|

市場調查報告書

商品編碼

1871073

用於 3D 生物列印的水凝膠市場機會、成長促進因素、產業趨勢分析及 2025-2034 年預測Hydrogels for 3D Bioprinting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

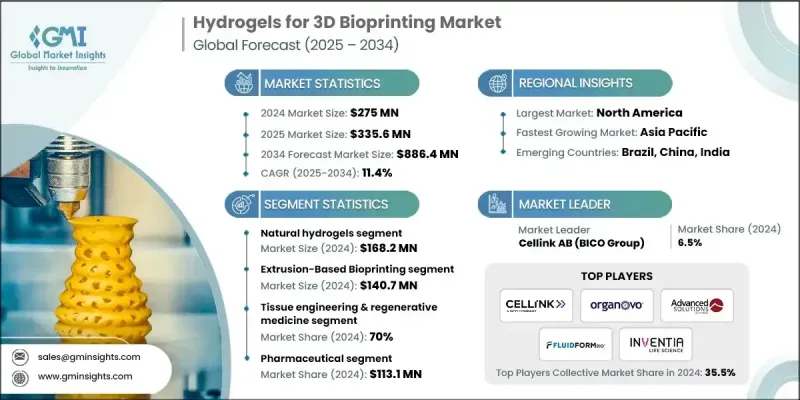

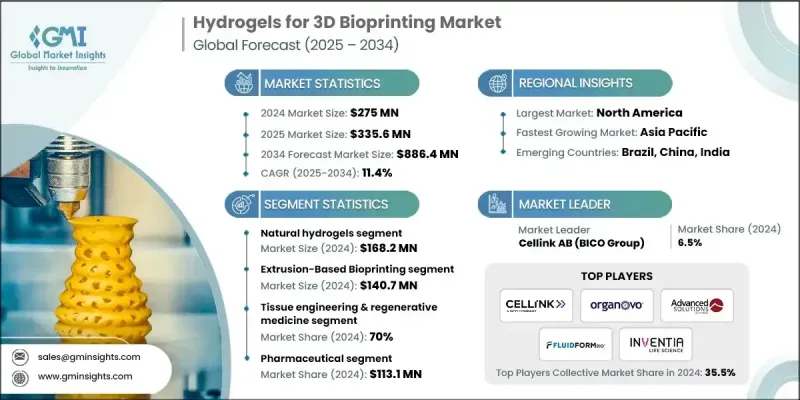

2024 年全球 3D 生物列印水凝膠市場價值為 2.75 億美元,預計到 2034 年將以 11.4% 的複合年成長率成長至 8.864 億美元。

水凝膠是一種生物相容性好、富含水分的材料,可用作3D生物列印中的生物墨水,用於建構支持活細胞的複雜生物結構。這些水凝膠模擬天然組織環境,能夠保持水分和營養,從而促進列印後細胞的存活和生長。其柔軟的凝膠狀特性使其能夠利用生物印表機進行精確塑形和分層,從而建構用於藥物測試、再生醫學或醫學研究的組織。對組織工程、器官再生和個人化醫療日益成長的需求正在推動市場擴張。生物列印技術的不斷進步,以及生物技術和醫療保健行業不斷成長的投資,正在拓展水凝膠基生物墨水的潛力。擠出和雷射輔助生物列印技術的進步提高了細胞定位和組織構建的精度,而改進的交聯工藝(例如紫外線和離子鍵合)則使列印的水凝膠能夠保持結構並確保高細胞活力。不斷增加的研發合作和3D生物列印技術的持續發展正在進一步加速全球市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.75億美元 |

| 預測值 | 8.864億美元 |

| 複合年成長率 | 11.4% |

2024年,天然水凝膠市場規模預計將達到1.682億美元。其快速成長主要得益於其良好的生物相容性及與人體天然細胞外環境的相似性。這些水凝膠能夠為細胞黏附、增殖和分化等功能提供強力的支持,使其成為再生醫學和組織重建應用的理想選擇。與合成替代品相比,天然水凝膠與生物系統的相容性使其更具優勢,從而促進了其在生物工程研究和臨床應用中的廣泛應用。

2024年,基於擠出技術的生物列印市場規模預計將達到1.407億美元。該技術因其能夠利用多種生物墨水列印高度精細且穩定的組織結構而備受關注。它成本低廉、操作簡便,適用於製造用於組織和器官重建等的厚實複雜的生物模型。儘管擠出技術仍是主流方法,但基於液滴和雷射輔助列印技術也因其在製造精細生物結構和藥物測試模型方面的精準性而日益受到重視。這些列印技術的共同作用,正在提升水凝膠基生物列印系統在醫療和研究領域的通用性和可擴展性。

2024年,美國用於3D生物列印的水凝膠市場規模達9,930萬美元。美國擁有強大的生物技術基礎、先進的研究基礎設施,並在再生醫學和3D列印技術領域投入巨資,為其市場發展提供了有利條件。北美市場的優勢也體現在製藥公司、大學和新創公司之間的積極合作,這些合作致力於提升水凝膠的性能,以提高其精確度和生物相容性。監管支援的不斷加強和對個人化醫療解決方案需求的日益成長,預計將推動整個地區水凝膠生物列印技術的應用。

全球3D生物列印水凝膠市場的主要企業包括Cellink AB(BICO集團)、Biomason Inc.、REGENHU、Nanoscribe、FluidForm Bio、Organovo Inc.、Advanced Solutions、Lifecore Biomedical、Nordmark、Manchester BIOGEL、Aspect Biosystems、TissueLabs、RevkissueLabs Ltd. Biomedical、Mimixbio、杭州美卓生物科技有限公司、Cellntec、Inventia Life Science Pty Ltd、ViscoTec / Puredyne和XPECT INX。為了鞏固在3D生物列印水凝膠市場的地位,各公司正積極推行以創新、合作和擴張為核心的策略。主要企業正大力投資研發,以提升水凝膠的生物功能性、可列印性和交聯效率。生物技術公司、學術機構和醫療機構之間的合作正被充分利用,以開發下一代生物墨水和可擴展的生物列印平台。各公司也在擴大產能,並專注於客製化水凝膠配方,以滿足組織特異性應用日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對個人化醫療的需求日益成長

- 先進交聯技術的整合

- 再生醫學應用範圍的擴大

- 多材料生物列印技術的發展

- 產業陷阱與挑戰

- 列印過程中保持細胞活力

- 機械強度有限

- 市場機遇

- 智慧水凝膠的開發

- 生物技術與醫療保健之間的合作

- 拓展至藥物檢測及化妝品領域

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依技術類型

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依水凝膠類型分類,2021-2034年

- 主要趨勢

- 天然水凝膠

- 基於藻酸鹽的系統

- 膠原蛋白和明膠系統

- 透明質酸基系統

- 基於纖維蛋白的系統

- 基於殼聚醣的系統

- 基於瓊脂糖的系統

- 去細胞ECM系統

- 合成水凝膠

- 基於PEG的系統

- PEG-PCL三嵌段共聚物

- 聚氨酯基體系

- PLA和PCL系統

- 基於聚乙烯醇(PVA)的系統

- 混合系統

- 天然-合成複合材料

- 多材料系統

- 增強型水凝膠網路

第6章:市場估算與預測:依生物技術印刷產業分類,2021-2034年

- 主要趨勢

- 基於擠出的生物列印

- 氣動擠出系統

- 機械擠壓系統

- 同軸擠壓系統

- 多材料擠出

- 基於液滴的生物列印

- 噴墨生物列印

- 按需投放系統

- 基於微閥的系統

- 雷射輔助生物列印

- 雷射誘導前向轉移

- 基質輔助脈衝雷射蒸發

- 吸收膜輔助雷射誘導前向轉移

- 立體光刻和光基方法

- 立體光刻(SLA)

- 數位光處理(DLP)

- 雙光子聚合

- 體積生物列印

- 新興技術

- 聲學

- 磁的

- 電液動力學

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 組織工程與再生醫學

- 心血管組織工程

- 神經組織工程

- 皮膚和傷口癒合應用

- 骨與軟骨工程

- 肝組織工程

- 腎臟組織工程

- 肺組織工程

- 藥物輸送系統

- 受控釋放平台

- 標靶藥物遞送

- 個人化藥物檢測

- 緩釋系統

- 疾病建模與藥物發現

- 器官晶片系統

- 癌症研究模型

- 疾病病理模型

- 毒性測試平台

- 生物感測器與診斷

- 植入式生物感測器

- 穿戴式感測器系統

- 即時診斷

- 其他

- 化妝品測試

- 食品與農業

- 環境應用

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 製藥

- 大的

- 專業

- 合約研究機構

- 生物技術

- 組織工程

- 細胞療法

- 再生醫學

- 學術和研究機構

- 大學和研究中心

- 政府研究機構

- 非營利研究機構

- 臨床和醫療保健提供者

- 醫院和醫療中心

- 專科診所

- 外科中心

- 其他

- 合約製造

- 材料供應商

- 技術平台

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- 3DBio Therapeutics

- Advanced Solutions

- Aspect Biosystems

- Cellink AB (BICO Group)

- Cellntec

- FluidForm Bio

- Hangzhou Meizhuo Biotechnology Co. Ltd

- Inventia Life Science Pty Ltd

- Lifecore Biomedical

- Manchester BIOGEL

- Mimixbio

- Nanoscribe

- Nordmark

- Organovo Inc.

- REGENHU

- Revotek Co. Ltd

- Rousselot Biomedical

- TissueLabs

- ViscoTec / Puredyne

- XPECT INX

The Global Hydrogels for 3D Bioprinting Market was valued at USD 275 million in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 886.4 million by 2034.

Hydrogels are biocompatible, water-rich materials used as bioinks in 3D bioprinting to create complex biological structures that support living cells. These hydrogels mimic the natural tissue environment, retaining moisture and nutrients that promote cell survival and growth after printing. Their soft, gel-like nature allows them to be precisely shaped and layered using bioprinters to form tissues for drug testing, regenerative medicine, or medical research. Increasing demand for tissue engineering, organ regeneration, and personalized medicine is fueling the market's expansion. The ongoing progress in bioprinting technologies, coupled with growing investments from the biotechnology and healthcare industries, is broadening the potential of hydrogel-based bioinks. Developments in extrusion and laser-assisted bioprinting are enhancing accuracy in cell placement and tissue fabrication, while improved crosslinking processes, such as UV and ionic bonding, allow printed hydrogels to maintain structure and ensure high cell viability. Rising R&D collaborations and the continuous evolution of 3D bioprinting techniques are further accelerating market growth globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $275 Million |

| Forecast Value | $886.4 Million |

| CAGR | 11.4% |

The natural hydrogels segment generated USD 168.2 million in 2024. Their rapid growth is driven by their biocompatibility and resemblance to the body's natural extracellular environment. These hydrogels provide strong support for cellular functions such as adhesion, proliferation, and differentiation, which makes them ideal for applications in regenerative medicine and tissue reconstruction. Their compatibility with living systems gives them an advantage over synthetic alternatives, contributing to their growing use in bioengineering research and clinical applications.

The extrusion-based bioprinting segment reached USD 140.7 million in 2024. This technique is gaining traction for its ability to print highly detailed, stable tissue structures using a wide range of bioinks. It is cost-effective, user-friendly, and suitable for producing thick, complex biological models such as those used for tissue and organ reconstruction. While extrusion remains the dominant approach, droplet-based and laser-assisted printing technologies are also gaining attention for their precision in fabricating delicate biological structures and drug-testing models. Together, these printing techniques are enhancing the versatility and scalability of hydrogel-based bioprinting systems across medical and research fields.

U.S. Hydrogels for 3D Bioprinting Market accounted for USD 99.3 million in 2024. The country benefits from a strong biotechnology base, advanced research infrastructure, and major investments in regenerative medicine and 3D printing technologies. North America's market strength is further reinforced by active collaborations between pharmaceutical firms, universities, and startups focused on improving hydrogel properties for greater precision and biocompatibility. Increasing regulatory support and rising demand for personalized medical solutions are expected to drive the adoption of hydrogel-based bioprinting technologies throughout the region.

Key companies in the Global Hydrogels for 3D Bioprinting Market include Cellink AB (BICO Group), Biomason Inc., REGENHU, Nanoscribe, FluidForm Bio, Organovo Inc., Advanced Solutions, Lifecore Biomedical, Nordmark, Manchester BIOGEL, Aspect Biosystems, TissueLabs, Revotek Co. Ltd, 3DBio Therapeutics, Rousselot Biomedical, Mimixbio, Hangzhou Meizhuo Biotechnology Co. Ltd, Cellntec, Inventia Life Science Pty Ltd, ViscoTec / Puredyne, and XPECT INX. To strengthen their foothold in the Hydrogels for 3D Bioprinting Market, companies are pursuing strategies focused on innovation, collaboration, and expansion. Major players are investing heavily in R&D to enhance the biofunctionality, printability, and crosslinking efficiency of hydrogels. Partnerships between biotechnology firms, academic institutions, and healthcare organizations are being leveraged to develop next-generation bioinks and scalable bioprinting platforms. Firms are also expanding production capacities and focusing on customized hydrogel formulations to meet the growing demand for tissue-specific applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Hydrogel type

- 2.2.3 Bioprinting technology

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized medicine

- 3.2.1.2 Integration of advanced crosslinking techniques

- 3.2.1.3 Expansion of regenerative medicine applications

- 3.2.1.4 Development of multi-material bioprinting

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Maintaining cell viability during printing

- 3.2.2.2 Limited mechanical strength

- 3.2.3 Market opportunities

- 3.2.3.1 Development of smart hydrogels

- 3.2.3.2 Collaboration between biotech and healthcare

- 3.2.3.3 Expansion into Drug Testing and Cosmetics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Hydrogel Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Natural hydrogels

- 5.2.1 Alginate-based systems

- 5.2.2 Collagen & gelatin systems

- 5.2.3 Hyaluronic acid-based systems

- 5.2.4 Fibrin-based systems

- 5.2.5 Chitosan-based systems

- 5.2.6 Agarose-based systems

- 5.2.7 Decellularized ECM systems

- 5.3 Synthetic hydrogel

- 5.3.1 PEG-based systems

- 5.3.2 PEG-PCL triblock copolymers

- 5.3.3 Polyurethane-based systems

- 5.3.4 PLA & PCL systems

- 5.3.5 PVA-based systems

- 5.4 Hybrid systems

- 5.4.1 Natural-synthetic composites

- 5.4.2 Multi-material systems

- 5.4.3 Reinforced hydrogel networks

Chapter 6 Market Estimates and Forecast, By Biotechnology Printing, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrusion-based bioprinting

- 6.2.1 Pneumatic extrusion systems

- 6.2.2 Mechanical extrusion systems

- 6.2.3 Coaxial extrusion systems

- 6.2.4 Multi-material extrusion

- 6.3 Droplet-based bioprinting

- 6.3.1 Inkjet bioprinting

- 6.3.2 Drop-on-demand systems

- 6.3.3 Microvalve-based systems

- 6.4 Laser-assisted bioprinting

- 6.4.1 Laser-induced forward transfer

- 6.4.2 Matrix-assisted pulsed laser evaporation

- 6.4.3 Absorbing film-assisted laser-induced forward transfer

- 6.5 Stereolithography & light-based methods

- 6.5.1 Stereolithography (SLA)

- 6.5.2 Digital Light Processing (DLP)

- 6.5.3 Two-photon polymerization

- 6.5.4 Volumetric bioprinting

- 6.6 Emerging technologies

- 6.6.1 Acoustic

- 6.6.2 Magnetic

- 6.6.3 Electrohydrodynamic

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tissue engineering & regenerative medicine

- 7.2.1 Cardiovascular tissue engineering

- 7.2.2 Neural tissue engineering

- 7.2.3 Skin & wound healing applications

- 7.2.4 Bone & cartilage engineering

- 7.2.5 Liver tissue engineering

- 7.2.6 Kidney tissue engineering

- 7.2.7 Lung tissue engineering

- 7.3 Drug delivery systems

- 7.3.1 Controlled release platforms

- 7.3.2 Targeted drug delivery

- 7.3.3 Personalized drug testing

- 7.3.4 Sustained release systems

- 7.4 Disease modeling & drug discovery

- 7.4.1 Organ-on-chip systems

- 7.4.2 Cancer research models

- 7.4.3 Disease pathology models

- 7.4.4 Toxicity testing platforms

- 7.5 Biosensors & diagnostics

- 7.5.1 Implantable biosensors

- 7.5.2 Wearable sensor systems

- 7.5.3 Point-of-care diagnostics

- 7.6 Other

- 7.6.1 Cosmetics testing

- 7.6.2 Food & agriculture

- 7.6.3 Environmental applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Pharmaceutical

- 8.1.1 Large

- 8.1.2 Specialty

- 8.1.3 Contract research organizations

- 8.2 Biotechnology

- 8.2.1 Tissue engineering

- 8.2.2 Cell therapy

- 8.2.3 Regenerative medicine

- 8.3 Academic & research institutions

- 8.3.1 Universities & research centers

- 8.3.2 Government research institutes

- 8.3.3 Non-profit research organizations

- 8.4 Clinical & healthcare providers

- 8.4.1 Hospitals & medical centers

- 8.4.2 Specialized clinics

- 8.4.3 Surgical centers

- 8.5 Other

- 8.5.1 Contract manufacturing

- 8.5.2 Material suppliers

- 8.5.3 Technology platform

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 3DBio Therapeutics

- 10.2 Advanced Solutions

- 10.3 Aspect Biosystems

- 10.4 Cellink AB (BICO Group)

- 10.5 Cellntec

- 10.6 FluidForm Bio

- 10.7 Hangzhou Meizhuo Biotechnology Co. Ltd

- 10.8 Inventia Life Science Pty Ltd

- 10.9 Lifecore Biomedical

- 10.10 Manchester BIOGEL

- 10.11 Mimixbio

- 10.12 Nanoscribe

- 10.13 Nordmark

- 10.14 Organovo Inc.

- 10.15 REGENHU

- 10.16 Revotek Co. Ltd

- 10.17 Rousselot Biomedical

- 10.18 TissueLabs

- 10.19 ViscoTec / Puredyne

- 10.20 XPECT INX