|

市場調查報告書

商品編碼

1858969

醫療保健3D列印市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Healthcare 3D Printing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

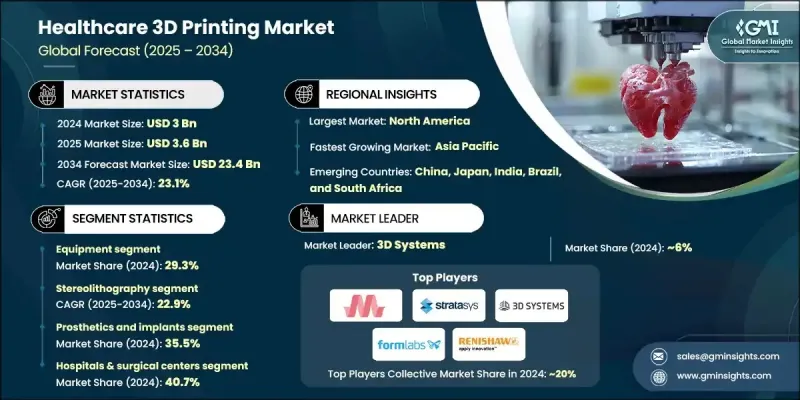

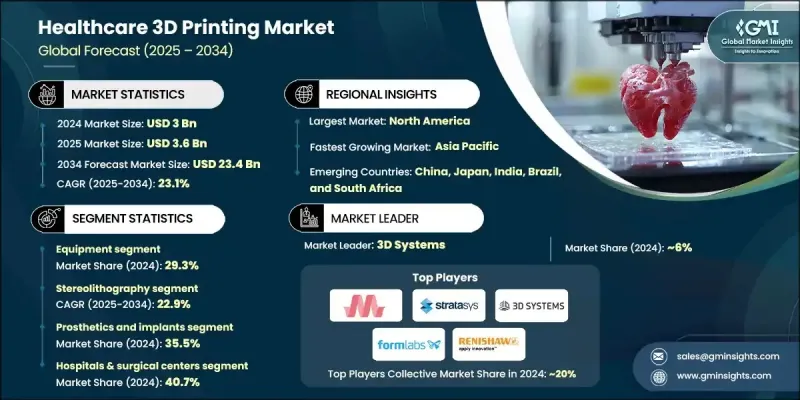

2024 年全球醫療保健 3D 列印市場價值為 30 億美元,預計到 2034 年將以 23.1% 的複合年成長率成長至 234 億美元。

3D列印技術的快速成長得益於對個人化醫療解決方案日益成長的需求、研發投入的增加以及臨床應用範圍的不斷擴大。隨著醫療保健系統向更加以患者為中心、精準化的方向發展,3D列印在外科手術規劃、義肢製造和再生醫學等領域持續發揮著至關重要的作用。人口老化加劇,加上生物列印和植入物客製化技術的進步,加速了對高效、精準且經濟實惠的技術的需求。醫療機構和學術中心紛紛建立內部3D列印實驗室,以縮短回應時間並提升病患照護水準。這些舉措反映了整個行業正在朝著整合數位設計和積層製造技術以改善診斷和治療效果的方向發展。隨著人們對3D列印解決方案在醫療保健領域價值的認知不斷提高,醫院、實驗室和專科護理機構的採用率也在不斷上升,進一步鞏固了3D列印市場的上升趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 234億美元 |

| 複合年成長率 | 23.1% |

典型的醫療3D列印設備包括一台3D列印機或生物列印機、專用設計軟體以及醫用安全材料,例如金屬、聚合物或水凝膠。這些系統可以將CT或MRI掃描的影像資料轉化為精確的實體模型或病患客製化的醫療器械,從而實現高度個人化的醫療干預。

2024年,設備領域佔據了29.3%的市場佔有率,這主要得益於醫療機構中先進3D列印機的日益普及。醫院和實驗室正擴大採用這項技術,在院內生產個人化工具、解剖模型和植入物,從而顯著縮短等待時間並改善手術計劃。即時製造的趨勢正在加速發展,設備已成為醫療保健3D列印領域的核心支柱。隨著人們越來越關注個人化護理和營運效率,對可靠、高性能設備的需求預計將持續成長。

預計到2034年,立體光刻(SLA)領域將以22.9%的複合年成長率成長。 SLA以其高解析度輸出和卓越的精確度而備受青睞,使其成為製造複雜醫療結構的理想選擇。其應用範圍涵蓋牙科修復體、患者客製化導板和解剖模型等多個領域,使其成為精準、精細醫療列印的首選技術。

預計到2024年,北美醫療保健3D列印市場佔有率將達到42%。該地區的成長得益於先進的醫療基礎設施、對創新技術的早期應用以及對醫學研究的持續投入。製造商、醫療服務提供者和監管機構之間緊密協作的生態系統,使北美成為醫療保健領域3D列印技術發展的熱點地區。美國和加拿大的醫院正在積極採用這項技術,用於客製化病患植入物、手術建模和義肢設計。

塑造全球醫療保健3D列印市場格局的關鍵企業包括:formLabs、OPM、nanoscribe、PROTOLABS、3D Systems、stratasys、Axial3D、ExOne、EOS、RENISHAW、materialise、ETEC 和 KONICA MINOLTA。這些企業正致力於策略性研發投資,以提高材料的生物相容性、列印速度和解析度。許多企業正在拓展產品組合,涵蓋軟體、服務解決方案和生物列印功能。與醫院、研究中心和大學的合作有助於加速創新並擴展臨床應用。一些企業也正在建立區域性合作夥伴關係,以加強分銷管道並改善即時3D列印服務的可及性。客製化是重點關注領域,企業提供針對植入物、手術規劃和牙科應用的客製化解決方案。監管合規和認證仍然是重中之重,確保產品能夠安全地應用於醫療環境。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 對客製化植入物的需求不斷成長

- 製造商和機構增加研發投入

- 拓展臨床應用

- 技術進步

- 產業陷阱與挑戰

- 缺乏熟練的專業人員

- 3D列印的高成本

- 市場機遇

- 新興市場採用率不斷上升

- 人工智慧與仿真整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 目前技術

- 新興技術

- 未來市場趨勢

- 消費者行為分析

- 管道分析

- 投資環境

- 創業場景

- 2024年定價分析

- 波特的分析

- PESTEL 分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 裝置

- 3D印表機

- 3D生物列印機

- 材料

- 塑膠

- 熱塑性塑膠

- 光敏聚合物

- 金屬和金屬合金

- 生物材料

- 陶瓷

- 紙

- 蠟

- 其他材料

- 塑膠

- 服務和軟體

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 立體光刻技術

- 熔融沈積成型(FDM)

- 選擇性雷射燒結(SLS)

- 金屬印刷

- 其他技術

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 義肢和植體

- 牙科

- 生物列印

- 組織和器官的生成

- 其他應用

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和外科中心

- 牙醫診所

- 醫療器材製造商

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 3D Systems

- Axial3D

- eos

- ETEC

- ExOne

- formlabs

- KONICA MINOLTA

- materialise

- nanoscribe

- OPM

- PROTOLABS

- RENISHAW

- stratasys

The Global Healthcare 3D Printing Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 23.1% to reach USD 23.4 billion by 2034.

The rapid growth is fueled by increasing demand for personalized medical solutions, rising investments in research and development, and the growing range of clinical uses. As healthcare systems shift toward more patient-specific and precision-driven approaches, 3D printing continues to play a critical role across surgical planning, prosthetics, and regenerative medicine. The growing elderly population, coupled with advancements in bioprinting and implant customization, is accelerating the need for efficient, accurate, and cost-effective technologies. Healthcare institutions and academic centers are setting up in-house 3D printing labs, improving response times, and enhancing patient care. These efforts reflect a larger industry movement toward integrating digital design and additive manufacturing for improved diagnostics and treatment outcomes. As awareness increases around the value of 3D printed solutions in the healthcare setting, adoption is rising across hospitals, labs, and specialized care facilities, further solidifying the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 23.1% |

A typical healthcare 3D printing setup includes a 3D printer or bioprinter, dedicated software for design, and medically safe materials such as metals, polymers, or hydrogels. These systems transform imaging data from CT or MRI scans into precise physical models or patient-specific medical devices, allowing for highly tailored healthcare interventions.

In 2024, the equipment segment held a 29.3% share, driven by the growing installation of sophisticated 3D printers across healthcare settings. Hospitals and labs are increasingly adopting this technology to produce personalized tools, anatomical models, and implants in-house, significantly reducing wait times and improving surgical planning. The trend of point-of-care manufacturing is gaining momentum, positioning equipment as a central pillar in the healthcare 3D printing landscape. As the focus continues to shift toward personalized care and operational efficiency, demand for reliable and high-performance equipment is expected to grow consistently.

The stereolithography (SLA) segment is expected to grow at a CAGR of 22.9% through 2034. SLA is favored for its high-resolution output and exceptional accuracy, making it ideal for creating complex medical structures. Its use spans across multiple applications such as dental prosthetics, patient-specific guides, and anatomical models, making it the go-to technology for precise, detailed medical printing.

North America Healthcare 3D Printing Market held a 42% share in 2024. The region's growth is supported by advanced healthcare infrastructure, early adoption of innovative technologies, and consistent funding for medical research. A well-integrated ecosystem involving manufacturers, healthcare providers, and regulatory agencies makes North America a hotspot for 3D printing advancements in healthcare. Hospitals across the U.S. and Canada are embracing this technology for patient-specific implants, surgical modeling, and prosthetic design.

Key players shaping the Global Healthcare 3D Printing Market include: formLabs, OPM, nanoscribe, PROTOLABS, 3D Systems, stratasys, Axial3D, ExOne, EOS, RENISHAW, materialise, ETEC, and KONICA MINOLTA. Companies operating in the Healthcare 3D Printing Market are focusing on strategic R&D investments to improve material biocompatibility, print speed, and resolution. Many are expanding their product portfolios to include software, service solutions, and bioprinting capabilities. Collaborations with hospitals, research centers, and universities help to accelerate innovation and broaden clinical applications. Several players are also building region-specific partnerships to strengthen their distribution channels and improve access to point-of-care 3D printing. Customization is a major focus, with firms offering tailored solutions for implants, surgical planning, and dental applications. Regulatory compliance and certifications remain a priority, ensuring safe integration into medical settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for custom implants

- 3.2.1.2 Increasing R&D investments from manufacturers and institutions

- 3.2.1.3 Extending clinical applications

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 High price associated with 3D printing

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption in emerging markets

- 3.2.3.2 AI & simulation integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Pipeline analysis

- 3.9 Investment landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Equipment

- 5.2.1 3D printers

- 5.2.2 3D bioprinters

- 5.3 Materials

- 5.3.1 Plastics

- 5.3.1.1 Thermoplastics

- 5.3.1.2 Photopolymers

- 5.3.2 Metals and metal alloys

- 5.3.3 Biomaterials

- 5.3.4 Ceramics

- 5.3.5 Paper

- 5.3.6 Wax

- 5.3.7 Other materials

- 5.3.1 Plastics

- 5.4 Services & software

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stereolithography

- 6.3 Fused deposition modelling (FDM)

- 6.4 Selective laser sintering (SLS)

- 6.5 Metal printing

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prosthetics and implants

- 7.3 Dental

- 7.4 Bioprinting

- 7.5 Tissue and organ generation

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & surgical centers

- 8.3 Dental clinics

- 8.4 Medical device manufacturers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3D Systems

- 10.2 Axial3D

- 10.3 eos

- 10.4 ETEC

- 10.5 ExOne

- 10.6 formlabs

- 10.7 KONICA MINOLTA

- 10.8 materialise

- 10.9 nanoscribe

- 10.10 OPM

- 10.11 PROTOLABS

- 10.12 RENISHAW

- 10.13 stratasys