|

市場調查報告書

商品編碼

1858862

汽車玻璃用電致變色材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Electrochromic Materials for Automotive Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

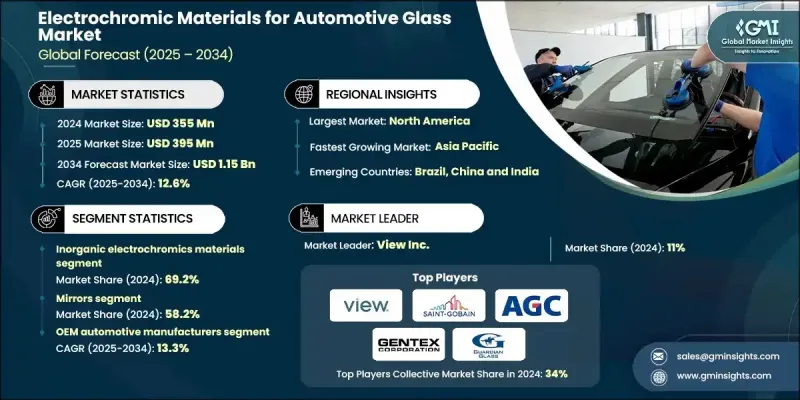

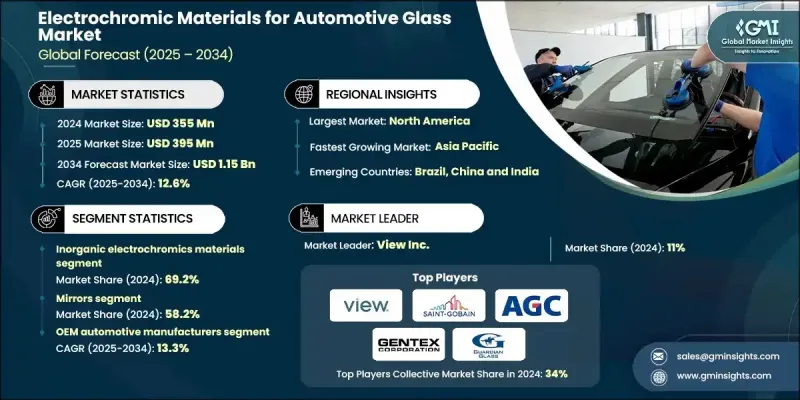

2024 年全球汽車玻璃用電致變色材料市場價值為 3.55 億美元,預計到 2034 年將以 12.6% 的複合年成長率成長至 11.5 億美元。

隨著汽車製造商日益重視智慧、節能和以使用者為中心的技術,市場正經歷變革。電致變色材料能夠動態控制光線和熱量的傳輸,透過減少眩光和調節車內溫度,直接提升乘客的舒適度。這些材料有助於實現環保目標,減少空調的使用,從而提高傳統汽車的燃油效率,並延長電動車的續航里程。隨著永續發展成為汽車策略的重要組成部分,電致變色玻璃的應用也日益普及。北美目前引領全球市場,這得益於其成熟的汽車創新環境、強勁的電動車和豪華車市場,以及整車製造商與材料科學公司之間的積極合作。該地區良好的研發環境使其成為智慧玻璃整合領域的中心。亞太地區緊隨其後,其發展動力來自不斷成長的城市化進程、收入水平的提高以及對電動出行解決方案需求的急劇成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.55億美元 |

| 預測值 | 11.5億美元 |

| 複合年成長率 | 12.6% |

2024年,無機電致變色材料佔據了69.2%的市場佔有率,預計到2034年將以11%的複合年成長率成長。這些金屬氧化物基材因其優異的耐久性和視覺穩定性而備受青睞。其卓越的性能使其成為全景天窗和側窗等大型汽車表面的理想選擇。製造商正致力於提高開關速度並降低功耗,以滿足混合動力汽車和電動車的能源效率需求。

2024年,後視鏡市佔率達到58.2%,預計到2034年將以9.7%的複合年成長率成長。後視鏡和側視鏡憑藉其成本效益、成熟的市場應用和穩定的性能,繼續保持領先地位。這些零件目前已成為眾多中高階車型的標配,能夠提升駕駛者的視野並自動減少眩光。

2024年,北美汽車玻璃用電致變色材料市佔率達36.1%。該地區受益於消費者對智慧節能汽車功能的強勁需求。北美汽車製造商已積極將電致變色玻璃應用於其車輛平台,整合先進技術,以滿足現代汽車在舒適性、效率和設計方面的追求。

推動全球汽車玻璃電致變色材料市場發展的企業包括:NSG集團(Pilkington)、Pleotint LLC、Guardian Glass、Kinestral Technologies、View Inc.、Smart Glass Country、SAGE Electrochromics Inc.、Research Frontiers Inc.、Vitro Architectural Glass、Gentex Corporation、AGC Inc.、Gen-Gobain Inc.、Genmoics ABin 和 AB。這些企業在汽車玻璃電致變色材料市場競爭中,高度重視創新、策略合作和可擴展的生產能力。主要廠商正投資研發新一代材料配方,以期實現更快的切換速度、更長的使用壽命和更低的能耗。汽車製造商與智慧玻璃開發商之間的合作是將這些材料整合到主流汽車平台的關鍵。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- FMVSS 205 合規性要求

- 電動車市場成長

- 能源效率指令

- 產業陷阱與挑戰

- 高昂的製造成本

- 切換速度限制

- 市場機遇

- 多區域動態控制系統

- 自動駕駛車輛整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依技術類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

(註:貿易統計僅針對重點國家提供)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 無機電致變色

- 有機電致變色

- 固態電解質

- 奈米晶體系統

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 鏡子

- 天窗和全景天窗

- 側窗

- 擋風玻璃

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- OEM汽車製造商

- 售後市場供應商

- 特種車輛製造商

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- View Inc.

- Saint-Gobain

- AGC Inc.

- Gentex Corporation

- Guardian Glass

- NSG Group (Pilkington)

- Guardian Glass

- Vitro Architectural Glass

- SAGE Electrochromics Inc.

- ChromoGenics AB

- Pleotint LLC

- Smart Glass Country

- Kinestral Technologies

- Research Frontiers Inc.

The Global Electrochromic Materials for Automotive Glass Market was valued at USD 355 million in 2024 and is estimated to grow at a CAGR of 12.6 % to reach USD 1.15 billion by 2034.

The market is undergoing transformation as automakers increasingly prioritize intelligent, energy-efficient, and user-centered technologies. Electrochromic materials offer dynamic control over light and heat transmission, directly enhancing passenger comfort by minimizing glare and regulating interior temperature. These materials support environmental goals by reducing the need for air conditioning, leading to improved fuel efficiency in conventional vehicles and extended battery range in EVs. As sustainability becomes integral to automotive strategy, electrochromic glass is seeing heightened adoption. North America currently leads the global market, driven by a mature automotive innovation landscape, strong electric and luxury vehicle adoption, and active collaboration between OEMs and material science firms. The region's favorable R&D environment makes it a stronghold for smart glass integration. Asia-Pacific follows closely, fueled by growing urban development, rising income levels, and a sharp increase in demand for electric mobility solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $355 Million |

| Forecast Value | $1.15 Billion |

| CAGR | 12.6% |

In 2024, the inorganic electrochromic materials held a 69.2% share and will grow at a CAGR of 11% through 2034. These metal oxide-based materials are favored for their excellent durability and visual stability. Their performance makes them ideal for large automotive surfaces like panoramic roofs and side windows. Manufacturers are working to improve switching speed and lower power consumption to align with the efficiency needs of hybrid and electric vehicles.

The mirrors segment held a 58.2% share in 2024 and is projected to grow at a CAGR of 9.7% through 2034. Rear-view and side mirrors continue to lead due to their cost-effectiveness, mature adoption, and consistent performance. These components are now standard in various mid-tier to premium vehicle models, offering enhanced driver visibility and automatic glare reduction.

North America Electrochromic Materials for Automotive Glass Market held a 36.1% share in 2024. The region benefits from strong consumer interest in smart and energy-saving automotive features. OEMs in North America have actively incorporated electrochromic glass into their vehicle platforms, integrating advanced technologies that align with modern comfort, efficiency, and design goals.

The companies driving the Global Electrochromic Materials for Automotive Glass Market include NSG Group (Pilkington), Pleotint LLC, Guardian Glass, Kinestral Technologies, View Inc., Smart Glass Country, SAGE Electrochromics Inc., Research Frontiers Inc., Vitro Architectural Glass, Gentex Corporation, AGC Inc., Saint-Gobain, and ChromoGenics AB. Companies competing in the Electrochromic Materials for Automotive Glass Market are focusing heavily on innovation, strategic partnerships, and scalable production capabilities. Major players are investing in next-gen material formulations that offer faster switching times, longer life cycles, and reduced energy usage. Collaborations between automakers and smart glass developers are key to integrating these materials into mainstream vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 FMVSS 205 compliance requirements

- 3.2.1.2 Electric vehicle market growth

- 3.2.1.3 Energy efficiency mandates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Switching speed limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Multi-zone dynamic control systems

- 3.2.3.2 Autonomous vehicle integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Inorganic electrochromics

- 5.3 Organic electrochromics

- 5.4 Solid-state electrolytes

- 5.5 Nanocrystal systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Mirrors

- 6.3 Sunroofs & moonroofs

- 6.4 Side windows

- 6.5 Windshields

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 OEM automotive manufacturers

- 7.3 Aftermarket suppliers

- 7.4 Specialty vehicle manufacturers

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 View Inc.

- 9.2 Saint-Gobain

- 9.3 AGC Inc.

- 9.4 Gentex Corporation

- 9.5 Guardian Glass

- 9.6 NSG Group (Pilkington)

- 9.7 Guardian Glass

- 9.8 Vitro Architectural Glass

- 9.9 SAGE Electrochromics Inc.

- 9.10 ChromoGenics AB

- 9.11 Pleotint LLC

- 9.12 Smart Glass Country

- 9.13 Kinestral Technologies

- 9.14 Research Frontiers Inc.