|

市場調查報告書

商品編碼

1876575

車載健康監測系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)In-Car Wellness Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

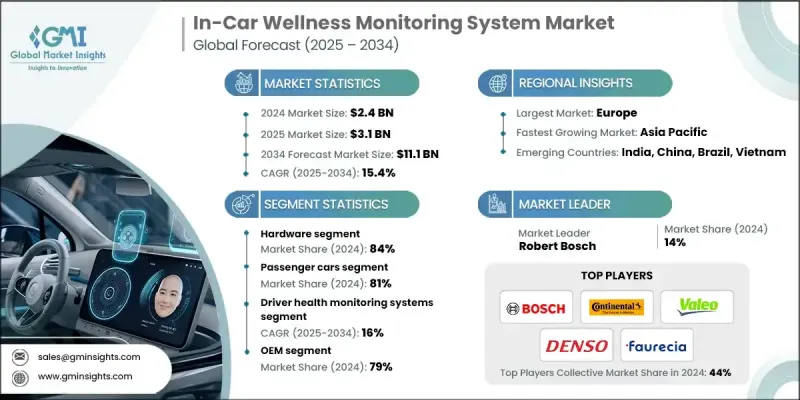

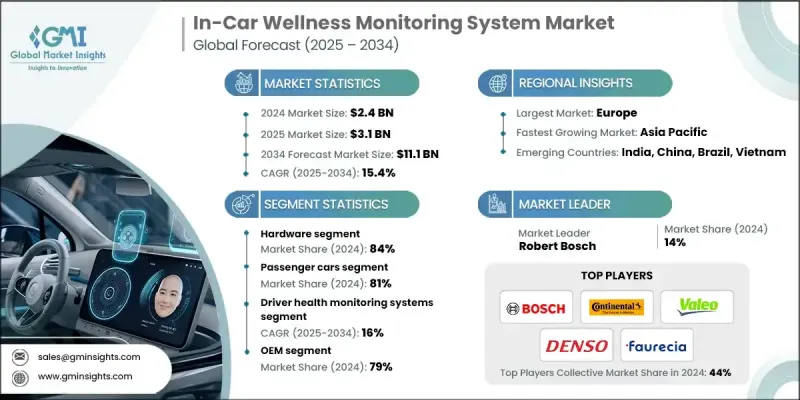

2024 年全球車載健康監測系統市場價值為 24 億美元,預計到 2034 年將以 15.4% 的複合年成長率成長至 111 億美元。

隨著車輛擴大整合感測器、攝影機和人工智慧技術來追蹤包括心率、疲勞程度和壓力水平在內的重要健康指標,市場正在迅速擴張。消費者對車內安全的日益重視,以及對先進互聯和豪華汽車功能的接受度不斷提高,共同推動了這一成長。人工智慧驅動的監控解決方案如今的功能已遠不止安全功能,它們利用複雜的電腦視覺演算法,實現了超過95%的檢測準確率。透過整合多種感測器,這些系統能夠評估生理訊號、環境條件和行為模式,從而建立全面的健康生態系統,監測乘員的健康、舒適度和警覺性。紅外線攝影機、生物識別感測器和多感測器系統用於即時追蹤生命徵象、姿勢和壓力水平。這些技術正日益融入智慧駕駛艙架構,進而實現主動駕駛輔助、自適應氣候控制和個人化舒適設定。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 111億美元 |

| 複合年成長率 | 15.4% |

隨著車載系統與穿戴式裝置和行動健康平台的連接,生態系統得到進一步加強,從而實現持續的健康監測和基於雲端的分析。隨著自動駕駛汽車的興起,健康監測在維護安全和情緒穩定方面發揮著至關重要的作用,尤其是在車輛部分接管控制權的情況下。

2024年,硬體部分佔據了84%的市場佔有率,預計2025年至2034年將以15.6%的複合年成長率成長。高解析度攝影機、紅外線感測器和座艙監控光學元件是硬體部分的主導產品,而基於雷達的感測器無需佩戴設備即可實現對心率、呼吸模式和微動的非接觸式監測。博世等公司提供由人工智慧增強的雷達解決方案,用於座艙健康監測。

預計到2024年,駕駛員健康監測系統市佔率將達到39.2%,凸顯其在安全、合規性和OEM廠商應用方面的關鍵作用。這些系統能夠偵測疲勞、追蹤注意力,並辨識心臟病發作或中風等突發醫療狀況。先進的駕駛員監測解決方案整合了生理感測技術,可透過心率、壓力和生命徵象測量實現即時健康評估。

德國車載健康監測系統市場預計將在2025年至2034年間以14.3%的複合年成長率成長。德國在該領域的領先地位源於其強大的汽車製造業和對駕駛安全的重視。奧迪和寶馬等領先汽車製造商正在將人工智慧驅動的健康監測系統(包括生物識別感測器、駕駛員注意力追蹤和情緒識別)應用於汽車中,以提升駕乘人員的健康水平。這些技術與日益普及的電動化、連網化和半自動駕駛汽車相契合,滿足了人們對個人化、以健康為中心的駕駛體驗的需求。

全球車載健康監測系統市場的主要企業包括大陸集團、佛吉亞、羅伯特·博世、安波福、電裝、法雷奧、Seeing Machines、Smart Eye、塔塔埃爾西和Gentex。這些企業正積極採取多種策略來鞏固其市場地位。供應商正大力投資人工智慧、電腦視覺和多感測器技術,以提高偵測的準確性和可靠性。與汽車原始設備製造商 (OEM) 建立策略合作夥伴關係,能夠將健康解決方案無縫整合到新車型中。此外,各公司也致力於建構軟硬體生態系統,將車輛與雲端分析和行動健康平台連接起來,從而提供持續的健康監測服務。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 人們越來越關注駕駛員安全和健康

- 人工智慧、物聯網和先進感測器的整合

- 政府安全法規和指令

- 豪華車和高階車的採用率不斷提高

- 與穿戴式裝置和行動裝置的技術融合

- 產業陷阱與挑戰

- 系統成本高且整合複雜

- 資料隱私和安全問題

- 市場機遇

- 拓展至商用及車隊車輛領域

- 自動駕駛和半自動駕駛汽車的成長

- 與穿戴式裝置和行動健康平台整合

- 人工智慧驅動的預測性健康分析的發展

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 技術成熟度和採用生命週期分析

- 技術成熟度(TRL)評估

- 按市場區隔分類的採用曲線

- 創新擴散模式

- 市場滲透率預測

- 定價分析與成本結構動態

- 歷史價格趨勢分析(2021-2024)

- 按組件分類的成本明細

- 製造成本結構分析

- 研發投資對定價的影響

- 基於銷售量的定價策略

- 成本效益和投資報酬率分析

- 總擁有成本 (TCO) 模型

- 投資報酬率(ROI)計算

- 投資回收期分析

- 經濟影響評估

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 貿易分析

- 關稅和貿易政策的影響

- 供應鏈本地化趨勢

- 區域製造中心

- 使用者體驗與人為因素

- 駕駛員接受度和採用率

- 可用性測試和使用者介面設計

- 隱私認知和消費者擔憂

- 警覺疲勞管理

- 系統設計中的行為心理學

- 網路安全與資料隱私框架

- 保險和車隊管理整合

- OEM與售後市場生態系統動態

- 健康資料互通性標準

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 硬體

- 感應器

- 相機

- 方向盤和座椅感應器

- 控制單元和處理器

- 軟體

- 基於人工智慧的健康分析

- 駕駛員監控演算法

- 數據整合和警報系統

- 服務

- 雲端連線和資料管理

- 緊急援助和遠距醫療整合

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車

- 中型商用車

- 重型商用車輛

- 電動車

第7章:市場估計與預測:依系統分類,2021-2034年

- 主要趨勢

- 駕駛員健康監測系統

- 乘客健康監測系統

- 車廂內環境與舒適度監測系統

- 整合車輛健康系統

- 其他

第8章:市場估算與預測:依銷售管道分類,2021-2034年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第10章:公司簡介

- 全球參與者

- Aptiv

- Continental

- Denso

- HARMAN International

- Magna International

- NXP Semiconductors

- Robert Bosch

- Valeo

- 區域玩家

- Antolin

- Faurecia

- Gentex

- LG Electronics

- Panasonic Automotive

- Seeing Machines

- Smart Eye

- Tata Elxsi

- Tobii

- Visteon

- Emerging Technology Innovators

- Affectiva

- Allegro MicroSystems

- Binah.ai

- Cerence

- Cipia

- Guardian Optical Technologies

- Ultraleap

The Global In-Car Wellness Monitoring System Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 11.1 billion by 2034.

The market is rapidly expanding as vehicles increasingly incorporate sensors, cameras, and AI technologies to track vital health metrics, including heart rate, fatigue, and stress levels. Consumer awareness around in-vehicle safety, combined with the adoption of advanced connected and luxury vehicle features, is fueling this growth. AI-driven monitoring solutions now offer more than safety functions, leveraging sophisticated computer vision algorithms to achieve detection accuracy exceeding 95%. By integrating multiple sensors, these systems assess physiological signals, environmental conditions, and behavioral patterns, creating comprehensive wellness ecosystems that monitor occupant health, comfort, and alertness. Infrared cameras, biometric sensors, and multi-sensor setups are used to track vital signs, posture, and stress in real time. These technologies are increasingly embedded in smart cockpit architectures, enabling proactive driver assistance, adaptive climate control, and personalized comfort settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 15.4% |

The ecosystem is further strengthened as in-car systems connect with wearable devices and mobile health platforms, enabling continuous health monitoring and cloud-based analytics. With the rise of automated vehicles, wellness monitoring plays a critical role in maintaining both safety and emotional stability, especially during situations where the vehicle assumes partial control.

The hardware segment held an 84% share in 2024 and is expected to grow at a CAGR of 15.6% from 2025 to 2034. High-resolution cameras, infrared sensors, and cabin monitoring optics dominate the hardware segment, while radar-based sensors allow contactless monitoring of heart rate, breathing patterns, and micro-movements without wearables. Bosch, among others, provides radar solutions enhanced by AI for in-cabin health monitoring.

The driver health monitoring systems segment held a 39.2% share in 2024, highlighting its crucial role in safety, regulatory compliance, and OEM adoption. These systems detect fatigue, track attention, and identify medical emergencies such as heart attacks or strokes. Advanced driver monitoring solutions integrate physiological sensing, enabling real-time health assessments through heart rate, stress, and vital sign measurements.

Germany In-Car Wellness Monitoring System Market is projected to grow at a CAGR of 14.3% from 2025 to 2034. The country's leadership stems from its strong automotive manufacturing sector and commitment to driver safety. Leading automakers like Audi and BMW are incorporating AI-driven wellness monitors, including biometric sensors, driver attention tracking, and emotion recognition, to enhance occupant well-being. These technologies align with the increasing adoption of electrified, connected, and semi-autonomous vehicles, catering to the demand for personalized, health-focused driving experiences.

Key companies operating in the Global In-Car Wellness Monitoring System Market include Continental, Faurecia, Robert Bosch, Aptiv, Denso, Valeo, Seeing Machines, Smart Eye, Tata Elxsi, and Gentex. Companies in the In-Car Wellness Monitoring System Market are deploying several strategies to strengthen their presence and market position. Providers are investing heavily in AI, computer vision, and multi-sensor technologies to enhance detection accuracy and reliability. Strategic partnerships with automotive OEMs enable seamless integration of wellness solutions into new vehicle models. Firms are also focusing on software-hardware ecosystems that connect vehicles with cloud analytics and mobile health platforms to offer continuous health monitoring.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 System

- 2.2.5 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising focus on driver safety and health

- 3.2.1.3 Integration of AI, IoT, and advanced sensors

- 3.2.1.4 Government safety regulations and mandates

- 3.2.1.5 Increasing adoption in luxury and premium vehicles

- 3.2.1.6 Technological convergence with wearables and mobile devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system cost and integration complexity

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into commercial and fleet vehicles

- 3.2.3.2 Growth in autonomous and semi-autonomous vehicles

- 3.2.3.3 Integration with wearable devices and mobile health platforms

- 3.2.3.4 Development of AI-driven predictive health analytics

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology maturity & adoption lifecycle analysis

- 3.7.3.1 Technology readiness level (TRL) assessment

- 3.7.3.2 Adoption curve by market segment

- 3.7.3.3 Innovation diffusion patterns

- 3.7.3.4 Market penetration forecasting

- 3.8 Pricing analysis & cost structure dynamics

- 3.8.1 Historical price trend analysis (2021-2024)

- 3.8.2 Cost breakdown by component

- 3.8.3 Manufacturing cost structure analysis

- 3.8.4 R&d investment impact on pricing

- 3.8.5 Volume-based pricing strategies

- 3.9 Cost-benefit & ROI analysis

- 3.9.1 Total cost of ownership (TCO) models

- 3.9.2 Return on investment (ROI) calculations

- 3.9.3 Payback period analysis

- 3.9.4 Economic impact assessment

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

- 3.13 Trade analysis

- 3.13.1 Tariff & trade policy impact

- 3.13.2 Supply chain localization trends

- 3.13.3 Regional manufacturing hubs

- 3.14 User experience and human factors

- 3.14.1 Driver acceptance and adoption rates

- 3.14.2 Usability testing and user interface design

- 3.14.3 Privacy perception and consumer concerns

- 3.14.4 Alert fatigue management

- 3.14.5 Behavioral psychology in system design

- 3.15 Cybersecurity and data privacy framework

- 3.16 Insurance and fleet management integration

- 3.17 OEM vs. aftermarket ecosystem dynamics

- 3.18 Health data interoperability standards

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Cameras

- 5.2.3 Steering wheel and seat sensors

- 5.2.4 Control units and processors

- 5.3 Software

- 5.3.1 AI-based health analytics

- 5.3.2 Driver monitoring algorithms

- 5.3.3 Data integration and alert systems

- 5.4 Services

- 5.4.1 Cloud connectivity and data management

- 5.4.2 Emergency assistance and telehealth integration

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

- 6.4 Electric vehicles

Chapter 7 Market Estimates & Forecast, By System, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Driver health monitoring systems

- 7.3 Passenger wellness monitoring systems

- 7.4 In-cabin environment and comfort monitoring systems

- 7.5 Integrated vehicle wellness systems

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Continental

- 10.1.3 Denso

- 10.1.4 HARMAN International

- 10.1.5 Magna International

- 10.1.6 NXP Semiconductors

- 10.1.7 Robert Bosch

- 10.1.8 Valeo

- 10.2 Regional Players

- 10.2.1 Antolin

- 10.2.2 Faurecia

- 10.2.3 Gentex

- 10.2.4 LG Electronics

- 10.2.5 Panasonic Automotive

- 10.2.6 Seeing Machines

- 10.2.7 Smart Eye

- 10.2.8 Tata Elxsi

- 10.2.9 Tobii

- 10.2.10 Visteon

- 10.3 Emerging Technology Innovators

- 10.3.1 Affectiva

- 10.3.2 Allegro MicroSystems

- 10.3.3 Binah.ai

- 10.3.4 Cerence

- 10.3.5 Cipia

- 10.3.6 Guardian Optical Technologies

- 10.3.7 Ultraleap