|

市場調查報告書

商品編碼

1871102

實驗室培育咖啡生產系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Lab-Grown Coffee Production Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

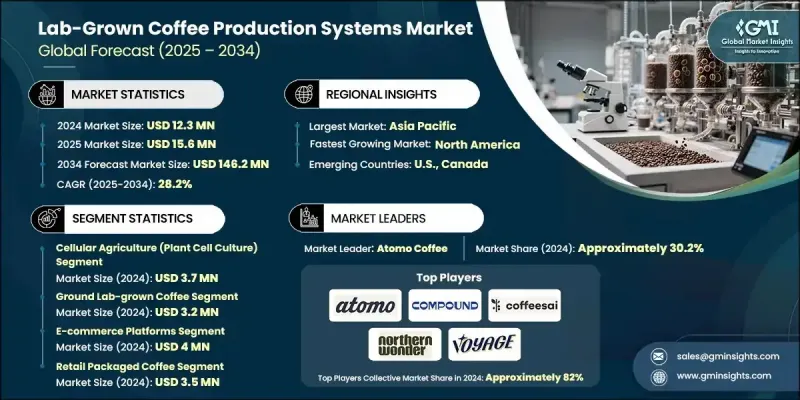

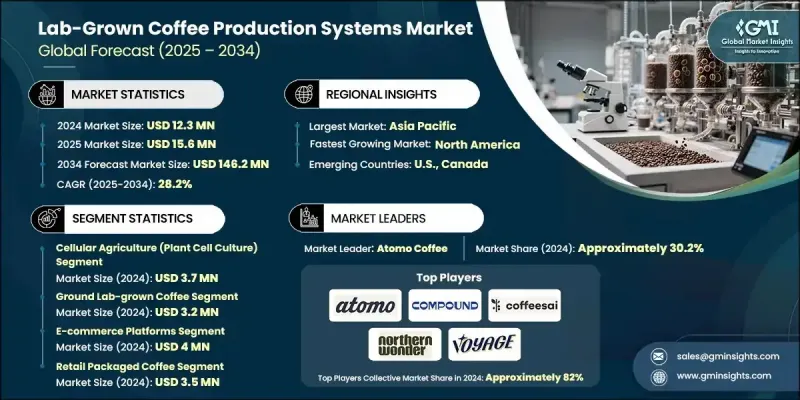

2024 年全球實驗室培育咖啡生產系統市值為 1,230 萬美元,預計到 2034 年將以 28.2% 的複合年成長率成長至 1.462 億美元。

由於全球對永續和符合道德的咖啡替代品的需求不斷成長,市場正經歷快速擴張。消費者越來越意識到傳統咖啡種植對環境和社會的影響,包括森林砍伐、過度用水以及發展中國家的勞動剝削。隨著這種意識的增強,實驗室培育咖啡的轉型動能日益強勁,其碳足跡更低,供應鏈更加透明且符合道德規範,與全球永續發展和ESG目標高度契合。此外,主要咖啡生產國耕地面積的減少以及土壤退化、氣候異常和作物產量下降等氣候相關挑戰,進一步加速了可控環境咖啡生產的轉變。實驗室系統能夠實現全年持續生產,確保可靠的品質和穩定的產量,不受地理和氣候限制,使其成為永續咖啡生產中越來越有吸引力的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1230萬美元 |

| 預測值 | 1.462億美元 |

| 複合年成長率 | 28.2% |

2024年,細胞農業領域的市場規模達到370萬美元,預計2025年至2034年間將以27.9%的複合年成長率成長。這種方法能夠在最佳化的實驗室環境中培養咖啡細胞,從而重現傳統種植咖啡的真實風味和香氣。此方法確保了穩定的生產、批次間的一致性,並降低了對農業變數的依賴。微生物生物合成,特別是精準發酵技術,也因其能夠以更少的自然資源高效合成咖啡風味分子和咖啡因,且週轉時間比傳統農業更快,而備受關注。

2024年,實驗室培育咖啡粉市場規模達320萬美元,預計2034年將以28.6%的複合年成長率成長。永續且便利的咖啡產品日益普及,推動了市場對這類產品的需求。具有環保意識的消費者擴大選擇實驗室培育的咖啡豆和咖啡粉產品,因為它們既能提供熟悉的沖泡體驗,也符合環保理念。這些產品在網路和專賣零售通路的普及,也促使它們在那些將永續性視為購買決策優先考量的消費者中穩步走紅。

2024年,北美實驗室培育咖啡生產系統市場規模預計將達到300萬美元,主要得益於消費者對永續和符合道德規範的飲品的需求。可支配收入的增加以及對氣候友善消費的濃厚興趣,推動了實驗室培育咖啡在零售、即飲和餐飲服務等各個領域的普及。技術進步、有利於新型食品監管的框架以及食品科技創新者不斷成長的投資,都為市場成長提供了支撐。該地區成熟的電商平台和直接面對消費者的訂閱模式,進一步提升了產品的可近性。生技公司與咖啡品牌之間的合作,也促進了產品開發和商業規模化。

全球實驗室培育咖啡生產系統市場的主要企業包括 Compound Foods、Voyage Foods、Atomo Coffee、Coffeesai(Pluri Biotech)和 Northern Wonder。這些企業正積極推行策略性舉措,以擴大市場佔有率並鞏固市場地位。領先企業正大力投資研發,以改善細胞農業和發酵技術,從而實現可擴展、低成本的咖啡生產。它們正與生物技術組織、飲料品牌和零售分銷商建立策略合作關係,以加速商業化進程並擴大市場覆蓋範圍。此外,企業也致力於建立永續的生產模式,在確保風味品質穩定的同時,最大限度地減少資源消耗。拓展直銷平台、線上零售和訂閱式配送系統等管道,正在提升產品的可及性和品牌知名度。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 供應鏈的複雜性

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 細胞農業(植物細胞培養)

- 懸浮培養

- 生物反應器培養的植物細胞

- 精準發酵(微生物生物合成)

- 工程酵母菌株

- 細菌發酵

- 合成生物學平台

- 基因編輯微生物

- 酵素合成

- 基於生物反應器的培養

- 批次生物反應器

- 連續流系統

- 混合動力系統

- 發酵+萃取

- 細胞培養+風味注入

第6章:市場估算與預測:依產品形式分類,2021-2034年

- 主要趨勢

- 實驗室培育的全豆咖啡

- 研磨的實驗室培育咖啡

- 即溶實驗室培育咖啡

- 咖啡膠囊/杯

- 液體濃縮物

- 咖啡萃取物

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 零售包裝咖啡

- 超市貨架商品

- 高階專業品牌

- 餐飲服務與飯店

- 連鎖飯店

- 咖啡館和餐廳

- 即飲飲料

- 瓶裝冷萃咖啡

- 咖啡能量飲料

- 功能性及營養保健品

- 含適應原的咖啡

- 加入蛋白質或膠原蛋白的咖啡

- 工業原料用途

- 調味劑

- 烘焙和糖果原料

- 其他

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 電子商務平台

- 品牌自有網站

- 線上市場(例如亞馬遜)

- 超市和大型超市

- 大眾零售連鎖店

- 有機/天然食品店

- 便利商店

- 城市奧特萊斯

- 加油站商店

- 特色咖啡店

- 第三波咖啡館

- 精品烘焙商

- 直接面對消費者(D2C)訂閱

- 每月咖啡盒

- 客製化烘焙訂閱

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Amatera

- Atomo Coffee

- Coffeesai (Pluri Biotech) - Israel

- Compound Foods

- Food Brewer

- Minus Coffee

- Northern Wonder

- Planting Costa Rica

- Prefer

- Voyage Foods

The Global Lab-Grown Coffee Production Systems Market was valued at USD 12.3 million in 2024 and is estimated to grow at a CAGR of 28.2% to reach USD 146.2 million by 2034.

The market is experiencing rapid expansion due to the growing global demand for sustainable and ethical coffee alternatives. Consumers are becoming increasingly aware of the environmental and social impacts linked with traditional coffee farming, including deforestation, excessive water usage, and labor exploitation in developing nations. As awareness grows, the transition toward lab-grown coffee is gaining traction, offering a lower carbon footprint and a more transparent, ethical supply chain that aligns closely with global sustainability and ESG objectives. Additionally, diminishing arable land and climate-related challenges such as soil degradation, erratic weather patterns, and declining crop yields in leading coffee-producing countries have further accelerated the shift toward controlled-environment coffee production. Lab-based systems enable consistent, year-round production with reliable quality and stable output, independent of geographical and climatic limitations, making them an increasingly attractive solution for sustainable coffee production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Million |

| Forecast Value | $146.2 Million |

| CAGR | 28.2% |

The cellular agriculture segment was valued at USD 3.7 million in 2024 and is estimated to grow at a CAGR of 27.9% from 2025 to 2034. This approach enables coffee cells to be cultivated in optimized laboratory environments that reproduce the authentic flavors and aroma of conventionally grown coffee. The method ensures stable production, consistency across batches, and reduced dependency on agricultural variables. Microbial biosynthesis, particularly through precision fermentation, is also gaining attention due to its ability to synthesize coffee flavor molecules and caffeine efficiently with fewer natural resources and faster turnaround times compared to traditional farming.

The ground lab-grown coffee segment reached USD 3.2 million in 2024 and is estimated to grow at a CAGR of 28.6% through 2034. The growing popularity of sustainable and convenient coffee products is driving demand for this format. Environmentally conscious consumers are increasingly adopting whole-bean and ground lab-grown coffee products, as they provide a familiar brewing experience while aligning with eco-friendly values. The availability of these products in online and specialty retail channels is contributing to their steady rise in popularity among consumers who prioritize sustainability in their purchasing decisions.

North America Lab-Grown Coffee Production Systems Market was valued at USD 3 million in 2024, driven by sustainable and ethically sourced beverages. Increasing disposable incomes and a strong interest in climate-friendly consumption are fueling the introduction of lab-grown coffee across retail, ready-to-drink, and foodservice categories. Market growth is supported by technological advancements, favorable regulatory frameworks for novel foods, and growing investments from food-tech innovators. The region's mature e-commerce platforms and direct-to-consumer subscription models are further accelerating product accessibility. Collaborations between biotechnology firms and coffee brands are also enhancing product development and commercial scalability.

Key companies operating in the Global Lab-Grown Coffee Production Systems Market include Compound Foods, Voyage Foods, Atomo Coffee, Coffeesai (Pluri Biotech), and Northern Wonder. Companies in the Lab-Grown Coffee Production Systems Market are pursuing strategic initiatives to expand their presence and strengthen their market positions. Leading firms are investing heavily in R&D to refine cellular agriculture and fermentation technologies for scalable, cost-efficient coffee production. Strategic collaborations with biotechnology organizations, beverage brands, and retail distributors are being established to accelerate commercialization and improve market reach. Businesses are also focusing on building sustainable production models that minimize resource consumption while ensuring consistent flavor quality. Expansion into direct-to-consumer platforms, online retail, and subscription-based delivery systems is enhancing accessibility and brand visibility.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Format

- 2.2.3 Technology

- 2.2.4 End Use

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Cellular Agriculture (Plant Cell Culture)

- 5.2.1 Suspension cultures

- 5.2.2 Bioreactor-grown plant cells

- 5.3 Precision Fermentation (Microbial Biosynthesis)

- 5.3.1 Engineered yeast strains

- 5.3.2 Bacterial fermentation

- 5.4 Synthetic Biology Platforms

- 5.4.1 Gene-edited microbes

- 5.4.2 Enzyme-based synthesis

- 5.5 Bioreactor-Based Cultivation

- 5.5.1 Batch bioreactors

- 5.5.2 Continuous flow systems

- 5.6 Hybrid Systems

- 5.6.1 Fermentation + extraction

- 5.6.2 Cell culture + flavor infusion

Chapter 6 Market Estimates and Forecast, By Product Format, 2021 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Whole bean lab-grown coffee

- 6.3 Ground lab-grown coffee

- 6.4 Instant lab-grown coffee

- 6.5 Coffee pods/capsules

- 6.6 Liquid concentrates

- 6.7 Coffee extracts

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Retail Packaged Coffee

- 7.2.1 Supermarket shelf products

- 7.2.2 Premium specialty brands

- 7.3 Foodservice & Hospitality

- 7.3.1 Hotel chains

- 7.3.2 Cafes and restaurants

- 7.4 Ready-to-Drink (RTD) Beverages

- 7.4.1 Bottled cold brew

- 7.4.2 Coffee-infused energy drinks

- 7.5 Functional & Nutraceutical Products

- 7.5.1 Coffee with adaptogens

- 7.5.2 Coffee with added protein or collagen

- 7.6 Industrial Ingredient Use

- 7.6.1 Flavoring agents

- 7.6.2 Bakery and confectionery inputs

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 E-commerce Platforms

- 8.2.1 Brand-owned websites

- 8.2.2 Online marketplaces (e.g., Amazon)

- 8.3 Supermarkets & Hypermarkets

- 8.3.1 Mass retail chains

- 8.3.2 Organic/natural food stores

- 8.4 Convenience stores

- 8.4.1 Urban outlets

- 8.4.2 Petrol station stores

- 8.5 Specialty coffee shops

- 8.5.1 Third-wave cafes

- 8.5.2 Boutique roasters

- 8.6 Direct-to-Consumer (D2C) Subscriptions

- 8.6.1 Monthly coffee boxes

- 8.6.2 Custom roast subscriptions

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Amatera

- 10.2 Atomo Coffee

- 10.3 Coffeesai (Pluri Biotech) - Israel

- 10.4 Compound Foods

- 10.5 Food Brewer

- 10.6 Minus Coffee

- 10.7 Northern Wonder

- 10.8 Planting Costa Rica

- 10.9 Prefer

- 10.10 Voyage Foods