.6 Dentsply Sirona

- 11.7 Envista Holdings Corporation

- 11.8 Glidewell

- 11.9 Henry Schein

- 11.10 Mega’gen Implant

- 11.11 MIS Implants Technologies

- 11.12 NucleOSS

- 11.13 Osstem Implant

- 11.14 Straumann Holding

- 11.15 ZimVie