|

市場調查報告書

商品編碼

1699239

車輛健康監測市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Vehicle Health Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

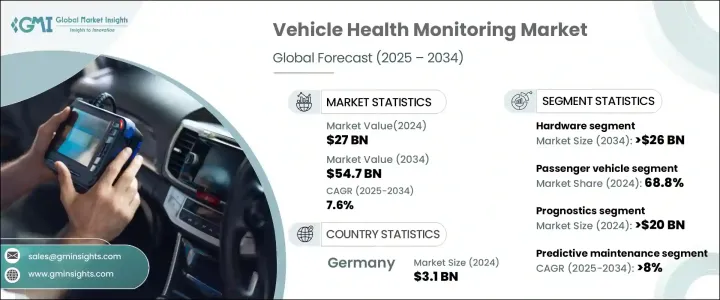

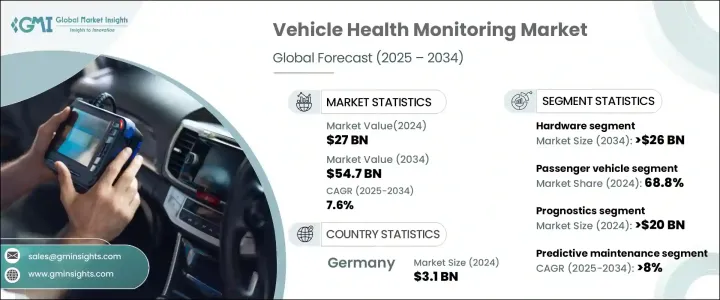

2024 年全球車輛健康監測市場價值為 270 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.6%。即時診斷工具的採用率不斷提高、物聯網感測器、遠端資訊處理和人工智慧驅動的分析技術的進步正在推動市場成長。這些技術增強了車輛監控,改善了預測性維護,並減少了意外故障。車輛健康監測系統持續評估引擎、變速箱、煞車和電池等關鍵零件,確保最佳性能並防止故障。

雲端運算和邊緣處理可以為駕駛員、車隊營運商和服務供應商提供即時資料回饋,從而提高車輛可靠性並最大限度地減少故障。連網和自動駕駛汽車的日益普及進一步推動了對先進診斷的需求。汽車製造商和科技公司正在整合人工智慧預測分析、遠端診斷和 OTA(無線)更新,以最佳化車輛維護。即時監控電池電量可提高能源效率並延長電池壽命。政府強制實施車載診斷 (OBD) 和排放監測的政策進一步刺激了對車輛健康監測解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 270億美元 |

| 預測值 | 547億美元 |

| 複合年成長率 | 7.6% |

即時診斷在預測性維護、最大限度地減少車隊停機時間和改善路線管理方面發揮著至關重要的作用。這些技術與商業車隊營運的整合正在改變遠端資訊處理行業。保險公司也利用車輛健康資料進行基於使用情況的保險(UBI),根據駕駛行為和車輛狀況調整保費。人工智慧和 5G 網路的發展有望提高車輛的安全性、效率並節省營運成本。

車輛健康監測市場分為硬體、軟體解決方案和服務。硬體部分佔了超過 50% 的市場佔有率,預計到 2034 年將超過 260 億美元。此部分包括感測器、GPS 和 OBD 端口,用於捕獲車輛資料以最佳化性能。感測器監測引擎溫度、輪胎壓力、燃料消耗和排放,而 GPS 增強車隊追蹤,OBD 端口實現遠端診斷。車輛自動化和連接性的不斷提高正在推動對先進硬體解決方案的需求。政府規定透過 OBD 進行排放監測,進一步鼓勵汽車製造商為車輛配備高精度感測器和診斷系統。

市場也按車輛類型分類,包括乘用車和商用車。 2024 年,乘用車佔據了 68.8% 的市場佔有率,而商用車則因客製化維修服務需求的不斷成長而顯著成長。

根據健康管理,市場分為診斷和預測。預測領域在 2024 年將達到 200 多億美元,佔據領先地位。汽車製造商和車隊營運商擴大採用預測解決方案,這些解決方案使用即時資料分析來提前預測故障。現代車輛配備了基於雲端的分析、支援物聯網的感測器和數位孿生技術,用於監控關鍵系統。 5G與邊緣運算的結合,進一步提高了診斷的準確性和效率。與傳統的維護檢查不同,預測系統分析即時感測器資料和人工智慧模型,以檢測組件退化的早期跡象,從而及時採取維護措施。

市場根據應用細分為預測性維護、道路救援、即時車輛診斷、排放監測、車隊管理以及車輛安全保障。預計預測期內預測性維護的最高複合年成長率將超過 8%。人工智慧、物聯網和即時資料運算正在推動預測性維護解決方案的發展,使感測器能夠持續追蹤車輛的重要部件。透過分析即時資料和維護歷史,預測性維護解決方案可以減少停機時間和維修成本。邊緣運算和基於雲端的分析的採用進一步提高了這些系統的效率。汽車製造商和車隊營運商擴大使用預測性維護來提高車輛性能和耐用性,同時最大限度地降低營運費用。

2024 年,德國引領歐洲車輛健康監測市場,創造約 31 億美元的收入。該國在物聯網預測、基於人工智慧的診斷和智慧車輛健康監測系統方面處於領先地位。憑藉強大的研發投入和智慧汽車技術的快速應用,德國仍然是塑造連網汽車診斷未來的關鍵參與者。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 技術提供者

- 系統整合商

- 最終用途景觀

- 配銷通路分析

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 案例研究

- 衝擊力

- 成長動力

- 全球電動車採用趨勢的轉變

- 北美和歐洲商用車需求增加

- 亞太地區網路普及率和智慧型手機連線率不斷提高

- 拉丁美洲對乘用車的需求很高

- 產業陷阱與挑戰

- 與車輛健康監測系統相關的網路安全威脅

- 缺乏互聯基礎設施

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 感應器

- GPS 系統

- OBD埠

- 其他

- 軟體

- 服務

- 維護和維修服務

- 諮詢與整合服務

第6章:市場估計與預測:按健康管理,2021 - 2034 年

- 主要趨勢

- 預測

- 診斷

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 重型商用車(HCV)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 預測性維護

- 即時車輛診斷

- 道路救援

- 排放監測

- 車隊管理

- 車輛安全與保障

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Bosch

- Car Media Lab

- Continental

- Delphi

- Denso

- Garrett Advancing Motion

- Harman International

- Intangles Lab

- Intellicar

- iotaSmart Labs

- KPIT Technologies

- Luxoft

- Octo Group

- Onstar

- Taabi

- TATA Elxsi

- Vector Informatik

- Visteon

- ZF Friedrichshafen

- Zubie

The Global Vehicle Health Monitoring Market was valued at USD 27 billion in 2024 and is projected to expand at a CAGR of 7.6% from 2025 to 2034. Increasing adoption of real-time diagnostic tools, advancements in IoT sensors, telematics, and AI-driven analytics are driving market growth. These technologies enhance vehicle monitoring, improve predictive maintenance, and reduce unexpected failures. Vehicle health monitoring systems continuously assess key components such as the engine, transmission, brakes, and battery, ensuring optimal performance and preventing malfunctions.

Cloud computing and edge processing enable real-time data feedback for drivers, fleet operators, and service providers, enhancing vehicle reliability and minimizing breakdowns. The increasing deployment of connected and autonomous vehicles further boosts demand for advanced diagnostics. Automakers and tech firms are integrating AI-powered predictive analytics, remote diagnostics, and OTA (over-the-air) updates to optimize vehicle maintenance. Monitoring battery charge levels in real time enhances energy efficiency and extends battery life. Government policies mandating real-time On-Board Diagnostics (OBD) and emissions monitoring further fuel demand for vehicle health monitoring solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $54.7 Billion |

| CAGR | 7.6% |

Real-time diagnostics play a crucial role in predictive maintenance, minimizing fleet downtime and improving route management. The integration of these technologies into commercial fleet operations is transforming the telematics industry. Insurance companies are also leveraging vehicle health data for usage-based insurance (UBI), adjusting premiums based on driving behavior and vehicle condition. The evolution of AI and 5G networks is expected to enhance vehicle safety, efficiency, and operational cost savings.

The vehicle health monitoring market is segmented into hardware, software solutions, and services. The hardware segment captured over 50% of the market share and is projected to exceed USD 26 billion by 2034. This segment includes sensors, GPS, and OBD ports, which capture vehicle data to optimize performance. Sensors monitor engine temperature, tire pressure, fuel consumption, and emissions, while GPS enhances fleet tracking and OBD ports enable remote diagnostics. The increasing automation and connectivity of vehicles are driving demand for advanced hardware solutions. Government regulations mandating emission monitoring through OBD further encourage automakers to equip vehicles with high-precision sensors and diagnostic systems.

The market is also categorized by vehicle type, including passenger and commercial vehicles. Passenger vehicles held a 68.8% market share in 2024, while commercial vehicles are seeing significant growth due to rising demand for tailored maintenance services.

Based on health management, the market is divided into diagnostics and prognostics. The prognostics segment led with over USD 20 billion in 2024. Automakers and fleet operators are increasingly adopting prognostic solutions, which use real-time data analytics to predict malfunctions in advance. Modern vehicles are equipped with cloud-based analytics, IoT-enabled sensors, and digital twin technology for monitoring critical systems. The integration of 5G with edge computing is further refining diagnostic accuracy and efficiency. Unlike traditional maintenance inspections, prognostic systems analyze real-time sensor data and AI models to detect early signs of component degradation, enabling timely maintenance actions.

The market is segmented by application into predictive maintenance, roadside assistance, real-time vehicle diagnostics, emission monitoring, fleet management, and vehicle safety and security. Predictive maintenance is expected to register the highest CAGR of over 8% during the forecast period. AI, IoT, and real-time data computing are advancing predictive maintenance solutions, allowing sensors to continuously track essential vehicle components. By analyzing real-time data and maintenance history, predictive maintenance solutions reduce downtime and repair costs. The adoption of edge computing and cloud-based analytics further enhances the efficiency of these systems. Automakers and fleet operators are increasingly using predictive maintenance to improve vehicle performance and durability while minimizing operational expenses.

Germany led the European vehicle health monitoring market in 2024, generating around USD 3.1 billion in revenue. The country is at the forefront of IoT-enabled prognostics, AI-based diagnostics, and smart vehicle health monitoring systems. With strong R&D investments and rapid adoption of intelligent vehicle technologies, Germany remains a key player in shaping the future of connected car diagnostics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component suppliers

- 3.1.1.2 Technology providers

- 3.1.1.3 System integrators

- 3.1.1.4 End use landscape

- 3.1.1.5 Distribution channel analysis

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Case study

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Shifting trends towards adoption of electric vehicles across the globe

- 3.7.1.2 Increase in the demand for commercial vehicles in North America and Europe

- 3.7.1.3 Growing internet penetration and smart phone connectivity in Asia Pacific

- 3.7.1.4 High demand for passenger cars in Latin America

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Cyber security threats related to vehicle health monitoring systems

- 3.7.2.2 Lack of connected infrastructure

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 GPS systems

- 5.2.3 OBD port

- 5.2.4 Others

- 5.3 Software

- 5.4 Services

- 5.4.1 Maintenance & repair services

- 5.4.2 Consulting & integration services

Chapter 6 Market Estimates & Forecast, By Health Management, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Prognostics

- 6.3 Diagnostics

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Predictive maintenance

- 8.3 Real-time vehicle diagnostics

- 8.4 Roadside assistance

- 8.5 Emission monitoring

- 8.6 Fleet management

- 8.7 Vehicle safety & security

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bosch

- 10.2 Car Media Lab

- 10.3 Continental

- 10.4 Delphi

- 10.5 Denso

- 10.6 Garrett Advancing Motion

- 10.7 Harman International

- 10.8 Intangles Lab

- 10.9 Intellicar

- 10.10 iotaSmart Labs

- 10.11 KPIT Technologies

- 10.12 Luxoft

- 10.13 Octo Group

- 10.14 Onstar

- 10.15 Taabi

- 10.16 TATA Elxsi

- 10.17 Vector Informatik

- 10.18 Visteon

- 10.19 ZF Friedrichshafen

- 10.20 Zubie