|

市場調查報告書

商品編碼

1871197

智慧逆變器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Smart Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

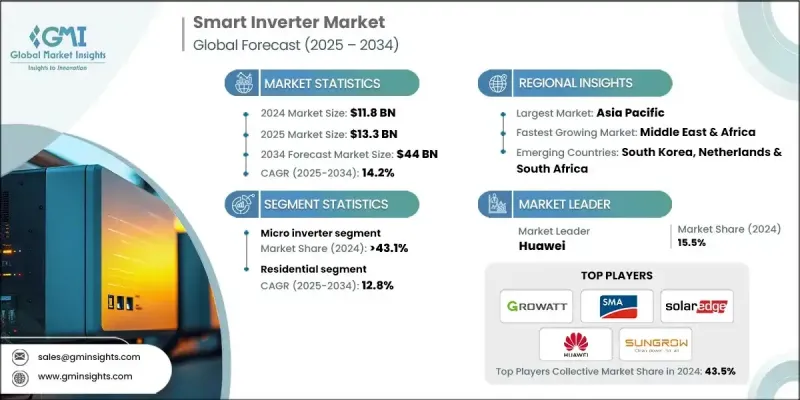

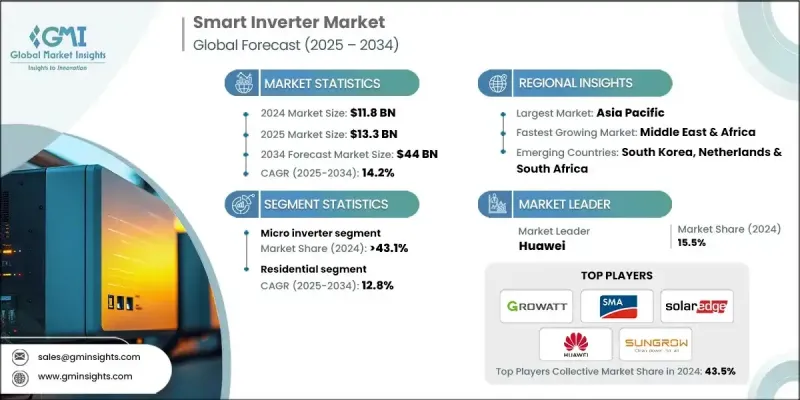

2024年全球智慧逆變器市場規模為118億美元,預計到2034年將以14.2%的複合年成長率成長至440億美元。

電網現代化投資的不斷增加推動了智慧逆變器的廣泛應用,因為它們透過電壓控制、無功功率管理和頻率調節等先進功能增強了電網穩定性。太陽能快速併入現有電網進一步刺激了產品需求,因為傳統逆變器缺乏有效穩定電網所需的動態通訊能力。智慧逆變器能夠與電網系統互動並適應電網波動,在最大限度減少電壓波動和增強電網在高峰需求或中斷期間的可靠性方面發揮著至關重要的作用。這些先進的功率轉換設備不僅可以將直流電轉換為交流電,還可以與電網進行智慧交互,從而提高能源系統的效率、合規性和性能。對電網韌性的日益重視,以及太陽能系統裝機量的不斷成長,持續塑造全球市場格局。新興企業正專注於儲能功能的創新和整合,使用戶能夠儲存多餘的太陽能電力以供後續使用,從而促進能源獨立並提高系統可靠性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 118億美元 |

| 預測值 | 440億美元 |

| 複合年成長率 | 14.2% |

微型逆變器在2024年佔據了43.1%的市場佔有率,預計到2034年將以13%的複合年成長率成長。對能夠提供更高發電效率和更穩定性能的系統日益成長的需求,顯著推動了微型逆變器的普及。這些設備能夠實現模組級功率最佳化,即使在部分遮陰或環境變化的情況下也能確保最大能量輸出。它們能夠在面板上直接進行直流到交流的轉換,無需高壓直流佈線,從而降低了電氣風險,並提高了安裝安全性。這一特性對於安全性和空間利用率至關重要的小型和機構應用尤為有利。

預計到2034年,商業和工業領域的複合年成長率將達到15.2%,這主要得益於市場對具成本效益能源管理解決方案和營運成本節約日益成長的需求。政府為太陽能部署提供大量財政激勵措施,從而加速了市場成長,縮短了專案投資回收期。全球企業永續發展目標和不斷變化的環境法規正促使各組織向再生能源併網轉型,而智慧逆變器在實現能源效率和碳減排目標方面發揮關鍵作用。持續推動清潔能源生產和最佳化電網連接,也推動了智慧逆變器在各種應用領域的普及。

2024年,美國智慧逆變器市佔率高達91.5%,預計到2034年將達到24億美元。美國市場擴張的驅動力主要來自那些面臨頻繁停電和高電價的地區,這些地區正大力推廣太陽能+儲能系統。智慧逆變器對於管理太陽能板、蓄電池和電網之間的能量流動至關重要,能夠確保無縫同步和運作可靠性。隨著極端天氣事件的增加和電力基礎設施的老化,人們對能源安全和韌性的日益重視促使人們更多地部署先進的混合逆變器系統,這些系統能夠實現高效的能源管理,並在停電期間提供不間斷的電力供應。

全球智慧逆變器市場的主要參與者包括華為、SMA Solar Technology、Growatt、Solis、SolarEdge、Luminous、Eastman Auto & Power Ltd、陽光電源、Vsole Solar Private Limited、EnerTech UPS、Unique Sun Power PVT.、Ushva Clean Technology Pvt. Ltd、MaxVolt Energy 和 Sertech System Limited System System。智慧逆變器市場的關鍵企業正在採取各種策略來鞏固其市場地位並擴大全球業務範圍。各公司正大力投資產品創新,專注於先進的能源管理功能和增強的連接性,以滿足不斷變化的電網需求。策略聯盟和合作夥伴關係使製造商能夠提升其技術專長並拓展產品線。各公司也正在增加研發投入,以開發整合智慧監控和基於人工智慧的診斷工具的緊湊、高效且經濟的逆變器型號。

目錄

第1章:方法論與範圍

第2章:行業洞察

- 產業概況,2021-2034年

- 商業趨勢

- 產品趨勢

- 應用趨勢

- 溝通趨勢

- 區域趨勢

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 成本結構分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依產品分類,2021-2034年

- 主要趨勢

- 細繩

- 微

- 中央

- 混合

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 住宅

- 商業和工業

- 公用事業

第7章:市場規模及預測:依通訊方式分類,2021-2034年

- 主要趨勢

- 有線

- 無線的

- 雲端/物聯網賦能

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 荷蘭

- 英國

- 法國

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第9章:公司簡介

- Eastman Auto & Power Ltd

- Enertechups

- Growatt

- Huawei

- Luminous

- MaxVolt Energy

- Servotech Renewable Power System Limited

- SMA Solar Technology

- Solar Edge

- Solis

- Sungrow

- Unique Sun Power PVT.

- Ushva Clean Technology Pvt. Ltd

- Vsole Solar Private Limited

The Global Smart Inverter Market was USD 11.8 Billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 44 Billion by 2034.

Increasing investments in grid modernization are driving the widespread adoption of smart inverters as they enhance grid stability through advanced functions such as voltage control, reactive power management, and frequency regulation. The rapid integration of solar energy into existing power networks is further boosting product demand, as conventional inverters lack the dynamic communication capabilities required to stabilize grids efficiently. Smart inverters, with their ability to interact with utility systems and adjust to fluctuating grid conditions, play a vital role in minimizing voltage fluctuations and strengthening grid reliability during high demand or disruptions. These advanced power conversion devices not only convert DC to AC but also offer intelligent interaction with the grid, improving energy system efficiency, compliance, and performance. Rising focus on grid resilience, coupled with increasing installations of solar energy systems, continues to shape the global market landscape. Emerging players are emphasizing innovation and integration of storage capabilities, allowing users to store surplus solar power for later use, thereby promoting energy independence and improving system reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.8 Billion |

| Forecast Value | $44 Billion |

| CAGR | 14.2% |

The micro inverter segment held 43.1% share in 2024 and is projected to grow at a CAGR of 13% through 2034. The growing need for systems that deliver superior power generation efficiency and consistent performance is significantly influencing micro inverter adoption. These devices enable module-level power optimization, ensuring maximum energy output even under partial shading or varying conditions. Their capability to perform DC-to-AC conversion directly at the panel eliminates the requirement for high-voltage DC wiring, reducing electrical hazards and enhancing installation safety. This feature is particularly beneficial for small-scale and institutional installations where safety and space optimization are top priorities.

The commercial and industrial segment is forecasted to grow at a CAGR of 15.2% through 2034, driven by the increasing demand for cost-effective energy management solutions and operational savings. Supportive government initiatives offering substantial financial incentives for solar deployment are accelerating market growth by reducing project payback periods. Global corporate sustainability goals and evolving environmental regulations are compelling organizations to transition toward renewable energy integration, with smart inverters playing a critical role in achieving energy efficiency and carbon reduction targets. The ongoing push toward cleaner power generation and optimized grid connectivity continues to propel smart inverter adoption across diverse applications.

United States Smart Inverter Market held a 91.5% share in 2024 and is expected to reach USD 2.4 Billion by 2034. Market expansion in the country is fueled by a surge in solar-plus-storage installations across regions facing frequent power interruptions and high electricity costs. Smart inverters are essential for managing the flow of energy between solar panels, batteries, and the grid, ensuring seamless synchronization and operational reliability. The growing emphasis on energy security and resilience amid rising instances of extreme weather and an aging power infrastructure has led to increased deployment of advanced hybrid inverter systems that enable efficient energy management and uninterrupted power supply during outages.

Leading participants in the Global Smart Inverter Market include Huawei, SMA Solar Technology, Growatt, Solis, Solar Edge, Luminous, Eastman Auto & Power Ltd, Sungrow, Vsole Solar Private Limited, EnerTech UPS, Unique Sun Power PVT., Ushva Clean Technology Pvt. Ltd, MaxVolt Energy, and Servotech Renewable Power System Limited. Key companies in the Smart Inverter Market are adopting various strategies to strengthen their market position and expand global reach. Firms are heavily investing in product innovation, focusing on advanced energy management capabilities and improved connectivity to support evolving grid requirements. Strategic alliances and partnerships are enabling manufacturers to enhance their technological expertise and broaden product offerings. Companies are also increasing their R&D expenditure to develop compact, efficient, and cost-effective inverter models integrated with smart monitoring and AI-based diagnostic tools.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Application trends

- 2.5 Communication trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

- 5.5 Hybrid

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & industrial

- 6.4 Utility

Chapter 7 Market Size and Forecast, By Communication, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

- 7.4 Cloud/IoT enabled

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Netherlands

- 8.3.3 UK

- 8.3.4 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

Chapter 9 Company Profiles

- 9.1 Eastman Auto & Power Ltd

- 9.2 Enertechups

- 9.3 Growatt

- 9.4 Huawei

- 9.5 Luminous

- 9.6 MaxVolt Energy

- 9.7 Servotech Renewable Power System Limited

- 9.8 SMA Solar Technology

- 9.9 Solar Edge

- 9.10 Solis

- 9.11 Sungrow

- 9.12 Unique Sun Power PVT.

- 9.13 Ushva Clean Technology Pvt. Ltd

- 9.14 Vsole Solar Private Limited