|

市場調查報告書

商品編碼

1833432

噴灌系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Sprinkler Irrigation System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

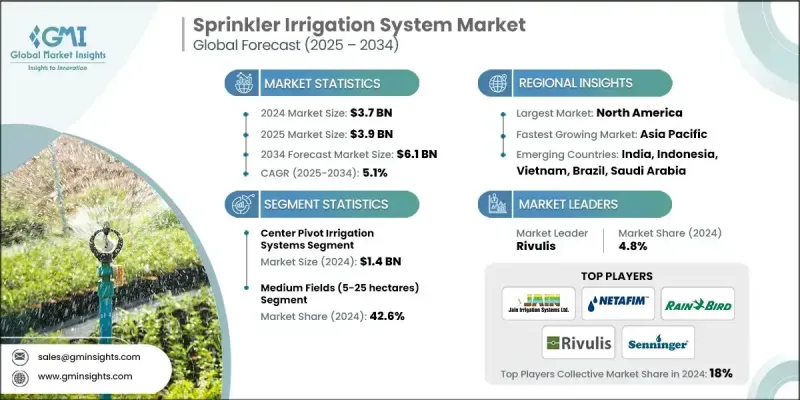

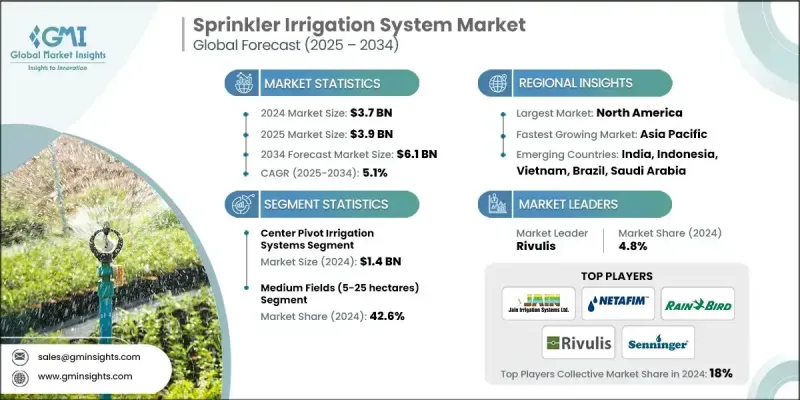

2024 年全球噴灌系統市場價值為 37 億美元,預計到 2034 年將以 5.1% 的複合年成長率成長至 61 億美元。

促成這一成長的因素有很多,包括技術進步提高了灌溉系統的可靠性和易用性。氣候變遷導致的熱浪增多,刺激了精準灌溉技術的採用,促使製造商開發更人性化、更有效率的系統。氣候變遷以及政府的激勵措施是推動農民採用噴灌系統的關鍵因素,尤其是在降雨不穩定的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 61億美元 |

| 複合年成長率 | 5.1% |

政府透過各種措施提供支持,顯著加速了噴灌技術的普及。物聯網 (IoT) 技術與噴灌系統的整合也正在改變灌溉管理,透過智慧控制器、濕度感測器和基於天氣的自動化技術,實現即時用水最佳化。為了應對不斷上漲的物流成本和全球供應鏈中斷,企業正在擴大實現在地化生產。例如,在戰略位置建立新的製造工廠有助於企業更有效率地服務區域市場。這種向本地製造中心發展的趨勢有助於企業縮短交貨週期,增強對本地需求的回應能力,並參與政府支持的「本土製造」計畫。

中心樞軸灌溉系統市場在2024年創造了14億美元的收入,預計在2025年至2034年期間的複合年成長率將達到4.5%。中心樞軸灌溉系統因其能夠均勻分配水量灌溉廣大區域而被大規模商業化農業廣泛採用。這些系統高度自動化,可最大限度地降低勞動成本並提高營運效率,非常適合種植玉米、小麥和大豆等作物的大型農場。這些灌溉系統在北美、拉丁美洲以及亞洲部分地區尤其普遍,因為這些地區大規模農業盛行。

2024年,覆蓋中型農地(5-25公頃)的細分市場創造了16億美元的收入。中型農場受益於經濟性和可擴展性的平衡,這使得噴灌系統成為頗具吸引力的選擇。這些農場通常種植經濟作物和糧食作物,而這些作物則受益於可控灌溉系統。印度的PMKSY-PDMC等政府計畫針對的是5-25公頃農地的農民,這進一步推動了噴灌系統的採用。中型農地通常更易於配備和維護模組化噴灌系統,與大型農場相比,其操作複雜性更低。

2024年,美國噴灌系統市場規模達10億美元,預計2025年至2034年期間的複合年成長率將達到4.6%。美國市場憑藉其龐大的農業用地和先進的灌溉基礎設施,在噴灌領域中佔據領先地位。在內布拉斯加州、德克薩斯州和堪薩斯州等主要農業州,中心樞軸灌溉系統的廣泛應用,以及玉米、小麥和大豆等作物的種植,是推動市場需求的重要驅動力。此外,美國農業部自然資源保護局(NRCS)的EQIP等計畫也提供技術與資金援助,推動噴灌系統等節水技術的推廣應用。

全球噴灌系統市場的領先公司包括 Jain Irrigation Systems Ltd.、Rain Bird Corporation、Netafim、Rivulis、K-Rain Manufacturing 和 Valmont Industries, Inc.。這些公司專注於開發和提供尖端噴灌解決方案,以滿足全球農民日益成長的需求。他們提供整合物聯網技術的先進系統,可提供即時資料並提高灌溉效率。噴灌系統市場中的公司正專注於關鍵策略以加強其影響力。主要策略之一是投資研發,將自動化、智慧感測器和物聯網技術等先進功能整合到其系統中,為農民提供更好的水管理和效率。製造商還專注於擴大其區域生產能力,以最大限度地降低物流成本並提高市場響應能力。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業影響力量

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區和產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 中心樞軸灌溉系統

- 橫向移動灌溉系統

- 固體灑水系統

- 移動式灑水系統

- 永久設置灑水系統

- 其他

第6章:市場估計與預測:依組件,2021 - 2034

- 主要趨勢

- 灑水器

- 管道

- 泵浦

- 控制單元

- 閥門

- 配件及配件

- 其他

第7章:市場估計與預測:依作物類型,2021 - 2034

- 主要趨勢

- 穀物和穀類

- 油籽和豆類

- 水果和蔬菜

- 糖料作物

- 其他

第8章:市場估計與預測:依領域規模,2021 - 2034

- 主要趨勢

- 小塊田地(5公頃以下)

- 中型田地(5-25公頃)

- 大片田地(25公頃以上)

第9章:市場估計與預測:依移動性,2021 - 2034

- 主要趨勢

- 固定系統

- 移動系統

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 個體農民

- 農業合作社

- 商業農場

- 政府機構

- 其他

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第13章:公司簡介

- Dripindia Irrigation pvt. Ltd.

- Jain Irrigation Systems Ltd.

- Kisan Irrigations & Infrastructure Ltd.

- Komet Austria GmbH

- Kothari Group

- K-Rain Manufacturing

- Nelson Irrigation

- Netafim

- Novedades Agricolas, SA

- Rain Bird Corporation

- Rivulis

- Senninger

- Siflon Drips & Sprinklers Pvt. Ltd.

- Sujay Irrigation

- Valmont Industries, Inc.

The Global Sprinkler Irrigation System Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 6.1 billion by 2034.

Several factors are contributing to this growth, including technological advancements that improve the reliability and ease of use of irrigation systems. The rise in climate change-related heatwaves has spurred the adoption of precision irrigation techniques, driving manufacturers to develop more user-friendly and efficient systems. Climate variability, along with government incentives, is a key driver pushing farmers toward sprinkler systems, especially in regions experiencing inconsistent rainfall.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 5.1% |

Government support through various initiatives has significantly accelerated the adoption of sprinkler irrigation. The integration of Internet of Things (IoT) technologies into sprinkler systems is also transforming irrigation management by enabling real-time water usage optimization through smart controllers, moisture sensors, and weather-based automation. In response to rising logistics costs and global supply chain disruptions, companies are increasingly localizing their production. For example, the establishment of new manufacturing facilities in strategic locations is helping companies serve regional markets more efficiently. This trend towards local manufacturing hubs is helping businesses reduce lead times, enhance responsiveness to local demands, and participate in government-backed "Make in Country" initiatives.

The center pivot irrigation systems segment generated USD 1.4 billion in 2024 and is expected to grow at a CAGR of 4.5% between 2025 and 2034. Center pivot systems are widely adopted for large-scale commercial farming because they are capable of irrigating vast areas with uniform water distribution. These systems are highly automated, minimizing labor costs and improving operational efficiency, which is ideal for large farms that grow crops like maize, wheat, and soybeans. These irrigation systems have become especially common in North America, Latin America, and parts of Asia, where large-scale agriculture is prevalent.

The segment covering medium-sized fields (5-25 hectares) generated USD 1.6 billion in 2024. Medium-sized farms benefit from a balance of affordability and scalability, making sprinkler systems an attractive option. These farms often support a combination of cash and food crops, which benefit from controlled irrigation systems. Government schemes, such as India's PMKSY-PDMC, target farmers in the 5-25 hectare range, further boosting adoption. Medium-sized fields are typically easier to equip and maintain with modular sprinkler systems, reducing operational complexities compared to large-scale farms.

U.S. Sprinkler Irrigation System Market was valued at USD 1 billion in 2024, and it is expected to grow at a CAGR of 4.6% between 2025 and 2034. The U.S. market is a leader in sprinkler irrigation due to its large agricultural land base and advanced irrigation infrastructure. The widespread use of center pivot irrigation in key farming states like Nebraska, Texas, and Kansas, where crops like corn, wheat, and soybeans are grown, is a significant driver of demand. Furthermore, programs such as the USDA's Natural Resources Conservation Service (NRCS) EQIP provide both technical and financial assistance, promoting the adoption of water-efficient technologies like sprinkler systems.

Leading companies in the Global Sprinkler Irrigation System Market include Jain Irrigation Systems Ltd., Rain Bird Corporation, Netafim, Rivulis, K-Rain Manufacturing, and Valmont Industries, Inc. These players are focused on developing and delivering cutting-edge sprinkler solutions to meet the growing needs of farmers around the world. They offer advanced systems with integrated IoT technologies that provide real-time data and improve irrigation efficiency. Companies in the sprinkler irrigation system market are focusing on key strategies to strengthen their presence. One of the main strategies is investing in R&D to integrate advanced features such as automation, smart sensors, and IoT technologies into their systems, offering farmers better water management and efficiency. Manufacturers are also focusing on expanding their regional production capacities to minimize logistical costs and improve market responsiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Component

- 2.2.3 Crop Type

- 2.2.4 Field Size

- 2.2.5 Mobility

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.2.8 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Center Pivot Irrigation Systems

- 5.3 Lateral Move Irrigation Systems

- 5.4 Solid Set Sprinkler Systems

- 5.5 Traveling Sprinkler Systems

- 5.6 Permanent Set Sprinkler Systems

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Sprinklers

- 6.3 Pipes

- 6.4 Pumps

- 6.5 Control Units

- 6.6 Valves

- 6.7 Fittings and Accessories

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Crop Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cereals and Grains

- 7.3 Oilseeds and Pulses

- 7.4 Fruits and Vegetables

- 7.5 Sugar Crops

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Field Size, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Small Fields (Below 5 Hectares)

- 8.3 Medium Fields (5-25 Hectares)

- 8.4 Large Fields (Above 25 Hectares)

Chapter 9 Market Estimates & Forecast, By Mobility, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Stationary Systems

- 9.3 Mobile Systems

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Individual Farmers

- 10.3 Agricultural Cooperatives

- 10.4 Commercial Farms

- 10.5 Government Institutions

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct Sales

- 11.3 Indirect Sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 Dripindia Irrigation pvt. Ltd.

- 13.2 Jain Irrigation Systems Ltd.

- 13.3 Kisan Irrigations & Infrastructure Ltd.

- 13.4 Komet Austria GmbH

- 13.5 Kothari Group

- 13.6 K-Rain Manufacturing

- 13.7 Nelson Irrigation

- 13.8 Netafim

- 13.9 Novedades Agricolas, S.A.

- 13.10 Rain Bird Corporation

- 13.11 Rivulis

- 13.12 Senninger

- 13.13 Siflon Drips & Sprinklers Pvt. Ltd.

- 13.14 Sujay Irrigation

- 13.15 Valmont Industries, Inc.