|

市場調查報告書

商品編碼

1871192

氫燃料電池汽車冷卻系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Hydrogen Fuel Cell Vehicle Cooling System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

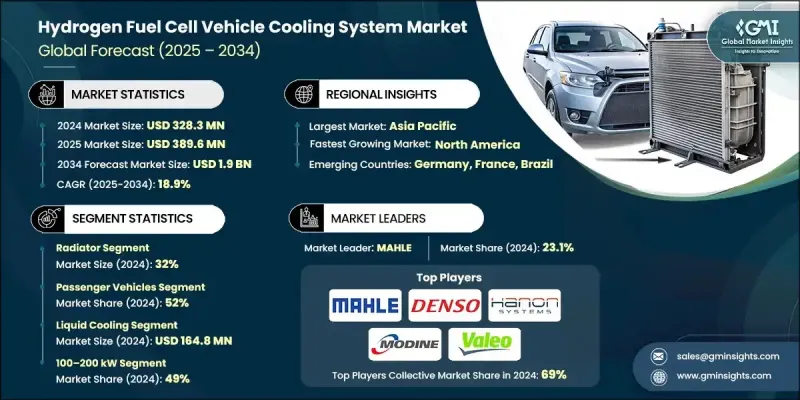

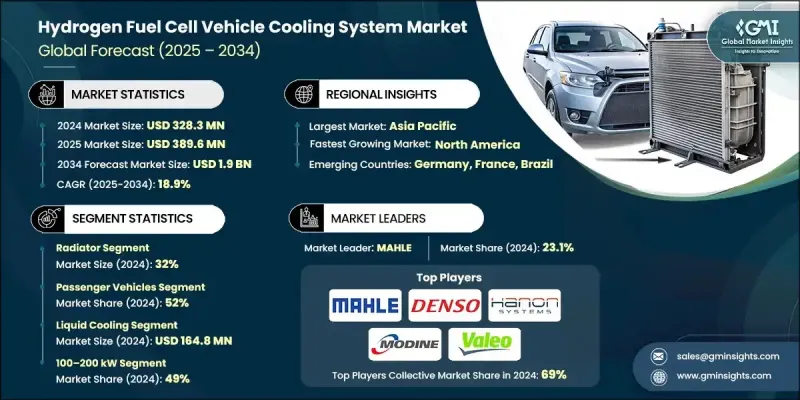

2024 年全球氫燃料電池汽車冷卻系統市值為 3.283 億美元,預計到 2034 年將以 18.9% 的複合年成長率成長至 19 億美元。

氫燃料電池汽車的日益普及、對永續交通的日益關注以及對能夠提升性能和耐久性的高效熱管理系統的需求不斷成長,共同推動了氫燃料電池市場的顯著擴張。冷卻技術、材料和系統設計的持續進步也為市場發展提供了支持,使製造商能夠生產出穩健、可擴展且節能的解決方案。這些創新對於維持氫動力汽車的熱平衡、提高整體可靠性以及確保符合全球安全和排放法規至關重要。隨著商用車隊的電氣化和氫能交通基礎設施的快速發展,對高效能冷卻系統的需求持續成長。汽車製造商和零件供應商正著力研發人工智慧驅動的輕量化熱管理技術,以打造面向未來交通生態系統的、兼具永續性、高效能和高性能的下一代燃料電池車。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.283億美元 |

| 預測值 | 19億美元 |

| 複合年成長率 | 18.9% |

氫燃料電池汽車的冷卻系統,包括散熱器、熱交換器、冷卻液泵、電子控制單元和導熱界面材料,在維持電力電子元件、電池和燃料電池的理想工作溫度方面發揮著至關重要的作用。高效率的熱管理不僅能確保穩定的功率輸出和延長零件壽命,還能最大限度地降低過熱和機械性能下降的風險。市場的快速成長與技術進步、日益嚴格的環境法規以及向零排放交通解決方案加速轉型密切相關。

2024年,散熱器市佔率佔比達32%,預計2025年至2034年間將以20.1%的複合年成長率成長。此細分市場佔據主導地位,是因為其在穩定關鍵車輛系統溫度、確保能量平穩流動和實現最佳性能方面發揮著至關重要的作用。領先的原始設備製造商 (OEM) 和一級供應商已廣泛採用散熱器,用於商用和乘用氫燃料電池汽車。採用混合式和液冷技術的先進散熱器設計具有卓越的散熱性能、更高的運行可靠性和更長的車輛使用壽命,使其成為氫能出行領域的首選。

2024年,乘用車市佔率達到52%,預計到2034年將以18.4%的複合年成長率成長。此細分市場的主導地位歸功於全球對高效能、低排放汽車日益成長的需求,以及先進冷卻架構在氫動力乘用車中的應用。這些系統最佳化了電池和燃料電池的性能,從而提高了可靠性、安全性和車輛耐用性。消費者對環保汽車的需求以及政府主導的永續發展政策,持續推動該細分市場的強勁成長。

中國氫燃料電池汽車冷卻系統市場佔41%的佔有率,市場規模達9,970萬美元。中國在該領域的領先地位得益於氫動力車隊的快速普及以及旨在推動清潔出行解決方案的強力政策激勵。亞太地區龐大的汽車製造基地以及對下一代汽車技術不斷成長的投資進一步鞏固了其市場主導地位。亞太地區仍然是氫燃料汽車發展的關鍵中心,這得益於其大規模的生產能力、不斷擴展的基礎設施以及先進冷卻系統在商用和乘用車隊中的廣泛應用。

全球氫燃料電池汽車冷卻系統市場的主要參與者包括博世、寶馬、電裝、韓昂系統、現代汽車、大陸集團、馬勒、莫迪恩、豐田汽車和法雷奧。為了鞏固市場地位,領先的製造商正積極推行一系列策略性舉措,並專注於創新、合作和產能擴張。各公司正大力投資研發,以推動熱管理材料的研發,提高冷卻效率,並改善氫動力汽車的系統整合。他們正與汽車原始設備製造商 (OEM) 和技術開發商建立合作關係,以加速產品開發並最佳化系統相容性。許多企業強調輕量化材料和數位化熱控制解決方案,以滿足能源效率標準和永續發展目標。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 氫燃料電池汽車的普及率不斷提高

- 冷卻系統的技術進步

- 嚴格的監管要求

- 車隊電氣化和商用車部署

- 產業陷阱與挑戰

- 高昂的系統成本

- 基礎設施和供應鏈有限

- 市場機遇

- 與連網汽車技術的整合

- 拓展至商業和重型應用領域

- 燃料電池汽車的日益普及

- 熱管理技術進步

- 成長促進因素

- 成長潛力分析

- 監管環境

- 國際標準框架

- 區域監理框架

- 安全與性能標準

- 認證和測試協議

- 未來監理演變

- 政府補貼和激勵措施對技術採納的影響

- 各地區的氫燃料補貼和稅收抵免

- 基礎設施投資和部署激勵措施

- 對冷卻系統規格及研發的影響

- 透過激勵措施加速產量成長

- 供應商選擇標準受政策影響

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術評估

- 技術準備度評估

- 創新生態系分析

- 專利格局與智慧財產權

- 未來創新路線圖

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 保護關鍵冷卻技術的關鍵專利

- 專利到期路線圖與研發機會

- 市場空白識別與創新差距

- 許可和交叉許可安排

- 新興專利持有者和顛覆性技術

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 風險評估框架

- 最佳情況

- 氫燃料電池系統熱行為與產熱曲線

- 不同運轉條件下的熱量產生

- 熱循環效應

- 系統回應時間和效率指標

- 與電池熱管理系統整合

- 雙熱負載管理

- 混合燃料電池-電池架構

- 跨系統熱交換策略

- 控制整合與最佳化

- 冷啟動和極端氣候性能

- 耐久性測試標準與驗證規程

- 製造製程創新與生產規模化

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 散熱器

- 冷卻液幫浦

- 熱交換器

- 散熱風扇

- 閥門和感測器

- 其他

第6章:市場估算與預測:依冷凍技術分類,2021-2034年

- 主要趨勢

- 液冷

- 混合冷卻

- 空氣冷卻

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- SUV

- 轎車

- 掀背車

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

- 特種車輛

第8章:市場估計與預測:依發電量分類,2021-2034年

- 主要趨勢

- 100-200千瓦

- 低於100千瓦

- 200度以上

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 私人交通

- 大眾運輸

- 工業的

- 軍事與國防

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第11章:公司簡介

- 全球參與者

- BMW

- Daimler

- Ford Motor

- General Motors

- Honda Motor

- Hyundai Motor

- Mercedes-Benz

- Stellantis

- Toyota Motor

- Volvo

- 區域玩家

- Aisin

- Bosch

- Continental

- Cummins

- Denso

- Hanon Systems

- MAHLE

- Modine

- Plug Power

- Valeo

- 新興玩家

- Eberspacher

- Hanon Systems

- Sanden

- Scania

- Webasto

The Global Hydrogen Fuel Cell Vehicle Cooling System Market was valued at USD 328.3 million in 2024 and is estimated to grow at a CAGR of 18.9% to reach USD 1.9 Billion by 2034.

The significant expansion is fueled by the growing adoption of hydrogen fuel cell vehicles, the rising focus on sustainable transportation, and the increasing need for high-efficiency thermal management systems that boost performance and durability. The market's development is being supported by continuous advancements in cooling technologies, materials, and system designs, enabling manufacturers to produce robust, scalable, and energy-efficient solutions. These innovations are essential for maintaining the thermal balance of hydrogen-powered vehicles, improving overall reliability, and ensuring compliance with global safety and emission regulations. The demand for effective cooling systems continues to rise alongside the electrification of commercial fleets and the rapid evolution of hydrogen mobility infrastructure. Automakers and component suppliers are emphasizing AI-driven and lightweight thermal management technologies to deliver next-generation fuel cell vehicles designed for sustainability, efficiency, and performance in future transportation ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $328.3 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 18.9% |

Hydrogen fuel cell vehicle cooling systems, which include radiators, heat exchangers, coolant pumps, electronic control units, and thermal interface materials, play a crucial role in maintaining the ideal operating temperature of power electronics, batteries, and fuel cells. Efficient thermal management not only ensures steady power delivery and component longevity but also minimizes the risk of overheating and mechanical degradation. The market's rapid growth is closely linked to technological advancements, stricter environmental mandates, and the accelerating transition toward zero-emission transportation solutions.

The radiator segment accounted for a 32% share in 2024 and is projected to grow at a CAGR of 20.1% between 2025 and 2034. This segment dominates due to its vital role in stabilizing the temperature of key vehicle systems, ensuring smooth energy flow, and optimal performance. Radiators are widely adopted by leading OEMs and Tier-1 suppliers for both commercial and passenger hydrogen fuel cell vehicles. Advanced radiator designs featuring hybrid and liquid-cooled technologies offer superior heat dissipation, increased operational reliability, and improved vehicle longevity, making them the preferred choice in the hydrogen mobility landscape.

The passenger vehicle segment held a 52% share in 2024 and is expected to grow at a CAGR of 18.4% through 2034. This segment's dominance is attributed to rising global interest in efficient, low-emission vehicles and the integration of advanced cooling architectures into hydrogen-powered passenger cars. These systems optimize the performance of batteries and fuel cells, providing greater reliability, enhanced safety, and improved vehicle durability. The combination of consumer demand for environmentally responsible vehicles and government-driven sustainability policies continues to support strong growth in this category.

China Hydrogen Fuel Cell Vehicle Cooling System Market held a 41% share, generating USD 99.7 million. The country's leadership is driven by the rapid adoption of hydrogen-powered fleets and strong policy incentives that promote cleaner mobility solutions. The region's vast automotive manufacturing base and growing investments in next-generation vehicle technologies further strengthen its dominance. Asia Pacific remains a key hub for hydrogen vehicle development, supported by large-scale production capabilities, infrastructure expansion, and widespread deployment of advanced cooling systems across both commercial and passenger fleets.

Major companies operating in the Global Hydrogen Fuel Cell Vehicle Cooling System Market include Bosch, BMW, Denso, Hanon Systems, Hyundai Motor, Continental, MAHLE, Modine, Toyota Motor, and Valeo. To reinforce their market position, leading manufacturers are pursuing a combination of strategic initiatives focused on innovation, collaboration, and capacity expansion. Companies are investing heavily in research and development to advance thermal management materials, enhance cooling efficiency, and improve system integration for hydrogen-powered vehicles. Partnerships with automotive OEMs and technology developers are being established to accelerate product development and optimize system compatibility. Many players emphasize lightweight materials and digital thermal control solutions to meet efficiency standards and sustainability targets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Cooling technology

- 2.2.4 Vehicle

- 2.2.5 Power output

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of hydrogen fuel cell vehicles

- 3.2.1.2 Technological advancements in cooling systems

- 3.2.1.3 Stringent regulatory mandates

- 3.2.1.4 Fleet electrification and commercial vehicle deployment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system costs

- 3.2.2.2 Limited infrastructure and supply chain

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with connected vehicle technologies

- 3.2.3.2 Expansion into commercial and heavy-duty applications

- 3.2.3.3 Growing adoption of fuel cell vehicles

- 3.2.3.4 Technological advancements in thermal management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 International standards framework

- 3.4.2 Regional regulatory frameworks

- 3.4.3 Safety & performance standards

- 3.4.4 Certification & testing protocols

- 3.4.5 Future regulatory evolution

- 3.4.6 Government subsidies and incentive impact on technology adoption

- 3.4.6.1 Hydrogen fuel subsidies and tax credits by region

- 3.4.6.2 Infrastructure investment and deployment incentives

- 3.4.6.3 Impact on cooling system specifications and R&D

- 3.4.6.4 Production volume acceleration from incentives

- 3.4.6.5 Supplier selection criteria influenced by policy

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technology assessment

- 3.7.2 Technology readiness assessment

- 3.7.3 Innovation ecosystem analysis

- 3.7.4 Patent landscape & intellectual property

- 3.7.5 Future innovation roadmap

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.11.1 Critical patents protecting key cooling technologies

- 3.11.2 Patent expiration roadmap and R&D opportunities

- 3.11.3 White space identification and innovation gaps

- 3.11.4 Licensing and cross-licensing arrangements

- 3.11.5 Emerging patent holders and disruptive technologies

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk assessment framework

- 3.14 Best case scenarios

- 3.15 Hydrogen fuel cell system thermal behavior and heat generation profiles

- 3.15.1 Heat generation at different operating conditions

- 3.15.2 Thermal cycling effects

- 3.15.3 System response times and efficiency metrics

- 3.16 Integration with battery thermal management systems

- 3.16.1 Dual thermal load management

- 3.16.2 Hybrid fuel cell-battery architectures

- 3.16.3 Cross-system heat exchange strategies

- 3.16.4 Control integration and optimization

- 3.17 Cold start and extreme climate performance

- 3.18 Durability testing standards and validation protocols

- 3.19 Manufacturing process innovations and production scalability

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Radiator

- 5.3 Coolant pump

- 5.4 Heat exchanger

- 5.5 Cooling fans

- 5.6 Valves and sensors

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Cooling Technology, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Liquid cooling

- 6.3 Hybrid cooling

- 6.4 Air cooling

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

- 7.4 Specialized Vehicles

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 100-200 kW

- 8.3 Below 100 kW

- 8.4 Above 200 kW

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Private transportation

- 9.3 Public transportation

- 9.4 Industrial

- 9.5 Military & defense

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 Key trends

- 10.3 North America

- 10.3.1 US

- 10.3.2 Canada

- 10.4 Europe

- 10.4.1 UK

- 10.4.2 Germany

- 10.4.3 France

- 10.4.4 Italy

- 10.4.5 Spain

- 10.4.6 Belgium

- 10.4.7 Netherlands

- 10.4.8 Sweden

- 10.5 Asia Pacific

- 10.5.1 China

- 10.5.2 India

- 10.5.3 Japan

- 10.5.4 Australia

- 10.5.5 Singapore

- 10.5.6 South Korea

- 10.5.7 Vietnam

- 10.5.8 Indonesia

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Mexico

- 10.6.3 Argentina

- 10.7 MEA

- 10.7.1 UAE

- 10.7.2 South Africa

- 10.7.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 BMW

- 11.1.2 Daimler

- 11.1.3 Ford Motor

- 11.1.4 General Motors

- 11.1.5 Honda Motor

- 11.1.6 Hyundai Motor

- 11.1.7 Mercedes-Benz

- 11.1.8 Stellantis

- 11.1.9 Toyota Motor

- 11.1.10 Volvo

- 11.2 Regional players

- 11.2.1 Aisin

- 11.2.2 Bosch

- 11.2.3 Continental

- 11.2.4 Cummins

- 11.2.5 Denso

- 11.2.6 Hanon Systems

- 11.2.7 MAHLE

- 11.2.8 Modine

- 11.2.9 Plug Power

- 11.2.10 Valeo

- 11.3 Emerging players

- 11.3.1 Eberspacher

- 11.3.2 Hanon Systems

- 11.3.3 Sanden

- 11.3.4 Scania

- 11.3.5 Webasto