|

市場調查報告書

商品編碼

1871228

氧化還原液流電池儲能市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Redox Flow Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

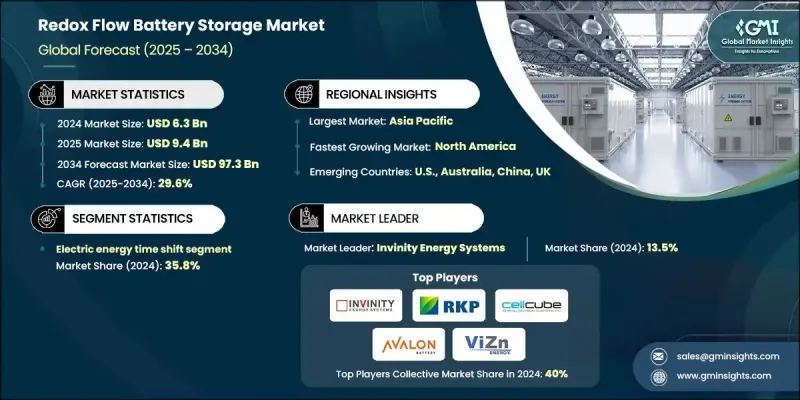

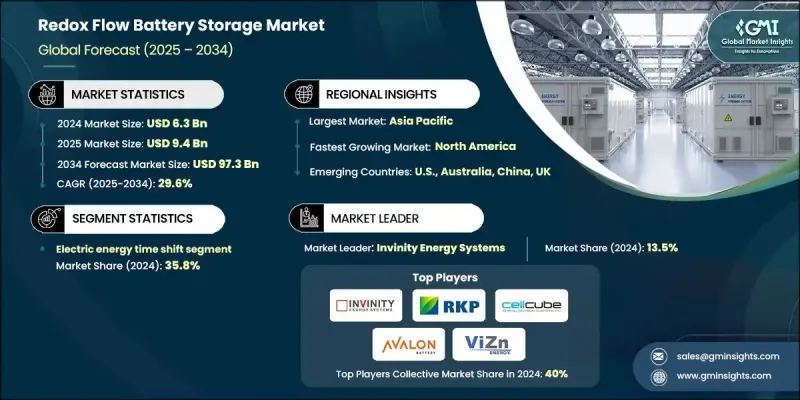

2024 年全球液流電池儲能市值為 63 億美元,預計到 2034 年將以 29.6% 的複合年成長率成長至 973 億美元。

再生能源(例如風能和太陽能)的加速部署推動了儲能技術的快速成長,而這些能源本身就需要穩定且高效的長時儲能系統。氧化還原液流電池(RFB)因其能夠長時間放電(通常為4至24小時)而日益受到青睞。這使其非常適合應對再生能源發電的波動,並提高電網可靠性。除了能夠有效地轉移過剩電力外,RFB還支援頻率控制和負載平衡等關鍵功能。作為能源基礎設施現代化和支持清潔能源轉型的更廣泛努力的一部分,全球公用事業公司和政府正在加大對先進儲能技術的投資。 RFB系統的可擴展性、安全性和可回收性也促進了其應用,尤其是在那些致力於在城市和農村地區實現永續、防火儲能解決方案的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 63億美元 |

| 預測值 | 973億美元 |

| 複合年成長率 | 29.6% |

氧化還原液流電池的一大優勢在於其模組化設計,這種設計將功率輸出與儲能容量分離,從而能夠靈活擴展以適應各種應用。這項獨特特性使液流電池成為多小時儲能應用的首選方案,包括電網支援和再生能源併網。隨著市場對8至12小時放電系統的需求不斷成長,這些電池在追求穩定性和成本效益的能源組合中優先考慮。其化學成分本身不易燃,消除了與熱事件相關的風險,使其成為社區級或關鍵基礎設施儲能的安全選擇。此外,可回收的電解液也使液流電池符合全球市場對永續能源解決方案的需求。

2024年,電力能源時移應用市佔率達到35.8%,預計2034年將以29.7%的複合年成長率成長。液流電池(RFB)在這些應用中表現出色,它們在用電低谷期充電,並在用電高峰期放電。這使得電力公司能夠更好地管理尖峰負載,同時利用浮動電價模式。其更長的放電時間和更高的循環性能使其成為重塑能源使用模式的理想選擇,尤其適用於嚴重依賴太陽能或風能的電力系統。

到2034年,美國液流電池儲能市場規模將達145億美元。其擴張得益於聯邦政府支持清潔能源普及、能源安全以及電池系統國內製造的政策。以創新為導向的扶持計畫正在幫助本地製造商和新創公司將新的化學技術和解決方案推向市場。隨著美國電網日益受到氣候相關壓力的影響,公用事業公司和州政府正在積極尋求防火、長時儲能技術。液流電池憑藉其模組化架構和深度循環能力,正被廣泛應用於從再生能源儲能到關鍵基礎設施韌性等各個領域。

引領全球液流電池儲能市場的主要參與者包括ESS、Avalon Battery、榮科電源、Voltstorage、住友電工、Elestor、Invinity Energy Systems、CellCube Energy Storage Systems、Everflow、Primus Power、Largo、ViZn Energy Systems和VRB Energy。這些企業正積極投資先進的化學技術,例如釩基或混合電解液,以提高系統效率並延長電池壽命。與能源供應商、政府和研究機構的策略合作正在加速液流電池儲能技術的商業化和在全球電網中的部署。許多企業正在擴大產能以滿足日益成長的長時儲能需求,而其他企業則在為微電網、遠端電氣化和工業備用等特定應用客製化系統。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 關鍵材料供應鏈圖

- 製造設備和製程要求

- 品質控制和測試基礎設施

- 供應鏈整合機遇

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 價格趨勢分析(美元/兆瓦)

- 按地區

- 投資和融資環境分析

- 新興科技趨勢和發展

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀錶板

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 創新與永續發展格局

第5章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 電力能量時移

- 頻率調節

- 再生能源併網

- 其他

第6章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 世界其他地區

第7章:公司簡介

- Avalon Battery

- CellCube Energy Storage Systems

- Elestor

- ESS

- Everflow

- Invinity Energy Systems

- Largo

- Primus Power

- Rongke Power

- Sumitomo Electric

- ViZn Energy Systems

- Voltstorage

- VRB Energy

The Global Redox Flow Battery Storage Market was valued at USD 6.3 Billion in 2024 and is estimated to grow at a CAGR of 29.6% to reach USD 97.3 Billion by 2034.

The sharp growth is fueled by the accelerating deployment of renewable energy sources such as wind and solar, which inherently require stable and efficient long-duration storage systems. Redox flow batteries (RFBs) are increasingly gaining preference due to their ability to discharge over extended periods, typically between 4 and 24 hours. This makes them well-suited for managing the fluctuations in renewable generation and for enhancing grid reliability. In addition to enabling effective time-shifting of excess power, RFBs support critical functions like frequency control and load balancing. Global utilities and governments are ramping up investments in advanced storage technologies as part of broader efforts to modernize energy infrastructure and support clean energy transitions. The scalability, safety, and recyclability of RFB systems also contribute to their growing adoption, particularly in regions aiming for sustainable, fire-safe energy storage solutions in both urban and rural settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $97.3 Billion |

| CAGR | 29.6% |

A defining advantage of redox flow batteries is their modular design, which separates power output from energy storage capacity, enabling flexible scaling for diverse applications. This unique trait positions RFBs as the go-to option for multi-hour energy storage uses, including grid support and renewable integration. With growing demand for 8 to 12-hour discharge systems, these batteries are being prioritized in energy portfolios seeking stability and cost-efficiency. Their chemical composition is inherently non-flammable, eliminating risks associated with thermal events, which makes them a safe choice for community-level or critical infrastructure storage. This, combined with recyclable electrolyte solutions, aligns RFBs with the push for sustainable energy solutions across global markets.

The electric energy time shift segment held 35.8% share in 2024, and is forecasted to grow at a CAGR of 29.7% through 2034. RFBs perform exceptionally in these applications by charging during periods of low electricity demand and discharging when consumption spikes. This enables utilities to better manage peak loads while taking advantage of variable pricing models. Their extended discharge duration and high cycling capabilities make them ideal for reshaping energy use patterns, particularly in power systems heavily reliant on solar or wind.

U.S. Redox Flow Battery Storage Market will reach USD 14.5 Billion by 2034. Its expansion is underpinned by federal policies supporting clean energy adoption, energy security, and domestic manufacturing of battery systems. Encouragement from innovation-focused programs is helping local manufacturers and startups bring new chemistries and solutions to market. With the U.S. energy grid increasingly affected by climate-related stressors, utilities and state governments are actively pursuing fire-safe, long-duration storage technologies. RFBs, with their modular architecture and deep cycle capabilities, are being deployed for everything from renewable storage to critical infrastructure resilience.

Leading participants shaping the Global Redox Flow Battery Storage Market include ESS, Avalon Battery, Rongke Power, Voltstorage, Sumitomo Electric, Elestor, Invinity Energy Systems, CellCube Energy Storage Systems, Everflow, Primus Power, Largo, ViZn Energy Systems, and VRB Energy. Companies in the redox flow battery storage market are actively investing in advanced chemistries, such as vanadium-based or hybrid electrolytes, to enhance system efficiency and extend battery life. Strategic collaborations with energy providers, governments, and research institutes are enabling faster commercialization and deployment across global energy grids. Many players are scaling up their production capacities to meet increasing demand for long-duration energy storage, while others are customizing systems for niche applications like microgrids, remote electrification, and industrial backup.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Critical materials supply chain mapping

- 3.1.2 Manufacturing equipment and process requirements

- 3.1.3 Quality control and testing infrastructure

- 3.1.4 Supply chain integration opportunities

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Price trend analysis (USD/MW)

- 3.7.1 By region

- 3.8 Investment and funding landscape analysis

- 3.9 Emerging technology trends and developments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Electric energy time shift

- 5.3 Frequency regulation

- 5.4 Renewable integration

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Avalon Battery

- 7.2 CellCube Energy Storage Systems

- 7.3 Elestor

- 7.4 ESS

- 7.5 Everflow

- 7.6 Invinity Energy Systems

- 7.7 Largo

- 7.8 Primus Power

- 7.9 Rongke Power

- 7.10 Sumitomo Electric

- 7.11 ViZn Energy Systems

- 7.12 Voltstorage

- 7.13 VRB Energy