|

市場調查報告書

商品編碼

1871081

永續包裝材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Sustainable Packaging Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

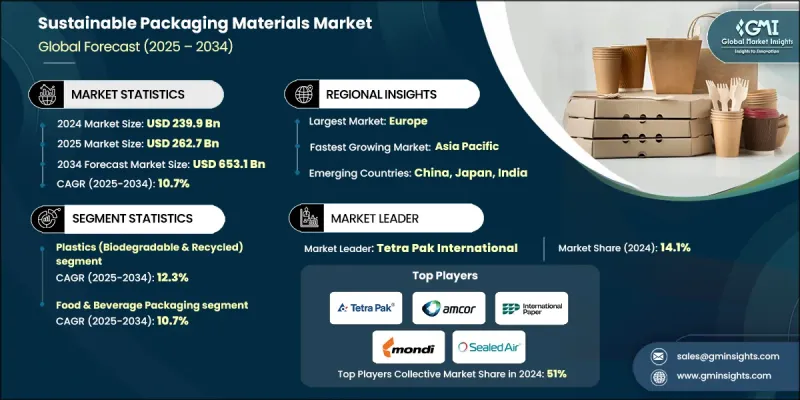

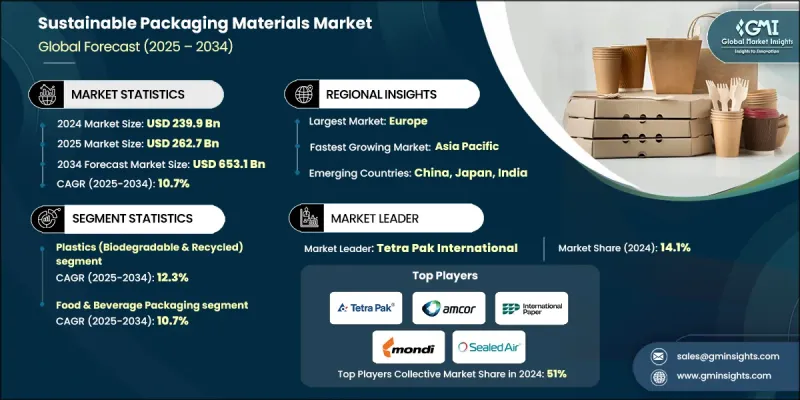

2024年全球永續包裝材料市場價值為2,399億美元,預計到2034年將以10.7%的複合年成長率成長至6,531億美元。

市場成長的主要驅動力是日益嚴格的監管要求和旨在最大限度減少包裝廢棄物的全球永續發展計劃。世界各國政府正在收緊環境政策,並推出諸如生產者延伸責任制(EPR)、禁止使用一次性塑膠以及強制包裝中使用再生材料等措施。這些法規迫使製造商轉向環保合規的包裝解決方案。材料科學的不斷發展也提升了永續材料的性能、可擴展性和經濟性。人工智慧和機器學習在分類技術中的應用最佳化了回收和再利用流程,而生產技術的創新則提高了可生物分解材料的成本效益。生物基和可堆肥材料(包括先進生物塑膠和可再生複合材料)的突破性進展,有助於克服以往在耐久性、強度和價格方面的限制。這些創新為全球各產業快速採用永續包裝替代方案奠定了基礎,使其與環境目標和企業永續發展承諾相契合。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2399億美元 |

| 預測值 | 6531億美元 |

| 複合年成長率 | 10.7% |

2024年,塑膠品類佔34%的市場佔有率,預計2025年至2034年間將以12.3%的複合年成長率成長。此品類涵蓋由可再生資源製成的生物塑膠、再生塑膠包裝以及兼顧永續性和性能的混合複合材料。這些材料需求的成長源自於其在維持傳統塑膠功能特性的同時,也能提供更佳的生命週期末期環境效益。它們在食品包裝、個人護理產品和電商物流包裝等領域的廣泛應用,凸顯了其適應性和重要性,不僅能保障產品安全和消費者便利,還能滿足環保目標。

2024年,食品飲料包裝應用佔了50%的市場佔有率,預計到2034年將以10.7%的複合年成長率成長。這一主導地位源於對能夠確保食品安全、延長保存期限並提升使用體驗的包裝的迫切需求。該行業面臨嚴格的食品接觸和阻隔性能要求,這影響著永續材料的選擇。日益嚴格的監管以及消費者對環保食品包裝的需求,促使製造商不斷創新,研發出既符合安全性又符合永續標準的材料。製造商正積極開發兼具環保性和功能性的包裝方案,以減少對環境的影響。

2024年,美國永續包裝材料市場規模達531億美元,預計2034年將達到1,402億美元。這一成長主要得益於各州強力的監管、企業永續發展舉措的加強以及消費者環保意識的提高。該地區擁有完善的回收基礎設施和強大的永續材料創新生態系統,並受益於此。持續的技術進步和不斷擴展的循環經濟項目也進一步推動了北美市場的成長。

全球永續包裝材料市場的主要企業包括斯道拉恩索公司 (Stora Enso Oyj)、日本製紙工業株式會社 (Nippon Paper Industries)、安姆科公司 (Amcor plc)、希悅爾公司 (Sealed Air Corporation)、索諾科產品公司 (Sonoco Products Company)、DS Smith plc、利樂國際公司 (Tetraak)和國際紙業公司 (International Paper Company)。這些領先企業正致力於創新、合作和循環經濟舉措,以增強其競爭優勢。許多企業正在加大研發投入,以開發符合監管和環境標準的高性能可生物分解、可回收和可堆肥材料。與消費品牌和回收技術公司的策略合作有助於拓展永續供應鏈和閉迴路系統。此外,企業也採取輕量化策略,以減少材料用量並提高成本效益。擴大全球生產能力和改善回收基礎設施整合進一步增強了規模化生產能力。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依材料類型分類,2021-2034年

- 主要趨勢

- 生物基聚合物

- 聚乳酸(PLA)

- 聚羥基脂肪酸酯(PHAs)

- 生物基聚乙烯

- 澱粉基材料

- 蛋白質包裝

- 再生材料

- 可堆肥和可生物分解材料

- 纖維基永續材料

- 混合及複合材料

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 食品飲料包裝

- 個人護理及化妝品包裝

- 電子商務及運輸包裝

- 工業及B2B包裝

- 醫療保健和藥品包裝

第7章:市場規模及預測:依最終用途產業分類,2021-2034年

- 食品飲料業

- 食品加工公司

- 飲料製造商

- 餐飲連鎖店

- 零售和雜貨連鎖店

- 消費品及零售

- 快速消費品

- 電子商務零售商

- 專業零售連鎖店

- 醫療保健與製藥

- 製藥公司

- 醫療器材製造商

- 醫療保健提供者

- 工業與製造業

- 汽車產業

- 電子與技術

- 化學與材料產業

- 農業與園藝

- 農產品包裝

- 種子和肥料包裝

- 園藝應用

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Tetra Pak International

- Amcor plc

- International Paper Company

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- DS Smith plc

- Stora Enso Oyj

- Nippon Paper Industries

- Krones AG

- Schott AG

- Crown Holdings

- Pregis Corporation

- Novoloop

- Ecovative Design

- Paboco

- Footprint

- Notpla

The Global Sustainable Packaging Materials Market was valued at USD 239.9 Billion in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 653.1 Billion by 2034.

Market growth is propelled primarily by escalating regulatory mandates and global sustainability initiatives aimed at minimizing packaging waste. Governments across the world are tightening environmental policies and introducing measures such as extended producer responsibility (EPR), bans on single-use plastics, and mandatory recycled content in packaging. These regulations are compelling manufacturers to transition toward eco-friendly and compliant packaging solutions. The ongoing evolution of material science is also enhancing the performance, scalability, and affordability of sustainable materials. Integration of artificial intelligence and machine learning in sorting technologies is optimizing recycling and recovery processes, while innovations in production techniques are improving the cost efficiency of biodegradable materials. Breakthroughs in bio-based and compostable materials, including advanced bioplastics and renewable composites, are helping overcome previous limitations related to durability, strength, and pricing. These innovations are setting the stage for the rapid adoption of sustainable packaging alternatives across global industries, aligning with both environmental goals and corporate sustainability commitments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $239.9 Billion |

| Forecast Value | $653.1 Billion |

| CAGR | 10.7% |

The plastics segment held a 34% share in 2024 and is projected to grow at a CAGR of 12.3% during 2025-2034. This category encompasses bioplastics made from renewable resources, recycled plastic packaging, and hybrid composites that balance sustainability with performance. The growing demand for these materials is driven by their ability to match the functional properties of traditional plastics while offering enhanced end-of-life environmental benefits. Their widespread use across food packaging, personal care products, and e-commerce shipping materials underscores their adaptability and importance in maintaining product safety and consumer convenience while meeting environmental objectives.

The food & beverage packaging application held a 50% share in 2024 and is forecasted to grow at a CAGR of 10.7% through 2034. This dominance stems from the critical need for packaging that ensures food safety, preserves shelf life, and enhances usability. The sector faces stringent food contact and barrier property requirements, which influence the choice of sustainable materials. Growing regulatory oversight and consumer demand for environmentally friendly food packaging have encouraged continuous innovation in materials that meet both safety and sustainability standards. Manufacturers are actively developing eco-efficient packaging options that maintain quality and functionality while reducing environmental impact.

United States Sustainable Packaging Materials Market reached USD 53.1 Billion in 2024 and is projected to reach USD 140.2 Billion by 2034, driven by robust state-level regulations, heightened corporate sustainability initiatives, and increasing consumer awareness regarding environmental issues. The region benefits from a well-developed recycling infrastructure and a strong ecosystem for innovation in sustainable materials. Continuous technological advancements and expanding circular economy programs are further supporting market growth across North America.

Key companies operating in the Global Sustainable Packaging Materials Market include Stora Enso Oyj, Nippon Paper Industries, Amcor plc, Sealed Air Corporation, Sonoco Products Company, DS Smith plc, Tetra Pak International, Krones AG, Mondi Group, and International Paper Company. Leading companies in the Sustainable Packaging Materials Market are focusing on innovation, collaboration, and circular economy initiatives to strengthen their competitive edge. Many are increasing R&D investments to develop high-performance biodegradable, recyclable, and compostable materials that meet regulatory and environmental standards. Strategic partnerships with consumer brands and recycling technology firms are helping expand sustainable supply chains and closed-loop systems. Companies are also adopting lightweighting strategies to reduce material use and enhance cost efficiency. Expanding global manufacturing capacities and improving recycling infrastructure integration are further supporting scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material Type

- 2.2.2 Application

- 2.2.3 End Use Industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Bio-based polymers

- 5.2.1 Polylactic acid (PLA)

- 5.2.2 Polyhydroxyalkanoates (PHAs)

- 5.2.3 Bio-based polyethylene

- 5.2.4 Starch-based materials

- 5.2.5 Protein-based packaging

- 5.3 Recycled content materials

- 5.4 Compostable & biodegradable materials

- 5.5 Fiber-based sustainable materials

- 5.6 Hybrid & composite materials

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage packaging

- 6.3 Personal care & cosmetics packaging

- 6.4 E-commerce & shipping packaging

- 6.5 Industrial & B2B packaging

- 6.6 Healthcare & pharmaceutical packaging

Chapter 7 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Food & beverage industry

- 7.1.1 Food processing companies

- 7.1.2 Beverage manufacturers

- 7.1.3 Restaurant & foodservice chains

- 7.1.4 Retail & grocery chains

- 7.2 Consumer goods & retail

- 7.2.1 Fast-moving consumer goods

- 7.2.2 E-commerce retailers

- 7.2.3 Specialty retail chains

- 7.3 Healthcare & pharmaceuticals

- 7.3.1 Pharmaceutical companies

- 7.3.2 Medical device manufacturers

- 7.3.3 Healthcare providers

- 7.4 Industrial & manufacturing

- 7.4.1 Automotive industry

- 7.4.2 Electronics & technology

- 7.4.3 Chemical & materials industry

- 7.5 Agriculture & horticulture

- 7.5.1 Agricultural product packaging

- 7.5.2 Seed & fertilizer packaging

- 7.5.3 Horticultural applications

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Tetra Pak International

- 9.2 Amcor plc

- 9.3 International Paper Company

- 9.4 Mondi Group

- 9.5 Sealed Air Corporation

- 9.6 Sonoco Products Company

- 9.7 DS Smith plc

- 9.8 Stora Enso Oyj

- 9.9 Nippon Paper Industries

- 9.10 Krones AG

- 9.11 Schott AG

- 9.12 Crown Holdings

- 9.13 Pregis Corporation

- 9.14 Novoloop

- 9.15 Ecovative Design

- 9.16 Paboco

- 9.17 Footprint

- 9.18 Notpla