|

市場調查報告書

商品編碼

1846194

低溫閥門:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Cryogenic Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

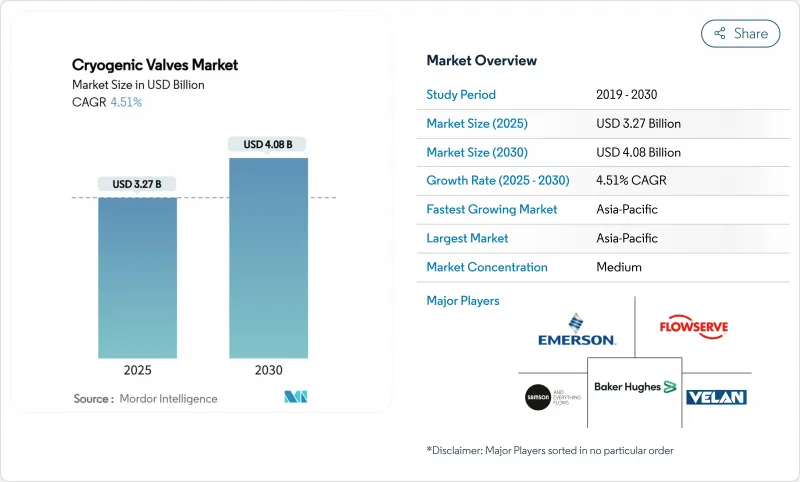

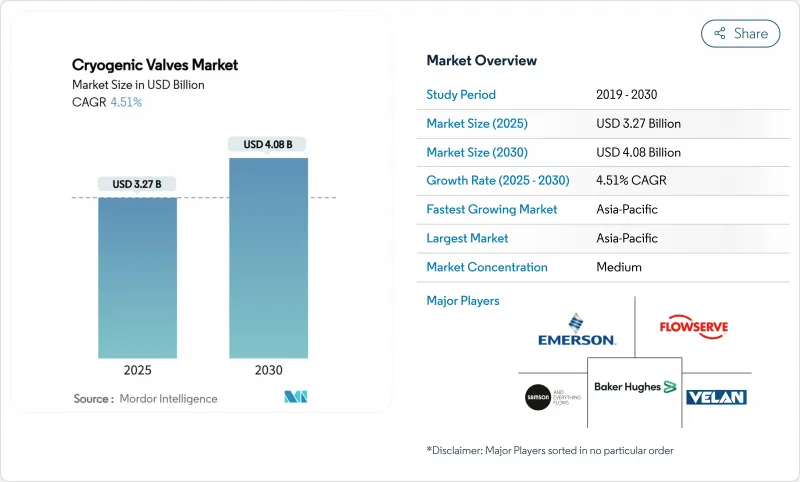

預計到 2025 年,低溫閥門市場規模將達到 32.7 億美元,到 2030 年將達到 40.8 億美元,預測期(2025-2030 年)複合年成長率為 4.51%。

液化天然氣 (LNG) 接收站、綠色氫能計劃和石化擴建專案的投資不斷成長,支撐著這一穩步發展趨勢。大型設施都需要數百個能夠在低於 -150 度C 的溫度下密封的閥門,因此業主更傾向於選擇能夠快速通過多項標準認證的供應商。亞太地區仍然是最大的設備買家,而北美則為氫氣試點工廠提供了高價值的商機。能夠將低溫工程與售後服務相結合的製造商正在贏得高額契約,因為終端用戶需要長期可靠性和快速的維護週轉時間。

全球低溫閥門市場趨勢及洞察

增加液化天然氣基礎設施投資

2024年至2028年間的擴建計畫將使全球液化天然氣(LNG)產能提升40%,屆時美國將超越卡達成為主導的出口國,而亞太地區將購買新增貨物的大部分。貝克休斯公司已獲得路易斯安那州兩套LNG生產線的56億美元訂單,這表明承包商對擁有現場驗證經驗、能夠保證超低洩漏性能的閥門合作夥伴的需求旺盛。預計到2030年,船舶燃料需求將超過每年1,600萬噸,促使港口指定使用具有整合式緊急切割閥的自動化低溫輸送組件。企業產品合作夥伴公司(Enterprise Products Partners)將把休士頓航道的冷卻能力擴大至每日30萬桶,從而產生新的訂單,用於生產工作溫度低至-162°C的三偏心截止閥。沙烏地阿美投資 77 億美元的法迪利升級項目將增加 13 億立方英尺/天的脫臭氣處理能力,每條生產線都配備冗餘的低溫流動路徑來處理混合冷媒。

工業氣體需求不斷成長

液化空氣集團位於德克薩斯州的四套模組化空氣分離裝置每天向埃克森美孚的低碳氫化合物生產聯合體供應9000噸氧氣,並生產北美最大的氬氣流。隨著醫療保健行業的擴張持續推動液態氧消費量,醫院要求採用能夠防止顆粒物在患者迴路中逸出的閥門設計。食品加工商傾向於使用液態氮隧道進行深度冷凍,並使用能夠承受低至-196°C快速熱循環並保持衛生潔淨的閥門。可再生驅動的空氣分離裝置需要快速反應的控制微調裝置,以便操作人員能夠根據電網電價的波動調整輸出。

安全與合規的複雜性

ASME B31.3 要求材料必須經過衝擊試驗,溫度低於 -425°F(-220°C)。符合標準的閥門採用經擺錘測試認證的奧氏體不銹鋼或鋁合金。 2025 年 ASME VIII 更新將引入新的低溫案例研究,要求設計人員增加更厚的閥蓋或波紋管密封件以滿足新規要求。 MSS SP-158-2021 強制要求進行高壓氣體測試,這增加了開發成本,但也鼓勵公用事業公司要求進行認證以降低停電風險。美國聯邦法規 49 CFR 要求閥門能夠承受儲罐測試壓力而不被穿透,並包含堅固的機械損傷防護裝置,這影響了拖車佈局的選擇。安全閥的五年重新認證週期雖然帶來了持續的服務收入,但也增加了小型業者的擁有成本。小型製造商難以跟上多個司法管轄區的規範更新,導致現有品牌的競爭力下降。

細分市場分析

到2024年,球閥將佔據低溫閥門市場34.18%的佔有率。製造商提供加長閥桿設計,可將閥座與沸騰的液化氣體隔離,防止結冰和閥座損壞。艾默生Fisher HP系列採用彈簧活化的聚四氟乙烯(PTFE)環,可在-198 度C下維持VI級密封性能。儘管截止閥的裝置量較小,但由於其節流精度高,在氫氣液化計劃中備受青睞,預計其年複合成長率將達到5.41%。在生產8至10噸/小時液氫的試驗工廠中,截止閥的市場規模預計將顯著擴大,因為這些工廠需要可變流量控制來管理正仲氫轉化過程中的熱量。

技術改進在兩條產品線中持續進行。球閥製造商正在增加符合 ISO 15848-1 A 級認證的石墨閥蓋密封件,以實現超低逸散排放,這對於尋求 ESG 積分的操作員而言至關重要。截止閥 OEM 廠商正在採用輪廓閥芯,以實現等比特性,從而提高多級膨脹機的製程穩定性。閘閥和止回閥繼續保持其在特定領域的應用。閘閥適用於最大 42 英吋的全通徑 LNG 裝載管線,而雙板低溫止回閥可防止蒸發氣再循環迴路中的突波。專用蝶閥和塞閥填補了諸如超低密度氦氣應用等對超低扭矩要求極高的應用空白。

到2024年,手動齒輪和手輪操作器將佔據低溫閥門市場59.82%的佔有率,其優勢在於操作簡便,且在斷電情況下具有固有的故障安全能力。液化天然氣出口終端依靠手動隔離閥在泊位緊急情況下保護貨物管線。然而,由於設施業主轉向遠端操作以減少人力投入,該領域的成長較為緩慢。氣動驅動裝置到2030年將以5.57%的複合年成長率成長,利用封閉式壓縮空氣或氮氣在故障關閉邏輯下快速行程。氫氣生產設施傾向於採用氣動驅動裝置,以避免與電動馬達相關的火災風險。

電動致動器在需要數據豐富的定位回饋的領域找到了用武之地,例如在數位管理的氮氣冷凍隧道中,它可以微調流量以保持產品質地。將可分離式變速箱與氣壓驅動裝置連接的混合解決方案,結合了手動超控和自動調速功能,在雙用途設備中越來越受歡迎。原始設備製造商 (OEM) 擴大採用智慧定位器,這些定位器可以測量閥桿摩擦和循環次數,並將資料輸入工廠歷史記錄,從而在洩漏發生之前觸發服務工單。這種預測性維護模式加強了售後市場聯繫,並提高了已安裝閥門的終身收益。

區域分析

預計到2024年,亞太地區將佔低溫閥門市場26.55%的佔有率,並在2030年之前以5.72%的複合年成長率持續成長。中國天然氣發電政策的轉變以及印度熱浪帶來的需求正在推動進口成長,而日本和韓國正在投資建設轉運中心,以重新定位來自美國的貨物。在澳大利亞,老舊的液化裝置正進入維修週期,從而促進了售後閥門服務的發展。中國、韓國和澳洲政府制定的氫能發展藍圖,正在增加試點液化裝置對高壓截止閥的競標。

北美受惠於美國成為全球最大的液化天然氣出口國以及聯邦政府對氫能中心的大力資助。墨西哥灣沿岸的棕地液化計劃要求加入北美閥門工業協會,這有利於擁有本地庫存的國內供應商。液化空氣集團在貝城的投資以及多個中型液態氧生產項目將維持工業氣體閥門的穩定需求。加拿大首批液化天然氣預計將於2027年從不列顛哥倫比亞省交付,將提振西半球的需求。

儘管2024年液化天然氣進口量下降,歐洲仍積極發展氫能。德國計劃建造10吉瓦的電解槽,該電解槽與液化和地下儲存計畫密切相關,這兩個計畫都指定使用超低洩漏隔離閥。歐洲地平線計畫正在資助西班牙和荷蘭之間的移動式液氫儲罐試驗,並由此獲得了一批專用貨物裝卸閥的訂單。北歐港口正在加速液化天然氣燃料庫的部署,以支援綠色走廊航運聯盟。

中東和非洲正在興建大規模的天然氣加工待開發區。沙烏地阿美公司的法迪利擴建計畫、卡達的北方南氣田計畫以及阿曼的多個石化聯合裝置都需要能夠耐受酸性氣體化合物的耐久性低溫冶金技術。阿布達比正在探索藍氨技術,並將液化天然氣生產線和閥門組件的設計概念融入其中。在非洲,莫三比克陸上液化天然氣工廠的建設已被推遲,但一旦安全局勢穩定,預計將啟動新一輪閥門採購。

南美洲的液化天然氣市場尚處於起步階段,但已展現出巨大潛力。巴西正在考慮採用浮體式儲存再氣化裝置(FSRA)來應對季節性天然氣短缺,因此需要緊湊型低溫閥門撬裝設備。阿根廷的瓦卡穆爾塔頁岩氣最終可能為液化天然氣出口駁船計劃提供氣源,但目前由於時間上的不確定性,需求暫時受到抑制。智利的採礦業正在探索使用液態氧來提高製程效率,這預示著小型但利潤豐厚的閥門應用前景廣闊。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 增加液化天然氣基礎設施投資

- 工業氣體需求不斷成長

- 加速氫能經濟計劃建設進程

- 石化和特種氣體廠產能擴張

- 全球港口的小規模液化天然氣燃料庫

- 市場限制

- 安全與合規的複雜性

- 不銹鋼和鎳的價格波動

- 硬焊零件的供應鏈差異

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 球閥

- 閘閥

- 截止閥

- 單向閥

- 其他產品類型

- 透過驅動

- 手動型

- 氣壓

- 電的

- 氣體

- 液態氮

- 液化天然氣

- 氫

- 氧

- 其他氣體

- 按最終用戶產業

- 石油和天然氣

- 能源和電力

- 化學

- 飲食

- 醫療保健

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度分析

- 策略舉措

- 市佔率分析

- 公司簡介

- BAC Valves

- Baker Hughes

- Bray International

- Burkert India Private Limited

- Cryofab Inc.

- Emerson Electric Co.

- Flowserve Corporation

- Habonim

- HEROSE GmbH

- L&T Valves Limited

- Meca-Inox

- Neway Valve

- OPW, A Dover Company

- Parker Hannifin Corp

- Powell Valves

- Samson AG

- Swagelok Company

- Velan

第7章 市場機會與未來展望

The Cryogenic Valves Market size is estimated at USD 3.27 billion in 2025, and is expected to reach USD 4.08 billion by 2030, at a CAGR of 4.51% during the forecast period (2025-2030).

Rising investment in liquefied natural gas (LNG) terminals, green-hydrogen projects, and petro-chemical expansions underpins this steady trajectory. Large-scale facilities each require hundreds of valves capable of sealing at temperatures below -150 °C, and owners favour suppliers able to certify products quickly for multiple codes. Asia-Pacific remains the largest regional buyer of equipment, while North America delivers high-value opportunities tied to hydrogen pilot plants. Producers able to combine cryogenic engineering depth with aftermarket services are attracting premium contract awards, as end-users seek long-term reliability and fast turn-round maintenance.

Global Cryogenic Valves Market Trends and Insights

Rising LNG Infrastructure Investments

Expansions slated between 2024-2028 will lift global LNG liquefaction capacity by 40%, with the United States overtaking Qatar as lead exporter while Asia-Pacific purchases the bulk of incremental cargoes. Baker Hughes secured USD 5.6 billion of LNG equipment awards for two Louisiana trains, illustrating contractor appetite for field-proven valve partners able to guarantee ultra-low-leak performance. Marine bunkering demand is forecast to exceed 16 million t annually by 2030, prompting ports to specify automated cryogenic transfer assemblies that integrate emergency shut-off valves. Enterprise Products Partners is expanding Houston Ship Channel refrigeration capacity by 300,000 bbl/d, creating new orders for triple-offset stop-valves rated down to -162 °C. Saudi Aramco's USD 7.7 billion Fadhili upgrade will add 1.3 Bcf/d of sweet-gas processing, each train fitted with redundant cryogenic flow-paths to handle mixed refrigerants.

Growth in Industrial Gas Demand

Air Liquide's four modular air-separation units in Texas will deliver 9,000 t/d of oxygen to ExxonMobil's low-carbon hydrogen complex and generate the continent's largest argon stream, placing long-cycle demand on valve makers able to certify for oxygen service. Healthcare expansion keeps liquid-oxygen consumption rising, and hospitals mandate valve designs that prevent particle shedding in patient circuits. Food processors favour liquid nitrogen tunnels for flash-freezing, with valves that tolerate rapid thermal cycling down to -196 °C while maintaining hygienic finishes. Renewable-powered air-separation plants require fast-response control trim so operators can throttle output to match fluctuating grid tariffs.

Safety & Compliance Complexities

ASME B31.3 mandates impact-tested materials below -425 °F; complying valves use austenitic stainless or aluminium alloys proven by Charpy testing. The 2025 ASME VIII update introduces fresh cryogenic case studies, prompting designers to add thicker bonnets or bellows seals to satisfy the new rules. MSS SP-158-2021 requires high-pressure gas tests that inflate development costs, yet utilities increasingly insist on the certification to reduce outage risk. U.S. Code 49 CFR obliges valves to hold tank test pressure without seepage and to include robust guards against mechanical damage, shaping layout choices on trailers. Five-year recertification cycles for safety valves generate recurring service revenue but raise ownership costs for small operators. Smaller fabricators struggle to keep pace with multi-jurisdiction code work, giving established brands a competitive edge.

Other drivers and restraints analyzed in the detailed report include:

- Hydrogen-Economy Project Pipeline Acceleration

- Capacity Additions in Petro-chem & Specialty Gas Plants

- Stainless-Steel & Nickel Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ball valves held a dominant 34.18% cryogenic valves market share in 2024, owing to proven tight shut-off and straightforward maintenance. Manufacturers supply extended-stem designs that isolate the seat from boiling liquefied gases, cutting ice buildup and seat damage. Emerson's Fisher HP series uses spring-energised PTFE rings to hold Class VI shut-off at -198 °C. Globe valves, though smaller in installed base, are expected to grow at 5.41% CAGR as hydrogen liquefaction projects favour their throttling precision. The cryogenic valves market size for globe valves is anticipated to widen notably in pilot plants producing 8-10 t/h of liquid hydrogen, each calling for variable-flow control to manage ortho-para conversion heat.

Technical enhancements continue across both lines. Ball-valve makers are adding graphite bonnet seals certified to ISO 15848-1 Class A for ultra-low fugitive emissions, an important factor for operators seeking ESG credits. Globe-valve OEMs are deploying contoured plugs that deliver equal-percentage characteristics, enhancing process stability in multi-stage expanders. Gate and check valves retain niche uses: gate valves accommodate full-bore LNG loading lines up to 42 in, while dual-plate cryogenic check valves prevent reverse surge in boil-off gas recirculation loops. Specialty butterfly and plug valves fill gaps such as helium service at ultra-low density where very low torque is essential.

Manual gear and hand-wheel operators represented 59.82% of the cryogenic valves market in 2024, prized for simplicity and intrinsic fail-safe capability during power loss. LNG export terminals rely on manual isolation valves to secure cargo lines during berth-side emergencies. The segment, however, grows slowly as facility owners look to remote operation to cut staffing. Pneumatic actuation will expand at 5.57% CAGR to 2030, leveraging plant air or nitrogen to deliver quick stroke times under fail-closed logic. Hydrogen sites favour pneumatic drives to avoid ignition risks linked to electric motors.

Electric actuators achieve niche uptake where data-rich position feedback is essential, such as in digitally managed nitrogen freezing tunnels that fine-tune flow to maintain product texture. Hybrid solutions that bolt a declutchable gearbox onto a pneumatic drive combine manual override with automated speed, capturing demand in dual-use installations. OEMs increasingly embed smart positioners measuring stem friction and cycle count, feeding plant historians that trigger service work orders before leakage occurs. This predictive-maintenance model strengthens aftermarket ties and lifts lifetime revenue per installed valve.

The Cryogenic Valves Market Report is Segmented by Product Type (Ball Valve, Gate Valve, Globe Valve, Check Valve, Other Product Types), Actuation (Manual, Pneumatic, Electric), Gas (Liquid Nitrogen, Liquid Natural Gas, and More), End-User Industry (Oil and Gas, Energy and Power, Chemicals, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 26.55% of the cryogenic valves market in 2024 and is projected to expand by a 5.72% CAGR through 2030. China's gas-to-power policy reversal and India's heat-wave-driven demand are reviving import growth, while Japan and South Korea invest in re-loading hubs that reposition cargoes from the United States. Australia's ageing liquefaction trains enter refurbishment cycles, pushing aftermarket valve services. Government hydrogen roadmaps in China, South Korea and Australia create incremental bids for high-pressure globe valves at pilot liquefier sites.

North America benefits from the United States becoming the world's largest LNG exporter and from aggressive federal funding for hydrogen hubs. Gulf Coast brownfield liquefaction projects stipulate North American Valve Manufacturers Association membership, favouring domestic suppliers with local inventories. Air Liquide's Baytown investment plus multiple mid-scale liquid-oxygen build-owns maintain steady industrial-gas valve uptake. Canada's first LNG shipment slated for 2027 from British Columbia will add western-hemisphere demand.

Europe, despite softer LNG imports in 2024, commits heavily to hydrogen. Germany's planned 10 GW of electrolyser capacity links to liquefaction and underground storage schemes, each specifying ultra-low-leak isolation valves. Horizon Europe funds mobile LH2 tank trials between Spain and the Netherlands, generating specialty cargo-handling valve orders. Nordic ports accelerate LNG bunkering roll-outs supporting green-corridor shipping alliances.

The Middle East and Africa witness sizeable greenfield gas processing. Saudi Aramco's Fadhili expansion, Qatar's North Field South and multiple Omani petro-chem complexes need durable cryogenic metallurgy that resists sour-gas compounds. Abu Dhabi is exploring blue-ammonia, which will import design philosophies from LNG trains to valve packages. In Africa, Mozambique's postponed onshore LNG plant, once security stabilises, promises a fresh cycle of valve procurement.

South America remains nascent yet promising. Brazil eyes floating storage and regasification units to manage seasonal gas deficits, requiring compact cryogenic valve skids. Argentina's Vaca Muerta shale may eventually feed LNG export barge projects, though timetable uncertainty tempers near-term demand. Chile's mining sector investigates liquid oxygen for process efficiency, presenting small but high-margin valve prospects.

- BAC Valves

- Baker Hughes

- Bray International

- Burkert India Private Limited

- Cryofab Inc.

- Emerson Electric Co.

- Flowserve Corporation

- Habonim

- HEROSE GmbH

- L&T Valves Limited

- Meca-Inox

- Neway Valve

- OPW, A Dover Company

- Parker Hannifin Corp

- Powell Valves

- Samson AG

- Swagelok Company

- Velan

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising LNG infrastructure investments

- 4.2.2 Growth in industrial gas demand

- 4.2.3 Hydrogen-economy project pipeline acceleration

- 4.2.4 Capacity additions in petro-chem & specialty gas plants

- 4.2.5 Small-scale LNG bunkering at global ports

- 4.3 Market Restraints

- 4.3.1 Safety & compliance complexities

- 4.3.2 Stainless-steel & nickel price volatility

- 4.3.3 Supply-chain gaps in vacuum-brazed components

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Ball Valve

- 5.1.2 Gate Valve

- 5.1.3 Globe Valve

- 5.1.4 Check Valve

- 5.1.5 Other Product Types

- 5.2 By Actuation

- 5.2.1 Manual

- 5.2.2 Pneumatic

- 5.2.3 Electric

- 5.3 By Gas

- 5.3.1 Liquid Nitrogen

- 5.3.2 Liquid Natural Gas

- 5.3.3 Hydrogen

- 5.3.4 Oxygen

- 5.3.5 Other Gases

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Energy and Power

- 5.4.3 Chemicals

- 5.4.4 Food and Beverage

- 5.4.5 Medical

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BAC Valves

- 6.4.2 Baker Hughes

- 6.4.3 Bray International

- 6.4.4 Burkert India Private Limited

- 6.4.5 Cryofab Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 Flowserve Corporation

- 6.4.8 Habonim

- 6.4.9 HEROSE GmbH

- 6.4.10 L&T Valves Limited

- 6.4.11 Meca-Inox

- 6.4.12 Neway Valve

- 6.4.13 OPW, A Dover Company

- 6.4.14 Parker Hannifin Corp

- 6.4.15 Powell Valves

- 6.4.16 Samson AG

- 6.4.17 Swagelok Company

- 6.4.18 Velan

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment