|

市場調查報告書

商品編碼

1876593

食品擠壓設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Food Extrusion Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

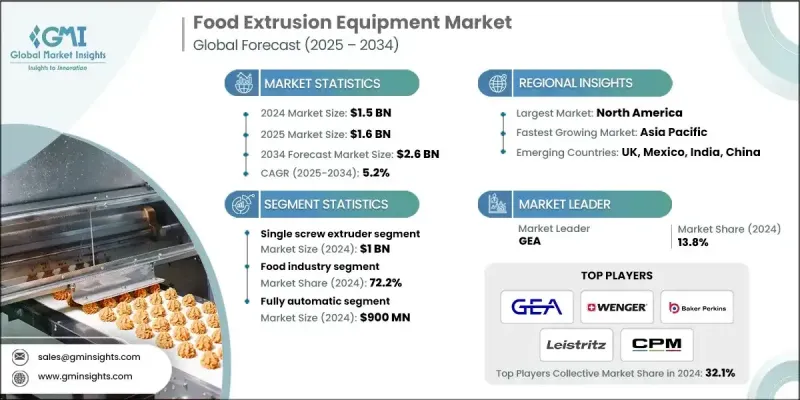

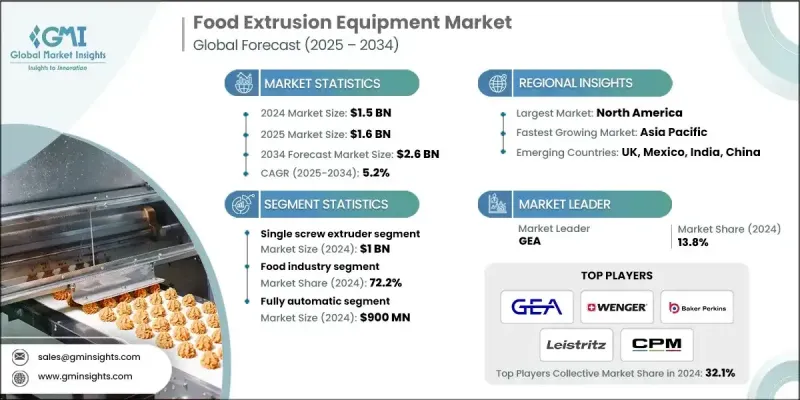

2024 年全球食品擠壓設備市場價值為 15 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 26 億美元。

消費者對植物性肉類和海鮮替代品的興趣日益濃厚,為專業擠壓技術創造了巨大的發展機會。高水分擠壓烹飪 (HMEC) 技術使生產商能夠在替代蛋白產品中獲得纖維狀、類似肉類的質地,從而推動了對專為高水分肉類替代品 (HMMA) 設計的高級雙螺桿擠壓機的需求。消費者尋求永續的、不含動物性蛋白質的選擇,推動了彈性素食飲食的興起,進一步促進了這一趨勢。同時,消費者對兼具美味和營養價值的零食的需求不斷成長,這與擠壓技術的需求不謀而合。此製程透過精確控制溫度、壓力和配料組成,能夠生產低脂、高蛋白、高纖維食品。擠壓製程是一種高效的連續生產方法,它將多個生產階段合併為一個操作,顯著降低了能源和水的消耗,同時最佳化了佔地面積和生產速度。這些優勢使得擠壓製程在競爭激烈的食品製造環境中成為一種經濟高效且永續的選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 5.2% |

2024年,單螺桿擠出機市場規模達10億美元。其成長主要得益於較低的投資門檻和操作簡便,使其成為發展中地區中小企業和製造商的理想選擇。對於希望在不投入大量資金的情況下擴大或升級生產的企業而言,這些系統提供了一個切實可行且經濟實惠的切入點。

2024年,全自動系統市場規模預計將達9億美元。自動化擠出機的日益普及極大地提高了產品的一致性、精度和整體效率。先進的自動化技術,包括感測器、可程式邏輯控制器(PLC)和即時監控工具,使製造商能夠嚴格控制溫度、進料速度、壓力和濕度等關鍵生產變數。這些系統只需極少的人工干預,即可顯著降低人為錯誤的風險,並確保大批量生產中產品品質的一致性。

2024年,美國食品擠壓設備市場佔81.8%的市場佔有率,市場規模達4.2億美元。美國市場的特點是擁有先進的製造能力、嚴格的監管標準,並高度重視自動化和食品安全。成熟的加工食品產業,包括休閒食品、穀物食品、寵物食品和替代蛋白等品類,持續推動對擠壓系統的投資,這些系統能夠提供高產量、穩定的質量,並符合美國食品藥物管理局(FDA)和美國農業部(USDA)制定的監管準則。

全球食品擠壓設備市場的主要企業包括 Bausano、Bonnot、GEA、Buhler、CPM、B&P Littleford、Cowin Extrusion、Leistritz、Baker Perkins、Wenger、Legris、Coperion、Steer World、Xtrutech 和 Xinda Corp.。這些企業致力於持續創新和技術進步,以在這個不斷變化的市場中保持領先地位。全球食品擠壓設備市場的主要製造商正著力採取一系列策略性舉措,以加強其全球影響力。許多企業正大力投資研發,以設計能夠處理新型原料並為植物性產品提供更佳質地控制的機器。此外,各公司也積極建立策略合作夥伴關係和開展合作,以拓展其技術組合併進入新的區域市場。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 植物性革命

- 消費者對更健康、功能性點心的需求

- 營運效率和多功能性

- 產業陷阱與挑戰

- 高資本投資及營運成本

- 營運複雜性與技能差距

- 機會

- 工業4.0的整合

- 新型原料與升級再造的開發

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 差距分析

- 風險評估與緩解

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 單螺桿擠出機

- 雙螺桿擠出機

第6章:市場估算與預測:依營運模式類型分類,2021-2034年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第7章:市場估計與預測:依產能分類,2021-2034年

- 主要趨勢

- 低於 3,000 公斤/小時

- 3,000-10,000公斤/小時

- 超過10,000公斤/小時

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 寵物食品和水產飼料

- 穀物和零食

- 植物蛋白

- 食品原料

- 其他(糖果製品等)

第9章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 食品工業

- 動物飼料業

- 其他(研究機構等)

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- B&P Littleford

- Baker Perkins

- Bausano

- Bonnot

- Buhler

- Coperion

- Cowin Extrusion

- CPM

- GEA

- Legris

- Leistritz

- Steer World

- Wenger

- Xinda Corp.

- Xtrutech

The Global Food Extrusion Equipment Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 2.6 billion by 2034.

Increasing consumer interest in plant-based alternatives to meat and seafood is creating substantial opportunities for specialized extrusion technologies. High moisture extrusion cooking (HMEC) is enabling manufacturers to achieve fibrous, meat-like textures in alternative protein products, fueling demand for advanced twin-screw extruders designed for high moisture meat analogues (HMMA). The shift toward flexitarian diets, driven by consumers looking for sustainable, animal-free protein options, is further supporting this trend. At the same time, the rising preference for snacks that combine great taste with nutritional benefits aligns well with extrusion technology. This process enables the creation of low-fat, high-protein, and high-fiber foods through precise control of temperature, pressure, and ingredient composition. Extrusion offers an efficient, continuous method that merges several manufacturing stages into a single operation, significantly reducing energy and water consumption while optimizing floor space and production speed. These advantages make extrusion a cost-effective and sustainable choice in a highly competitive food manufacturing environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 5.2% |

In 2024, the single-screw extruders segment generated USD 1 billion. Their growth is largely driven by lower investment requirements and operational simplicity, making them an attractive choice for small and medium-sized enterprises (SMEs) and manufacturers in developing regions. These systems provide a practical and affordable entry point for businesses seeking to expand or modernize production without large capital expenditures.

The fully automatic systems segment generated USD 900 million in 2024. The increasing adoption of automated extruders has greatly enhanced product consistency, precision, and overall efficiency. Advanced automation technologies, including sensors, programmable logic controllers (PLCs), and real-time monitoring tools, allow manufacturers to maintain strict control over key production variables such as temperature, feed rate, pressure, and moisture. With minimal operator intervention, these systems significantly reduce the risk of human error and ensure uniform product quality across large production volumes.

United States Food Extrusion Equipment Market accounted for 81.8% share in 2024, generating USD 420 million. The country's market is characterized by advanced manufacturing capabilities, stringent regulatory standards, and a strong focus on automation and food safety. A mature processed food sector, including categories like snacks, cereals, pet food, and alternative proteins, continues to drive investments in extrusion systems that offer high throughput, consistent quality, and compliance with regulatory guidelines set by the FDA and USDA.

Leading companies operating in the Global Food Extrusion Equipment Market include Bausano, Bonnot, GEA, Buhler, CPM, B&P Littleford, Cowin Extrusion, Leistritz, Baker Perkins, Wenger, Legris, Coperion, Steer World, Xtrutech, and Xinda Corp. These players are focusing on continuous innovation and technical advancement to stay ahead in this evolving landscape. Major manufacturers in the Global Food Extrusion Equipment Market are focusing on a mix of strategic initiatives to strengthen their global presence. Many are investing heavily in research and development to design machines capable of handling novel ingredients and delivering enhanced texture control for plant-based products. Companies are also entering strategic partnerships and collaborations to expand their technology portfolios and reach new regional markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Mode of operation

- 2.2.4 Capacity

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The plant-based revolution

- 3.2.1.2 Demand for better for you and functional snacks

- 3.2.1.3 Operational efficiency and versatility

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment and operating costs

- 3.2.2.2 Operational complexity and skill gap

- 3.2.3 Opportunities

- 3.2.3.1 Integration of industry 4.0

- 3.2.3.2 Development for novel ingredients and upcycling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single screw extruder

- 5.3 Twin screw extruder

Chapter 6 Market Estimates and Forecast, By Mode of Operation Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 3,000 kg/hr

- 7.3 3,000-10,000 kg/hr

- 7.4 Above 10,000 kg/hr

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pet food & aqua feed

- 8.3 Cereals & snacks

- 8.4 Plant-based proteins

- 8.5 Food ingredients

- 8.6 Others (confectionery products, etc.)

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food industry

- 9.3 Animal feed industry

- 9.4 Others (research institutions, etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 B&P Littleford

- 12.2 Baker Perkins

- 12.3 Bausano

- 12.4 Bonnot

- 12.5 Buhler

- 12.6 Coperion

- 12.7 Cowin Extrusion

- 12.8 CPM

- 12.9 GEA

- 12.10 Legris

- 12.11 Leistritz

- 12.12 Steer World

- 12.13 Wenger

- 12.14 Xinda Corp.

- 12.15 Xtrutech