|

市場調查報告書

商品編碼

1876589

面向消費應用的4D列印服務市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)4D Printing Services for Consumer Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

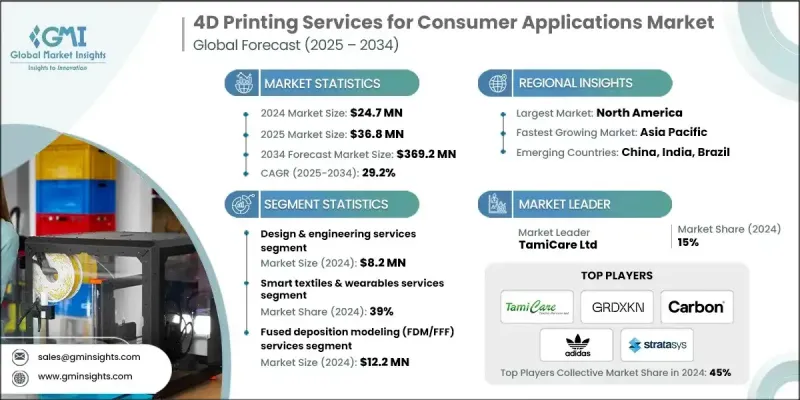

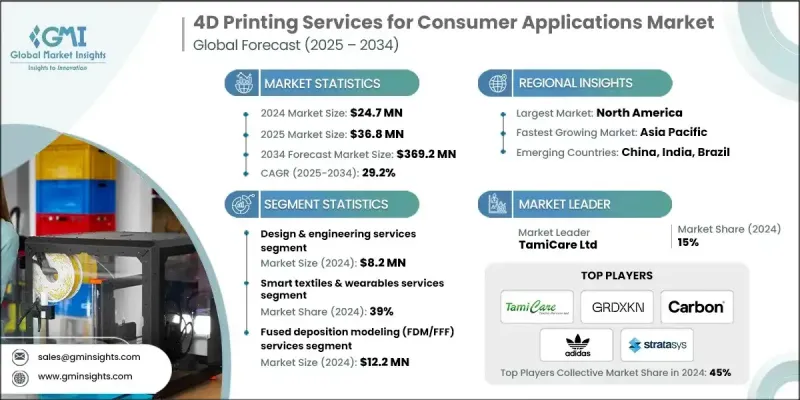

2024 年全球消費應用 4D 列印服務市值為 2,470 萬美元,預計到 2034 年將以 29.2% 的複合年成長率成長至 3.692 億美元。

4D列印在消費領域的成長潛力在於人們對自適應、個人化和永續產品日益成長的興趣。與傳統的3D列印不同,4D列印採用智慧材料,能夠根據溫度、光照或濕度等環境因素改變自身形狀和功能。這項技術正在為自適應服裝、自組裝家具和響應式家居產品等領域的消費創新鋪平道路。隨著技術的不斷進步,研究機構、新創公司和成熟的技術供應商正在探索旨在提升功能性和效率的新材料和生產流程。隨著可擴展性和成本相關問題的逐步緩解,市場正逐步從概念開發過渡到實際應用。消費者對互動式和可客製化產品的需求日益成長,預計將推動4D列印技術在日常消費領域得到更廣泛的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2470萬美元 |

| 預測值 | 3.692億美元 |

| 複合年成長率 | 29.2% |

2024年,設計和工程服務領域創造了820萬美元的收入。該領域的領先地位歸功於專案合作數量的增加以及對材料科學、相變力學和產品設計等專業知識的需求。隨著產業向更複雜的應用領域發展,服務供應商正在提升自身的技術能力,以滿足不斷變化的客戶需求。對合約製造服務日益成長的興趣表明,市場正開始向生產規模化營運轉型,凸顯了其走向商業成熟的進程。

智慧紡織品和穿戴式裝置領域預計在2024年將佔據39%的市場。該領域涵蓋了旨在適應環境刺激或用戶特定需求的高級紡織品應用。功能性服裝、醫用紡織品和自適應時尚單品等產品正擴大利用4D列印技術來提升舒適性、功能性和效率。在時尚、健身和科技融合的推動下,消費者對響應式穿戴裝置的興趣日益濃厚,為該領域創造了不斷成長的商業機會。

美國面向消費應用的4D列印服務市場佔84%的佔有率,預計2024年市場規模將達到800萬美元。北美仍然是先進材料和積層製造技術研究、創新和商業化的領先中心。該地區受益於強大的研發投入、活躍的學術合作以及政府鼓勵技術轉移和產業發展的支持性舉措。其先進的基礎設施、智慧財產權保護以及對下一代製造的投入,使其成為推動面向消費市場的4D列印服務擴張的關鍵力量。

參與全球消費應用4D列印服務市場的知名企業包括Carbon, Inc.、Nervous System Inc.、TamiCare Ltd.、惠普公司、三菱化學株式會社、Formlabs Inc.、Stratasys Ltd.、GRDXKN、麻省理工學院自組裝實驗室以及阿迪達斯創新實驗室。這些行業參與者專注於研發、合作和材料創新,以提供專為消費者量身定做的先進4D列印解決方案。在消費應用4D列印服務市場營運的企業正致力於創新與合作,以鞏固其全球影響力。許多企業正大力投資研發,以提升智慧材料的性能並增強其變形反應能力。技術供應商、研究機構以及時尚或消費品品牌之間的合作,正在加速自適應產品的商業化。各公司也強調永續的製造流程和可擴展的生產方法,以滿足不斷成長的消費者需求。拓展服務範圍,涵蓋設計諮詢、原型製作和合約製造,也是一項關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 消費品的客製化與智慧適應性

- 智慧材料和印刷技術的進步

- 對永續和功能性設計的需求日益成長

- 產業陷阱與挑戰

- 生產成本高且可擴展性有限

- 缺乏標準化和監管框架

- 機會

- 融入穿戴式科技和智慧紡織品

- 拓展至家庭自動化和智慧家具領域

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依服務類型分類,2021-2034年

- 主要趨勢

- 設計與工程服務

- 合約製造服務

- 材料開發服務

- 軟體和數位服務

- 監理合規諮詢

- 維護和支援服務

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 熔融沈積成型(FDM/FFF)服務

- 立體光刻(SLA/DLP)服務

- 直接墨水書寫 (DIW) 服務

- 混合多技術服務

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 智慧紡織品和穿戴式裝置服務

- 食品應用服務

- 消費性電子服務

- 家具及家居用品服務

- 個人醫療保健設備服務

第8章:市場估算與預測:依服務交付模式分類,2021-2034年

- 主要趨勢

- 按需服務

- 訂閱式服務

- 基於專案的服務

- 託管服務

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Stratasys Ltd.

- Carbon, Inc.

- HP Inc.

- Formlabs Inc.

- GRDXKN

- Mitsubishi Chemical Corporation

- Adidas AG - Innovation Lab

- Nervous System Inc.

- Self-Assembly Lab (MIT)

- TamiCare Ltd.

The Global 4D Printing Services for Consumer Applications Market was valued at USD 24.7 million in 2024 and is estimated to grow at a CAGR of 29.2% to reach USD 369.2 million by 2034.

The growth potential of 4D printing in consumer applications lies in the increasing interest in adaptive, personalized, and sustainable products. Unlike conventional 3D printing, 4D printing utilizes smart materials capable of transforming their shapes and functions in response to environmental factors such as temperature, light, or humidity. This technology is paving the way for consumer-oriented innovations in areas like adaptive apparel, self-assembling furniture, and responsive home products. As advancements continue, research institutions, startups, and established technology providers are exploring new materials and production processes aimed at improving functionality and efficiency. The market is gradually transitioning from conceptual development to practical implementation as issues related to scalability and cost have begun to ease. The growing consumer appetite for interactive and customizable products is expected to drive wider adoption of 4D printing technologies in the everyday consumer space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.7 Million |

| Forecast Value | $369.2 Million |

| CAGR | 29.2% |

In 2024, the design and engineering services segment generated USD 8.2 million. This segment's leadership is attributed to the increasing number of project collaborations and the need for specialized expertise in materials science, transformation mechanics, and product design. Service providers are enhancing their technical capabilities to support evolving client demands as the industry progresses toward more complex applications. The growing interest in contract manufacturing services signals that the market is beginning to move toward production-scale operations, highlighting its path toward commercial maturity.

The smart textiles and wearables segment held a 39% share in 2024. This segment includes advanced textile applications designed to adapt to environmental stimuli or user-specific conditions. Products such as performance-based clothing, medical textiles, and adaptive fashion items are increasingly leveraging 4D printing technologies to deliver comfort, functionality, and efficiency. Consumer interest in responsive wearables is expanding, driven by the convergence of fashion, fitness, and technology, creating a growing commercial opportunity within this category.

U.S. 4D Printing Services for Consumer Applications Market held 84% share, generating USD 8 million in 2024. North America remains a leading hub for research, innovation, and commercialization of advanced materials and additive manufacturing technologies. The region benefits from strong investment in R&D, robust academic collaboration, and supportive government initiatives that encourage technology transfer and industrial development. Its advanced infrastructure, intellectual property protections, and commitment to next-generation manufacturing have positioned it as a key player in driving the expansion of 4D printing services for consumer markets.

Prominent companies participating in the Global 4D Printing Services for Consumer Applications Market include Carbon, Inc., Nervous System Inc., TamiCare Ltd., HP Inc., Mitsubishi Chemical Corporation, Formlabs Inc., Stratasys Ltd., GRDXKN, Self-Assembly Lab (MIT), and Adidas AG - Innovation Lab. These industry players are focusing on research, partnerships, and material innovations to deliver advanced 4D printing solutions tailored for consumer use. Companies operating in the 4D Printing Services for Consumer Applications Market are focusing on innovation and collaboration to strengthen their global presence. Many are investing heavily in research and development to advance smart material capabilities and improve shape-shifting responsiveness. Partnerships between technology providers, research institutions, and fashion or consumer goods brands are enabling faster commercialization of adaptive products. Firms are also emphasizing sustainable manufacturing processes and scalable production methods to meet growing consumer demand. Expanding service portfolios to include design consulting, prototyping, and contract manufacturing is another key strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service type

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Service delivery model

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Customization and smart adaptability of consumer products

- 3.2.1.2 Advancements in smart materials and printing technologies

- 3.2.1.3 Growing demand for sustainable and functional design

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High production costs and limited scalability

- 3.2.2.2 Lack of standardization and regulatory frameworks

- 3.2.3 Opportunities

- 3.2.3.1 Integration into wearable technology and smart textiles

- 3.2.3.2 Expansion into home automation and smart furniture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Design & engineering services

- 5.3 Contract manufacturing services

- 5.4 Material development services

- 5.5 Software & digital services

- 5.6 Regulatory compliance consulting

- 5.7 Maintenance & support services

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Fused deposition modeling (FDM/FFF) services

- 6.3 Stereolithography (SLA/DLP) services

- 6.4 Direct ink writing (DIW) services

- 6.5 Hybrid multi-technology services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Smart textiles & wearables services

- 7.3 Food application services

- 7.4 Consumer electronics services

- 7.5 Furniture & home goods services

- 7.6 Personal healthcare device services

Chapter 8 Market Estimates and Forecast, By Service Delivery Model, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 On-demand services

- 8.3 Subscription-based services

- 8.4 Project-based services

- 8.5 Managed services

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Stratasys Ltd.

- 10.2 Carbon, Inc.

- 10.3 HP Inc.

- 10.4 Formlabs Inc.

- 10.5 GRDXKN

- 10.6 Mitsubishi Chemical Corporation

- 10.7 Adidas AG - Innovation Lab

- 10.8 Nervous System Inc.

- 10.9 Self-Assembly Lab (MIT)

- 10.10 TamiCare Ltd.