|

市場調查報告書

商品編碼

1858811

昆蟲蛋白加工設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Insect Protein Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

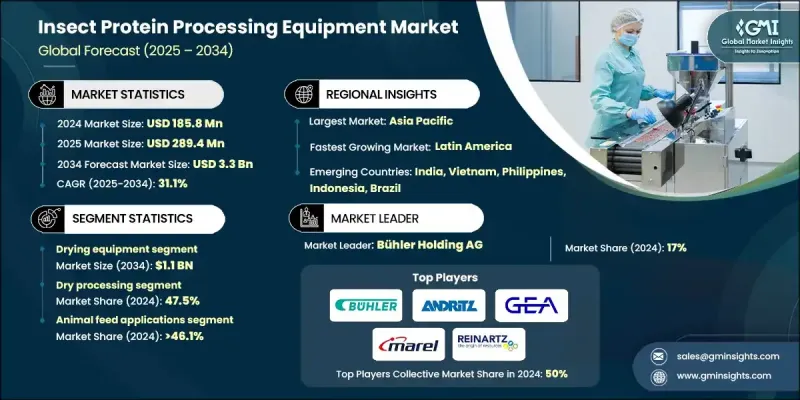

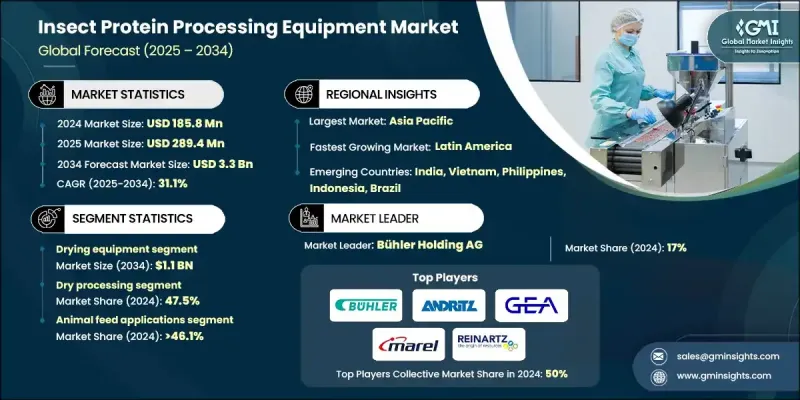

2024 年全球昆蟲蛋白加工設備市場價值為 1.858 億美元,預計到 2034 年將以 31.1% 的複合年成長率成長至 33 億美元。

水產養殖、動物飼料、寵物食品和人類消費等領域的快速擴張,催生了對可擴展、高效昆蟲蛋白加工系統的龐大需求。隨著昆蟲營養品的持續普及,新興新創公司和成熟的農業產業集團都向設備供應商發出了越來越多的訂單。這一成長與農業和食品生產領域更廣泛的永續發展趨勢密切相關。隨著該行業向安全、高產、高品質的昆蟲基原料轉型,先進的加工設備變得至關重要。製造商正在積極回應市場需求,開發能夠提供精準加工、降低能耗並符合嚴格的安全和可追溯性協議的系統,尤其是在日本和歐盟等市場。隨著自動化、人工智慧和能源監控功能被整合到新一代設備中,生產設施正變得更有效率、更永續且經濟可行。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.858億美元 |

| 預測值 | 33億美元 |

| 複合年成長率 | 31.1% |

2024年,乾燥設備市場規模達6,510萬美元,預計2034年將達到11億美元,複合年成長率(CAGR)為31.2%。該市場之所以佔據主導地位,是因為其在保持蛋白質完整性、微生物安全性和延長產品保存期限方面發揮著至關重要的作用。真空乾燥機和冷凍乾燥機因其能夠維持生物活性和蛋白質濃度而備受青睞,尤其是在面向人類營養和高價值應用的產品中。儘管這些系統能耗較高,但它們能夠確保卓越的產品品質和更長的保存期限,因此在營養保健品和食品級昆蟲產品領域得到了越來越廣泛的應用。

2024年,動物飼料應用領域佔46.1%的市場佔有率,仍是最成熟、商業化程度最高的領域。隨著畜牧營養市場大規模採用昆蟲蛋白,飼料生產廠的油提取、研磨和乾燥設備的安裝量持續成長。

2024年,加拿大昆蟲蛋白加工設備市場佔據了顯著佔有率,這主要得益於政府對昆蟲蛋白加工的重點支持。對研發和永續食品體系的投資正在推動全國各地昆蟲蛋白加工廠的擴張。消費者對清潔標章和永續蛋白質來源的需求也加速了人類食用級昆蟲蛋白生產系統的發展,這與美國的趨勢類似。

昆蟲蛋白加工設備市場的主要企業包括GEA集團、布勒控股、安德里茨集團、萊納茨機械製造有限公司和馬瑞爾。這些企業致力於整合智慧自動化、人工智慧監控和節能系統,以提高加工產量和永續性。各公司正在設計模組化系統,這些系統可根據不同的昆蟲種類和規模進行客製化,從而確保大型製造商和新興企業都能靈活選擇合適的解決方案。此外,無溶劑油分離和閉迴路萃取系統也獲得了越來越多的投資,以更好地保留昆蟲油脂和胜肽的營養成分。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依設備類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計

- 主要進口國

- 主要出口國(註:僅提供重點國家的貿易統計)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 乾燥設備

- 皮帶乾燥機和強制通風系統

- 真空乾燥機和冷凍乾燥系統

- 噴霧乾燥器和專用熱力系統

- 研磨和銑削設備

- 錘式粉碎機和衝擊式研磨機

- 錐形磨機及粒度減小

- 專用通訊系統

- 分離和過濾系統

- 離心機和臥螺離心機系統

- 薄膜過濾和超濾

- 振動篩和網狀分離

- 萃取和加工設備

- 蛋白質萃取系統

- 油水分離及脫脂設備

- 溶劑回收純化系統

- 自動化與控制系統

- 製程控制與監控設備

- 品質保證與測試系統

- 可追溯性與資料管理平台

- 其他設備類別

- 包裝和儲存系統

- 消毒和殺菌設備

- 物料搬運和輸送系統

第6章:市場估算與預測:依加工方式分類,2021-2034年

- 主要趨勢

- 乾式加工

- 濕式加工

- 混合處理

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 動物飼料應用

- 水產養殖飼料加工

- 家禽飼料應用

- 寵物食品及特殊飼料

- 畜牧飼料一體化

- 人類食品應用

- 蛋白質粉及原料加工

- 休閒食品和能量棒生產

- 肉類替代品和替代蛋白質加工

- 功能性食品和營養保健品應用

- 工業及其他應用

- 藥物和生物活性化合物萃取

- 化妝品和個人護理應用

- 肥料和糞便處理

- 研究與開發應用

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Alfa Laval AB

- ANDRITZ Group

- Aspire Food Group

- Beta Hatch

- Better Insect Solution

- Buhler Holding AG

- Cricket One

- FarmInsect

- GEA Group Aktiengesellschaft

- Heat and Control Inc.

- Hosokawa Micron BV

- InnovaFeed

- INSPRO SCIENCE

- JBT Corporation

- Key Technology

- Krones AG

- Marel

- Maschinenfabrik Reinartz GmbH & Co. KG

- Protix

- Russell Finex Ltd.

- Tebrio

- Tetra Pak

- The Dupps Company

- Urschel Laboratories

- Ynsect

The Global Insect Protein Processing Equipment Market was valued at USD 185.8 million in 2024 and is estimated to grow at a CAGR of 31.1% to reach USD 3.3 billion by 2034.

Rapid expansion across sectors such as aquaculture, animal feed, pet food, and human consumption is creating significant demand for scalable, efficient insect protein processing systems. Equipment providers are receiving increased orders from both emerging startups and established agro-industrial groups as insect-based nutrition continues gaining ground. This growth closely mirrors broader sustainability trends in agriculture and food production. Advanced processing equipment is becoming essential as the sector shifts toward safe, high-yield, and quality-driven insect-based ingredients. Manufacturers are responding to the need for systems that deliver precision, reduce energy consumption, and comply with strict safety and traceability protocols, particularly in markets such as Japan and the EU. As automation, AI, and energy-monitoring features are integrated into next-gen machines, facilities are becoming more efficient, sustainable, and economically viable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $185.8 Million |

| Forecast Value | $3.3 Billion |

| CAGR | 31.1% |

The drying equipment segment generated USD 65.1 million in 2024 and is projected to reach USD 1.1 billion by 2034, with a CAGR of 31.2%. This segment leads due to its critical function in preserving protein integrity, microbial safety, and overall product shelf life. Vacuum and freeze dryers are seeing high demand for their ability to maintain bioactivity and protein concentration, especially in products targeted for human nutrition and high-value applications. Though energy-intensive, these systems support superior output quality and longer shelf stability, justifying their growing use in nutraceuticals and food-grade insect products.

The animal feed applications segment held 46.1% share in 2024, remaining the most mature and commercialized segment. As livestock nutrition markets adopt insect protein at scale, installations of oil recovery, grinding, and drying equipment in feed manufacturing plants continue to rise.

Canada Insect Protein Processing Equipment Market held a significant share in 2024, driven by the insect protein processing through focused government support. Investments in R&D and sustainable food systems are prompting the expansion of insect protein facilities across the country. Consumer preferences for clean-label and sustainable protein sources are also accelerating the development of human-grade insect protein production systems, like trends seen in the United States.

Leading companies in the Insect Protein Processing Equipment Market include GEA Group AG, Buhler Holding AG, ANDRITZ Group, Maschinenfabrik Reinartz GmbH & Co. KG, and Marel. Key players in the insect protein processing equipment industry are focusing on integrating smart automation, AI-based monitoring, and energy-efficient systems to enhance process yields and sustainability. Companies are designing modular systems that can be tailored for different insects and scale levels, ensuring flexibility for both large manufacturers and emerging players. There is growing investment in solvent-free oil separation and closed-loop extraction systems to preserve nutrient quality in insect-derived oils and peptides.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Processing method

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By equipment type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Drying equipment

- 5.2.1 Belt dryers & forced-air systems

- 5.2.2 Vacuum dryers & freeze drying systems

- 5.2.3 Spray dryers & specialized thermal systems

- 5.3 Grinding & milling equipment

- 5.3.1 Hammer mills & impact grinders

- 5.3.2 Conical mills & particle size reduction

- 5.3.3 Specialized communication systems

- 5.4 Separation & filtration systems

- 5.4.1 Centrifuges & decanter systems

- 5.4.2 Membrane filtration & ultrafiltration

- 5.4.3 Vibratory screens & mesh separation

- 5.5 Extraction & processing equipment

- 5.5.1 Protein extraction systems

- 5.5.2 Oil separation & defatting equipment

- 5.5.3 Solvent recovery & purification systems

- 5.6 Automation & control systems

- 5.6.1 Process control & monitoring equipment

- 5.6.2 Quality assurance & testing systems

- 5.6.3 Traceability & data management platforms

- 5.7 Other equipment categories

- 5.7.1 Packaging & storage systems

- 5.7.2 Sterilization & sanitization equipment

- 5.7.3 Material handling & conveying systems

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 - 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Dry processing

- 6.3 Wet processing

- 6.4 Hybrid processing

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Animal feed applications

- 7.2.1 Aquaculture feed processing

- 7.2.2 Poultry feed applications

- 7.2.3 Pet food & specialty feed

- 7.2.4 Livestock feed integration

- 7.3 Human food applications

- 7.3.1 Protein powder & ingredient processing

- 7.3.2 Snack food & bar manufacturing

- 7.3.3 Meat analog & alternative protein processing

- 7.3.4 Functional food & nutraceutical applications

- 7.4 Industrial & other applications

- 7.4.1 Pharmaceutical & bioactive compound extraction

- 7.4.2 Cosmetic & personal care applications

- 7.4.3 Fertilizer & frass processing

- 7.4.4 Research & development applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Alfa Laval AB

- 9.2 ANDRITZ Group

- 9.3 Aspire Food Group

- 9.4 Beta Hatch

- 9.5 Better Insect Solution

- 9.6 Buhler Holding AG

- 9.7 Cricket One

- 9.8 FarmInsect

- 9.9 GEA Group Aktiengesellschaft

- 9.10 Heat and Control Inc.

- 9.11 Hosokawa Micron B.V.

- 9.12 InnovaFeed

- 9.13 INSPRO SCIENCE

- 9.14 JBT Corporation

- 9.15 Key Technology

- 9.16 Krones AG

- 9.17 Marel

- 9.18 Maschinenfabrik Reinartz GmbH & Co. KG

- 9.19 Protix

- 9.20 Russell Finex Ltd.

- 9.21 Tebrio

- 9.22 Tetra Pak

- 9.23 The Dupps Company

- 9.24 Urschel Laboratories

- 9.25 Ynsect