|

市場調查報告書

商品編碼

1844348

電池材料回收市場機會、成長動力、產業趨勢分析及2025-2034年預測Battery Materials Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

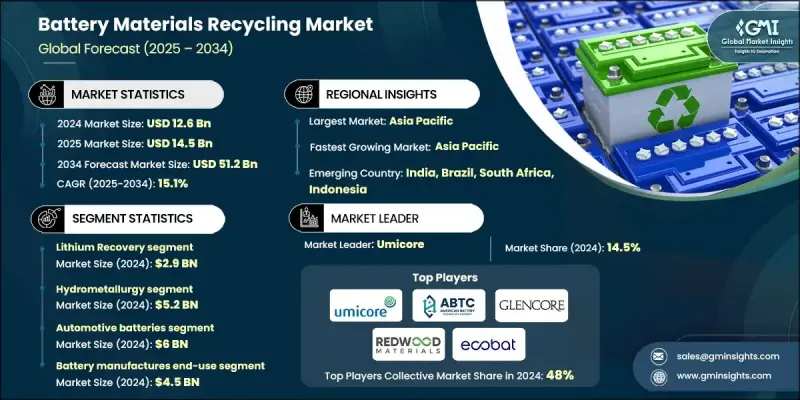

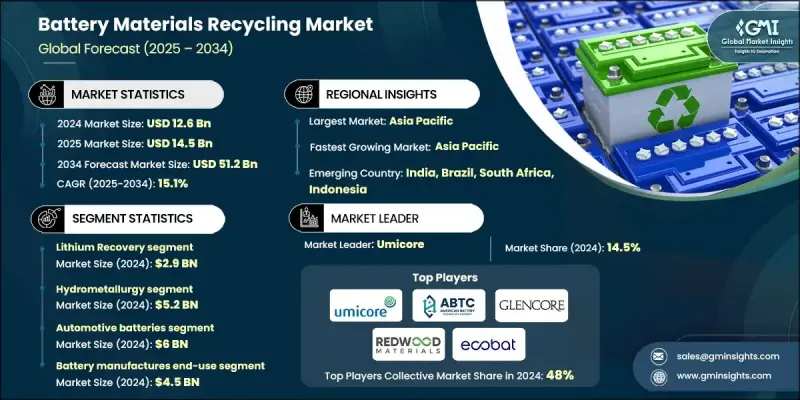

2024 年全球電池材料回收市場價值為 126 億美元,預計到 2034 年將以 15.1% 的複合年成長率成長至 512 億美元。

隨著電動車和再生能源產業的擴張,對鋰、鈷、錳和鎳等關鍵電池金屬的需求激增。回收這些材料作為傳統採礦的永續替代方案,正日益受到關注,為應對原料價格波動、地緣政治不確定性和環境惡化等問題提供了解決方案。監管改革正在各主要地區迅速推進,以鼓勵資源循環利用並改善電池報廢管理,這進一步推動了市場發展。這些變化正在培育長期成長前景,並促使私營和公共部門對回收生態系統進行強勁投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 126億美元 |

| 預測值 | 512億美元 |

| 複合年成長率 | 15.1% |

全球對永續供應鏈的日益關注,強化了儲能和電動車領域對循環經濟的需求。回收不僅被視為環保方法,也是減少對原料開採依賴的策略工具。重塑該行業的關鍵趨勢之一是將回收業務垂直整合到電池製造供應鏈中。這種整合有助於製造商形成閉迴路,確保穩定地採購高價值的回收材料,同時提高整個生產生命週期的成本效率和合規性。

2024年,鋰回收領域產值達29億美元,預計2025年至2034年的複合年成長率將達到13.9%。由於電動車、攜帶式電子設備和電網級儲能系統中使用的鋰離子電池需求旺盛,鋰將繼續佔據主導地位。隨著直接鋰萃取和濕式冶金等技術的進步,鋰回收效率不斷提高,進一步鞏固了其在電池材料回收市場的主導地位。這些技術的日益普及提高了鋰萃取率,使得鋰回收在商業規模上越來越可行。

汽車電池市場在2024年創造了60億美元的產值,預計到2034年將以14.5%的複合年成長率成長。全球電動車的持續普及加速推動了汽車電池市場的快速成長,這產生了大量的廢棄鋰離子電池。汽車製造商和電池供應商正在與回收商建立戰略合作關係,以建立閉迴路系統,回收鋰、鈷和鎳等金屬,並將其用於新電池的生產。這些系統在減少電動車成長對環境的影響和確保更具韌性的供應鏈方面發揮關鍵作用。

2024年,中國電池材料回收市場規模達30億美元,預計2034年將以15.3%的複合年成長率成長。中國已實施嚴格的電池回收法規,並擁有支撐先進回收技術發展的產業規模。同時,印度正迅速崛起,成為一個充滿潛力的市場,新的法規和投資正在增強其回收能力。隨著電動車和電子產品產業的擴張,澳洲、印尼和泰國等國家也正在加速基礎設施建設,以支持電池材料的回收。

推動全球電池材料回收市場創新和擴張的領先公司包括 Stena Recycling、Redwood Materials、Ascend Elements、TES(SK Ecoplant 的一部分)、Umicore、LG Energy、RecycLiCo Battery Materials Inc.、Duesenfeld GmbH、Primobius GmbH(Neometal、RVom)、Neometal、Etidelxs、Primobius GmbH(Neometals JV)、Glenoms、Nexal、tidom (ESM) 和 American Battery Technology Co. 為了鞏固其在電池材料回收市場的立足點,各公司正在推行以垂直整合和技術創新為中心的策略。領先的企業正在與汽車製造商和電池製造商合作,創建閉迴路生態系統,以促進廢棄電池的直接採購。他們也正在投資先進的濕式冶金和直接萃取技術,以提高材料回收率並降低加工成本。各公司正在透過建立區域回收中心和組建合資企業來本地化收集和精煉業務,從而擴大其全球影響力。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供主要國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- 鋰回收

- 鈷回收

- 鎳回收

- 錳回收

- 賤金屬回收

- 其他材料回收

第6章:市場估計與預測:依技術,2021-2034

- 主要趨勢

- 濕式冶金

- 火法冶金

- 直接回收

- 機械加工

第7章:市場估計與預測:依電池來源,2021-2034

- 主要趨勢

- 汽車電池

- 消費性電子產品

- 儲能系統

- 工業來源

第 8 章:市場估計與預測:按最終用途,2021-2034 年

- 主要趨勢

- 電池製造商

- 材料供應商

- 汽車原廠設備製造商

- 電子產品製造商

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- American Battery Technology Co

- Ascend Elements

- Duesenfeld GmbH

- Ecobat

- Elemental Strategic Metals (ESM)

- Glencore plc

- LG Energy

- Neometals Ltd

- Primobius GmbH (Neometals JV)

- RecycLiCo Battery Materials Inc.

- Redwood Materials

- Retriev Technologies

- Stena Recycling

- TES (part of SK ecoplant)

- Umicore

The Global Battery Materials Recycling Market was valued at USD 12.6 billion in 2024 and is estimated to grow at a CAGR of 15.1% to reach USD 51.2 billion by 2034.

Demand for key battery metals like lithium, cobalt, manganese, and nickel is surging as the electric vehicle and renewable energy sectors expand. Recycling these materials is gaining traction as a sustainable alternative to traditional mining, offering a solution to volatile raw material pricing, geopolitical uncertainty, and environmental degradation. The market is being further propelled by regulatory reforms, which are evolving rapidly across key regions to encourage resource circularity and improve battery end-of-life management. These changes are fostering long-term growth prospects and enabling robust private and public sector investments in recycling ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $51.2 Billion |

| CAGR | 15.1% |

Increasing global attention toward sustainable supply chains is reinforcing the need for circular economies in energy storage and electric mobility. Recycling is not only seen as an eco-conscious approach but also as a strategic tool for reducing dependency on virgin material extraction. One of the key trends reshaping the industry is the vertical integration of recycling operations into battery manufacturing supply chains. This integration is helping manufacturers close the loop, ensuring stable sourcing of high-value recovered materials while improving cost efficiency and regulatory compliance throughout production lifecycles.

The lithium recovery segment generated USD 2.9 billion in 2024 and is expected to grow at a CAGR of 13.9% from 2025 to 2034. Lithium continues to dominate due to its high demand in lithium-ion batteries used across EVs, portable electronics, and grid-scale storage systems. With advancements in techniques such as direct lithium extraction and hydrometallurgical processes, lithium recovery is becoming more efficient, further fueling its dominance within the battery materials recycling market. The rising use of these technologies enhances extraction yields, which is making recycling increasingly viable at a commercial scale.

The automotive battery segment generated USD 6 billion in 2024 and is projected to grow at a CAGR of 14.5% through 2034. The segment growth is fueled by the ongoing acceleration of global EV adoption, which is creating enormous volumes of spent lithium-ion batteries. Automakers and battery suppliers are forming strategic collaborations with recyclers to build closed-loop systems that reclaim metals such as lithium, cobalt, and nickel for reuse in new battery production. These systems are playing a key role in reducing the environmental impact of EV growth and ensuring more resilient supply chains.

China Battery Materials Recycling Market generated USD 3 billion in 2024 and is expected to grow at a CAGR of 15.3% through 2034. The country has implemented strict battery recycling regulations and possesses the industrial scale to support the growth of advanced recovery technologies. Meanwhile, India is quickly emerging as a promising market, with new regulations and investments strengthening its recycling capabilities. Countries like Australia, Indonesia, and Thailand are also accelerating infrastructure development to support battery material recovery as their EV and electronics sectors expand.

Leading companies driving innovation and expansion in Global Battery Materials Recycling Market include Stena Recycling, Redwood Materials, Ascend Elements, TES (part of SK Ecoplant), Umicore, LG Energy, RecycLiCo Battery Materials Inc., Duesenfeld GmbH, Primobius GmbH (Neometals JV), Glencore plc, Ecobat, Neometals Ltd, Retriev Technologies, Elemental Strategic Metals (ESM), and American Battery Technology Co. To strengthen their foothold in the battery materials recycling market, companies are pursuing strategies centered around vertical integration and technology innovation. Leading players are partnering with automakers and battery manufacturers to create closed-loop ecosystems that facilitate direct sourcing of spent batteries. Investments are also being made in advanced hydrometallurgical and direct extraction technologies to improve material recovery rates and reduce processing costs. Firms are expanding their global footprint by setting up regional recycling hubs and forming joint ventures to localize collection and refining operations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Technology

- 2.2.4 Battery Source

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium recovery

- 5.3 Cobalt recovery

- 5.4 Nickel recovery

- 5.5 Manganese recovery

- 5.6 Base metals recovery

- 5.7 Other materials recovery

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrometallurgy

- 6.3 Pyrometallurgy

- 6.4 Direct recycling

- 6.5 Mechanical processing

Chapter 7 Market Estimates & Forecast, By Battery Source, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive batteries

- 7.3 Consumer electronics

- 7.4 Energy storage systems

- 7.5 Industrial sources

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Battery manufacturers

- 8.3 Material suppliers

- 8.4 Automotive OEMs

- 8.5 Electronics manufacturers

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 American Battery Technology Co

- 10.2 Ascend Elements

- 10.3 Duesenfeld GmbH

- 10.4 Ecobat

- 10.5 Elemental Strategic Metals (ESM)

- 10.6 Glencore plc

- 10.7 LG Energy

- 10.8 Neometals Ltd

- 10.9 Primobius GmbH (Neometals JV)

- 10.10 RecycLiCo Battery Materials Inc.

- 10.11 Redwood Materials

- 10.12 Retriev Technologies

- 10.13 Stena Recycling

- 10.14 TES (part of SK ecoplant)

- 10.15 Umicore