|

市場調查報告書

商品編碼

1858982

數位療法市場機會、成長促進因素、產業趨勢分析及預測(2024-2032年)Digital Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

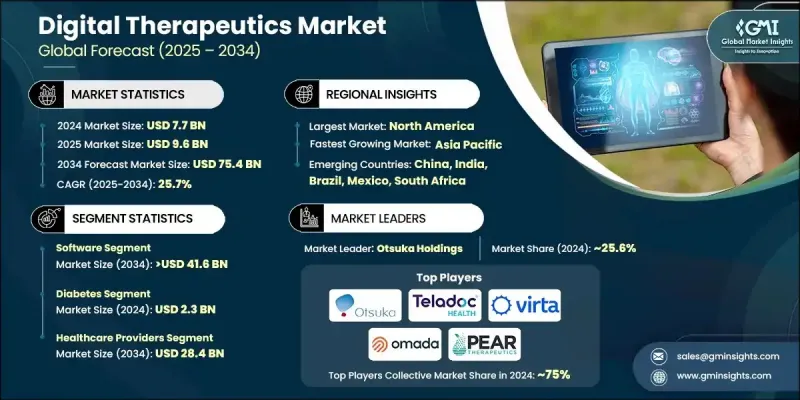

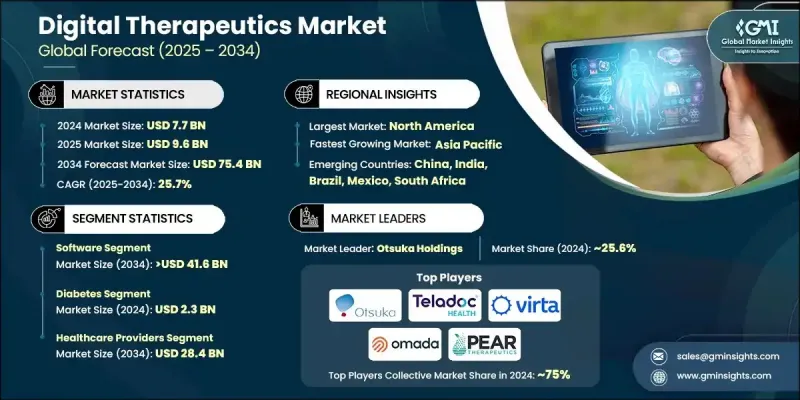

2024 年全球數位療法市場價值為 77 億美元,預計到 2034 年將以 25.7% 的複合年成長率成長至 754 億美元。

全球慢性疾病(例如心血管疾病、糖尿病和精神健康問題)盛行率的不斷上升推動了數位療法的發展。這些持續存在的醫療保健挑戰正在推動對數位療法的需求,數位療法能夠提供經濟高效、可擴展且個人化的治療方案。這些軟體驅動的醫療干預措施正日益與人工智慧、穿戴式裝置、遊戲化和行為健康工具相結合,從而提高患者的依從性、治療效果和參與度。這些工具既可獨立使用,也可與傳統療法合併使用,正逐漸成為現代醫療保健的基石。隨著醫療服務提供者和患者越來越尋求靈活且非侵入性的解決方案,數位療法的吸引力持續成長。它們能夠在降低整體醫療成本的同時,提供經臨床驗證的療效,這使得它們對雇主、保險公司和公共衛生系統尤其具有吸引力。支付方的支持力度不斷加大,以及主要市場監管機構的認可度不斷提高,正在進一步加速從代謝疾病到精神健康等各個治療領域的數位療法的開發和應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 77億美元 |

| 預測值 | 754億美元 |

| 複合年成長率 | 25.7% |

2024年,軟體領域佔據54.3%的市場佔有率,預計到2034年將達到416億美元,複合年成長率達25.9%。該領域涵蓋本地部署和雲端平台,能夠基於用戶資料、行為趨勢和人工智慧驅動的演算法,提供量身定做的治療干預措施。這些解決方案不僅有助於養成良好習慣和管理慢性疾病,而且由於其可擴展性和在智慧型手機、電腦和平板電腦等數位設備上的可訪問性,也得到了廣泛應用。日益便捷的存取方式和遠端持續照護能力,使得基於軟體的數位療法成為預防和持續治療框架中的首選模式。

2024年,糖尿病領域市場規模預計將達23億美元。包括第1型糖尿病、第2型糖尿病和懷孕期糖尿病在內的所有類型糖尿病發病率的不斷上升,促使人們對能夠實現即時監測和永續生活方式改變的工具的需求日益成長。數位療法提供個人化干預措施,包括行為指導、血糖追蹤、用藥提醒和基於分析的洞察,使其成為長期糖尿病護理計劃的關鍵組成部分。隨著患者對數位療法在代謝健康管理中作用的認知不斷提高,以及臨床對數位療法的認可度不斷提升,該領域將繼續受益。

預計到2024年,北美數位療法市場將佔據58.1%的佔有率。該地區強大的醫療保健基礎設施、慢性病患病率的不斷上升以及有利的監管環境正在推動數位療法的普及。在美國和加拿大,越來越多的雇主將數位療法平台納入員工健康管理策略,以改善員工健康並降低保險支出。此外,廣泛的報銷機制和強大的技術應用也促進了數位療法融入主流臨床和健康管理系統。

全球數位療法市場的主要參與者包括Teladoc Health、Virta Health、LifeScan、Hyfe、Omada Health、Akili Interactive、Pear Therapeutics、Orexo、Otsuka Holdings、Click Therapeutics、Propeller Health(ResMed)和AmerisourceBergen。為了鞏固市場地位,數位療法公司正致力於與支付方、製藥公司和醫療保健系統建立策略合作夥伴關係,以擴大覆蓋範圍並確保醫療保險報銷。許多公司正在拓展全球分銷網路,以滲透新興市場,同時大力投資研發,利用人工智慧、機器學習和即時病患監測等技術增強平台功能。法規核准仍是重中之重,各公司正與監管機構密切合作,以加快核准速度。與電子健康記錄和遠距醫療平台的整合是另一個核心關注點,旨在提高互通性和患者參與度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 慢性病盛行率不斷上升

- 對成本控制的需求日益成長

- 擴大醫療服務品質

- 數位療法的日益普及

- 產業陷阱與挑戰

- 資料安全和隱私問題

- 缺乏熟練的IT專業人員

- 市場機遇

- 預防性和價值導向醫療的趨勢日益增強

- 聯合療法模式的擴展

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 軟體

- 現場

- 基於雲端的

- 硬體

- 穿戴式裝置

- 感測器和監控設備

- 其他設備

- 服務

- 諮詢與整合

- 培訓和教育

- 其他服務

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 糖尿病

- 肥胖

- 心血管

- 心理健康和行為健康

- 高血壓

- 失眠

- 其他應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫療保健提供者

- 醫院

- 診所

- 遠距醫療平台

- 付款人

- 患者

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AmerisourceBergen

- Akili Interactive

- Click Therapeutics

- Hyfe

- LifeScan

- Omada Health

- Orexo

- Otsuka Holdings

- Pear Therapeutics

- Propeller Health (ResMed)

- Teladoc Health

- Virta Health

The Global Digital Therapeutics Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 25.7% to reach USD 75.4 billion by 2034.

The growth is fueled by the rising global prevalence of chronic illnesses such as cardiovascular diseases, diabetes, and mental health conditions. These ongoing healthcare challenges are driving demand for digital therapeutics, which deliver cost-efficient, scalable, and personalized treatment alternatives. These software-driven medical interventions are increasingly integrated with artificial intelligence, wearables, gamification, and behavioral health tools that improve adherence, patient outcomes, and engagement. Designed to work either independently or in conjunction with traditional treatments, these tools are becoming a cornerstone of modern healthcare. As providers and patients increasingly seek flexible and non-invasive solutions, the appeal of digital therapeutics continues to grow. Their ability to deliver clinically proven outcomes while reducing overall care costs makes them particularly attractive to employers, insurers, and public health systems. Growing support from payers and expanded regulatory acceptance across major markets are further accelerating development and deployment across therapeutic areas, from metabolic conditions to mental wellness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $75.4 Billion |

| CAGR | 25.7% |

The software segment held a 54.3% share in 2024 and is anticipated to reach USD 41.6 billion by 2034, growing at a CAGR of 25.9%. This segment includes both on-premise and cloud-based platforms that enable tailored therapeutic interventions based on user data, behavioral trends, and AI-driven algorithms. These solutions not only promote habit formation and chronic disease management but are also widely adopted due to their scalability and accessibility across digital devices such as smartphones, computers, and tablets. The growing ease of access and ability to deliver continuous care remotely make software-based digital therapeutics a preferred model in preventive and ongoing treatment frameworks.

The diabetes segment generated USD 2.3 billion in 2024. Increasing rates of all forms of diabetes, Type 1, Type 2, and gestational, are contributing to rising demand for tools that enable real-time monitoring and sustainable lifestyle changes. Digital therapeutics provide tailored interventions, including behavioral coaching, glucose tracking, medication reminders, and analytics-based insights, positioning them as key components in long-term diabetes care plans. This segment continues to benefit from growing patient awareness and clinical recognition of DTx in metabolic health management.

North America Digital Therapeutics Market held 58.1% share in 2024. The region's strong healthcare infrastructure, rising prevalence of chronic conditions, and favorable regulatory landscape are boosting adoption. In the U.S. and Canada, employers are increasingly including DTx platforms in workplace wellness strategies to enhance employee health outcomes and reduce insurance expenditures. Additionally, widespread reimbursement availability and robust technology adoption are supporting the integration of DTx into mainstream clinical and wellness environments.

Key players in the Global Digital Therapeutics Market are Teladoc Health, Virta Health, LifeScan, Hyfe, Omada Health, Akili Interactive, Pear Therapeutics, Orexo, Otsuka Holdings, Click Therapeutics, Propeller Health (ResMed), and AmerisourceBergen. To strengthen their presence, digital therapeutics companies are focusing on strategic partnerships with payers, pharmaceutical firms, and healthcare systems to broaden reach and ensure reimbursement coverage. Many are expanding their global distribution networks to penetrate emerging markets while investing heavily in R&D to enhance platform functionality using AI, machine learning, and real-time patient monitoring. Regulatory approvals remain a priority, with companies working closely with agencies to gain faster clearances. Integration with electronic health records and telehealth platforms is another core focus, aimed at improving interoperability and patient engagement.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disease

- 3.2.1.2 Rising demand for cost containment

- 3.2.1.3 Expansion of quality-of-care delivery

- 3.2.1.4 Growing popularity of digital therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data security and privacy concerns

- 3.2.2.2 Lack of skilled IT professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing shift toward preventive and value-based care

- 3.2.3.2 Expansion of combination therapy models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 On-premises

- 5.2.2 Cloud-based

- 5.3 Hardware

- 5.3.1 Wearable devices

- 5.3.2 Sensors and monitoring devices

- 5.3.3 Other devices

- 5.4 Services

- 5.4.1 Consulting and integration

- 5.4.2 Training and education

- 5.4.3 Other services

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetes

- 6.3 Obesity

- 6.4 Cardiovascular

- 6.5 Mental & behavior health

- 6.6 Hypertension

- 6.7 Insomnia

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Healthcare providers

- 7.2.1 Hospitals

- 7.2.2 Clinics

- 7.2.3 Telehealth platforms

- 7.3 Payers

- 7.4 Patients

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AmerisourceBergen

- 9.2 Akili Interactive

- 9.3 Click Therapeutics

- 9.4 Hyfe

- 9.5 LifeScan

- 9.6 Omada Health

- 9.7 Orexo

- 9.8 Otsuka Holdings

- 9.9 Pear Therapeutics

- 9.10 Propeller Health (ResMed)

- 9.11 Teladoc Health

- 9.12 Virta Health