|

市場調查報告書

商品編碼

1871136

直通式馬達啟動器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Direct on Line Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

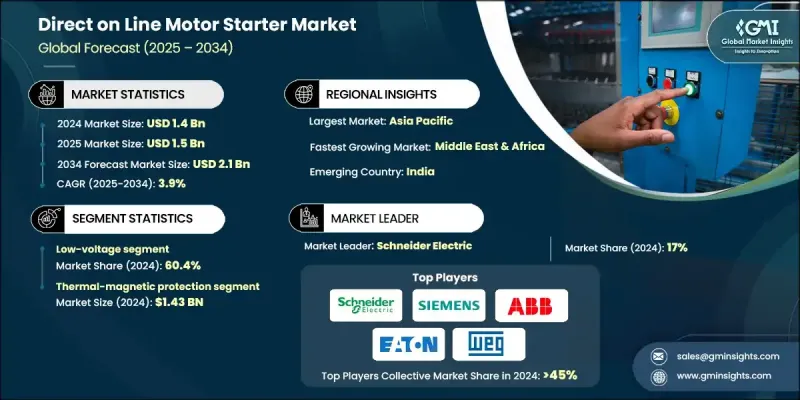

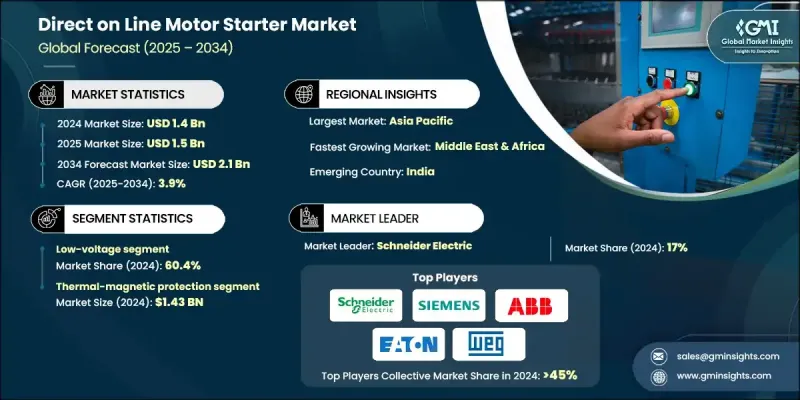

2024 年全球直接啟動馬達市場價值為 14 億美元,預計到 2034 年將以 3.9% 的複合年成長率成長至 21 億美元。

全球電力需求不斷成長,工業電氣化進程加速,推動了直接啟動馬達(DOL)技術的應用,尤其是在中小型馬達領域。這些啟動器因其成本效益高、操作簡便而備受青睞。水利基礎設施現代化和污水處理設施的投資,也支撐了水泵、風扇和輔助馬達負載對直接啟動馬達的穩定需求。亞洲製造業的成長,得益於資本支出的復甦和高科技工廠升級的大力推進,進一步促進了輸送機和公用設施設備等關鍵系統的部署。在撒哈拉以南非洲和亞洲部分地區,電力供應的增加為基礎馬達控制系統創造了新的應用情境。國際能源總署(IEA)的最新數據顯示,電力供應顯著成長,轉化為對壓縮機、風扇和水泵(直接啟動系統的關鍵應用領域)需求的增加。新興市場正在採用這些解決方案,因為它們具有生命週期成本低、易於維護等優點,能夠滿足不斷擴展的基礎設施需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 21億美元 |

| 複合年成長率 | 3.9% |

由於其經濟實惠、可靠性高且功能高效,熱磁保護裝置在直接啟動器中仍廣泛應用。這些組合機制可有效防止過載和短路,使其適用於暖通空調、製造業和水管理等行業。隨著各行業在預算限制下不斷優先考慮安全性和簡易性,熱磁裝置在性能和實用性之間實現了理想的平衡。

由於低壓直接啟動器在中小型馬達中的廣泛應用,其市佔率在2024年達到了60.4%。該類別產品憑藉其易於安裝、與標準馬達配置相容以及在大批量應用中的成本效益等優勢,持續保持領先地位。全球市場基礎設施建設的擴張和公用事業投資的增加,也推動了低壓直接啟動器需求的成長,尤其是在水處理和工業設施領域。

2024年,美國直接啟動式馬達市場規模預計將達到1.627億美元。由於美國在水務和污水處理基礎設施現代化方面的投資,市場需求持續強勁。聯邦政府為提高水泵效率和馬達控制技術提供的資金,正在推動傳統系統的更新換代。美國能源部(DOE)推廣的能源效率標準也促進了公共和工業領域向新型低壓啟動器技術的過渡。

全球直接啟動式馬達市場的主要競爭企業包括施耐德電氣、WEG、Kalp Controls、LOVATO ELECTRIC、BCH Electric Limited、Jaydeep Controls、羅克韋爾自動化、ABB、正泰集團、Lauritz Knudsen Electrical & Automation、C&S Electric、西門子、LS ELECTRIC、CMItroalar, Electrical Electric、ccontrolal, Electric、ccontroal、ELECTRIC、CMINOar、S Electric.和伊頓。為了鞏固其在直接啟動式馬達市場的地位,各企業優先採取的策略包括:擴展產品組合,推出專為新興基礎設施項目量身定做的緊湊型模組化設計;增強與節能電機和智慧工業系統的兼容性;以及利用與政府主導的公用事業和水務項目的戰略合作來提高公共部門的市場滲透率。同時,全球企業正透過在高成長地區設立本地製造工廠和服務中心,瞄準市場,旨在縮短交貨週期並加強支援。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 直接啟動式(DoL)馬達起動器的成本結構分析

- 價格趨勢分析(美元/單位)

- 按地區

- 新興機會與趨勢

- DoL馬達起動器投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 戰略儀錶板

- 競爭性標竿分析

- 創新與技術格局

第5章:市場規模及預測:依防護系統分類,2021-2034年

- 主要趨勢

- 電子過載繼電器

- 固態過載保護

- 熱磁性保護

第6章:市場規模及預測:依控制系統分類,2021-2034年

- 主要趨勢

- PLC

- 現場總線

第7章:市場規模及預測:依電壓等級分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場規模及預測:依當前狀況、2021年-2034年

- 主要趨勢

- > 9A - 27A

- > 27 安培 - 90 安培

- 90 安培 - 270 安培

- 270 安培 - 810 安培

- 810 A

第9章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 分散式架構

- 控制櫃

- 混合配置

第10章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第11章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

第12章:公司簡介

- ABB

- BCH Electric Limited

- C&S Electric

- CG Power & Industrial Solutions

- CHINT Group

- CMI Switchgear

- c3controls

- Danfoss

- Eaton

- Jaydeep Controls

- Kalp Controls

- Lauritz Knudsen Electrical & Automation

- LOVATO ELECTRIC

- LS ELECTRIC

- NOARK Electric

- Omron Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

- WEG

The Global Direct on Line Motor Starter Market was valued at USD 1.4 Billion in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 2.1 Billion by 2034.

Increasing global electricity demand and the accelerated pace of industrial electrification are fueling the adoption of DOL motor starters, especially in small to medium motor segments. These starters continue to be favored for their cost efficiency and operational simplicity. Investments in water infrastructure modernization and wastewater facilities are supporting steady demand for DOL starters across pumps, blowers, and auxiliary motor loads. Manufacturing growth in Asia, driven by revived capital expenditure and a strong push toward high-tech plant upgrades, is further boosting deployment in essential systems like conveyors and utility equipment. In regions across sub-Saharan Africa and parts of Asia, increasing access is creating new use cases for basic motor control systems. The IEA's latest updates highlight substantial growth in power availability, which is translating into heightened demand for compressors, fans, and pumps, key applications for DOL starter systems. Emerging markets are adopting these solutions for their low life-cycle cost and easy maintenance, aligning with the needs of expanding infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 3.9% |

Thermal-magnetic protection remains widely adopted in DOL starters due to its affordability, reliability, and functional efficiency. These combined mechanisms ensure effective protection against overload and short-circuit events, making them suitable for sectors such as HVAC, manufacturing, and water management. As industries continue prioritizing safety and simplicity under budget constraints, thermal-magnetic units offer an ideal balance between performance and practicality.

The low-voltage DOL starters segment held 60.4% share in 2024, owing to their prevalent use in small and medium-sized electric motors. This category continues to lead due to ease of installation, compatibility with standard motor configurations, and cost-effectiveness in high-volume applications. Expansion in infrastructure development and rising utility investments across global markets are also contributing to the increasing preference for low-voltage DOL starters, especially in water treatment and industrial facilities.

United States Direct on Line Motor Starter Market generated USD 162.7 million in 2024. U.S. continues to witness strong demand due to investments in modernizing water and wastewater infrastructure. Federal funding aimed at improving pump efficiency and motor control technologies is driving the replacement of legacy systems. Energy efficiency standards promoted by the Department of Energy (DOE) are also supporting the transition toward updated low-voltage starter technologies across both public and industrial sectors.

Key companies competing in the Global Direct on Line Motor Starter Market include Schneider Electric, WEG, Kalp Controls, LOVATO ELECTRIC, BCH Electric Limited, Jaydeep Controls, Rockwell Automation, ABB, CHINT Group, Lauritz Knudsen Electrical & Automation, C&S Electric, Siemens, LS ELECTRIC, CMI Switchgear, CG Power & Industrial Solutions, Omron Corporation, Danfoss, NOARK Electric, c3controls, and Eaton. To strengthen their position in the Direct on Line Motor Starter Market, companies are prioritizing strategies such as expanding product portfolios with compact, modular designs tailored for emerging infrastructure projects. They are also enhancing compatibility with energy-efficient motors and smart industrial systems. Strategic collaborations with government-led utility and water projects are being leveraged to increase public sector penetration. In parallel, global players are targeting high-growth regions by setting up local manufacturing facilities and service centers, aiming to reduce lead times and enhance support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Protection system trends

- 2.1.3 Control system trends

- 2.1.4 Voltage trends

- 2.1.5 Current trends

- 2.1.6 Application trends

- 2.1.7 End use trends

- 2.1.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Cost structure analysis of Direct on Line (DoL) motor starters

- 3.8 Price trend analysis, (USD/Unit)

- 3.8.1 By region

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future outlook for the DoL motor starter

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Protection System, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Electronic overload relays

- 5.3 Solid-state overload protection

- 5.4 Thermal-magnetic protection

Chapter 6 Market Size and Forecast, By Control System, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 PLC

- 6.3 Fieldbus

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Current, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 > 9 A - 27 A

- 8.3 > 27 A - 90 A

- 8.4 > 90 A - 270 A

- 8.5 > 270 A - 810 A

- 8.6 > 810 A

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 Distributed architecture

- 9.3 Control cabinet

- 9.4 Hybrid configuration

Chapter 10 Market Size and Forecast, By End Use, 2021 - 2034 (Units & USD Million)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Industrial

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 Russia

- 11.3.4 UK

- 11.3.5 Italy

- 11.3.6 Spain

- 11.3.7 Netherlands

- 11.3.8 Austria

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 South Korea

- 11.4.4 India

- 11.4.5 Australia

- 11.4.6 New Zealand

- 11.4.7 Indonesia

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 Qatar

- 11.5.4 Egypt

- 11.5.5 South Africa

- 11.5.6 Nigeria

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 BCH Electric Limited

- 12.3 C&S Electric

- 12.4 CG Power & Industrial Solutions

- 12.5 CHINT Group

- 12.6 CMI Switchgear

- 12.7 c3controls

- 12.8 Danfoss

- 12.9 Eaton

- 12.10 Jaydeep Controls

- 12.11 Kalp Controls

- 12.12 Lauritz Knudsen Electrical & Automation

- 12.13 LOVATO ELECTRIC

- 12.14 LS ELECTRIC

- 12.15 NOARK Electric

- 12.16 Omron Corporation

- 12.17 Rockwell Automation

- 12.18 Schneider Electric

- 12.19 Siemens

- 12.20 WEG