|

市場調查報告書

商品編碼

1844281

墨盒及筆材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cartridge and Pen Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

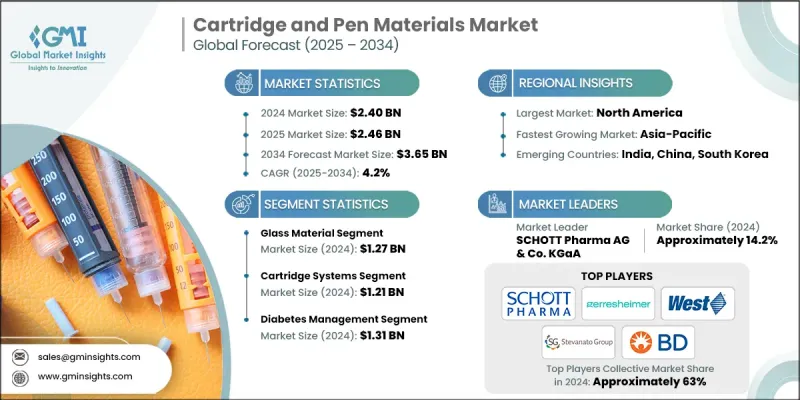

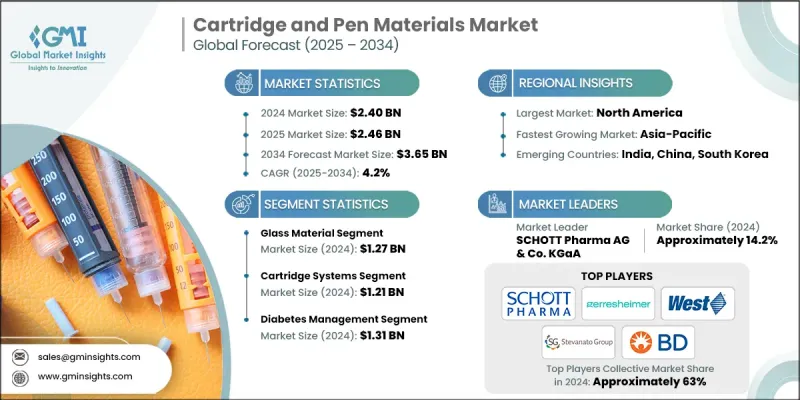

2024 年全球墨盒和筆材料市場價值為 24 億美元,預計將以 4.2% 的複合年成長率成長,到 2034 年達到 36.5 億美元。

這個不斷發展的市場正經歷著從高容量胰島素輸送系統轉向更精密設計的轉變,這些系統專注於提高患者的易用性。隨著越來越多的療法從醫院給藥轉向家庭注射,材料創新已成為核心重點。人們越來越重視開發耐用、安全且符合法規的材料,以提升設備性能和病患體驗。整個供應鏈上的製造商都在投資開發適用於複雜藥物配方(尤其是生物製劑和聯合療法)的材料。隨著對患者友善、自主給藥系統的需求不斷成長,材料必須具備卓越的兼容性、更低的反應性和更強的機械性能。 GLP-1 和多藥療法的日益普及,正推動市場發展為支持長期可用性和依從性的先進聚合物和混合材料。此外,人們對居家護理和數位監控的日益成長的偏好也推動了對智慧輸送設備的需求,這給注射筆和藥筒的組件製造和材料選擇帶來了新的複雜性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 36.5億美元 |

| 複合年成長率 | 4.2% |

2024年,玻璃材料市場佔有52.4%的佔有率。玻璃在傳統注射療法和胰島素筆芯中仍被廣泛使用。由於玻璃易破損、重量較大、與敏感化合物的兼容性較低(尤其是在現代療法中),市場正在逐漸放棄使用玻璃。製造商正在逐步採用先進的塑膠,以提高安全性、降低污染風險,並提高組裝靈活性。

2024年,注射筆組件市場佔28.5%的市佔率。人體工學、智慧且可重複使用的注射筆系統日益普及,推動了對高性能材料的需求,這些材料能夠支援可重複使用性、連接性和使用者舒適度。隨著人們越來越重視治療依從性和便利性,尤其是在慢性病治療中,對支持複雜給藥機制的注射筆設計的需求也不斷成長。 GLP-1應用、複方注射和自我給藥方案的推廣極大地影響了注射筆組件的設計和製造方式,使其重點轉向精準性、觸覺回饋和高耐用性。

2024年,美國墨水匣和筆材市場產值達6.7億美元。醫療和消費領域對可再填充和一次性筆產品的需求不斷成長,推動了美國市場的發展。中性筆和原子筆等書寫工具的需求保持穩定,消費者更重視流暢的使用體驗和持久耐用性。製造商正在將先進的塑膠聚合物與輕質合金相結合,以滿足消費者在舒適度、設計和功能方面不斷變化的偏好。此外,促銷筆的需求持續旺盛,尤其是在品牌推廣和行銷活動中。隨著電商通路的蓬勃發展,個人化和特種材料越來越受到消費者的青睞,推動了該領域材料需求的穩定成長。

全球墨水匣和筆材料市場的主要參與者包括 Gerresheimer AG、SCHOTT Pharma AG、West Pharmaceutical Services, Inc.、Becton, Dickinson and Company (BD) 和 Stevanato Group SpA。墨盒和筆材料市場的領先公司正在透過開發具有耐化學性、低反應性並符合不斷發展的全球標準的先進聚合物來擴展其材料組合。 SCHOTT Pharma AG 和 Gerresheimer AG 正在大力投資製造能力以支持混合材料開發,將傳統玻璃和高級聚合物相結合,用於下一代墨盒和筆。 BD 和 Stevanato Group 等公司正在將智慧技術相容性整合到他們的筆平台中,以實現數位連接。為了提高供應鏈彈性和區域影響力,許多公司正在本地化生產設施。與藥物開發商合作設計客製化的輸送裝置的做法也在增加。強調永續性,提供可回收和環保的材料選擇,是另一個確保產品線面向未來並獲得競爭優勢的關鍵策略。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 生物製劑和生物相似藥的興起

- 自我管理和家庭護理

- 加強注射器安全監管

- 產業陷阱與挑戰

- 玻璃脫層和破損

- 嚴格的監管測試

- 供應鏈複雜性

- 市場機會

- 高分子材料創新

- 智慧型/連網注射器系統

- 亞太新興市場的需求

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按材料類型,2025 - 2034 年

- 主要趨勢

- 玻璃材質

- 硼矽酸鹽玻璃

- 鈉鈣玻璃

- 鍍膜玻璃解決方案

- 高分子材料

- 環烯烴共聚物(COC)

- 環狀烯烴聚合物(COP)

- 其他聚合物(聚丙烯、聚乙烯)

- 特種聚合物

- 金屬部件

- 不銹鋼

- 鋁合金

- 塗層/鍍層金屬

- 彈性體組件

- 橡膠密封件

- 有機矽彈性體

- 熱塑性彈性體(TPE)

第6章:市場估計與預測:依產品類型,2025 - 2034

- 主要趨勢

- 墨水匣系統

- 胰島素筆芯

- 生物製劑藥筒

- 特種藥筒

- 筆組件

- 筆身

- 注射機制

- 針頭組件

- 封閉密封系統

- 柱塞塞

- 針頭護罩

- 蓋子和鎖定系統。

第7章:市場估計與預測:按應用類型,2025 - 2034

- 主要趨勢

- 糖尿病管理

- 胰島素筆

- GLP-1激動劑

- 組合噴油器

- 生物製劑和生物相似藥

- 單株抗體

- 生長激素

- 疫苗注射器

- 專科治療

- 自體免疫疾病治療

- 腫瘤治療

- 罕見疾病藥物輸送

第8章:市場估計與預測:按地區,2025 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- SCHOTT Pharma AG & Co. KGaA

- Gerresheimer AG

- Stevanato Group SpA

- West Pharmaceutical Services, Inc.

- Becton, Dickinson and Company (BD)

- Ypsomed AG

- Owen Mumford Ltd.

- SHL Medical AG

- Haselmeier GmbH

- Phillips-Medisize (a Molex company)

- Nemera

- Credence MedSystems, Inc.

- Terumo Corporation

- Kraton Corporation

- Datwyler Holding Inc.

The Global Cartridge and Pen Materials Market was valued at USD 2.40 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 3.65 billion by 2034.

This evolving market is undergoing a shift from high-volume insulin delivery systems to more sophisticated designs focused on improved usability for patients. As more therapies move from hospital-based administration to home-based injectable formats, material innovation has become a core priority. The focus is increasingly on developing durable, safe, and regulatory-compliant materials that enhance device performance and patient experience. Manufacturers across the supply chain are investing in materials tailored for complex drug formulations, particularly in biologics and combination therapies. As demand for patient-friendly, self-administered systems rises, materials must offer superior compatibility, reduced reactivity, and enhanced mechanical properties. The growing popularity of GLP-1s and multi-drug regimens is pushing the market toward advanced polymers and hybrid materials that support long-term usability and compliance. Additionally, the growing preference for at-home care and digital monitoring is driving demand for smart delivery devices, adding another layer of complexity to component manufacturing and material selection in pens and cartridges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.40 Billion |

| Forecast Value | $3.65 Billion |

| CAGR | 4.2% |

In 2024, the glass materials segment held a 52.4% share. Glasses continue to be widely used in legacy injectable therapies and traditional insulin cartridges. The market is moving away from glass because of its susceptibility to breakage, higher weight, and lower compatibility with sensitive compounds, especially in modern therapies. Manufacturers are progressively adopting advanced plastics that provide improved safety, reduced contamination risk, and greater flexibility during assembly.

The pen components segment held a 28.5% share in 2024. The rising use of ergonomic, smart, and reusable pen systems is driving the need for high-performance materials that support reusability, connectivity, and user comfort. With the increasing focus on therapy adherence and convenience, particularly in chronic treatments, demand is rising for pen designs that support complex delivery mechanisms. The expansion of GLP-1 use, combination injectables, and self-administration protocols has significantly influenced the way pen components are designed and manufactured, shifting emphasis toward precision, tactile feedback, and high durability.

United States Cartridge and Pen Materials Market generated USD 670 million in 2024. The US market is shaped by growing demand for both refillable and disposable pen products across medical and consumer use cases. Demand for writing instruments like gel and ballpoint pens remains steady, with consumers valuing smooth performance and long-lasting durability. Manufacturers are blending advanced plastic polymers and lightweight alloys to meet evolving preferences in comfort, design, and function. Additionally, promotional pens continue to see high demand, especially for branding and marketing activities. As e-commerce channels gain strength, personalization and specialty materials are gaining more traction among buyers, supporting steady growth in material demand across this segment.

Major players in the Global Cartridge and Pen Materials Market include Gerresheimer AG, SCHOTT Pharma AG, West Pharmaceutical Services, Inc., Becton, Dickinson and Company (BD), and Stevanato Group S.p.A. Leading companies in Cartridge and Pen Materials Market are expanding their material portfolios by developing advanced polymers that offer chemical resistance, low reactivity, and regulatory alignment with evolving global standards. SCHOTT Pharma AG and Gerresheimer AG are heavily investing in manufacturing capabilities to support hybrid material development, combining traditional glass and high-grade polymers for next-gen cartridges and pens. Firms like BD and Stevanato Group are integrating smart technology compatibility into their pen platforms, enabling digital connectivity. To improve supply chain resilience and regional presence, many companies are localizing production facilities. Collaborations with drug developers to co-design customized delivery devices are also on the rise. Emphasis on sustainability, with recyclable and eco-friendly material options, is another key tactic adopted to future-proof product lines and gain a competitive advantage.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Product Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in biologics and biosimilars

- 3.2.1.2 Self-administration & home care

- 3.2.1.3 Regulatory push for syringe safety

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Glass delamination & breakage

- 3.2.2.2 Stringent regulatory testing

- 3.2.2.3 Supply chain complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Polymer material innovation

- 3.2.3.2 Smart/connected syringe systems

- 3.2.3.3 Demand in APAC emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2025 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Glass materials

- 5.2.1 Borosilicate glass

- 5.2.2 Soda-lime glass

- 5.2.3 Coated glass solutions

- 5.3 Polymer materials

- 5.3.1 Cyclic olefin copolymer (COC)

- 5.3.2 Cyclic olefin polymer (COP)

- 5.3.3 Other polymers (polypropylene, polyethylene)

- 5.3.4 Specialty polymers

- 5.4 Metal components

- 5.4.1 Stainless steel

- 5.4.2 Aluminum alloys

- 5.4.3 Coated/plated metals

- 5.5 Elastomer components

- 5.5.1 Rubber seals

- 5.5.2 Silicone elastomers

- 5.5.3 Thermoplastic elastomers (TPEs)

Chapter 6 Market Estimates and Forecast, By Product Type, 2025 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Cartridge systems

- 6.2.1 Insulin cartridges

- 6.2.2 Biologics cartridges

- 6.2.3 Specialty drug cartridges

- 6.3 Pen components

- 6.3.1 Pen bodies

- 6.3.2 Injection mechanisms

- 6.3.3 Needle assemblies

- 6.4 Closure & sealing systems

- 6.4.1 Plunger stoppers

- 6.4.2 Needle shields

- 6.4.3 Cap and locking systems.

Chapter 7 Market Estimates and Forecast, By Application type, 2025 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Diabetes management

- 7.2.1 Insulin pens

- 7.2.2 GLP-1 agonists

- 7.2.3 Combination injectors

- 7.3 Biologics and biosimilars

- 7.3.1 Monoclonal antibodies

- 7.3.2 Growth hormones

- 7.3.3 Vaccine injectors

- 7.4 Specialty therapeutics

- 7.4.1 Autoimmune disease therapies

- 7.4.2 Oncology treatments

- 7.4.3 Rare disease drug delivery

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 SCHOTT Pharma AG & Co. KGaA

- 9.2 Gerresheimer AG

- 9.3 Stevanato Group S.p.A.

- 9.4 West Pharmaceutical Services, Inc.

- 9.5 Becton, Dickinson and Company (BD)

- 9.6 Ypsomed AG

- 9.7 Owen Mumford Ltd.

- 9.8 SHL Medical AG

- 9.9 Haselmeier GmbH

- 9.10 Phillips-Medisize (a Molex company)

- 9.11 Nemera

- 9.12 Credence MedSystems, Inc.

- 9.13 Terumo Corporation

- 9.14 Kraton Corporation

- 9.15 Datwyler Holding Inc.