|

市場調查報告書

商品編碼

1801953

住宅太陽能光電逆變器市場機會、成長動力、產業趨勢分析及2025-2034年預測Residential Solar PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

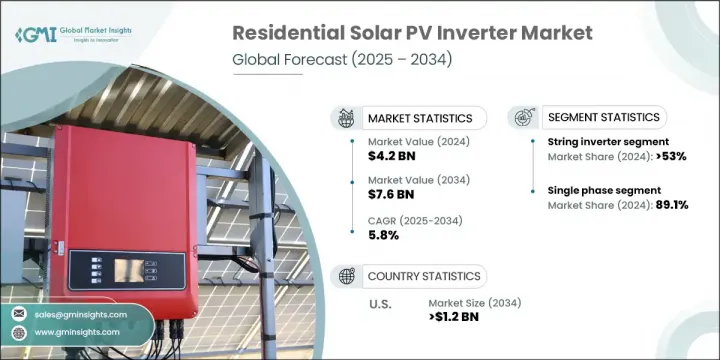

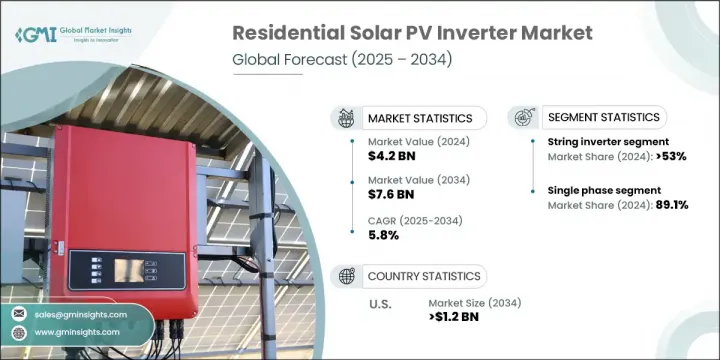

2024年,全球住宅太陽能光電逆變器市場規模達42億美元,預計年複合成長率將達5.8%,2034年將達76億美元。太陽能光電模組及相關技術價格的下降,以及政府透過補貼、回饋和稅收優惠等方式提供的財政支持,推動了太陽能應用的穩定成長。與傳統電網相關的公用事業成本不斷上漲,促使屋主探索替代能源,從而推高了對太陽能系統及光伏逆變器等配套產品的需求。

這些逆變器在將太陽能板的直流電轉換為住宅電網使用的交流電方面發揮關鍵作用,同時也提供必要的安全性和監控功能。推廣清潔能源的監管框架以及展示長期節能效益的宣傳活動,進一步鼓勵了住宅安裝逆變器。產業領導者擴大採用尖端逆變器技術,以滿足追求永續發展和能源獨立的家庭日益成長的能源需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 76億美元 |

| 複合年成長率 | 5.8% |

微型逆變器市場預計在2034年實現6%的複合年成長率,這得益於其面板級最佳化,即使在部分遮光的環境下也能確保更高的性能。簡化的安裝、低壓設計和可擴展的架構使微型逆變器成為中小型住宅的理想選擇,從而推動其更廣泛的市場應用。

單相逆變器在2024年佔了89.1%的市場佔有率,預計到2034年將以5.6%的複合年成長率成長。這些設備因其緊湊的設計、易於安裝以及與普通住宅用電需求的兼容性而廣受青睞。它們與儲能系統和智慧能源平台的整合也滿足了那些希望減少水電費並最大程度減少碳足跡的家庭日益成長的需求。隨著太陽能+儲能解決方案的普及,對能夠在現代智慧家庭中無縫運行的單相逆變器的需求持續成長。

2024年,美國住宅太陽能光電逆變器市場佔99.3%的市場佔有率,預計2034年將達到12億美元。美國強勁的發展勢頭得益於再生能源強制令、稅收優惠、淨計量計劃以及公用事業級補貼等優惠政策。這些措施正在鼓勵大規模安裝住宅太陽能系統。主要市場參與者對先進產品開發的投入,進一步支持了美國家庭向再生能源解決方案轉型的長期成長。

住宅太陽能光電逆變器市場的知名公司包括陽光電源、Solar Edge Technologies, Inc.、西門子、施耐德電氣、松下公司、INVERGY、華為技術有限公司、日立 Hi-Rel 電力電子私人有限公司、固德威、Goldi Solar、錦浪科技、通用電氣、Fronius International GmbH、Fimer Group、伊頓電角、Enphase 電圖、通用電氣公司。領先的企業正在透過推動產品創新來鞏固其市場地位,專注於與儲存和物聯網應用相容的緊湊、高效和智慧逆變器。企業正在積極投資研發,以增強安全功能、整合基於人工智慧的監控並提高每塊面板的能量產量。與電池製造商和智慧家庭平台的合作正在創造符合不斷變化的住宅能源需求的增值產品。企業也透過區域製造部門、分銷合作夥伴關係和數位銷售網路擴大其地理覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:行業洞察

- 2021 - 2034 年產業概要

- 商業趨勢

- 產品趨勢

- 階段趨勢

- 區域趨勢

第3章:行業洞察

- 產業生態系統分析

- 原料和零件供應商

- 逆變器製造商

- EPC和系統整合商

- 專案開發商和獨立發電廠

- 2021-2034年價格趨勢分析

- 按產品

- 按地區

- 成本結構分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 細繩

- 微

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 波蘭

- 荷蘭

- 奧地利

- 英國

- 法國

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

第8章:公司簡介

- Canadian Solar

- Darfon Electronics Corp.

- Delta Electronics, Inc.

- Enphase Energy

- Eaton

- Fimer Group

- Fronius International GmbH

- General Electric

- Ginlong Technologies

- Goldi Solar

- GoodWe

- Hitachi Hi-Rel Power Electronics Private Limited

- Huawei Technologies Co., Ltd.

- INVERGY

- Panasonic Corporation

- Schneider Electric

- Siemens

- SMA Solar Technology AG

- Servotech Power Systems

- Solar Edge Technologies, Inc.

- Sungrow

The Global Residential Solar PV Inverter Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 7.6 billion by 2034. A steady rise in solar energy adoption is being fueled by declining prices of panels and associated technologies, along with increasing availability of financial support through grants, rebates, and tax incentives. Escalating utility costs tied to conventional power grids are motivating homeowners to explore energy alternatives, pushing up demand for solar-powered systems and supporting products like PV inverters.

These inverters play a critical role in converting direct current from solar panels into alternating current used by residential electrical grids, while also providing essential safety and monitoring features. Regulatory frameworks promoting cleaner energy and awareness campaigns that showcase long-term savings are further encouraging residential installations. Industry leaders are increasingly adopting cutting-edge inverter technologies to meet the growing energy demands of households aiming for sustainability and energy independence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 5.8% |

The micro inverter segment is poised for a CAGR of 6% through 2034, driven by its panel-level optimization, which ensures enhanced performance even in partially shaded installations. The simplified installation, low-voltage design, and scalable architecture make micro inverters ideal for small and mid-size homes, promoting wider market adoption.

The single-phase inverters captured 89.1% share in 2024 and is projected to grow at a CAGR of 5.6% through 2034. These units are widely favored due to their compact design, ease of installation, and compatibility with average residential power demands. Their integration with energy storage systems and intelligent energy platforms also supports growing interest from households looking to reduce utility bills and minimize their carbon footprint. As solar-plus-storage solutions gain traction, the demand for single-phase inverters that seamlessly operate within modern smart homes continues to rise.

United States Residential Solar PV Inverter Market held a 99.3% share in 2024 and is anticipated to reach USD 1.2 billion by 2034. The country's strong momentum is driven by favorable policies such as renewable energy mandates, tax incentives, net metering programs, and utility-level rebate offerings. These measures are encouraging the installation of residential solar systems at scale. The presence of major market players investing in advanced product development further supports long-term growth across US households transitioning toward renewable power solutions.

Prominent companies operating in the Residential Solar PV Inverter Market include Sungrow, Solar Edge Technologies, Inc., Siemens, Schneider Electric, Panasonic Corporation, INVERGY, Huawei Technologies Co., Ltd., Hitachi Hi-Rel Power Electronics Private Limited, GoodWe, Goldi Solar, Ginlong Technologies, General Electric, Fronius International GmbH, Fimer Group, Eaton, Enphase Energy, Delta Electronics, Inc., Darfon Electronics Corp., Canadian Solar, and Servotech Power Systems. Leading players are strengthening their market foothold by advancing product innovation, focusing on compact, high-efficiency, and smart inverters compatible with storage and IoT applications. Firms are actively investing in R&D to enhance safety features, integrate AI-based monitoring, and increase energy yield per panel. Collaborations with battery manufacturers and smart home platforms are creating value-added offerings that align with evolving residential energy needs. Companies are also expanding their geographic footprint through regional manufacturing units, distribution partnerships, and digital sales networks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Phase trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw materials & component suppliers

- 3.1.2 Inverter manufacturers

- 3.1.3 EPC & system integrators

- 3.1.4 Project developers & IPPs

- 3.2 Price trend analysis, 2021-2034

- 3.2.1 By product

- 3.2.2 By region

- 3.3 Cost structure analysis

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Canadian Solar

- 8.2 Darfon Electronics Corp.

- 8.3 Delta Electronics, Inc.

- 8.4 Enphase Energy

- 8.5 Eaton

- 8.6 Fimer Group

- 8.7 Fronius International GmbH

- 8.8 General Electric

- 8.9 Ginlong Technologies

- 8.10 Goldi Solar

- 8.11 GoodWe

- 8.12 Hitachi Hi-Rel Power Electronics Private Limited

- 8.13 Huawei Technologies Co., Ltd.

- 8.14 INVERGY

- 8.15 Panasonic Corporation

- 8.16 Schneider Electric

- 8.17 Siemens

- 8.18 SMA Solar Technology AG

- 8.19 Servotech Power Systems

- 8.20 Solar Edge Technologies, Inc.

- 8.21 Sungrow