|

市場調查報告書

商品編碼

1871219

燃料電池電動車(FCEV)動力系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Fuel Cell Electric Vehicle (FCEV) Powertrain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

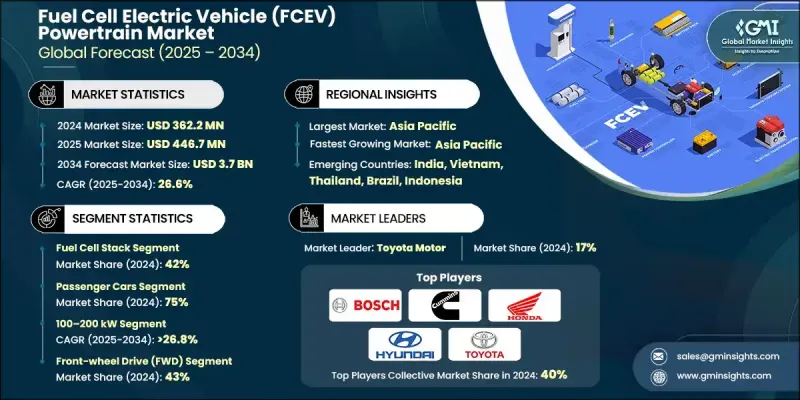

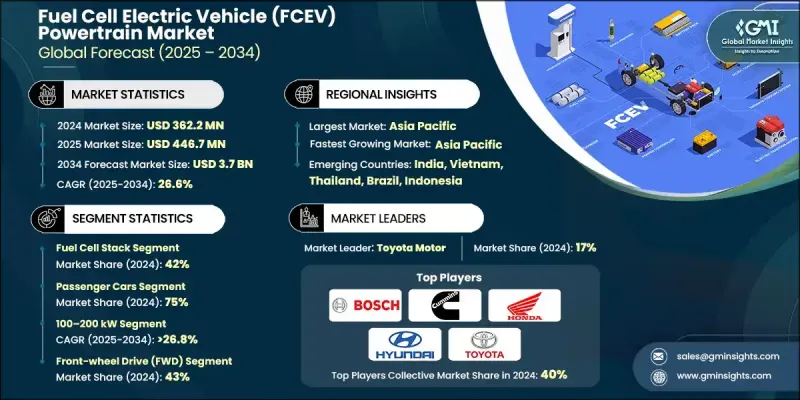

2024 年全球燃料電池電動車 (FCEV) 動力系統市場價值為 3.622 億美元,預計到 2034 年將以 26.6% 的複合年成長率成長至 37 億美元。

市場正受到快速技術進步的驅動,汽車製造商不斷推出更有效率、更緊湊、可擴展的新一代燃料電池系統。近期發展趨勢強調模組化設計,可整合到乘用車、商用車隊和固定式應用中,從而提升性能和製造效率。催化劑技術的改進以及貴金屬用量的減少降低了系統成本,而政府對氫能基礎設施的支持和資金投入則加速了市場普及。自動化生產技術和卷對捲製造流程正在改變燃料電池組件的生產,確保更高的一致性和效率。高功率密度和先進系統中的最佳化整合進一步促進了燃料電池的普及,尤其是在那些大力投資氫能出行和清潔能源政策的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.622億美元 |

| 預測值 | 37億美元 |

| 複合年成長率 | 26.6% |

2024年,乘用車市佔率達到75%,預計2025年至2034年將以27.1%的複合年成長率成長。該細分市場受益於車型選擇的增加、基礎設施的擴展以及提升效率、續航里程和加氫速度的技術進步。豪華和高階車型擴大採用模組化燃料電池動力系統,以滿足不斷變化的能源管理標準和消費者期望。

2024年,100-200千瓦動力總成市場規模達到1.501億美元,並有望持續成長,這主要得益於其適用於中型商用車、豪華乘用車和小型商用車。標準化設計和規模經濟使此功率範圍具有廣泛的適用性,能夠為主流應用提供高性能、具成本效益和高效的封裝。

亞太地區燃料電池電動車(FCEV)動力總成市場預計到2024年將佔據46%的市場佔有率,這主要得益於政府的支持性政策、對氫能基礎設施的投資以及汽車製造商的積極舉措。在地化生產的成長、研發投入的增加以及汽車製造商與能源供應商之間的合作,正在建立一個強大的氫能生態系統。作為該地區最大的市場,中國受惠於車隊電氣化計畫和政府對燃料電池電動車推廣的激勵措施,而商業和物流領域需求的成長也進一步推動了市場發展。

全球燃料電池電動車(FCEV)動力系統市場的主要參與者包括尼古拉(Nikola)、本田汽車(Honda Motor)、巴拉德動力(Ballard Power)、PowerCell、豐田汽車(Toyota Motor)、Bosch(Bosch)、康明斯(Cummins)、通用汽車(General Motors)、Plug Power和現代汽車(Hyundai)。各公司正透過大力投資研發來提升燃料電池的效率、耐久性和功率密度,以鞏固自身市場地位。與能源供應商、政府機構和汽車製造商建立策略合作夥伴關係,有助於建立氫氣加註網路和供應鏈。各公司正在為多個車型領域推出模組化和可擴展的動力總成,並將產品組合擴展到乘用車、商用車和工業應用領域。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 政府激勵措施和零排放法規

- 氫氣生產和加氫基礎設施的進步

- 燃料電池成本下降和效率提高

- 對遠端和重型行動解決方案的需求不斷成長

- 汽車製造商與能源公司的合作

- 產業陷阱與挑戰

- 氫氣生產和儲存成本高昂

- 氫氣加註基礎設施有限

- 市場機遇

- 綠色氫氣生產擴張

- 氫能基礎設施發展夥伴關係

- 燃料電池組件的技術創新

- 與再生能源系統整合

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- PEM燃料電池技術成熟度

- 氫氣儲存技術現狀

- 工廠平衡最佳化

- 整合和控制系統

- 新興技術

- 固態燃料電池

- 先進膜技術

- 下一代儲存解決方案

- 人工智慧驅動的系統最佳化

- 當前技術趨勢

- 價格趨勢

- 組件級定價分析

- 系統級定價趨勢

- 區域價格差異

- 定價策略分析

- 基於價值的定價模型

- 競爭性定價策略

- 批量折扣結構

- 生產統計和製造業分析

- 全球生產概覽

- 製造能力分析

- 生產技術評估

- 供應鏈製造

- 成本細分分析

- 燃料電池堆成本結構

- 設備平衡成本分析

- 整合和組裝成本

- 總擁有成本分析

- 專利分析

- 專利格局概述

- 關鍵技術專利

- 知識產權授權策略

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 研發投資分析

- 全球研發支出趨勢

- 企業研發計劃

- 政府研究項目

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 燃料電池堆

- 氫氣儲存罐

- 電動機

- 電源控制單元(PCU)

- 電池系統

- 空氣壓縮機和加濕器

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車

- 中型商用車

- 重型商用車輛

第7章:市場估計與預測:依發電量分類,2021-2034年

- 主要趨勢

- 低於100千瓦

- 100-200千瓦

- 200度以上

第8章:市場估算與預測:以驅動方式分類,2021-2034年

- 主要趨勢

- 前輪驅動(FWD)

- 後輪驅動(RWD)

- 全輪驅動(AWD)

第9章:市場估算與預測:依區間分類,2021-2034年

- 主要趨勢

- 最遠可達 400 公里

- 400-600公里

- 600公里以上

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第11章:公司簡介

- Major fuel cell powertrain manufacturers

- Ballard Power

- Bloom Energy

- Bosch

- Cummins

- Honda Motor

- Horizon Fuel Cell Technologies

- Hyundai Motor

- Intelligent Energy

- ITM Power

- Plug Power

- SFC Energy

- Toyota Motor

- Weichai Power

- General Motor

- Component and technology suppliers

- Aisin

- Denso

- Mahle

- Mitsubishi Heavy

- PowerCell

- Schaeffler

- Toshiba Energy

- Emerging and innovative fuel cell companies

- GenCell Energy

- Hydrogenious

- Hyster-Yale

- Nikola

- Nuvera Fuel

The Global Fuel Cell Electric Vehicle (FCEV) Powertrain Market was valued at USD 362.2 million in 2024 and is estimated to grow at a CAGR of 26.6% to reach USD 3.7 Billion by 2034.

The market is being driven by rapid technological advancements, with automakers introducing next-generation fuel cell systems that are more efficient, compact, and scalable. Recent developments emphasize modular designs that can be integrated into passenger vehicles, commercial fleets, and stationary applications, enhancing both performance and manufacturing efficiency. Improvements in catalyst technology, along with reduced use of precious metals, have lowered system costs, while government support and funding for hydrogen infrastructure have accelerated market adoption. Automated production techniques and roll-to-roll manufacturing processes are transforming fuel cell component production, ensuring better consistency and efficiency. High power density and optimized integration in advanced systems have further enhanced adoption, particularly in regions investing in hydrogen mobility and clean energy policies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $362.2 Million |

| Forecast Value | $3.7 Billion |

| CAGR | 26.6% |

In 2024, the passenger cars segment held a 75% share and is expected to grow at a CAGR of 27.1% from 2025 to 2034. The segment benefits from increased model availability, infrastructure expansion, and technological advances that improve efficiency, range, and refueling speed. Luxury and premium models increasingly utilize modular fuel cell powertrains to meet evolving energy management standards and consumer expectations.

The 100-200 kW powertrain segment generated USD 150.1 million in 2024 and is poised to grow owing to its suitability for medium-duty commercial vehicles, luxury passenger cars, and smaller commercial units. Standardized designs and economies of scale make this range versatile, offering high performance, cost-efficiency, and effective packaging for mainstream applications.

Asia Pacific Fuel Cell Electric Vehicle (FCEV) Powertrain Market held 46% share in 2024, driven by supportive government policies, investments in hydrogen infrastructure, and automaker initiatives. Increased local production, R&D investment, and partnerships between automakers and energy providers are fostering a robust hydrogen ecosystem. China, the largest market in the region, is benefiting from fleet electrification initiatives and government incentives for FCEV adoption, with rising demand in commercial and logistics sectors further boosting growth.

Key players operating in the Global Fuel Cell Electric Vehicle (FCEV) Powertrain Market include Nikola, Honda Motor, Ballard Power, PowerCell, Toyota Motor, Bosch, Cummins, General Motors, Plug Power, and Hyundai Motor. Companies are strengthening their position by investing heavily in research and development to enhance fuel cell efficiency, durability, and power density. Strategic partnerships with energy providers, government agencies, and automotive manufacturers are helping build hydrogen refueling networks and supply chains. Firms are introducing modular and scalable powertrains for multiple vehicle segments, expanding their portfolio to include passenger, commercial, and industrial applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Power Output

- 2.2.5 Drive

- 2.2.6 Range

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Government incentives and zero-emission regulations

- 3.2.1.3 Advancements in hydrogen production and refueling infrastructure

- 3.2.1.4 Declining fuel cell costs and improved efficiency

- 3.2.1.5 Rising demand for long-range and heavy-duty mobility solutions

- 3.2.1.6 Collaboration between automakers and energy companies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High hydrogen production and storage costs

- 3.2.2.2 Limited hydrogen refueling infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Green hydrogen production expansion

- 3.2.3.2 Hydrogen infrastructure development partnerships

- 3.2.3.3 Technological innovation in fuel cell components

- 3.2.3.4 Integration with renewable energy systems

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 PEM fuel cell technology maturity

- 3.7.1.2 Hydrogen storage technology status

- 3.7.1.3 Balance of plant optimization

- 3.7.1.4 Integration and control systems

- 3.7.2 Emerging technologies

- 3.7.2.1 Solid-state fuel cells

- 3.7.2.2 Advanced membrane technologies

- 3.7.2.3 Next-generation storage solutions

- 3.7.2.4 AI-driven system optimization

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 Component-level pricing analysis

- 3.8.2 System-level pricing trends

- 3.8.3 Regional price variations

- 3.9 Pricing strategy analysis

- 3.9.1 Value-based pricing models

- 3.9.2 Competitive pricing strategies

- 3.9.3 Volume discount structures

- 3.10 Production statistics and manufacturing analysis

- 3.10.1 Global production overview

- 3.10.2 Manufacturing capacity analysis

- 3.10.3 Production technology assessment

- 3.10.4 Supply chain manufacturing

- 3.11 Cost breakdown analysis

- 3.11.1 Fuel cell stack cost structure

- 3.11.2 Balance of plant cost analysis

- 3.11.3 Integration and assembly costs

- 3.11.4 Total cost of ownership analysis

- 3.12 Patent analysis

- 3.12.1 Patent landscape overview

- 3.12.2 Key technology patents

- 3.12.3 IP licensing strategies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 R&D investment analysis

- 3.14.1 Global R&D spending trends

- 3.14.2 Corporate R&D initiatives

- 3.14.3 Government research programs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Fuel cell stack

- 5.3 Hydrogen storage tank

- 5.4 Electric motor

- 5.5 Power control unit (PCU)

- 5.6 Battery system

- 5.7 Air compressor & humidifier

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Power Output, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Below 100 kW

- 7.3 100-200 kW

- 7.4 Above 200 kW

Chapter 8 Market Estimates & Forecast, By Drive, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Front-wheel drive (FWD)

- 8.3 Rear-wheel drive (RWD)

- 8.4 All-wheel drive (AWD)

Chapter 9 Market Estimates & Forecast, By Range, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Up to 400 km

- 9.3 400-600 km

- 9.4 Above 600 km

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Major fuel cell powertrain manufacturers

- 11.1.1 Ballard Power

- 11.1.2 Bloom Energy

- 11.1.3 Bosch

- 11.1.4 Cummins

- 11.1.5 Honda Motor

- 11.1.6 Horizon Fuel Cell Technologies

- 11.1.7 Hyundai Motor

- 11.1.8 Intelligent Energy

- 11.1.9 ITM Power

- 11.1.10 Plug Power

- 11.1.11 SFC Energy

- 11.1.12 Toyota Motor

- 11.1.13 Weichai Power

- 11.1.14 General Motor

- 11.2 Component and technology suppliers

- 11.2.1 Aisin

- 11.2.2 Denso

- 11.2.3 Mahle

- 11.2.4 Mitsubishi Heavy

- 11.2.5 PowerCell

- 11.2.6 Schaeffler

- 11.2.7 Toshiba Energy

- 11.3 Emerging and innovative fuel cell companies

- 11.3.1 GenCell Energy

- 11.3.2 Hydrogenious

- 11.3.3 Hyster-Yale

- 11.3.4 Nikola

- 11.3.5 Nuvera Fuel