|

市場調查報告書

商品編碼

1871280

汽車資訊通訊技術服務市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive TIC Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

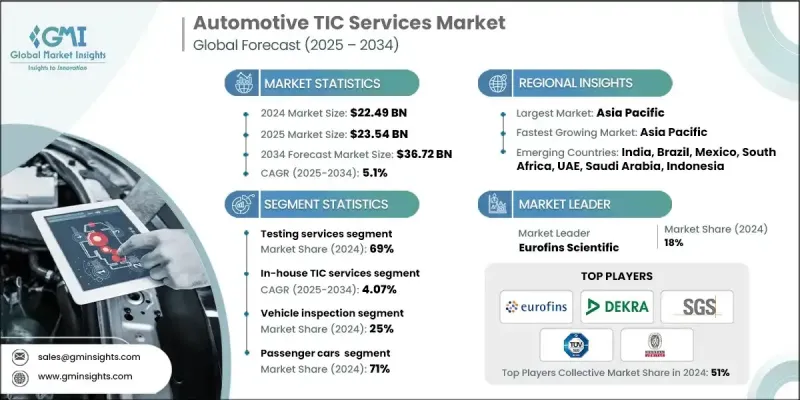

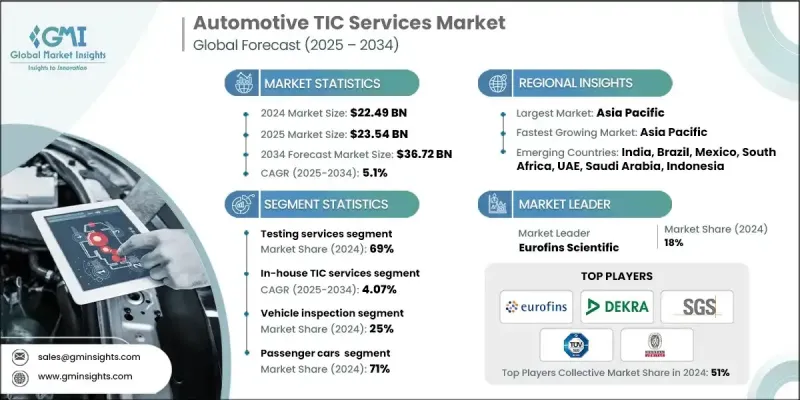

2024 年全球汽車 TIC 服務市值為 224.9 億美元,預計到 2034 年將以 5.1% 的複合年成長率成長至 367.2 億美元。

汽車技術資訊認證 (TIC) 產業已成為不斷發展的出行格局中不可或缺的一部分,確保配備電動動力系統、數位系統和連網技術的現代車輛符合嚴格的安全、性能和環保標準。這些服務驗證每個組件和流程是否符合國際和地區法規,從而支援汽車產業轉型為永續和智慧。隨著電動和混合動力車在全球的普及,對 TIC 服務的需求持續成長,這需要對電池系統、零排放推進系統和連網軟體平台進行更複雜的驗證。此外,主要經濟體各國政府實施的嚴格法規也推動了對獨立驗證和認證的需求,以確保符合碳中和目標和安全要求。針對電動車和自動駕駛汽車的新全球標準的推出也提高了測試要求,從而推動了全球 TIC 服務供應商的穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 224.9億美元 |

| 預測值 | 367.2億美元 |

| 複合年成長率 | 5.1% |

2024年,測試服務業務佔據了69%的市場佔有率,預計到2034年將以4.53%的複合年成長率成長。該業務的領先地位歸功於不斷發展的監管標準和技術複雜性,這些因素要求對車輛性能和安全性進行持續驗證。測試仍然是汽車合規性的基石,因為它在車輛交付給消費者之前評估其耐久性、排放、安全機制和整體功能。不同區域市場對精度和可靠性的日益成長的需求,並持續推動測試服務業務的發展。

2024年,企業內部測試業務佔59%的市場佔有率,預計2025年至2034年將以4.07%的複合年成長率成長。企業傾向於採用內部測試與認證(TIC)營運模式,以全面控制品質保證、資料安全以及與內部生產系統的整合。擁有專用測試基礎設施的大型汽車原始設備製造商(OEM)依靠內部驗證來滿足嚴格的監管要求並確保製造標準的一致性。這種方法能夠加快認證速度並實現更深入的流程最佳化,從而鞏固了該領域在全球市場的主導地位。

亞太地區汽車檢測、測試和認證服務市場佔38%的市場佔有率,預計2024年市場規模將達到85.3億美元。該地區的領先地位得益於其龐大的汽車生產能力、不斷完善的監管體係以及先進的技術。亞太各國正在擴展車輛測試框架,以滿足更高的安全和排放標準。此外,該地區持續的工業化進程以及對電動車和智慧網聯汽車測試設施的投資也推動了市場成長。

汽車檢測與認證服務市場的主要參與者包括TUV萊茵、Eurofins Scientific、DEKRA、BSI、必維國際檢驗集團、Intertek、SGS、TUV SUD和DNV GL。這些領先企業正致力於策略擴張、數位轉型和合作夥伴關係,以鞏固其市場地位。許多公司正在投資自動化和人工智慧驅動的測試解決方案,以提高效率、縮短測試時間並提升準確性。與汽車原始設備製造商 (OEM) 和政府機構的合作有助於服務提供者適應新興的監管框架,並為電動車和自動駕駛汽車開發先進的測試能力。此外,各公司也透過併購和合資等方式拓展地域範圍,以進入新市場並實現服務組合多元化。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 嚴格的監理合規

- 汽車產業的全球化

- 車輛性能測試的需求日益成長

- 消費者對品質保證的需求

- 汽車系統的技術進步

- 產業陷阱與挑戰

- 先進TIC設備成本高昂

- 複雜的監管環境

- 市場機遇

- 新興市場的成長機遇

- 電動和自動駕駛汽車的研發

- 擴充商用車TIC服務

- OEM廠商將TIC服務外包

- 成長促進因素

- 成長潛力分析

- 專利分析

- 波特的分析

- PESTEL 分析

- 成本細分分析

- 技術格局

- 當前技術趨勢

- 新興技術

- 監管環境

- 價格趨勢

- 按地區

- 透過服務

- 永續性和環境合規性

- 碳足跡和排放測試

- 生命週期評估 (LCA) 服務

- 循環經濟和可回收性測試

- 環境永續性認證

- 綠色車輛合規標準

- 成本最佳化與投資報酬率分析

- TIC服務投資報酬分析

- 成本效益評估框架

- 總擁有成本模型

- 產能利用率和資源最佳化

- 實驗室能力分析

- 設備利用率

- 勞動生產力指標

- 外包與內部決策分析

- 自製與外購決策框架

- 核心能力評估

- 風險收益分析

- 服務水平協議基準測試

- 服務等級協定 (SLA) 效能標準

- 品質指標和關鍵績效指標

- 懲罰與激勵機制

- 汽車測試中的網路安全

- 軟體安全測試與驗證

- 漏洞評估和滲透測試

- ISO/SAE 21434 合規性與標準

- 互聯自動駕駛汽車網路安全

- 快速上市和敏捷測試

- 加速測試方案

- 並行測試方法

- 快速認證途徑

- 壓縮開發週期策略

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新採購計劃

- 擴張計劃和資金

第5章:市場估算與預測:依服務類型分類,2021-2034年

- 主要趨勢

- 測試服務

- 檢查服務

- 認證服務

- 其他

第6章:市場估算與預測:依採購方式分類,2021-2034年

- 主要趨勢

- 內部

- 外包

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 車輛檢查

- 排放測試

- 組件測試

- 車載資訊系統

- 高級駕駛輔助系統

- 認證測試

- 燃料、液體和潤滑油

- 電氣系統和組件

- 其他

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 泰國

- 韓國

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- BSI

- Bureau Veritas

- DEKRA

- DNV GL

- Eurofins Scientific

- Intertek

- Kiwa

- RINA

- SGS

- TUV Rheinland

- TUV SUD

- UL Solutions

- 區域玩家

- ALS

- Applus+ Services

- MISTRAS

- NSF International

- SOCOTEC

- The Smithers

- TUV NORD

- UTAC CERAM

- 新興參與者/顛覆者

- AVL

- Element Materials Technology

- ESCRYPT

- ETAS

- Keysight Technologies

The Global Automotive TIC Services Market was valued at USD 22.49 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 36.72 billion by 2034.

The automotive TIC sector has become a fundamental part of the evolving mobility landscape, ensuring that modern vehicles equipped with electric powertrains, digital systems, and connected technologies meet rigorous safety, performance, and environmental standards. These services validate that every component and process complies with international and regional regulations, supporting the automotive industry's transition toward sustainable and intelligent mobility. The demand for TIC services continues to rise as electric and hybrid vehicles expand globally, requiring more sophisticated validation for battery systems, emissions-free propulsion, and connected software platforms. In addition, the implementation of stringent regulations by governments across major economies is driving the need for independent verification and certification to ensure compliance with carbon neutrality goals and safety mandates. The introduction of new global standards for electric and autonomous vehicles has also intensified testing requirements, fueling steady growth for TIC providers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.49 Billion |

| Forecast Value | $36.72 Billion |

| CAGR | 5.1% |

The testing services segment held a 69% share in 2024 and is projected to grow at a 4.53% CAGR through 2034. The segment's dominance is attributed to evolving regulatory standards and technological complexity that demand continuous validation of vehicle performance and safety. Testing remains the cornerstone of automotive compliance as it assesses durability, emissions, safety mechanisms, and overall functionality before vehicles reach consumers. The rising need for precision and reliability across diverse regional markets continues to propel the testing services segment forward.

The in-house segment held a 59% share in 2024 and is estimated to register a 4.07% CAGR from 2025 to 2034. Companies favor in-house TIC operations to maintain full control over quality assurance, data security, and integration with internal production systems. Large automotive OEMs with dedicated testing infrastructure rely on in-house validation to meet strict regulatory requirements and ensure consistent manufacturing standards. This approach enables faster certification timelines and deeper process optimization, which has strengthened the dominance of this segment in the global market.

Asia Pacific Automotive TIC Services Market held a 38% share and generated USD 8.53 billion in 2024. The region's leadership is due to its vast automotive production capacity, regulatory evolution, and technological progress. Countries across APAC are expanding their vehicle testing frameworks to meet higher safety and emissions standards. The region's continuous industrialization and investment in electric and connected vehicle testing facilities are also propelling market growth.

Prominent players in the Automotive TIC Services Market include TUV Rheinland, Eurofins Scientific, DEKRA, BSI, Bureau Veritas, Intertek, SGS, TUV SUD, and DNV GL. Leading companies in the Automotive TIC Services Market are focusing on strategic expansion, digital transformation, and partnerships to strengthen their market position. Many firms are investing in automated and AI-driven testing solutions to improve efficiency, reduce testing times, and enhance accuracy. Collaborations with automotive OEMs and government bodies help providers align with emerging regulatory frameworks and develop advanced testing capabilities for electric and autonomous vehicles. Companies are also expanding geographically through mergers, acquisitions, and joint ventures to access new markets and diversify service portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Sourcing

- 2.2.4 Application

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent regulatory compliance

- 3.2.1.2 Globalization of the automotive industry

- 3.2.1.3 Rising demand for vehicle performance testing

- 3.2.1.4 Consumer demand for quality assurance

- 3.2.1.5 Technological advancements in automotive systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced TIC equipment

- 3.2.2.2 Complex regulatory environment

- 3.2.3 Market opportunities

- 3.2.3.1 Growth opportunities in emerging markets

- 3.2.3.2 Development of electric and autonomous vehicles

- 3.2.3.3 Expansion of commercial vehicle TIC services

- 3.2.3.4 Outsourcing of TIC services by OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.2 Europe

- 3.9.3 Asia Pacific

- 3.9.4 Latin America

- 3.9.5 Middle East and Africa

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By service

- 3.11 Sustainability & environmental compliance

- 3.11.1 Carbon footprint and emissions testing

- 3.11.2 Lifecycle assessment (LCA) services

- 3.11.3 Circular economy and recyclability testing

- 3.11.4 Environmental sustainability certifications

- 3.11.5 Green vehicle compliance standards

- 3.12 Cost optimization & ROI analysis

- 3.12.1 TIC service investment return analysis

- 3.12.2 Cost-benefit assessment framework

- 3.12.3 Total cost of ownership models

- 3.13 Capacity utilization & resource optimization

- 3.13.1 Laboratory capacity analysis

- 3.13.2 Equipment utilization rates

- 3.13.3 Workforce productivity metrics

- 3.14 Outsourcing vs in-house decision analysis

- 3.14.1 Make vs buy decision framework

- 3.14.2 Core competency assessment

- 3.14.3 Risk-benefit analysis

- 3.15 Service level agreement benchmarking

- 3.15.1 SLA performance standards

- 3.15.2 Quality metrics & KPIs

- 3.15.3 Penalty & incentive structures

- 3.16 Cybersecurity in automotive testing

- 3.16.1 Software security testing and validation

- 3.16.2 Vulnerability assessment and penetration testing

- 3.16.3 ISO/SAE 21434 compliance and standards

- 3.16.4 Connected and autonomous vehicle cybersecurity

- 3.17 Speed to market & agile testing

- 3.17.1 Accelerated testing protocols

- 3.17.2 Parallel testing methodologies

- 3.17.3 Rapid certification pathways

- 3.17.4 Compressed development cycle strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New sourcing launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Testing services

- 5.3 Inspection services

- 5.4 Certification services

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Sourcing, 2021 - 2034 (USD Bn)

- 6.1 Key trends

- 6.2 In-house

- 6.3 Outsourced

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Vehicle inspection

- 7.3 Emission testing

- 7.4 Component testing

- 7.5 Telematics

- 7.6 ADAS

- 7.7 Homologation testing

- 7.8 Fuels, fluids and lubricants

- 7.9 Electric systems and components

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 BSI

- 10.1.2 Bureau Veritas

- 10.1.3 DEKRA

- 10.1.4 DNV GL

- 10.1.5 Eurofins Scientific

- 10.1.6 Intertek

- 10.1.7 Kiwa

- 10.1.8 RINA

- 10.1.9 SGS

- 10.1.10 TUV Rheinland

- 10.1.11 TUV SUD

- 10.1.12 UL Solutions

- 10.2 Regional Players

- 10.2.1 ALS

- 10.2.2 Applus+ Services

- 10.2.3 MISTRAS

- 10.2.4 NSF International

- 10.2.5 SOCOTEC

- 10.2.6 The Smithers

- 10.2.7 TUV NORD

- 10.2.8 UTAC CERAM

- 10.3 Emerging Players / Disruptors

- 10.3.1 AVL

- 10.3.2 Element Materials Technology

- 10.3.3 ESCRYPT

- 10.3.4 ETAS

- 10.3.5 Keysight Technologies