|

市場調查報告書

商品編碼

1844372

非公路車輛遠端資訊處理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Off-Highway Vehicle Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

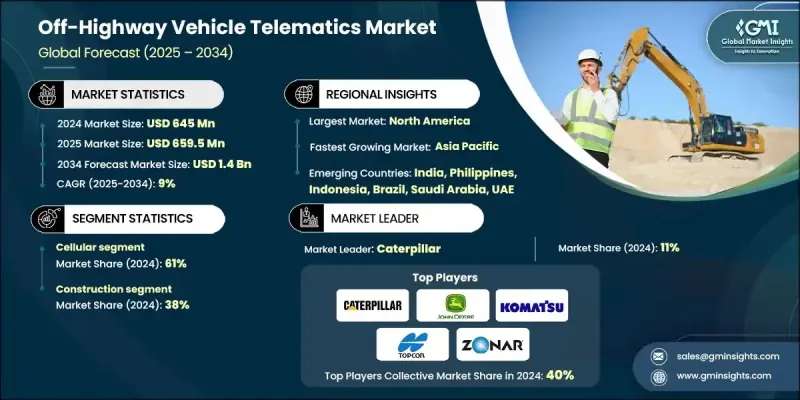

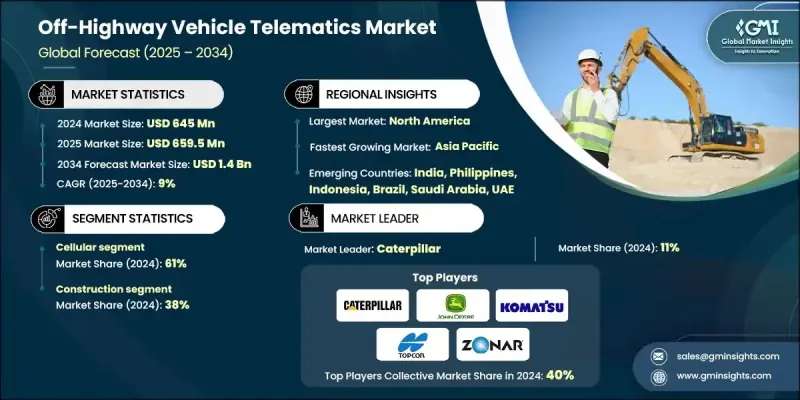

2024 年全球非公路車輛遠端資訊處理市場價值為 6.45 億美元,預計到 2034 年將以 9% 的複合年成長率成長至 14 億美元。

隨著脫碳浪潮的興起以及電動和混合動力非公路設備的應用日益普及,市場正在快速發展。原始設備製造商和營運商正在轉向遠端資訊處理技術,以增強能源管理、延長電池壽命並更好地利用充電網路。這些系統在各個領域發揮著至關重要的作用,能夠實現更智慧的資源配置、減少停機時間並提高機器效率。例如,農業作業受益於支援精準作業的智慧監控系統。整體而言,隨著各行各業向更清潔、數據驅動的營運模式轉型,先進的遠端資訊處理技術正成為不可或缺的基礎設施組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.45億美元 |

| 預測值 | 14億美元 |

| 複合年成長率 | 9% |

疫情顯著加速了非公路用車產業的數位轉型,企業越來越依賴基於雲端的車隊工具、預測性診斷和自動化分析來保持營運順暢。這導致對數位孿生、安全資料環境和遠端營運中心的投資不斷增加。智慧農業、採礦自動化和下一代建築技術的發展,催生了對可擴展、精確且與營運平台深度整合的遠端資訊處理系統的需求。 5G、人工智慧驅動的維護和M2M通訊持續吸引投資,重點在於提高安全性、減少設備閒置時間和提高產量。在監管規定、先進基礎設施和廣泛的OEM合作夥伴關係的支持下,北美和歐洲保持著強勁的市場地位。

2024年,蜂窩網路佔據了61%的市場佔有率,預計到2034年將以8.5%的複合年成長率成長。這些網路對於維持重型機械與集中式車隊管理系統之間的持續連接至關重要。即時存取資產位置、燃油油位、性能指標和服務警報等資料,使操作員能夠更好地控制非公路應用,並提高營運可見度。

建築業在2024年佔據了38%的佔有率,預計到2034年將以7.6%的複合年成長率成長。該行業高度依賴遠端資訊處理來管理在多個工地作業的各種設備,例如推土機、起重機、裝載機和挖掘機。簡化資產管理並保持進度的能力是滿足緊迫期限和預算的關鍵。

美國非公路車輛遠端資訊處理市場佔了85%的市場佔有率,2024年市場規模達2.096億美元。受資產追蹤、安全標準和營運效率提升需求的推動,美國在採礦、建築和農業領域對遠端資訊處理的採用持續強勁成長。基礎設施的增強、數位化就緒度的提升以及企業數位化程度的提高,使得企業更容易在非公路車輛營運中採用和擴展遠端資訊處理技術。

活躍於非公路車輛遠端資訊處理市場的主要公司包括Teletrac Navman、Caterpillar、小松、Zonar Systems、迪爾公司、拓普康公司、日立建機、Orbcomm、Trimble和Trackunit。為了鞏固市場地位,各公司正積極投資研發,以開發模組化、可擴展的遠端資訊處理平台,相容於各種車型和應用。與原始設備製造商(OEM)的合作允許在製造階段進行整合,從而提高系統效率和普及率。此外,各公司正專注於人工智慧和預測分析,以提供更智慧的維護計劃和機器洞察。許多公司也正在擴展其軟體即服務 (SaaS) 產品和資料安全框架,以吸引企業買家。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 供應鏈生態系圖

- 產業衝擊力

- 成長動力

- 快速工業化和基礎設施發展

- 非公路車輛自動化程度的成長

- 越野車輛運行效率的需求不斷增加

- 更重視工人的安全保障

- 產業陷阱與挑戰

- 非公路車輛遠端資訊處理的前期成本高昂

- 準確性和可靠性挑戰

- 市場機會

- 預測性維護需求不斷成長

- 5G與衛星物聯網連接的整合

- 永續性和綠色車隊計劃

- 新興市場的擴張

- 成長動力

- 成長潛力

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利分析

- 數據分析和情報能力

- 機器學習應用評估

- 邊緣運算基礎設施需求

- 即時處理能力

- 預測分析框架

- 數據視覺化和儀表板要求

- 電源管理和連接基礎設施

- 電池和電力系統分析

- 無線通訊可靠性

- 偏遠地區連接解決方案

- 混合通訊系統設計

- 基礎建設投資需求

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

- 成本分解分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 蜂巢

- 衛星

第6章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 車隊管理

- 車輛追蹤

- 燃料管理

- 安全保障

- 其他

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 建造

- 農業

- 礦業

- 林業

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 菲律賓

- 印尼

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- AGCO Corporation

- Caterpillar

- CNH Industrial

- Continental

- Deere & Company

- Komatsu

- Kubota

- Orbcomm

- Teletrac Navman

- Topcon

- Trackunit A/S

- Trimble

- Volvo Group

- Zonar Systems

- 區域參與者

- Atlas Copco

- CLAAS Group

- Doosan Group

- Escorts Limited

- Hitachi Construction Machinery

- Liebherr Group

- Mahindra & Mahindra

- Sandvik

- Volvo Construction Equipment

- Yanmar Holdings

- 新興玩家

- Cartrack Holdings

- Epiroc

- MONTRANS

- Raven Industries

- TTControl

The Global Off-Highway Vehicle Telematics Market was valued at USD 645 million in 2024 and is estimated to grow at a CAGR of 9% to reach USD 1.4 billion by 2034.

The market is evolving rapidly as the push for decarbonization and the adoption of electric and hybrid-powered off-highway equipment intensifies. OEMs and operators are turning to telematics to enhance energy management, extend battery performance, and better utilize charging networks. These systems play a crucial role in various sectors by enabling smarter resource allocation, reducing downtime, and improving machine efficiency. Agricultural operations, for example, benefit from intelligent monitoring systems that support precision activities. Overall, as industries transition toward cleaner, data-driven operations, advanced telematics is becoming an essential infrastructure component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $645 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 9% |

The pandemic significantly accelerated digital transformation in off-highway industries, with companies increasingly relying on cloud-based fleet tools, predictive diagnostics, and automated analytics to keep operations moving. This led to rising investments in digital twins, secure data environments, and remote operations hubs. The growth of smart farming, automation in mining, and next-gen construction technologies has created demand for telematics systems that are scalable, accurate, and deeply integrated with operational platforms. 5G, AI-driven maintenance, and M2M communications continue to attract investment, with a focus on improving safety, reducing idle equipment time, and boosting output. North America and Europe maintain strong market positions, supported by regulatory mandates, advanced infrastructure, and widespread OEM partnerships.

In 2024, the cellular segment held a 61% share and is forecast to grow at a CAGR of 8.5% through 2034. These networks are critical to maintaining constant connectivity between heavy machines and centralized fleet management systems. Real-time access to data such as asset location, fuel levels, performance metrics, and service alerts gives operators more control and operational visibility across off-highway applications.

The construction segment held a 38% share in 2024 and is expected to grow at a CAGR of 7.6% through 2034. The segment relies heavily on telematics to manage diverse fleets of equipment like bulldozers, cranes, loaders, and excavators that operate across multiple job sites. The ability to streamline asset management and maintain schedules is key to meeting tight deadlines and budgets.

United States Off-Highway Vehicle Telematics Market held an 85% share and generated USD 209.6 million in 2024. The U.S. continues to see strong growth in telematics adoption across mining, construction, and agriculture, driven by a need to improve asset tracking, safety standards, and operational efficiency. Enhanced infrastructure, high digital readiness, and increasing enterprise digitalization are making it easier for companies to adopt and scale telematics across off-highway operations.

Key companies active in the Off-Highway Vehicle Telematics Market include Teletrac Navman, Caterpillar, Komatsu, Zonar Systems, Deere & Company, Topcon Corporation, Hitachi Construction Machinery, Orbcomm, Trimble, and Trackunit. To strengthen their market presence, companies are actively investing in R&D to develop modular and scalable telematics platforms compatible across a variety of vehicle types and applications. Collaborations with OEMs allow integration at the manufacturing stage, enhancing system efficiency and adoption. Additionally, players are focusing on AI and predictive analytics to offer smarter maintenance scheduling and machine insights. Many are also expanding their software-as-a-service (SaaS) offerings and data security frameworks to appeal to enterprise buyers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Sales channel

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.7 Supply chain ecosystem mapping

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid industrialization and infrastructure development

- 3.2.1.2 Growth of automation in off-highway vehicles

- 3.2.1.3 Rising need for operational efficiency of OHVs

- 3.2.1.4 Increased focus on the safety and security of workers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs of off-highway vehicle telematics

- 3.2.2.2 Accuracy and reliability challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for predictive maintenance

- 3.2.3.2 Integration of 5G and satellite IoT connectivity

- 3.2.3.3 Sustainability and green fleet initiatives

- 3.2.3.4 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Data analytics & intelligence capabilities

- 3.9.1 Machine learning application assessment

- 3.9.2 Edge computing infrastructure requirements

- 3.9.3 Real-time processing capabilities

- 3.9.4 Predictive analytics framework

- 3.9.5 Data visualization & dashboard requirements

- 3.10 Power management & connectivity infrastructure

- 3.10.1 Battery & power system analysis

- 3.10.2 Wireless communication reliability

- 3.10.3 Remote area connectivity solutions

- 3.10.4 Hybrid communication system design

- 3.10.5 Infrastructure investment requirements

- 3.11 Sustainability & environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Cost-breakdown analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Cellular

- 5.3 Satellite

Chapter 6 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Fleet management

- 7.3 Vehicle tracking

- 7.4 Fuel management

- 7.5 Safety and security

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Agriculture

- 8.4 Mining

- 8.5 Forestry

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Philippines

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AGCO Corporation

- 10.1.2 Caterpillar

- 10.1.3 CNH Industrial

- 10.1.4 Continental

- 10.1.5 Deere & Company

- 10.1.6 Komatsu

- 10.1.7 Kubota

- 10.1.8 Orbcomm

- 10.1.9 Teletrac Navman

- 10.1.10 Topcon

- 10.1.11 Trackunit A/S

- 10.1.12 Trimble

- 10.1.13 Volvo Group

- 10.1.14 Zonar Systems

- 10.2 Regional Players

- 10.2.1 Atlas Copco

- 10.2.2 CLAAS Group

- 10.2.3 Doosan Group

- 10.2.4 Escorts Limited

- 10.2.5 Hitachi Construction Machinery

- 10.2.6 Liebherr Group

- 10.2.7 Mahindra & Mahindra

- 10.2.8 Sandvik

- 10.2.9 Volvo Construction Equipment

- 10.2.10 Yanmar Holdings

- 10.3 Emerging Players

- 10.3.1 Cartrack Holdings

- 10.3.2 Epiroc

- 10.3.3 MONTRANS

- 10.3.4 Raven Industries

- 10.3.5 TTControl