|

市場調查報告書

商品編碼

1871084

重組蛋白食品配料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Recombinant Protein Food Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

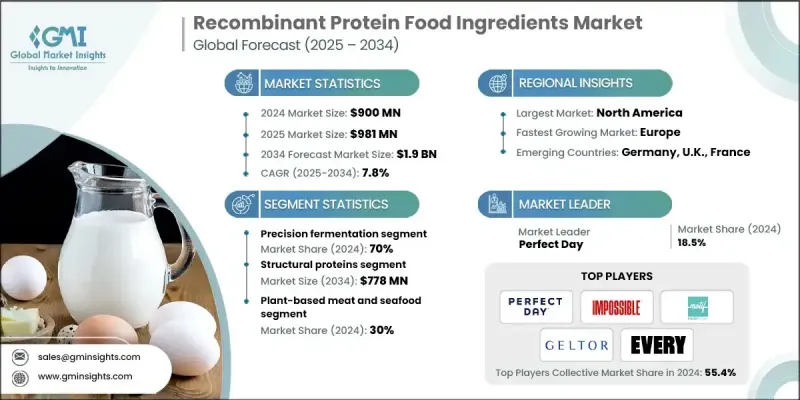

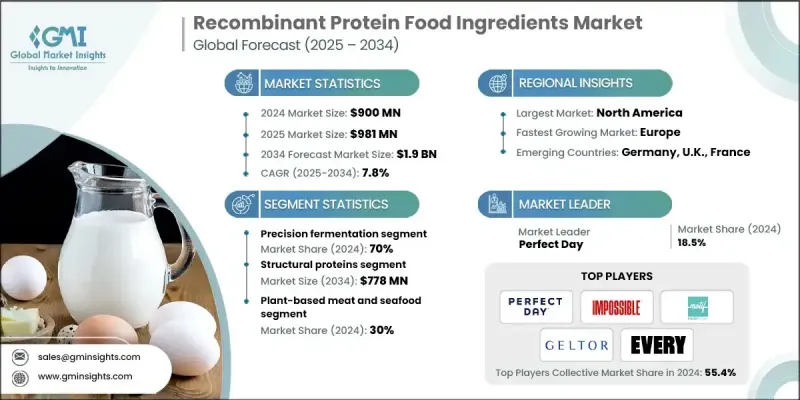

2024 年全球重組蛋白食品配料市場價值為 9 億美元,預計到 2034 年將以 7.8% 的複合年成長率成長至 19 億美元。

隨著生物技術的進步和消費者對永續和功能性食品日益成長的需求重塑食品創新格局,該行業正迅速擴張。慢性病發病率的上升和對個人化營養的日益重視是推動市場需求的關鍵因素。製造商正在提升合成生物學、菌株工程和精準發酵的能力,以開發能夠複煞車物源蛋白的質地、營養成分和感官特性的蛋白質。這項進展使得大規模生產成為可能,重組蛋白從實驗室概念轉變為乳製品、肉類和飲料等應用領域的商業配料。永續性已成為這一發展進程的核心,生產商正致力於循環和低碳生產過程。諸如氣體發酵和農業副產品利用等新技術正在降低碳排放強度,並有可能實現碳負排放蛋白的生產。這些永續發展措施符合全球脫碳和ESG目標,吸引了優先考慮環境責任的投資者。對環保生產方式的日益重視也增強了消費者的信任,並有助於獲得全球監管機構的批准。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9億美元 |

| 預測值 | 19億美元 |

| 複合年成長率 | 7.8% |

預計到2024年,精準發酵技術將佔70%的市場。此技術利用基因工程改造的微生物生產高純度、高穩定性的蛋白質,這些蛋白質與動物性蛋白質高度相似。由於其可擴展性、合規性和成本效益,精準發酵已成為行業標準,並支持乳製品、雞蛋和肉類替代品的大規模生產。

2024年,結構蛋白市佔率佔40%,預計到2034年將達到7.78億美元。這些蛋白質在食品配方中發揮著至關重要的作用,尤其是在植物肉、起司和烘焙食品等領域,它們賦予食物結構、穩定性和結合力。產業合作加速了生產進程,使得各種替代食品領域所需的關鍵蛋白質成分能夠大規模生產。

2024年北美重組蛋白食品配料市場規模為3.79億美元,預計2034年將以8%的複合年成長率成長。該地區受益於強大的生物技術生態系統、美國食品藥物管理局(FDA)在GRAS框架下提供的有利監管路徑、不斷成長的風險投資以及消費者對永續蛋白替代品日益增強的認知。此外,合作計畫和資助計畫也持續推動北美地區重組蛋白配料的生產和商業化。

全球重組蛋白食品配料市場的主要參與者包括帝斯曼-菲美意(DSM-Firmenich)、Geltor Inc.、Perfect Day Inc.、EVERY Company、Kerry Group plc、奇華頓(Givaudan SA)、Motif FoodWorks Inc.、諾維信(Novozymes A/S)、科漢森控股(Ihr)、A.a. Hansen(Novozymes A/S)、科漢森控股(I.3.H Foods)。這些公司正採取策略措施擴大市場佔有率並提升競爭力。各公司大力投資研發,以最佳化蛋白質設計、提高生產效率,並透過精準發酵實現更好的規模化生產。與食品製造商和生技公司進行策略合作、建立夥伴關係和成立合資企業,有助於加速新型蛋白質的商業化進程。此外,各公司也正在擴大全球生產能力,並進軍新的區域市場,以滿足不斷成長的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 消費者對永續蛋白質替代品的需求不斷成長

- 精準發酵規模化技術的進步

- 監理核准加速商業市場准入

- 產業陷阱與挑戰

- 商業規模化生產需要高額的資本投資。

- 消費者對新型蛋白質成分的接受障礙

- 市場機遇

- 在植物性食品領域不斷拓展應用

- 政府支持替代蛋白創新

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 透過蛋白質功能

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 未來展望與機遇

- 市場預測摘要(2025-2034)

- 新興市場機遇

- 技術路線圖與創新管道

- 投資機會與風險評估

- 市場准入策略建議

- 未來市場情境分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依生產技術分類,2021-2034年

- 主要趨勢

- 精準發酵

- 生質能發酵

- 無細胞系統

- 混合型和新興型

第6章:市場估算與預測,蛋白質功能,2021-2034年

- 主要趨勢

- 結構蛋白

- 酪蛋白和乳清蛋白

- 膠原蛋白和明膠

- 雞蛋蛋白

- 功能性酵素

- 轉谷氨醯胺酶

- 脂肪酶和蛋白酶

- 澱粉酶和纖維素酶

- 感覺增強蛋白

- 血紅素蛋白

- 風味活性胜肽

- 營養蛋白

- 乳鐵蛋白和免疫球蛋白

- 生物活性胜肽

- 單細胞蛋白

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 植物肉和海鮮

- 乳製品替代品及類似物

- 飲料和功能飲料

- 烘焙食品、糖果和零食

- 直接工業應用

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Chr. Hansen Holding A/S

- DSM-Firmenich

- Geltor Inc.

- Givaudan SA

- Impossible Foods Inc.

- Kerry Group plc

- Motif FoodWorks Inc.

- Novozymes A/S

- Perfect Day Inc.

- The EVERY Company

The Global Recombinant Protein Food Ingredients Market was valued at USD 900 million in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 1.9 Billion by 2034.

The industry is expanding rapidly as advancements in biotechnology and the growing consumer preference for sustainable and functional foods reshape the food innovation landscape. Rising incidences of chronic illnesses and the growing emphasis on personalized nutrition are key drivers fueling market demand. Manufacturers are enhancing the capabilities of synthetic biology, strain engineering, and precision fermentation to develop proteins that replicate the texture, nutritional profile, and sensory characteristics of animal-derived proteins. This progress is enabling large-scale production, transforming recombinant proteins from laboratory concepts to commercial ingredients in dairy, meat, and beverage applications. Sustainability has become central to this evolution, with producers focusing on circular and low-carbon manufacturing processes. Novel technologies such as gas fermentation and the use of agricultural byproducts are reducing carbon intensity, potentially leading to carbon-negative protein production. These sustainable developments align with global decarbonization and ESG goals, attracting investors who prioritize environmental responsibility. The growing emphasis on eco-friendly production methods also strengthens consumer trust and global regulatory approval.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $900 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 7.8% |

The precision fermentation segment held a 70% share in 2024, as this method utilizes engineered microorganisms to produce highly pure and consistent proteins that closely resemble animal proteins. This approach has become the industry standard due to its scalability, regulatory compliance, and cost-efficiency, supporting mass production for dairy, egg, and meat substitute applications.

The structural proteins segment held a 40% share in 2024 and is projected to reach USD 778 million by 2034. These proteins play a crucial role in providing structure, stability, and binding properties in food formulations, particularly within plant-based meat, cheese, and bakery applications. Industrial partnerships have accelerated the production process, enabling large-scale manufacturing of key protein ingredients used across alternative food segments.

North America Recombinant Protein Food Ingredients Market was valued at USD 379 million in 2024 and is expected to grow at a CAGR of 8% through 2034. The region benefits from a robust biotechnology ecosystem, favorable FDA regulatory pathways under the GRAS framework, increasing venture capital investments, and rising consumer awareness of sustainable protein alternatives. Additionally, collaborative initiatives and funding programs continue to strengthen the production and commercialization of recombinant protein ingredients across North America.

Leading companies in the Global Recombinant Protein Food Ingredients Market include DSM-Firmenich, Geltor Inc., Perfect Day Inc., The EVERY Company, Kerry Group plc, Givaudan SA, Motif FoodWorks Inc., Novozymes A/S, Chr. Hansen Holding A/S and Impossible Foods Inc. are Major players in the Recombinant Protein Food Ingredients Market and are employing strategic measures to expand their market presence and enhance competitiveness. Companies are heavily investing in research and development to optimize protein design, improve production efficiency, and achieve better scalability through precision fermentation. Strategic collaborations, partnerships, and joint ventures with food manufacturers and biotechnology firms are helping accelerate the commercialization of novel proteins. Firms are also expanding their global manufacturing capacities and entering new regional markets to meet rising demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Production technology

- 2.2.3 Protein functionality

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for sustainable protein alternatives

- 3.2.1.2 Technological advancements in precision fermentation scaling

- 3.2.1.3 Regulatory approvals accelerating commercial market entry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment requirements for commercial scale

- 3.2.2.2 Consumer acceptance barriers for novel protein ingredients

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding applications in plant-based food categories

- 3.2.3.2 Government support for alternative protein innovation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By protein functionality

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

- 3.14 Future outlook & opportunities

- 3.15 Market forecast summary (2025-2034)

- 3.15.1 Emerging market opportunities

- 3.15.2 Technology roadmap & innovation pipeline

- 3.15.3 Investment opportunities & risk assessment

- 3.15.4 Strategic recommendations for market entry

- 3.15.5 Future market scenarios analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Production Technology, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Precision fermentation

- 5.3 Biomass fermentation

- 5.4 Cell-free systems

- 5.5 Hybrid & emerging

Chapter 6 Market Estimates and Forecast, Protein Functionality, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Structural proteins

- 6.2.1 Casein & whey proteins

- 6.2.2 Collagen & gelatin

- 6.2.3 Egg proteins

- 6.3 Functional enzymes

- 6.3.1 Transglutaminase

- 6.3.2 Lipases & proteases

- 6.3.3 Amylases & cellulases

- 6.4 Sensory enhancement proteins

- 6.4.1 Heme proteins

- 6.4.2 Flavor-active peptides

- 6.5 Nutritional proteins

- 6.5.1 Lactoferrin & immunoglobulins

- 6.5.2 Bioactive peptides

- 6.5.3 Single-cell proteins

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Plant-based meat & seafood

- 7.3 Dairy alternatives & analogs

- 7.4 Beverages & functional drinks

- 7.5 Bakery, confectionery & snacks

- 7.6 Direct industrial applications

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Chr. Hansen Holding A/S

- 9.2 DSM-Firmenich

- 9.3 Geltor Inc.

- 9.4 Givaudan SA

- 9.5 Impossible Foods Inc.

- 9.6 Kerry Group plc

- 9.7 Motif FoodWorks Inc.

- 9.8 Novozymes A/S

- 9.9 Perfect Day Inc.

- 9.10 The EVERY Company