|

市場調查報告書

商品編碼

1871131

製藥用低溫閥市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Cryogenic Valve for Pharmaceutical Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

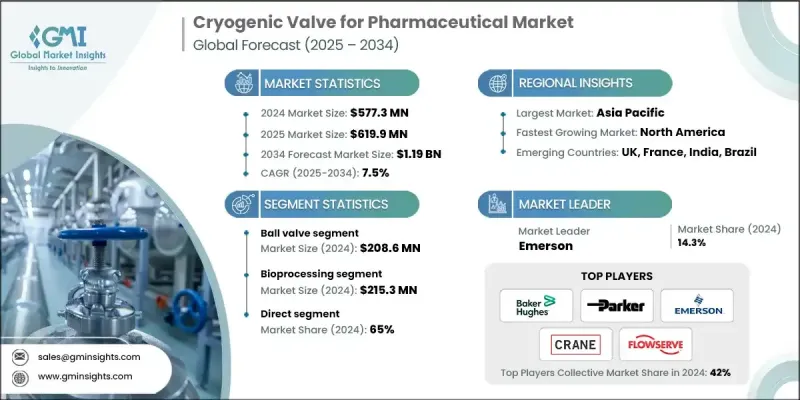

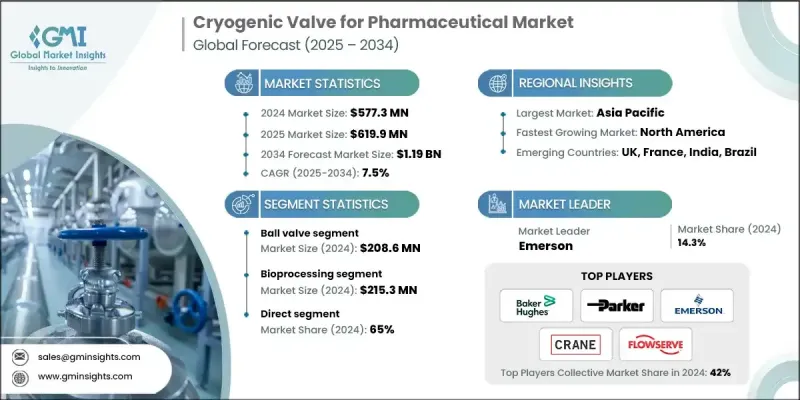

2024 年全球製藥用低溫閥市場價值為 5.773 億美元,預計到 2034 年將以 7.5% 的複合年成長率成長至 11.9 億美元。

製藥和生物技術應用領域對液態氮、氬氣和氧氣等特殊氣體的需求不斷成長,推動了市場發展。這些氣體在藥物保存、疫苗儲存和實驗室研究等領域至關重要,而這些領域都需要超低溫環境。低溫閥門是關鍵零件,可確保在無菌高壓條件下精確控制並安全輸送這些氣體。低溫閥門的使用有助於製藥公司遵守國際防洩漏、材料純度和衛生標準。隨著製藥公司擴大使用低溫系統來支持生物製藥生產和冷鏈儲存,對先進低溫閥門的需求持續成長。對溫度敏感的藥物和生物製劑產量不斷提高,為閥門製造商創造了新的機遇,他們可以提供滿足嚴格安全性和性能標準的專用解決方案。總而言之,低溫技術在現代製藥營運中的應用,凸顯了高效能優質低溫閥門在全球範圍內的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.773億美元 |

| 預測值 | 11.9億美元 |

| 複合年成長率 | 7.5% |

由於其結構緊湊、成本效益高,且能夠承受高壓高溫環境,隔膜閥在2024年佔據了26.1%的市場佔有率。隨著製藥業對水基礎設施投資的增加,隔膜閥的作用日益凸顯,它們在水淨化、處理和無菌系統管理等流程中發揮越來越重要的作用。隔膜閥在這些系統中的日益普及,凸顯了它們在維持製藥生產設施清潔、可控和可靠運作方面的重要作用。

到2024年,直銷通路市佔率將達到65%。製造商與製藥公司直接對接,能夠確保高品質的產品供應,並促進更牢固的業務關係。透過減少中間環節,企業可以降低整體採購成本,並提供高效的售後服務,這在設備可靠性和溫度控制精度至關重要的行業中是一項關鍵優勢。此外,這種直接模式還允許製造商根據客戶的具體要求客製化解決方案,從而更好地響應製藥應用日益成長的、對性能和可追溯性要求極高的市場需求。

2024年,美國製藥用低溫閥市佔率達到78.8%,這反映了其強大的製藥生產基礎和在研發方面的巨額投入。聯邦政府在製藥研發方面的支出超過700億美元,大大促進了低溫系統的技術進步和創新。對溫度敏感藥物可靠儲存和運輸需求的不斷成長,推動了低溫閥在生產和物流網路中的應用。此外,美國食品藥物管理局(FDA)對品質保證的持續重視以及生物製藥基礎設施的現代化,也支持了先進低溫處理系統的廣泛應用,使美國成為重要的市場中心。

全球製藥用低溫閥門市場的主要參與者包括Flowserve、Baker Hughes、Velan、Parker Hannifin、Kitz、Swagelok、Herose、Powell Valves、Trimteck、Rego、PK Valve and Engineering、Crane Company、Bray International、Microfinish和Emerson。這些公司採取的關鍵策略著重於加強技術創新、策略合作和全球擴張。主要企業優先投資研發,以開發具有更高密封性能、更強滅菌相容性和更耐極端溫度的閥門。許多公司正與製藥廠商建立合作關係,共同開發符合業界特定標準的客製化低溫解決方案。擴大生產能力和加強新興市場的本地分銷網路也是提高產品可近性的關鍵步驟。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對特種藥品的需求不斷成長

- 擴建空氣分離裝置(ASU)

- 注重營運安全和效率

- 產業陷阱與挑戰

- 合規和認證成本高昂

- 材料相容性問題

- 機會

- 新興市場和生物技術中心

- 自動化和智慧閥門技術

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按閥門類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼- 84818090)

- 主要進口國

- 主要出口國

- 差距分析

- 風險評估與緩解

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依閥門類型分類,2021-2034年

- 主要趨勢

- 球閥

- 隔膜閥

- 球閥

- 止回閥

- 其他(洩壓閥、安全閥、電磁閥等)

第6章:市場估算與預測:依閥門尺寸分類,2021-2034年

- 主要趨勢

- 小於1英寸

- 介於 1 到 4 英吋之間

- 介於 4 到 8 英吋之間

- 超過 8 英寸

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 生物加工和生物製藥

- 疫苗儲存和冷鏈

- 細胞和基因治療

- 冷凍乾燥

- 其他(醫用氣體、冷凍保存等)

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Baker Hughes

- Bray International

- CP Valves (Hammer brand)

- Crane Company

- Cryofab, Inc.

- Emerson

- Flowserve

- Herose

- Kitz

- Microfinish

- Parker Hannifin

- PK Valve and Engineering

- Steriflow Valve

- Swagelok

- Velan

The Global Cryogenic Valve for Pharmaceutical Market was valued at USD 577.3 million in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 1.19 Billion by 2034.

Increasing demand for specialty gases such as liquid nitrogen, argon, and oxygen across pharmaceutical and biotechnology applications is driving market growth. These gases are essential in areas such as drug preservation, vaccine storage, and laboratory research, all of which require ultra-low temperature environments. Cryogenic valves are critical components that ensure precise control and secure transfer of these gases under sterile and high-pressure conditions. Their use supports compliance with international standards for leak prevention, material purity, and hygiene in pharmaceutical operations. As pharmaceutical companies increase the use of cryogenic systems to support biopharmaceutical manufacturing and cold-chain storage, demand for advanced cryogenic valves continues to expand. The rising production of temperature-sensitive medicines and biologics is creating new opportunities for valve manufacturers offering specialized solutions that meet strict safety and performance criteria. Overall, the integration of cryogenic technology into modern pharmaceutical operations is reinforcing the importance of efficient and high-quality cryogenic valves worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $577.3 Million |

| Forecast Value | $1.19 Billion |

| CAGR | 7.5% |

The diaphragm valves segment held 26.1% share in 2024, owing to their compact design, cost-effectiveness, and capability to withstand high-pressure and high-temperature applications. Their role has become even more significant as investment in water infrastructure has increased across the pharmaceutical sector, supporting processes such as water purification, treatment, and sterile system management. The growing application of diaphragm valves in such systems underscores their essential function in maintaining clean, controlled, and reliable operations within pharmaceutical production facilities.

The direct sales channel segment held a 65% share in 2024. Direct engagement between manufacturers and pharmaceutical companies ensures high-quality product supply and fosters stronger business relationships. By minimizing intermediaries, companies reduce overall procurement costs and provide efficient after-sales services, a key advantage in industries where equipment reliability and temperature control precision are vital. The direct approach also allows manufacturers to tailor solutions to client specifications, improving responsiveness to the growing needs of pharmaceutical applications that demand stringent performance and traceability.

United States Cryogenic Valve for Pharmaceutical Market held a 78.8% share in 2024, reflecting its strong pharmaceutical production base and substantial investments in research and development. Federal spending on pharmaceutical R&D exceeding USD 70 Billion has significantly contributed to technological advancement and innovation in cryogenic systems. The increasing requirement for reliable storage and transport of temperature-sensitive drugs has fueled the adoption of cryogenic valves across manufacturing and logistics networks. Furthermore, the Food and Drug Administration's continued emphasis on quality assurance and modernized biopharmaceutical infrastructure supports the widespread implementation of advanced cryogenic handling systems, positioning the U.S. as a major market hub.

Leading players in the Global Cryogenic Valve for Pharmaceutical Market include Flowserve, Baker Hughes, Velan, Parker Hannifin, Kitz, Swagelok, Herose, Powell Valves, Trimteck, Rego, PK Valve and Engineering, Crane Company, Bray International, Microfinish, and Emerson. Key strategies employed by companies in the Cryogenic Valve For Pharmaceutical Market focus on enhancing technological innovation, strategic collaborations, and global expansion. Major firms are prioritizing R&D investments to develop valves with improved sealing performance, sterilization compatibility, and durability under extreme temperatures. Many companies are forming partnerships with pharmaceutical manufacturers to co-develop customized cryogenic solutions that meet industry-specific standards. Expanding manufacturing capacities and strengthening local distribution networks in emerging markets are also vital steps to improve accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Valve size

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for specialty pharmaceuticals

- 3.2.1.2 Expansion of air separation units (ASUs)

- 3.2.1.3 Focus on operational safety and efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of compliance and certification

- 3.2.2.2 Material compatibility issues

- 3.2.3 Opportunities

- 3.2.3.1 Emerging markets and biotech hubs

- 3.2.3.2 Automation and smart valve technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Valve type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 84818090)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Valve type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Ball valve

- 5.3 Diaphragm valves

- 5.4 Globe valve

- 5.5 Check valve

- 5.6 Others (relief, safety, solenoid valve etc.)

Chapter 6 Market Estimates & Forecast, By Valve size, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 1 inch

- 6.3 Between 1 to 4 inches

- 6.4 Between 4 to 8 inches

- 6.5 More than 8 inches

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Bioprocessing and biopharmaceutical

- 7.3 Vaccine storage and cold chain

- 7.4 Cell and gene therapy

- 7.5 Freeze drying

- 7.6 Others (medical gas, cryopreservation etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baker Hughes

- 10.2 Bray International

- 10.3 C.P. Valves (Hammer brand)

- 10.4 Crane Company

- 10.5 Cryofab, Inc.

- 10.6 Emerson

- 10.7 Flowserve

- 10.8 Herose

- 10.9 Kitz

- 10.10 Microfinish

- 10.11 Parker Hannifin

- 10.12 PK Valve and Engineering

- 10.13 Steriflow Valve

- 10.14 Swagelok

- 10.15 Velan