|

市場調查報告書

商品編碼

1876655

艾迪生氏症藥物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Addisons Disease Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

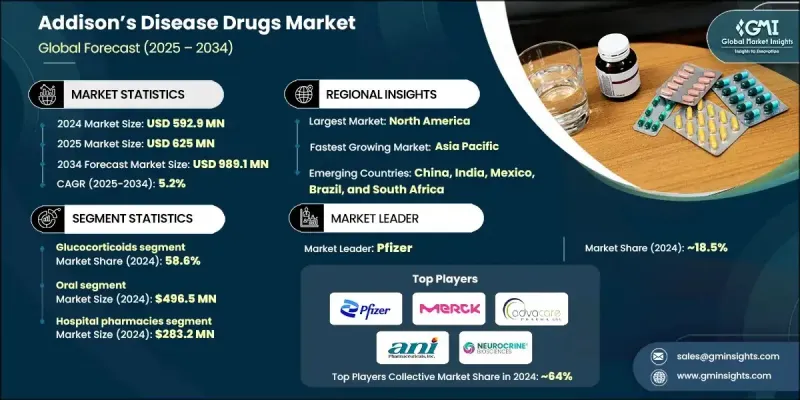

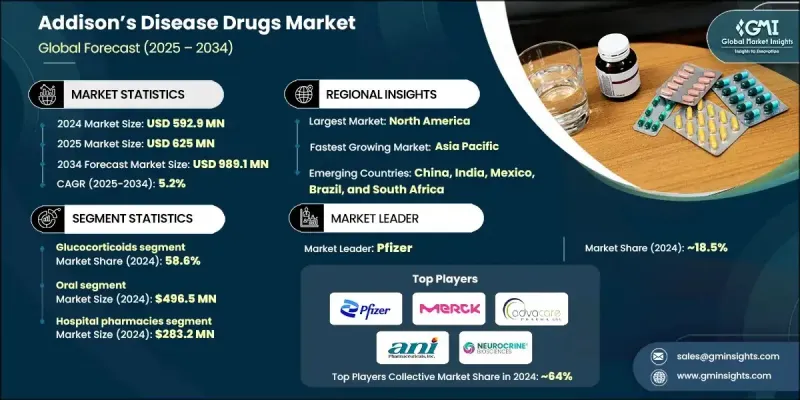

2024 年全球艾迪生氏病藥物市場價值為 5.929 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 9.891 億美元。

隨著與腎上腺功能衰竭相關的自體免疫疾病日益常見,以及醫療保健系統不斷擴大罕見疾病計畫和宣傳活動,該領域的成長勢頭依然強勁。越來越多的人被診斷為原發性腎上腺皮質功能不全,這種疾病源自於腎上腺皮質的進行性損傷,通常需要終身服用皮質類固醇替代療法。繼發性腎上腺皮質功能不全的病例也在增加,這得益於對腦下垂體問題或長期使用皮質類固醇引起的荷爾蒙失衡的診斷水平的提高。隨著越來越多的患者依賴長期荷爾蒙治療,對可靠治療方案的需求持續成長。製藥公司正在透過改進藥物輸送系統和最佳化配方來應對這一需求,旨在維持穩定的皮質醇和醛固酮水平,最終改善慢性腎上腺疾病患者的日常管理。艾迪生病藥物涵蓋了用於支持腎上腺無法產生足夠必需激素的患者的療法。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.929億美元 |

| 預測值 | 9.891億美元 |

| 複合年成長率 | 5.2% |

2024年,糖皮質激素類藥物佔了58.6%的市場佔有率,這反映了其在腎上腺皮質功能不全患者中取代皮質醇的關鍵作用。其持續領先地位得益於廣泛的適用性、多種給藥方式以及在預防危及生命的腎上腺危象方面強大的臨床可靠性。緩釋技術的進步和最佳化的給藥方案提高了患者的依從性和治療效果,進一步鞏固了其在原發性和繼發性腎上腺皮質功能不全治療方案中的地位。

2024年,注射劑市場規模達到9,640萬美元,預計2025年至2034年將以4.4%的複合年成長率成長。快速起效的注射用皮質類固醇在急性腎上腺緊急情況下的廣泛應用是推動這一趨勢的主要因素。人們對自我給藥套裝的日益重視以及在嚴重荷爾蒙缺乏情況下對快速起效藥物的需求,持續支撐著急診和臨床環境中對注射劑的需求。

預計到2024年,北美艾迪生氏病藥物市佔率將達到40.7%。美國和加拿大地區普遍提供全面的荷爾蒙替代療法,加上輝瑞和默克等知名企業的存在,推動了該地區的成長。與自體免疫疾病和慢性感染相關的腎上腺功能不全病例報告數量不斷增加,促使現有療法的使用率上升。對罕見疾病的支持性資助以及包括ATRS-1902在內的新興藥物的加速核准流程,也促進了該地區的快速擴張。對個人化藥物治療方案和數位監測工具的重視,預計將進一步提升北美地區的藥物普及率。

全球艾迪生病藥物市場的主要參與者包括NEUROCRINE BIOSCIENCES、Hikma、ani Pharmaceuticals, Inc.、OMICRON PHARMA、Advacare PHARMA、默克、輝瑞、Cayman CHEMICAL、GNB PHARMACEUTICALS和SimSon Pharma Limited。這些公司透過採取有針對性的策略來擴大其市場競爭力。許多公司優先推進荷爾蒙替代療法,透過改進配方來維持穩定的荷爾蒙水平並減少給藥併發症。一些公司投資於研發,以改善緩釋皮質類固醇,並開發適用於慢性病管理和緊急使用的創新給藥系統。擴大生產能力和最佳化分銷網路有助於確保患者能夠可靠地獲得救命藥物。與臨床研究人員的策略合作支持正在進行的臨床試驗,並拓展治療產品組合。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 自體免疫疾病的盛行率不斷上升,而這些疾病通常與艾迪生病並存。

- 政府的積極支持和罕見疾病資助計劃

- 荷爾蒙替代療法的進展

- 人們對腎上腺功能不全的認知提高

- 產業陷阱與挑戰

- 由於症狀不典型而導致的漏診和誤診

- 長期使用皮質類固醇的副作用

- 市場機遇

- 緩釋和透皮皮質類固醇的研發

- 精準醫療和基因分析助力個人化治療

- 成長促進因素

- 成長潛力分析

- 投資環境

- 管道分析

- 未來市場趨勢

- 報銷方案

- 監管環境

- 技術格局

- 目前技術

- 新興技術

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新藥上市

- 擴張計劃

第5章:市場估算與預測:依藥物類型分類,2021-2034年

- 主要趨勢

- 糖皮質激素

- 鹽皮質激素

- 其他藥物類型

第6章:市場估計與預測:依給藥途徑分類,2021-2034年

- 主要趨勢

- 口服

- 注射劑

第7章:市場估計與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- advacare PHARMA

- ani Pharmaceuticals, Inc.

- Cayman CHEMICAL

- GNB PHARMACEUTICALS

- hikma

- Merck

- NEUROCRINE BIOSCIENCES

- OMICRON PHARMA

- Pfizer

- SimSon Pharma Limited

The Global Addisons Disease Drugs Market was valued at USD 592.9 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 989.1 million by 2034.

Growth remains strong as autoimmune disorders tied to adrenal gland failure become more common and healthcare systems expand rare disease programs and awareness initiatives. A rising number of individuals are being diagnosed with primary adrenal insufficiency, which stems from progressive damage to the adrenal cortex and typically requires lifelong corticosteroid replacement. Cases of secondary adrenal insufficiency are also climbing as diagnosis improves for hormonal imbalances caused by pituitary issues or prolonged corticosteroid use. With more patients relying on long-term hormone therapy, demand for dependable treatment options continues to climb. Pharmaceutical manufacturers are responding by enhancing drug delivery systems and refining formulations designed to maintain stable cortisol and aldosterone levels, ultimately improving daily management for those living with chronic adrenal disorders. Addison's disease drugs encompass therapies used to support patients whose adrenal glands are unable to produce adequate essential hormones.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $592.9 Million |

| Forecast Value | $989.1 Million |

| CAGR | 5.2% |

The glucocorticoids category held a 58.6% share in 2024, reflecting its essential role in replacing cortisol in individuals with adrenal insufficiency. Their continued lead is reinforced by broad availability, multiple dosing formats, and strong clinical reliability in helping prevent life-threatening adrenal crises. Advances in extended-release technology and optimized dosing protocols have strengthened adherence and therapeutic outcomes, reinforcing their position in both primary and secondary adrenal insufficiency treatment plans.

The injectable drug segment generated USD 96.4 million in 2024 and is projected to grow at a 4.4% CAGR from 2025 to 2034. Increasing adoption of fast-acting injectable corticosteroids for acute adrenal emergencies is a major contributor to this trend. Greater recognition of self-administration kits and the need for rapid-response medication during severe hormone deficits continues to support demand for injectables across emergency and clinical environments.

North America Addisons Disease Drugs Market held a 40.7% share in 2024. Access to comprehensive hormone replacement therapies across the U.S. and Canada, combined with the presence of established companies such as Pfizer and Merck, bolsters regional growth. Reported cases of adrenal insufficiency associated with autoimmune conditions and chronic infections are increasing, driving higher utilization of available treatments. Supportive rare disease funding and accelerated pathways for emerging drugs, including therapies such as ATRS-1902, contribute to rapid regional expansion. A strong emphasis on personalized drug regimens and digital monitoring tools is expected to enhance adoption across North America.

Leading companies active in the Global Addisons Disease Drugs Market include NEUROCRINE BIOSCIENCES, Hikma, ani Pharmaceuticals, Inc., OMICRON PHARMA, Advacare PHARMA, Merck, Pfizer, Cayman CHEMICAL, GNB PHARMACEUTICALS, and SimSon Pharma Limited. Companies operating in the Addison's disease drugs market apply targeted strategies to expand their competitive reach. Many prioritize advancing hormone replacement therapies through improved formulations that deliver steady hormone levels and reduce dosing complications. Several firms invest in research to refine modified-release corticosteroids and develop innovative delivery systems suited for both chronic management and emergency use. Expanding manufacturing capabilities and optimizing distribution networks help ensure reliable access to life-saving medications. Strategic collaborations with clinical researchers support ongoing trials and broaden therapeutic portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Route of administration trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of autoimmune disorders, which are often comorbid with Addison’s disease

- 3.2.1.2 Favourable government support and rare disease funding initiatives

- 3.2.1.3 Advancements in hormone replacement therapies

- 3.2.1.4 Increased awareness about adrenal insufficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Underdiagnosis and misdiagnosis due to non-specific symptoms

- 3.2.2.2 Side effects of long-term corticosteroid use

- 3.2.3 Market opportunities

- 3.2.3.1 Development of sustained-release and transdermal corticosteroids

- 3.2.3.2 Precision medicine and genetic profiling to tailor treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Investment landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Regulatory landscape

- 3.9 Technology landscape

- 3.9.1 Current technologies

- 3.9.2 Emerging technologies

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New drug launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Glucocorticoids

- 5.3 Mineralocorticoids

- 5.4 Other drug types

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Injectable

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 advacare PHARMA

- 9.2 ani Pharmaceuticals, Inc.

- 9.3 Cayman CHEMICAL

- 9.4 GNB PHARMACEUTICALS

- 9.5 hikma

- 9.6 Merck

- 9.7 NEUROCRINE BIOSCIENCES

- 9.8 OMICRON PHARMA

- 9.9 Pfizer

- 9.10 SimSon Pharma Limited