|

市場調查報告書

商品編碼

1871216

汽車48伏特電子接線盒及配電中心市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive 48-Volt Electronic Junction Box and Power Distribution Center Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

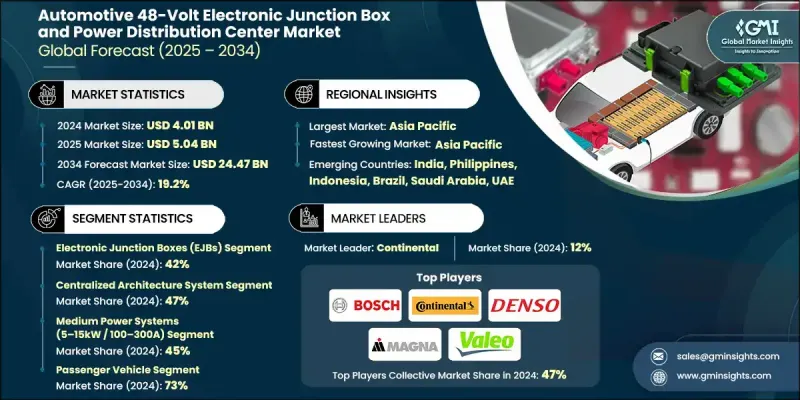

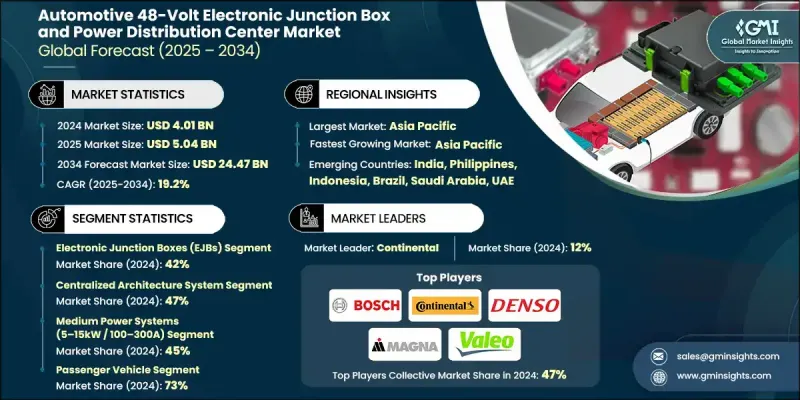

2024 年全球汽車 48 伏特電子接線盒和配電中心市值為 40.1 億美元,預計到 2034 年將以 19.2% 的複合年成長率成長至 244.7 億美元。

隨著汽車製造商不斷向車輛電氣化和高效電源管理轉型,這一市場正在不斷擴大。混合動力和輕混系統的日益普及推動了對48V架構的需求,有助於最大限度地減少排放、透過再生煞車最佳化能量回收,並為高功率車輛零件提供支援。先進電子系統和區域車輛設計的整合進一步提升了智慧配電模組的重要性,這些模組能夠進行即時監控、故障檢測和自適應能量控制。此外,網路安全和軟體定義車輛技術在這一市場中也變得至關重要。製造商和一級供應商正在引入先進的安全機制,例如加密資料通訊、安全啟動協定和持續的系統監控。這些創新可以保護電子元件免受未經授權的訪問,確保韌體更新的穩定性,並維持互連系統之間穩定的電力流。透過將複雜的軟體管理與基於硬體的安全功能相結合,汽車製造商正在確保電動車平台的高性能、高可靠性,並符合嚴格的排放和安全法規。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 40.1億美元 |

| 預測值 | 244.7億美元 |

| 複合年成長率 | 19.2% |

2024年,電子接線盒(EJB)市佔率達到42%,預計到2034年將以18.2%的複合年成長率成長。 EJB之所以佔據主導地位,是因為它們在管理下一代汽車複雜的電氣網路方面發揮著至關重要的作用。它們將各種配電功能整合到緊湊的模組中,取代了傳統的繼電器和熔斷器。 EJB還能實現精確的負載管理、即時診斷和最佳化能源利用,使其成為48V混合動力和輕度混合動力汽車架構不可或缺的組件。

2024年,集中式架構系統市佔率達到47%,預計2025年至2034年將以17.9%的複合年成長率成長。這種配置之所以仍佔據主導地位,是因為它集中了電源控制和分配,簡化了車輛電氣系統,同時降低了佈線複雜性。集中式配置還能提高運作可靠性,簡化製造程序,並提升多個電子元件的能源效率。

中國汽車48伏特電子接線盒及配電中心市場佔30%的市場佔有率,預計2024年市場規模將達到6.853億美元。在政府鼓勵低排放汽車、加速混合動力技術應用以及嚴格環保政策的推動下,中國市場正快速發展。不斷成長的城市化進程和消費者對節能汽車日益成長的需求也推動了48伏特系統的部署,該系統能夠有效管理電氣負載,並提升車輛性能和舒適性。

全球汽車48伏特電子接線盒和配電中心市場的主要參與者包括博世、安波福、大陸集團、電裝、比亞迪、伊頓、法雷奧、麥格納國際、古河電工和埃伯斯帕赫汽車電子。為了鞏固自身地位,汽車48伏特電子接線盒和配電中心產業的企業正在實施一系列策略性措施。這些措施包括擴大生產能力、與領先的汽車製造商建立長期合作關係,以及大力投資研發,以開發輕量化、軟體驅動和節能的系統。許多公司正致力於模組化設計,以支援靈活的車輛整合,並採用數位模擬工具進行產品測試和最佳化。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動和混合動力汽車產量激增

- 汽車電子技術的進步

- 擴大電動車充電基礎設施

- 低於 60VDC 門檻的監理合規優勢。

- 產業陷阱與挑戰

- 48伏特系統的初始成本較高

- 缺乏技術工人。

- 市場機遇

- 新興市場的成長

- 智慧配電系統的發展

- 與自動駕駛汽車技術的整合

- 合作與策略夥伴關係

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 系統架構演進(從12V到48V遷移)

- 配電拓撲結構和設計方法

- 與直流-直流轉換器系統的整合

- 新興技術

- 智慧電源管理和人工智慧整合

- 區域架構和軟體定義車輛

- 先進半導體技術(氮化鎵、碳化矽)

- 當前技術趨勢

- 價格趨勢

- 按地區

- 搭車

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 材料成本

- 製造成本

- 工程和開發成本

- 專利分析

- 專利申請趨勢和活動

- 主要專利持有人和技術領導者

- 創新熱點和技術集群

- 專利懸崖分析和智慧財產權到期時間表

- 研發投資模式與投資組合策略

- 未來市場趨勢與顛覆性因素

- 市場發展情境(2025-2030 年)

- 科技顛覆時間線

- 新興商業模式與價值主張

- 市場整合與併購趨勢

- 監管演變和政策影響

- 競爭格局轉變

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 採用全48伏特架構的高級乘用車

- 整合EPTO系統的商用車隊車輛

- 整合V2G技術的工業微電網

- 最佳情況

- 透過產業標準化加速全面採用 48V 架構

- 寬禁帶半導體成本與效能突破

- 監管加速與全球協調

- 生態系整合與平台融合

- 成長規劃與策略發展框架

- 市場進入策略框架

- 產品組合開發策略

- 地理擴張規劃框架

- 風險管理與情境規劃

- 策略實施路線圖

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 羅伯特博世有限公司

- 大陸集團

- 法雷奧

- 伊頓公司

- 安波福公司

- 電裝公司

- 麥格納國際

- 競爭地位矩陣。

- 戰略展望矩陣

- 關鍵進展。

- 併購

- 新產品發布

- 擴張計劃和資金

- 供應商選擇標準和決策因素

- 技術能力和性能規格

- 品質、可靠性和安全標準

- 成本結構與總擁有成本

- 製造和供應鏈能力

- 創新與技術領導力

- 監理合規與認證

- 服務和支援能力

- 合作與夥伴關係潛力

- 地理分佈與本地化

- 永續發展與環境責任

第5章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車輛(HCV)

- 搭乘用車

第6章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 電子接線盒(EJB)

- 智慧接線盒(附微控制器)

- 智慧接線盒(具備基本邏輯)

- 標準接線盒(被動式配電)

- 配電中心(PDC)

- 主配電中心

- 輔助配電中心

- 專業應用PDC

- 整合式電源管理單元

第7章:市場估算與預測:依系統架構分類,2021-2034年

- 主要趨勢

- 集中式架構系統

- 分散式架構系統

- 混合架構系統

第8章:市場估算與預測:依功率等級分類,2021-2034年

- 主要趨勢

- 低功率系統(1-5kW / 20-100A)

- 中功率系統(5-15kW / 100-300A)

- 高功率系統(15-30kW / 300-600A)

- 超高功率系統(>30kW / >600A)

第9章:市場估算與預測:依銷售管道分類,2021-2034年

- 主要趨勢

- 原始設備製造商

- 售後市場

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 印尼

- 菲律賓

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- Aptiv

- Continental

- Eaton

- Leoni

- Littelfuse

- Bosch

- 區域玩家

- Delphi Technologies

- Sumitomo Electric Industries

- Valeo

- Yazaki

- 新興參與者

- Denso

- Furukawa Electric

- HELLA

- Hyundai Mobis

- Magna International

- Sensata Technologies

- Legal and Traditional Providers

- BYD Company

- Eberspacher Automotive Electronics

- Ficosa International

- IntegreL Solutions

- KOSTAL

- Lear

- Marelli

- Redler Technologies

- Samvardhana

- UAES (United Automotive Electronic Systems)

The Global Automotive 48-Volt Electronic Junction Box and Power Distribution Center Market was valued at USD 4.01 Billion in 2024 and is estimated to grow at a CAGR of 19.2% to reach USD 24.47 Billion by 2034.

This market is expanding as automakers increasingly transition toward vehicle electrification and efficient power management. The growing popularity of hybrid and mild-hybrid systems is fueling demand for 48V architectures that help minimize emissions, optimize energy recovery through regenerative braking, and support high-power vehicle components. The integration of advanced electronic systems and zonal vehicle designs has further elevated the importance of intelligent power distribution modules capable of real-time monitoring, fault detection, and adaptive energy control. Additionally, cybersecurity and software-defined vehicle technologies are becoming crucial in this market. Manufacturers and Tier-1 suppliers are introducing advanced security mechanisms such as encrypted data communication, secure boot protocols, and ongoing system surveillance. These innovations protect electronic components from unauthorized access, ensure stable firmware updates, and maintain consistent power flow across interconnected systems. By combining sophisticated software management with hardware-based safety features, automakers are ensuring high performance, reliability, and compliance with stringent emission and safety regulations across electrified vehicle platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.01 Billion |

| Forecast Value | $24.47 Billion |

| CAGR | 19.2% |

The electronic junction boxes (EJBs) segment held a 42% share in 2024 and is projected to grow at a CAGR of 18.2% through 2034. EJBs dominate due to their essential function in managing complex electrical networks within next-generation vehicles. They integrate various power distribution functions into compact modules, replacing traditional relays and fuses. EJBs also enable precise load management, real-time diagnostics, and optimized energy usage, making them indispensable for 48V hybrid and mild-hybrid vehicle architectures.

The centralized architecture system segment held a 47% share in 2024 and is anticipated to grow at a CAGR of 17.9% from 2025 to 2034. This configuration remains dominant as it centralizes power control and distribution, streamlining vehicle electrical systems while reducing wiring complexity. Centralized setups also improve operational reliability, simplify manufacturing, and enhance energy efficiency across multiple electronic components.

China Automotive 48-Volt Electronic Junction Box and Power Distribution Center Market held a 30% share, generating USD 685.3 million in 2024. The market in China is evolving rapidly, supported by government incentives promoting low-emission vehicles, accelerating the adoption of hybrid technologies, and the enforcement of strict environmental policies. Growing urbanization and rising consumer demand for energy-efficient vehicles are also driving the deployment of 48V systems, which effectively manage electrical loads and support enhanced vehicle performance and comfort features.

Prominent players active in the Global Automotive 48-Volt Electronic Junction Box and Power Distribution Center Market include Bosch, Aptiv, Continental, Denso, BYD Company, Eaton, Valeo, Magna International, Furukawa Electric, and Eberspacher Automotive Electronics. To strengthen their position, companies in the Automotive 48-Volt Electronic Junction Box and Power Distribution Center Industry are implementing a mix of strategic initiatives. These include expanding manufacturing capabilities, forming long-term collaborations with leading automakers, and investing heavily in R&D to develop lightweight, software-driven, and energy-efficient systems. Many firms are focusing on modular designs to support flexible vehicle integration and adopting digital simulation tools for product testing and optimization.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 System Architecture

- 2.2.4 Vehicle

- 2.2.5 Power Rating

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in electric and hybrid vehicle production

- 3.2.1.2 Advancements in automotive electronics

- 3.2.1.3 Expansion of electric vehicle charging infrastructure

- 3.2.1.4 Regulatory compliance advantages below 60 VDC threshold.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost of 48v systems

- 3.2.2.2 Lack of skilled workforce.

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in emerging markets

- 3.2.3.2 Development of smart power distribution systems

- 3.2.3.3 Integration with autonomous vehicle technologies

- 3.2.3.4 Collaborations and strategic partnerships

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 Application growth ranking

- 3.3.2 Product segment growth comparison

- 3.3.3 Market maturity vs growth potential assessment

- 3.3.4 Competitive intensity and growth correlation

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 System architecture evolution (12v to 48v migration)

- 3.7.1.2 Power distribution topologies and design approaches

- 3.7.1.3 Integration with DC-DC converter systems

- 3.7.2 Emerging technologies

- 3.7.2.1 Intelligent power management and AI integration

- 3.7.2.2 Zonal architecture and software-defined vehicles

- 3.7.2.3 Advanced semiconductor technologies (GaN, SiC)

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By vehicle

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Material costs

- 3.10.2 Manufacturing costs

- 3.10.3 Engineering and development costs

- 3.11 Patent analysis

- 3.11.1 Patent filing trends and activity

- 3.11.2 Key patent holders and technology leaders

- 3.11.3 Innovation hotspots and technology clusters

- 3.11.4 Patent cliff analysis and ip expiration timeline

- 3.11.5 R&d investment patterns and portfolio strategies

- 3.12 Future market trends and disruptions

- 3.12.1 Market evolution scenarios (2025-2030)

- 3.12.2 Technology disruption timeline

- 3.12.3 Emerging business models and value propositions

- 3.12.4 Market consolidation and M&A trends

- 3.12.5 Regulatory evolution and policy impact

- 3.12.6 Competitive landscape transformation

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Use cases

- 3.14.1. Premium passenger vehicle with full 48 v architecture

- 3.14.2 Commercial fleet vehicle with epto integration

- 3.14.3. Industrial microgrid with V2 G integration

- 3.15 Best-case scenario

- 3.15.1. Accelerated full 48 v architecture adoption with industry standardization

- 3.15.2 Breakthrough in wide-bandgap semiconductor cost and performance

- 3.15.3 Regulatory acceleration and global harmonization

- 3.15.4 Ecosystem integration and platform convergence

- 3.16 Growth planning & strategic development framework

- 3.16.1 Market entry strategy framework

- 3.16.2 Product portfolio development strategy

- 3.16.3 Geographic expansion planning framework

- 3.16.4 Risk management and scenario planning

- 3.16.5 Strategic implementation roadmap

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive Analysis of Major Market Players

- 4.3.1. Robert Bosch GmbH

- 4.3.2. Continental AG

- 4.3.3. Valeo

- 4.3.4. Eaton Corporation plc

- 4.3.5. Aptiv PLC

- 4.3.6. Denso Corporation

- 4.3.7. Magna International

- 4.4 Competitive position matrix.

- 4.5 Strategic outlook matrix

- 4.6 Key developments.

- 4.6.1 mergers & acquisitions

- 4.6.2 New product launches

- 4.6.3 Expansion plans and funding

- 4.7 Vendor selection criteria & decision factors

- 4.7.1 Technical capabilities & performance specifications

- 4.7.2 Quality, reliability & safety standards

- 4.7.3 Cost structure & total cost of ownership

- 4.7.4 Manufacturing & supply chain capabilities

- 4.7.5 Innovation & technology leadership

- 4.7.6 Regulatory compliance & certification

- 4.7.7 Service & support capabilities

- 4.7.8 Partnership & collaboration potential

- 4.7.9 Geographic presence & localization

- 4.7.10 Sustainability & environmental responsibility

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.1.1 Passenger cars

- 5.1.1.1 Hatchbacks

- 5.1.1.2 Sedans

- 5.1.1.3 SUVs

- 5.1.2 Commercial vehicles

- 5.1.2.1 Light commercial vehicles (LCVs)

- 5.1.2.2 Medium commercial vehicles (MCVs)

- 5.1.2.3 Heavy commercial vehicles (HCVs)

- 5.1.1 Passenger cars

Chapter 6 Market Estimates & Forecast, By Product, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Electronic Junction Boxes (EJBs)

- 6.2.1 Intelligent Junction Boxes (with microcontrollers)

- 6.2.2 Smart Junction Boxes (with basic logic)

- 6.2.3 Standard Junction Boxes (passive distribution)

- 6.3 Power Distribution Centers (PDCs)

- 6.3.1 Main Power Distribution Centers

- 6.3.2 Auxiliary Power Distribution Centers

- 6.3.3 Specialized Application PDCs

- 6.4 Integrated Power Management Units

Chapter 7 Market Estimates & Forecast, By System Architecture, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Centralized architecture system

- 7.3 Distributed architecture system

- 7.4 Hybrid architecture system

Chapter 8 Market Estimates & Forecast, By Power Rating, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Low Power Systems (1-5kW / 20-100A)

- 8.3 Medium Power Systems (5-15kW / 100-300A)

- 8.4 High Power Systems (15-30kW / 300-600A)

- 8.5 Ultra-High-Power Systems (>30kW / >600A)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Indonesia

- 10.4.8 Philippines

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aptiv

- 11.1.2 Continental

- 11.1.3 Eaton

- 11.1.4 Leoni

- 11.1.5 Littelfuse

- 11.1.6 Bosch

- 11.2 Regional Players

- 11.2.1 Delphi Technologies

- 11.2.2 Sumitomo Electric Industries

- 11.2.3 Valeo

- 11.2.4 Yazaki

- 11.3 Emerging Players

- 11.3.1 Denso

- 11.3.2 Furukawa Electric

- 11.3.3 HELLA

- 11.3.4 Hyundai Mobis

- 11.3.5 Magna International

- 11.3.6 Sensata Technologies

- 11.4 Legal and Traditional Providers

- 11.4.1 BYD Company

- 11.4.2 Eberspacher Automotive Electronics

- 11.4.3 Ficosa International

- 11.4.4 IntegreL Solutions

- 11.4.5 KOSTAL

- 11.4.6 Lear

- 11.4.7 Marelli

- 11.4.8 Redler Technologies

- 11.4.9 Samvardhana

- 11.4.10 UAES (United Automotive Electronic Systems)