|

市場調查報告書

商品編碼

1871238

自修復防水材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Self-healing Waterproofing Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

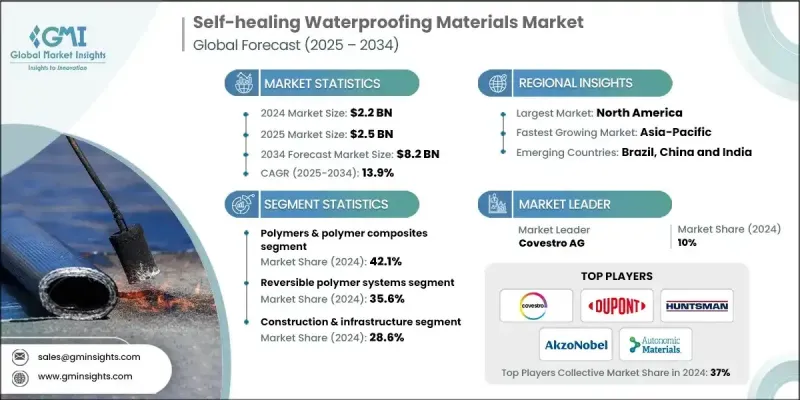

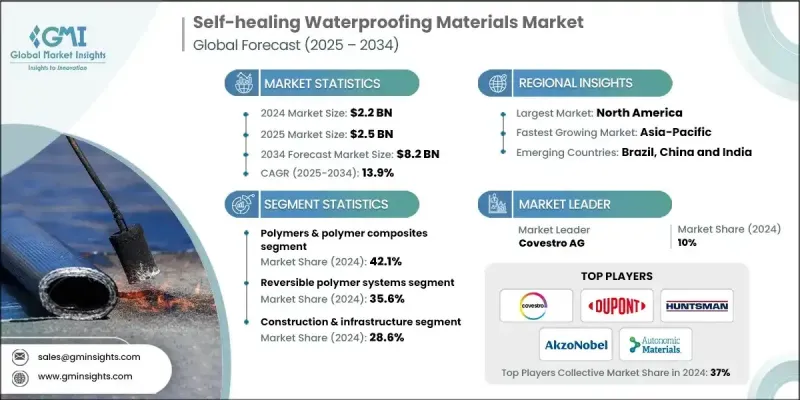

2024 年全球自修復防水材料市場價值為 22 億美元,預計到 2034 年將以 13.9% 的複合年成長率成長至 82 億美元。

隨著各行業日益關注長期耐久性和降低維護成本,市場正經歷強勁成長。這些先進材料在建築、汽車和電子應用領域正獲得廣泛認可,因為在這些領域,潮濕和惡劣的環境條件往往會影響材料的性能和使用壽命。在建築領域,自修復塗料和混凝土正被應用於提高結構韌性並最大限度地降低生命週期成本。汽車產業正在採用耐腐蝕和損傷修復表面來增強耐久性。微膠囊化、血管系統和形狀記憶聚合物等技術的進步正在推動更高效的自修復機制的發展。此外,用於即時損傷檢測和自主修復激活的感測器系統的整合正在塑造下一代防水解決方案。儘管取得了這些進展,但市場仍面臨著成本效益和可擴展性方面的挑戰,尤其是在發展中經濟體。然而,對永續材料的監管支持力度不斷加大以及全球在標準化方面所做的努力有望促進其商業化。亞太地區基礎設施的快速發展,在城市化進程和對持久耐用建築材料日益成長的需求的推動下,進一步促進了市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 82億美元 |

| 複合年成長率 | 13.9% |

2024年,聚合物及聚合物複合材料市佔率達到42.1%,預計2034年將以13.6%的複合年成長率成長。其市場主導地位歸功於其高度的適應性、成熟的製造流程以及在多個行業多樣化應用領域的適用性。這些材料可採用多種自修復機制,使其成為建築、汽車和電子應用的理想選擇。永續和生物基聚合物技術的不斷進步,以及研發投入的不斷成長,正在進一步提升全球環保市場對這類材料的需求。

2024年,可逆聚合物體系市佔率達到35.6%,預計2025年至2034年間將以13.7%的複合年成長率成長。這些系統因其能夠在多次自癒循環中保持良好的機械性能而備受青睞。基於動態共價鍵和非共價鍵,它們能夠在受到應力或損傷時自主恢復結構。其與現有製造流程的兼容性以及商業化規模化生產的特性,使其非常適合建築、電子和交通運輸等行業的大規模應用。其自癒機制的可靠性和可重複性也促進了其在工業領域的廣泛應用。

2024年,北美自修復防水材料市佔率達38.2%。該地區受益於政府的大力支持、世界一流的研究設施以及先進材料的早期商業化。航太、國防和基礎設施領域的高性能應用正在推動市場需求,而私營和公共機構對創新的巨額投資也為此提供了有力支撐。致力於材料科學的研究合作和機構的資助持續鞏固北美的領先地位。眾多知名大學、新創企業和成熟的化學企業的存在,推動了產品的持續開發和技術進步,確保了該地區創新自修復解決方案的穩定供應。

全球自修復防水材料市場的主要參與者包括:Autonomic Materials Inc.、杜邦公司、PPG工業公司、Avecom NV、科思創股份公司、Critical Materials SA、Tnemec Company Inc.、Devan Chemicals NV、阿克蘇諾貝爾公司、亨斯邁公司、Applied Thin Films Inc.、Acciona Ltd SA 和 Som。為了鞏固市場地位,領先企業正致力於技術創新、產品多元化和永續發展。許多企業正在加大研發投入,以提高自修復系統的效率、反應速度和成本效益。他們正與研究機構和工業企業建立策略合作夥伴關係,以加速產品測試和商業化進程。製造商正在擴大產能,並開發環保配方,以滿足全球永續發展標準。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 基礎設施維護成本不斷成長,以及降低維修頻率的需求日益迫切。

- 航太工業需要輕質、自修復複合材料

- 汽車產業力推耐刮擦和自我修復塗層

- 產業陷阱與挑戰

- 高昂的初始材料成本和複雜的製造程序

- 標準化測試方案和效能驗證有限

- 市場機遇

- 再生能源系統中的新興應用

- 醫療器材整合及生物相容性自修復材料

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依材料類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 聚合物及聚合物複合材料

- 金屬及金屬合金

- 陶瓷和玻璃材料

- 混凝土及水泥材料

- 複合材料

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 可逆聚合物體系

- 形狀記憶材料

- 微膠囊化技術

- 血管網路系統

- 生物材料系統

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 建築與基礎設施

- 汽車與運輸

- 航太與國防

- 醫療保健和生物醫學

- 電子與半導體

- 能源與電力系統

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Covestro AG

- DuPont de Nemours Inc.

- Huntsman Corporation

- Akzo Nobel NV

- Autonomic Materials Inc.

- Acciona SA

- PPG Industries Inc.

- Applied Thin Films Inc.

- Avecom NV

- Critical Materials SA

- Devan Chemicals NV

- Sensor Coating Systems Ltd.

- Tnemec Company, Inc.

The Global Self-healing Waterproofing Materials Market was valued at USD 2.2 Billion in 2024 and is estimated to grow at a CAGR of 13.9% to reach USD 8.2 Billion by 2034.

The market is experiencing strong growth as industries increasingly focus on long-term durability and reduced maintenance costs. These advanced materials are gaining traction in construction, automotive, and electronics applications, where exposure to moisture and harsh environmental conditions often affects performance and lifespan. In the construction sector, self-healing coatings and concretes are being incorporated to improve structural resilience and minimize lifecycle expenses. The automotive industry is adopting corrosion-resistant and damage-repairing surfaces to enhance durability. Technological progress in microencapsulation, vascular systems, and shape-memory polymers is driving the evolution of more efficient self-repair mechanisms. In addition, the integration of sensor-based systems for real-time damage detection and autonomous healing activation is shaping the next generation of waterproofing solutions. Despite these advancements, the market faces challenges related to cost-effectiveness and scalability, especially in developing economies. However, growing regulatory support for sustainable materials and global efforts toward standardization are expected to foster commercialization. Rapid infrastructure development across the Asia-Pacific region further contributes to market expansion, driven by urbanization and the rising need for long-lasting construction materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 13.9% |

The polymers and polymer composites segment held a 42.1% share in 2024 and is projected to grow at a CAGR of 13.6% through 2034. Their dominance is attributed to high adaptability, mature manufacturing capabilities, and suitability for diverse applications across multiple industries. These materials can employ a range of self-healing mechanisms, making them ideal for construction, automotive, and electronic applications. Continuous advancements in sustainable and bio-based polymer technologies, combined with growing research investments, are reinforcing their demand in environmentally conscious markets worldwide.

The reversible polymer systems segment held 35.6% share in 2024 and is expected to grow at a CAGR of 13.7% during 2025-2034. These systems are favored for their ability to undergo multiple healing cycles without significant loss in mechanical performance. Based on dynamic covalent and non-covalent bonding, they can autonomously restore their structure when exposed to stress or damage. Their compatibility with existing manufacturing processes and commercial scalability make them highly suitable for large-scale applications in sectors such as construction, electronics, and transportation. The reliability and repeatability of their healing mechanisms contribute to their widespread industrial adoption.

North America Self-healing Waterproofing Materials Market held 38.2% share in 2024. The region benefits from strong government funding, world-class research facilities, and early commercialization of advanced materials. High-performance applications in aerospace, defense, and infrastructure are driving demand, supported by significant investments in innovation from both private and public institutions. Research collaborations and funding from agencies dedicated to material science continue to strengthen North America's leadership position. The presence of major universities, startups, and established chemical companies fuels continuous product development and technological advancement, ensuring a steady supply of innovative self-healing solutions across the region.

Key companies active in the Global Self-healing Waterproofing Materials Market include Autonomic Materials Inc., DuPont de Nemours Inc., PPG Industries Inc., Avecom N.V., Covestro AG, Critical Materials S.A., Tnemec Company Inc., Devan Chemicals NV, Akzo Nobel N.V., Huntsman Corporation, Applied Thin Films Inc., Acciona S.A., and Sensor Coating Systems Ltd. To strengthen their position, leading companies are focusing on technological innovation, product diversification, and sustainable development. Many are increasing R&D investments to improve the efficiency, responsiveness, and cost-effectiveness of self-healing systems. Strategic partnerships with research organizations and industrial players are being established to accelerate product testing and commercialization. Manufacturers are expanding production capacities and developing eco-friendly formulations to meet global sustainability standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Technology type

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing infrastructure maintenance costs & repair frequency reduction needs

- 3.2.1.2 Aerospace industry demands lightweight, self-repairing composites

- 3.2.1.3 Automotive industry push for scratch-resistant & self-healing coatings

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial material costs & manufacturing complexity

- 3.2.2.2 Limited standardized testing protocols & performance validation

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in renewable energy systems

- 3.2.3.2 Medical device integration & biocompatible self-healing materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By material type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo tons)

- 5.1 Key trends

- 5.2 Polymers & polymer composites

- 5.3 Metals & metal alloys

- 5.4 Ceramics & glass materials

- 5.5 Concrete & cementitious materials

- 5.6 Composite materials

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo tons)

- 6.1 Key trends

- 6.2 Reversible polymer systems

- 6.3 Shape memory materials

- 6.4 Microencapsulation technologies

- 6.5 Vascular network systems

- 6.6 Biological material systems

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo tons)

- 7.1 Key trends

- 7.2 Construction & infrastructure

- 7.3 Automotive & transportation

- 7.4 Aerospace & defense

- 7.5 Healthcare & biomedical

- 7.6 Electronics & semiconductors

- 7.7 Energy & power systems

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Covestro AG

- 9.2 DuPont de Nemours Inc.

- 9.3 Huntsman Corporation

- 9.4 Akzo Nobel N.V.

- 9.5 Autonomic Materials Inc.

- 9.6 Acciona S.A.

- 9.7 PPG Industries Inc.

- 9.8 Applied Thin Films Inc.

- 9.9 Avecom N.V.

- 9.10 Critical Materials S.A.

- 9.11 Devan Chemicals NV

- 9.12 Sensor Coating Systems Ltd.

- 9.13 Tnemec Company, Inc.