|

市場調查報告書

商品編碼

1871078

汽車氫燃料電池堆市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Hydrogen Fuel Cell Stack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

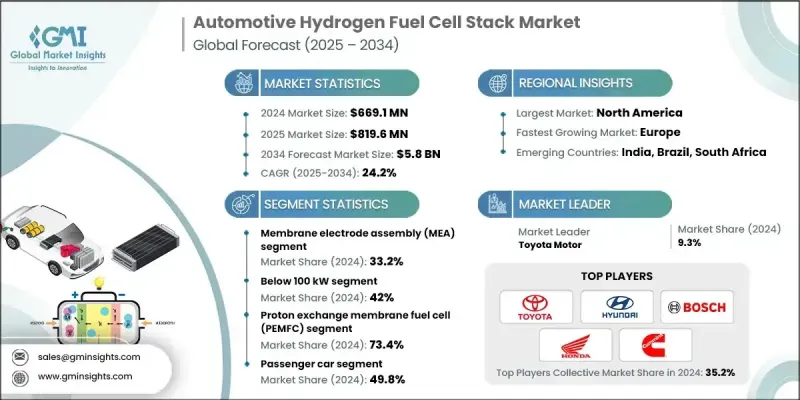

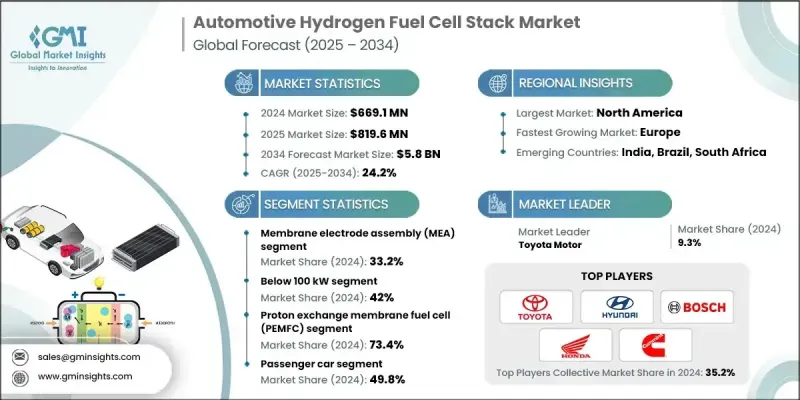

2024 年全球汽車氫燃料電池堆市場價值為 6.691 億美元,預計到 2034 年將以 24.2% 的複合年成長率成長至 58 億美元。

全球對空氣污染和氣候變遷等環境挑戰的日益關注,正在加速向零排放出行方式的轉型。氫動力汽車僅排放水蒸氣,使其成為傳統內燃機的清潔永續替代方案。材料科學與工程的進步推動了燃料電池技術的不斷發展,顯著提高了氫燃料電池的效率、性能和使用壽命。這些發展增強了氫燃料電池與純電動車的競爭力,並拓寬了其在汽車領域的應用。此外,氫氣可利用多種國內資源生產,從而降低了對進口石油的依賴,並有助於能源多元化和能源安全。政府的扶持政策,例如稅收優惠、財政激勵和研究資助,透過降低製造成本和促進綠色交通基礎設施建設,進一步鼓勵了氫燃料電池的普及。這些措施正在加速全球向永續移動和更清潔能源生態系統的轉型。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.691億美元 |

| 預測值 | 58億美元 |

| 複合年成長率 | 24.2% |

2024年,膜電極組件(MEA)市佔率達到33.2%。 MEA作為氫燃料電池的電化學核心,負責氫氣和氧氣的結合以產生電能。該市場佔有率反映了催化劑性能、膜強度和整體效率方面持續的技術進步。 MEA技術的不斷進步降低了對鉑金的依賴性,提高了能量轉換效率,增強了耐久性,從而降低了生產成本,並延長了乘用車和商用車氫動力汽車的使用壽命。

2024年,質子交換膜燃料電池(PEMFC)市佔率達到73.4%,預計2034年將以24%的複合年成長率成長。 PEMFC因其體積小、重量輕、功率密度高等優點,在汽車領域廣泛應用,使其成為車輛整合的理想選擇,尤其適用於對效率和空間最佳化要求較高的應用場景。其低工作溫度和快速啟動能力使其特別適用於轎車、SUV和輕型商用車等多種車型。膜耐久性和催化劑穩定性的不斷提升進一步增強了PEMFC的性能,推動了其在全球市場的大規模部署。

預計到2024年,美國汽車氫燃料電池堆市佔率將達到86.4%。政府支持的各項措施正在推動燃料電池堆的國內生產和技術進步,重點在於提高功率密度、成本效益和使用壽命。公共和私營部門對氫能基礎設施的投資不斷增加,以及汽車製造商和零件製造商之間的合作,正在推動中重型車輛氫燃料電池系統的大規模生產和整合。該地區對清潔能源和創新的重視,持續鞏固了在氫能出行解決方案領域的領先地位。

全球汽車氫燃料電池堆市場的主要參與者包括豐田汽車、瑞典PowerCell公司、康明斯、本田汽車、現代汽車、巴拉德動力系統公司、Symbio公司、濰柴動力、羅伯特博世公司和EKPO燃料電池技術公司。汽車氫燃料電池堆市場的領導者正透過持續的研發和創新來增強其競爭優勢,專注於開發高效、低成本且耐用的燃料電池堆系統。許多公司正在投資研發下一代材料,以最大限度地減少鉑的使用量、提高功率輸出並延長燃料電池的使用壽命。汽車製造商與技術開發商之間的策略合作正在加速氫燃料電池的大規模生產及其在商用車輛中的應用。此外,各公司還優先考慮與政府建立合作關係,以確保基礎設施擴大和研發所需的資金。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 系統整合商

- OEM

- 最終用途

- 產業影響因素

- 成長促進因素

- 政府激勵措施和政策

- 環境問題

- 技術進步

- 能源安全與多元化

- 產業陷阱與挑戰

- 生產成本高

- 加油基礎設施有限

- 氫氣生產面臨的挑戰

- 消費者意識與認知

- 市場機遇

- 燃料電池技術的進步

- 與再生能源的整合

- 拓展重型運輸業務

- 全球政策支持

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 專利分析

- 價格趨勢分析

- 依產品

- 按地區

- 成本細分分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 關稅和貿易壁壘

- 供應鏈韌性與多元化

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 供應鏈與物流

- 氫能供應鏈基礎設施

- 分銷網路和通路

- 加油基礎建設開發

- 冷鏈管理與存儲

- 物流挑戰與解決方案

- 最後一公里配送注意事項

- 總擁有成本 (TCO) 分析

- 汽車認證和測試成本

- 製造和部署費用

- 維護和更換成本

- 按技術類型分類的總擁有成本比較

- 製造流程及品質控制分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 膜電極組件(MEA)

- 雙極板

- 墊片及密封件

- 端板和集電器

- 冷卻板

- 歧管和氣體擴散層

第6章:市場估計與預測:依發電量分類,2021-2034年

- 主要趨勢

- 低於100千瓦

- 100-250千瓦

- 250度以上

第7章:市場估計與預測:依燃料電池技術分類,2021-2034年

- 主要趨勢

- 質子交換膜燃料電池(PEMFC)

- 固態氧化物燃料電池(SOFC)

- 鹼性燃料電池(AFC)

- 熔融碳酸鹽燃料電池(MCFC)

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 低容量性狀

- MCV

- C型肝炎

- 特種車輛

- 工業車輛

- 軍用車輛

第9章:市場估算與預測:依銷售管道分類,2021-2034年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- BMW

- Robert Bosch

- Daimler

- General Motors (GM)

- Honda Motor

- Hyundai Mobis

- Hyundai Motor

- Stellantis

- Toyota Motor

- Volvo

- Regional Champions

- EKPO Fuel Cell Technologies

- ElringKlinger

- Nissan Motor

- SAIC Motor

- Schaeffler

- Weichai Power

- 新興參與者和專家

- Ballard Power Systems

- Doosan

- Hyzon Motors

- Nuvera

- PowerCell

- Symbio

The Global Automotive Hydrogen Fuel Cell Stack Market was valued at USD 669.1 million in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 5.8 Billion by 2034.

Rising global awareness about environmental challenges such as air pollution and climate change is accelerating the transition toward zero-emission mobility. Hydrogen-powered vehicles emit only water vapor, positioning them as a clean and sustainable alternative to conventional combustion engines. The continuous evolution of fuel cell technology, driven by advances in materials science and engineering, has significantly improved the efficiency, performance, and lifespan of hydrogen fuel cells. These developments are enhancing their competitiveness with battery electric vehicles and broadening their use across automotive applications. Moreover, hydrogen's ability to be produced from multiple domestic sources reduces dependency on imported oil and contributes to energy diversification and security. Supportive government initiatives such as tax benefits, financial incentives, and research grants are further encouraging adoption by reducing manufacturing costs and promoting green transportation infrastructure. Such measures are helping accelerate the global shift toward sustainable mobility and cleaner energy ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $669.1 Million |

| Forecast Value | $5.8 Billion |

| CAGR | 24.2% |

The membrane electrode assembly (MEA) segment held a 33.2% share in 2024. Serving as the electrochemical core of a hydrogen fuel cell, the MEA is where hydrogen and oxygen combine to generate electricity. The segment reflects the ongoing technological progress in catalyst performance, membrane strength, and overall efficiency. Continued advancements in MEA development have led to reduced platinum dependency, better energy conversion, and enhanced durability, driving down production costs and extending the operational lifespan of hydrogen-powered vehicles across passenger and commercial categories.

The proton exchange membrane fuel cell (PEMFC) segment held a 73.4% share in 2024 and is expected to grow at a CAGR of 24% through 2034. PEMFCs are widely adopted in the automotive sector due to their compact size, low weight, and high power density, which make them ideal for vehicle integration where efficiency and space optimization are essential. Their low operating temperature and rapid start-up capabilities make them particularly suitable for diverse vehicle categories such as sedans, SUVs, and light commercial trucks. Continuous improvements in membrane durability and catalyst stability are further enhancing performance, enabling large-scale deployment of PEMFCs across global markets.

U.S. Automotive Hydrogen Fuel Cell Stack Market held 86.4% share in 2024. Government-backed initiatives are promoting domestic production and technological advancement in fuel cell stacks, with a focus on improving power density, cost-efficiency, and lifespan. Increasing public and private sector investment in hydrogen infrastructure, along with collaboration between automakers and component manufacturers, is advancing large-scale manufacturing and integration of hydrogen fuel cell systems for medium- and heavy-duty vehicles. The region's emphasis on clean energy and innovation continues to reinforce its leadership in hydrogen mobility solutions.

Key companies participating in the Global Automotive Hydrogen Fuel Cell Stack Market include Toyota Motor, PowerCell Sweden, Cummins, Honda Motor, Hyundai Motor, Ballard Power Systems, Symbio, Weichai Power, Robert Bosch, and EKPO Fuel Cell Technologies. Leading companies in the Automotive Hydrogen Fuel Cell Stack Market are enhancing their competitive edge through continuous research and innovation, focusing on developing high-efficiency, low-cost, and durable stack systems. Many firms are investing in next-generation materials to minimize platinum usage, boost power output, and extend fuel cell lifespan. Strategic collaborations between automakers and technology developers are accelerating large-scale production and integration of hydrogen fuel cells into commercial fleets. Companies are also prioritizing partnerships with governments to secure funding for infrastructure expansion and R&D.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Power output

- 2.2.3 Fuel cell technology

- 2.2.4 Vehicle

- 2.2.5 Sales channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 OEM

- 3.2.5 End Use

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Government Incentives and Policies

- 3.3.1.2 Environmental Concerns

- 3.3.1.3 Technological Advancements

- 3.3.1.4 Energy Security and Diversification

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Production Costs

- 3.3.2.2 Limited Refueling Infrastructure

- 3.3.2.3 Hydrogen Production Challenges

- 3.3.2.4 Consumer Awareness and Perception

- 3.3.3 Market opportunities

- 3.3.3.1 Advancements in Fuel Cell Technology

- 3.3.3.2 Integration with Renewable Energy Sources

- 3.3.3.3 Expansion into Heavy-Duty Transport

- 3.3.3.4 Global Policy Support

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle east and Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Patent analysis

- 3.10 Price Trends Analysis

- 3.10.1 By product

- 3.10.2 By region

- 3.11 Cost Breakdown Analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.12.4 Tariffs and Trade Barriers

- 3.12.5 Supply Chain Resilience and Diversification

- 3.13 Sustainability and Environmental Aspects

- 3.13.1 Sustainable Practices

- 3.13.2 Waste Reduction Strategies

- 3.13.3 Energy Efficiency in Production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon Footprint Considerations

- 3.14 Supply Chain & Logistics

- 3.14.1 Hydrogen Supply Chain Infrastructure

- 3.14.2 Distribution Networks and Channels

- 3.14.3 Refueling Infrastructure Development

- 3.14.4 Cold Chain Management and Storage

- 3.14.5 Logistics Challenges and Solutions

- 3.14.6 Last-mile Delivery Considerations

- 3.15 Total Cost of Ownership (TCO) Analysis

- 3.15.1 Automotive Qualification & Testing Costs

- 3.15.2 Manufacturing & Deployment Expenses

- 3.15.3 Maintenance & Replacement Costs

- 3.15.4 TCO Comparison by Technology Type

- 3.16 Manufacturing Process & Quality Control Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Membrane electrode assembly (MEA)

- 5.3 Bipolar plates

- 5.4 Gaskets and seals

- 5.5 End plates & current collectors

- 5.6 Cooling plates

- 5.7 Manifolds & gas diffusion layers

Chapter 6 Market Estimates & Forecast, By Power output, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 100 kW

- 6.3 100-250 kW

- 6.4 Above 250 kW

Chapter 7 Market Estimates & Forecast, By Fuel Cell Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Proton exchange membrane fuel cell (PEMFC)

- 7.3 Solid oxide fuel cell (SOFC)

- 7.4 Alkaline fuel cell (AFC)

- 7.5 Molten carbonate fuel cell (MCFC)

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger Car

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial Vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Specialized Vehicles

- 8.4.1 Industrial vehicles

- 8.4.2 Military vehicles

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BMW

- 11.1.2 Robert Bosch

- 11.1.3 Daimler

- 11.1.4 General Motors (GM)

- 11.1.5 Honda Motor

- 11.1.6 Hyundai Mobis

- 11.1.7 Hyundai Motor

- 11.1.8 Stellantis

- 11.1.9 Toyota Motor

- 11.1.10 Volvo

- 11.2 Regional Champions

- 11.2.1 EKPO Fuel Cell Technologies

- 11.2.2 ElringKlinger

- 11.2.3 Nissan Motor

- 11.2.4 SAIC Motor

- 11.2.5 Schaeffler

- 11.2.6 Weichai Power

- 11.3 Emerging Players & Specialists

- 11.3.1 Ballard Power Systems

- 11.3.2 Doosan

- 11.3.3 Hyzon Motors

- 11.3.4 Nuvera

- 11.3.5 PowerCell

- 11.3.6 Symbio