|

市場調查報告書

商品編碼

1665387

自動調光鏡市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Auto-Dimming Mirror Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

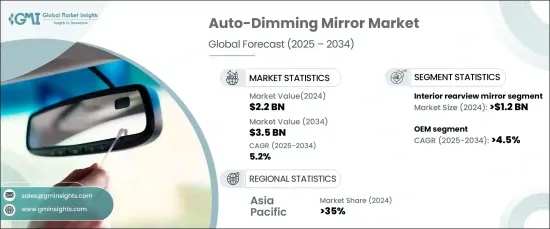

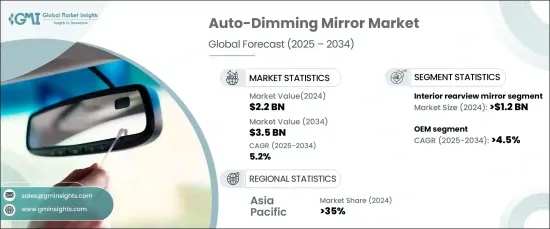

2024 年全球自動調光鏡市場價值為 22 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.2%。隨著汽車製造商尋求透過先進的功能來使其產品與眾不同,向電動車和自動駕駛汽車的轉變進一步推動了自動調光鏡的採用。數位整合和智慧功能的結合將為未來十年市場實現顯著擴張奠定基礎。此外,智慧後視鏡日益普及,透過整合數位顯示器、攝影機和連接等功能來提高安全性和便利性,這是推動需求的關鍵因素。這些鏡子消除了盲點並提供周圍環境的全面視野,確保了更安全的駕駛體驗。

智慧後視鏡領域預計將實現大幅成長,到 2032 年將創造約 150 億美元的收入,年成長率超過 12%。這些鏡子配備了導航支援、即時交通更新和障礙物警報功能,重新定義了超越傳統功能的駕駛體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 35億美元 |

| 複合年成長率 | 5.2% |

市場分為車內後視鏡和車外後視鏡,其中車內部分的價值在 2024 年將超過 12 億美元。整合攝影機、感測器和智慧調光機制等技術的採用繼續推動這一領域的成長。汽車製造商擴大將這些先進的功能融入入門級和中檔汽車中,反映了讓更多消費者能夠使用創新汽車技術的更廣泛趨勢。

市場也按配銷通路進行分類,涵蓋原始設備製造商 (OEM) 和售後市場銷售。在汽車製造商和鏡子製造商之間合作的推動下, OEM領域預計從 2025 年到 2034 年將以超過 4.5% 的複合年成長率成長。這些合作關係實現了自動調光技術與其他車輛系統的無縫整合,包括高級駕駛輔助系統 (ADAS) 和車內監控。雖然由於消費者對車輛升級的需求,售後市場正在成長,但由於新車擴大配備先進的自動調光鏡作為標準功能, OEM通路可能仍將佔據主導地位。

到 2024 年,亞太地區將佔全球市場的 35% 以上,其中,中國汽車和電動車產業的蓬勃發展將起到領導作用。消費者安全意識的不斷增強以及政府推動先進技術的舉措正在推動該地區自動調光後視鏡的廣泛應用。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 組件提供者

- 製造商

- 經銷商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 成本分析

- 自動調光技術與 ADAS 的分析

- 衝擊力

- 成長動力

- 對增強車輛安全功能的需求不斷增加

- 整合技術的智慧後視鏡日益普及

- 自動駕駛汽車市場的成長推動了對先進可視性解決方案的需求

- 嚴格的汽車安全法規

- 產業陷阱與挑戰

- 先進材料和技術帶來的高成本

- 自動調光鏡的製造和整合到各種車型中存在複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 車內後視鏡

- 外後視鏡

第6章:市場估計與預測:依技術,2021 - 2034 年

- 主要趨勢

- 電致變色

- 非電致變色

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 8 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車

第 9 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Autoliv

- Continental

- Delphi

- Faurecia

- Ficosa

- Gentex

- Germid

- Hella

- Ichikoh

- Johnson Controls

- Konview Electronics

- Magna International

- Murakami

- Robert Bosch

- Samvardhana Motherson

- Tokai Rika

- TRW Automotive

- Valeo

- Yazaki

- ZF Friedrichshafen

The Global Auto-Dimming Mirror Market, valued at USD 2.2 billion in 2024, is expected to grow at a CAGR of 5.2% from 2025 to 2034. This growth is largely attributed to the increasing integration of advanced safety technologies in vehicles and the rising demand for enhanced driver comfort. The transition to electric and autonomous vehicles has further fueled the adoption of auto-dimming mirrors as automakers seek to differentiate their offerings with advanced features. The incorporation of digital integration and smart functionalities positions the market for significant expansion in the coming decade. Moreover, the rising popularity of smart rearview mirrors, which improve safety and convenience by integrating features such as digital displays, cameras, and connectivity, is a key factor driving demand. These mirrors eliminate blind spots and provide a comprehensive view of the surroundings, ensuring a safer driving experience.

The smart rearview mirror segment is projected to see substantial growth, generating approximately USD 15 billion in revenue by 2032, with an annual growth rate exceeding 12%. These mirrors, equipped with navigation support, real-time traffic updates, and alerts for obstacles, are redefining the driving experience beyond traditional functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 5.2% |

The market is segmented into interior and exterior rearview mirrors, with the interior segment valued at over USD 1.2 billion in 2024. Interior auto-dimming mirrors play a critical role in ensuring safety and comfort by minimizing glare from headlights, particularly during nighttime driving. The adoption of technologies like integrated cameras, sensors, and smart dimming mechanisms continues to drive the growth of this segment. Automakers are increasingly incorporating these advanced features into entry-level and mid-range vehicles, reflecting the broader trend of making innovative automotive technology accessible to more consumers.

The market is also categorized by distribution channel, encompassing both original equipment manufacturers (OEMs) and aftermarket sales. The OEM segment is expected to grow at a CAGR of over 4.5% from 2025 to 2034, driven by collaborations between automakers and mirror manufacturers. These partnerships enable seamless integration of auto-dimming technologies with other vehicle systems, including advanced driver-assistance systems (ADAS) and in-cabin monitoring. While the aftermarket segment is growing due to consumer demand for vehicle upgrades, the OEM channel is likely to remain dominant as new vehicles increasingly come equipped with advanced auto-dimming mirrors as standard features.

The Asia Pacific region accounted for over 35% of the global market in 2024, led by China's booming automotive and electric vehicle sectors. Growing consumer awareness about safety and government initiatives promoting advanced technologies are driving the widespread adoption of auto-dimming mirrors across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Cost analysis

- 3.8 Analysis of auto-dimming technologies vs. ADAS

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for enhanced vehicle safety features

- 3.9.1.2 Rising adoption of smart rearview mirrors with integrated technologies

- 3.9.1.3 Growth of the autonomous vehicle market driving the need for advanced visibility solutions

- 3.9.1.4 Stringent automotive safety regulations

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs associated with advanced materials and technologies

- 3.9.2.2 Complexity in manufacturing and integrating auto-dimming mirrors into various vehicle models

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Interior rearview mirror

- 5.3 Exterior rearview mirror

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Electro chromatic

- 6.3 Non-electro chromatic

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric vehicles

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Autoliv

- 11.2 Continental

- 11.3 Delphi

- 11.4 Faurecia

- 11.5 Ficosa

- 11.6 Gentex

- 11.7 Germid

- 11.8 Hella

- 11.9 Ichikoh

- 11.10 Johnson Controls

- 11.11 Konview Electronics

- 11.12 Magna International

- 11.13 Murakami

- 11.14 Robert Bosch

- 11.15 Samvardhana Motherson

- 11.16 Tokai Rika

- 11.17 TRW Automotive

- 11.18 Valeo

- 11.19 Yazaki

- 11.20 ZF Friedrichshafen