|

市場調查報告書

商品編碼

1876783

再生金屬市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Recycled Metal Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

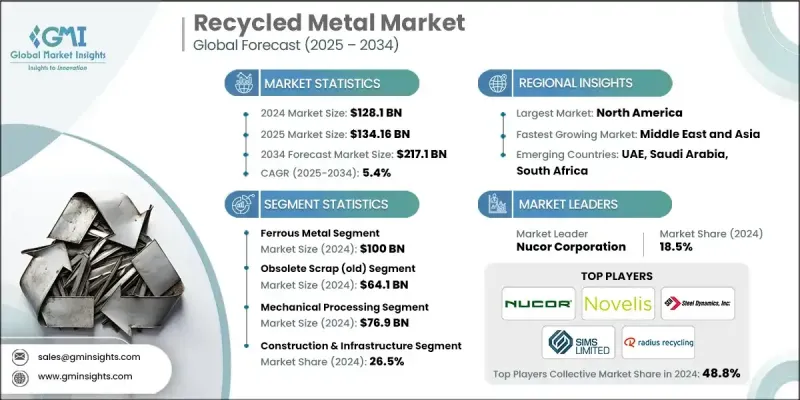

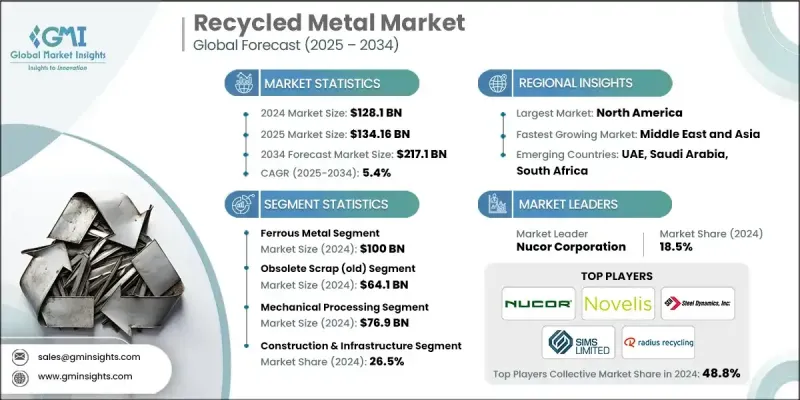

2024年全球再生金屬市場價值為1,281億美元,預計2034年將以5.4%的複合年成長率成長至2,171億美元。

市場專注於收集、加工和再利用廢棄金屬,將其轉化為新的原料,從而減少對原生礦石的開採需求。從車輛、建築、電子產品和包裝等報廢產品中回收的金屬在環境永續性、節能減排和溫室氣體減排方面發揮著至關重要的作用。鋁、鋼、銅和鋅可以重複回收而不損失質量,是循環經濟的關鍵組成部分。包括人工智慧驅動的分類、機器人技術、基於感測器的分離以及低排放爐在內的技術進步,顯著提高了回收效率。數位追蹤和區塊鏈應用正被日益廣泛地採用,以確保回收金屬的透明度、可追溯性和真實性,使製造商和消費者能夠驗證供應鏈的完整性和永續採購實踐。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1281億美元 |

| 預測值 | 2171億美元 |

| 複合年成長率 | 5.4% |

預計到2024年,機械加工環節的產值將達到769億美元,該環節能夠高效地對廢金屬進行破碎、切割和預處理,以便其再利用。熱加工環節緊隨其後,該環節擅長從成分複雜或受污染的廢料中回收金屬,透過在高溫下熔化和分離,獲得適用於工業用途的高純度金屬產品。

2024年,建築和基礎設施領域佔據26.5%的市場佔有率,這主要得益於建築和土木工程項目對鋼鐵和鋁材的強勁需求。汽車和交通運輸行業由於電動和輕型汽車的普及而快速成長。工業機械、電子產品、電氣設備、包裝和能源公用事業也高度依賴回收金屬來實現經濟高效且永續的生產,其應用範圍涵蓋電路、線路以及可再生能源系統等各個領域。

受汽車和建築業需求成長的推動,美國再生金屬市場規模在2024年達到266億美元。在北美,電動車、節能基礎設施和永續製造實踐的普及是推動市場成長的主要動力。加拿大正加大工業廢棄物和廢棄物回收的投資,以支持循環經濟措施。

全球再生金屬市場的主要企業包括:Metaloop GmbH、Redwood Materials Inc.、Kuusakoski Group、Steel Dynamics Inc.、Radius Recycling Inc.、Sims Metal Management Limited、Lohum Cleantech Pvt Ltd、Ace Green Recycling Inc.、Nucor Corporation、Europe Metalan Metal,clid、Ace Green。 Alliance、Hensel Recycling GmbH、Novelis Inc.、ScrapBees GmbH、Sortera Technologies Inc. 和 Triple M Metal LP。這些企業正採取多種策略來鞏固自身市場地位,包括擴大加工能力、投資先進的分類和冶煉技術以及引入自動化以提高效率。此外,他們還透過建立策略合作夥伴關係和合資企業來增強供應鏈能力並確保原料供應。許多企業正致力於數位化、基於區塊鏈的可追溯性以及永續性認證,以吸引具有環保意識的客戶。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 不斷成長的工業和建築活動

- 回收製程的技術進步

- 來自汽車和電子行業的需求不斷成長

- 成長促進因素

- 產業陷阱與挑戰

- 廢金屬價格波動

- 缺乏高效率的收集和分類系統

- 市場機遇

- 數位技術與自動化的融合

- 綠色產業對再生原料的需求不斷成長

- 產品創新與再生金屬製造

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按金屬類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依金屬類型分類,2021-2034年

- 主要趨勢

- 黑色金屬

- 廢鋼

- 廢鐵

- 鑄鐵

- 有色金屬

- 鋁

- 原鋁廢料

- 再生鋁合金

- 銅

- 銅線電纜

- 銅管

- 帶領

- 電池引線

- 鉛片

- 貴金屬

- 黃金回收

- 銀回收

- 鉑族金屬

- 特殊金屬

- 鈦

- 鎳

- 稀土元素

- 鋁

第6章:市場估算與預測:依廢棄物來源分類,2021-2034年

- 主要趨勢

- 工業廢料(快速廢料)

- 製造廢棄物流

- 加工廠副產品

- 廢棄廢料(舊廢料)

- 報廢車輛

- 拆除的建築物和基礎設施

- 電子垃圾(電子廢棄物)

- 家用電器和消費品

- 家庭廢料(新廢料)

- 鋼鐵廠回歸

- 鑄造廠回歸

第7章:市場估算與預測:依加工方式分類,2021-2034年

- 主要趨勢

- 機械加工

- 粉碎和尺寸縮減

- 磁選

- 密度分離

- 熱處理

- 電弧爐(EAF)

- 感應爐

- 火法冶金加工

- 化學加工

- 濕式冶金萃取

- 電解精煉

- 溶劑萃取

- 先進的分選技術

- 人工智慧驅動的光學分選

- 基於感測器的分離

- 雷射誘導擊穿光譜(LIBS)

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 建築與基礎設施

- 結構鋼應用

- 加固材料

- 政府基礎建設項目

- 汽車與運輸

- 車身及車架部件

- 引擎和傳動系統部件

- 電動汽車零件

- 製造和工業機械

- 重型設備

- 工業工具及組件

- 電氣與電子

- 電線和導線

- 電子元件

- 電池應用

- 包裝及容器

- 食品飲料包裝

- 工業包裝

- 能源與公用事業

- 發電設備

- 再生能源基礎設施

- 電網和輸電系統

- 航太與國防

- 飛機部件

- 國防應用

- 消費品和家電

- 化工及加工工業

- 海洋與造船

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Ace Green Recycling Inc.

- Asahi Holdings Inc.

- Batx Energies Private Limited

- Befesa SA

- 歐洲金屬回收有限公司

- GFG Alliance

- Hensel Recycling GmbH

- Kuusakoski Group

- Lohum Cleantech Pvt Ltd

- Metaloop GmbH

- Nucor Corporation

- Novelis Inc

- Redwood Materials Inc.

- ScrapBees GmbH

- Radius Recycling Inc.

- Sims Metal Management Limited

- Sortera Technologies Inc

- Steel Dynamics Inc.

- Triple M Metal LP

The Global Recycled Metal Market was valued at USD 128.1 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 217.1 billion by 2034.

The market focuses on collecting, processing, and repurposing used metals into new raw materials, reducing the need for mining virgin ores. Metals recovered from end-of-life products such as vehicles, buildings, electronics, and packaging play a crucial role in environmental sustainability, energy conservation, and greenhouse gas reduction. Aluminium, steel, copper, and zinc can be recycled repeatedly without losing quality, making them key contributors to a circular economy. Technological advancements, including AI-driven sorting, robotics, sensor-based separation, and low-emission furnaces, have significantly enhanced recovery efficiency. Digital tracking and blockchain applications are increasingly being adopted to ensure transparency, traceability, and authenticity of recycled metals, enabling manufacturers and consumers to verify supply chain integrity and sustainable sourcing practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128.1 Billion |

| Forecast Value | $217.1 Billion |

| CAGR | 5.4% |

The mechanical processing segment generated USD 76.9 billion in 2024, as it efficiently shreds, cuts, and prepares scrap metals for reuse. Thermal processing follows, excelling in recovering metals from complex or contaminated scrap by melting and separating them at high temperatures to achieve high-purity outputs suitable for industrial use.

The construction and infrastructure segment held a 26.5% share in 2024, driven by high demand for steel and aluminium in building and civil engineering projects. The automotive and transportation sector is experiencing rapid growth due to the adoption of electric and lightweight vehicles. Industrial machinery, electronics, electrical equipment, packaging, and energy utilities also rely heavily on recycled metals for cost-effective and sustainable production, ranging from circuits and wiring to renewable energy systems.

U.S. Recycled Metal Market reached USD 26.6 billion in 2024, driven by increasing demand from the automotive and construction sectors. In North America, the growth is fueled by the shift toward electric vehicles, energy-efficient infrastructure, and sustainable manufacturing practices. Canada is investing in recovery from industrial and obsolete scrap to support circular economy initiatives.

Key companies operating in the Global Recycled Metal Market include: Metaloop GmbH, Redwood Materials Inc., Kuusakoski Group, Steel Dynamics Inc., Radius Recycling Inc., Sims Metal Management Limited, Lohum Cleantech Pvt Ltd, Ace Green Recycling Inc., Nucor Corporation, European Metal Recycling Limited, Asahi Holdings Inc., Befesa S.A., Batx Energies Private Limited, GFG Alliance, Hensel Recycling GmbH, Novelis Inc., ScrapBees GmbH, Sortera Technologies Inc., Triple M Metal LP. Companies in the recycled metal market are employing several strategies to strengthen their position, including expanding processing capacities, investing in advanced sorting and smelting technologies, and integrating automation to improve efficiency. They are also forming strategic partnerships and joint ventures to enhance supply chain capabilities and secure raw material sources. Many players are focusing on digitalization, blockchain-based traceability, and sustainability certifications to appeal to environmentally conscious customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Metal Type

- 2.2.2 Scrap Source

- 2.2.3 Processing Method

- 2.2.4 End use Industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing industrial and construction activities

- 3.2.1.2 Technological advancements in recycling processes

- 3.2.1.3 Increasing demand from automotive and electronics sectors

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 Fluctuating scrap metal prices

- 3.3.2 Lack of efficient collection and segregation systems

- 3.4 Market opportunities

- 3.4.1 Integration of digital technologies and automation

- 3.4.2 Rising demand for secondary raw materials in green industries

- 3.4.3 Product innovation and recycled metal-based manufacturing

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By metal type

- 3.11 Future market trends

- 3.12 Technology and innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Patent landscape

- 3.14 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.14.1 Major importing countries

- 3.14.2 Major exporting countries

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.16 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Metal Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ferrous metals

- 5.2.1 Steel scrap

- 5.2.2 Iron scrap

- 5.2.3 Cast iron

- 5.3 Non-ferrous metals

- 5.3.1 Aluminum

- 5.3.1.1 Primary aluminum scrap

- 5.3.1.2 Secondary aluminum alloys

- 5.3.2 Copper

- 5.3.2.1 Copper wire & cable

- 5.3.2.2 Copper tubing & pipe

- 5.3.3 Lead

- 5.3.3.1 Battery lead

- 5.3.3.2 Sheet lead

- 5.3.4 Precious metals

- 5.3.4.1 Gold recovery

- 5.3.4.2 Silver recovery

- 5.3.4.3 Platinum group metals

- 5.3.5 Specialty metals

- 5.3.5.1 Titanium

- 5.3.5.2 Nickel

- 5.3.5.3 Rare earth elements

- 5.3.1 Aluminum

Chapter 6 Market Estimates and Forecast, By Scrap Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Industrial scrap (Prompt scrap)

- 6.2.1 Manufacturing waste streams

- 6.2.2 Processing facility byproducts

- 6.3 Obsolete scrap (Old scrap)

- 6.3.1 End-of-life vehicles

- 6.3.2 Demolished buildings & infrastructure

- 6.3.3 Electronic waste (E-waste)

- 6.3.4 Appliances & consumer goods

- 6.4 Home scrap (New scrap)

- 6.4.1 Steel mill revert

- 6.4.2 Foundry returns

Chapter 7 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical processing

- 7.2.1 Shredding & size reduction

- 7.2.2 Magnetic separation

- 7.2.3 Density separation

- 7.3 Thermal processing

- 7.3.1 Electric arc furnace (EAF)

- 7.3.2 Induction furnace

- 7.3.3 Pyrometallurgical processing

- 7.4 Chemical processing

- 7.4.1 Hydrometallurgical extraction

- 7.4.2 Electrorefining

- 7.4.3 Solvent extraction

- 7.5 Advanced sorting technologies

- 7.5.1 AI-powered optical sorting

- 7.5.2 Sensor-based separation

- 7.5.3 Laser-induced breakdown spectroscopy (LIBS)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction & infrastructure

- 8.2.1 Structural steel applications

- 8.2.2 Reinforcement materials

- 8.2.3 Government infrastructure projects

- 8.3 Automotive & transportation

- 8.3.1 Body & frame components

- 8.3.2 Engine & drivetrain parts

- 8.3.3 Electric vehicle components

- 8.4 Manufacturing & industrial machinery

- 8.4.1 Heavy equipment

- 8.4.2 Industrial tools & components

- 8.5 Electrical & electronics

- 8.5.1 Wiring & conductors

- 8.5.2 Electronic components

- 8.5.3 Battery applications

- 8.6 Packaging & containers

- 8.6.1 Food & beverage packaging

- 8.6.2 Industrial packaging

- 8.7 Energy & utilities

- 8.7.1 Power generation equipment

- 8.7.2 Renewable energy infrastructure

- 8.7.3 Grid & transmission systems

- 8.8 Aerospace & defense

- 8.8.1 Aircraft components

- 8.8.2 Defense applications

- 8.9 Consumer products & appliances

- 8.10 Chemical & process industries

- 8.11 Marine & shipbuilding

- 8.12 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Ace Green Recycling Inc.

- 10.2 Asahi Holdings Inc.

- 10.3 Batx Energies Private Limited

- 10.4 Befesa S.A.

- 10.5 European Metal Recycling Limited

- 10.6 GFG Alliance

- 10.7 Hensel Recycling GmbH

- 10.8 Kuusakoski Group

- 10.9 Lohum Cleantech Pvt Ltd

- 10.10 Metaloop GmbH

- 10.11 Nucor Corporation

- 10.12 Novelis Inc

- 10.13 Redwood Materials Inc.

- 10.14 ScrapBees GmbH

- 10.15 Radius Recycling Inc.

- 10.16 Sims Metal Management Limited

- 10.17 Sortera Technologies Inc

- 10.18 Steel Dynamics Inc.

- 10.19 Triple M Metal LP