|

市場調查報告書

商品編碼

1822654

汽油直噴 (GDI) 系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gasoline Direct Injection (GDI) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

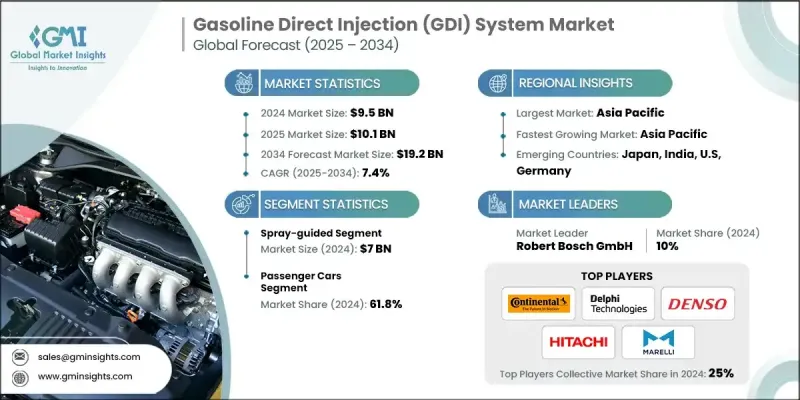

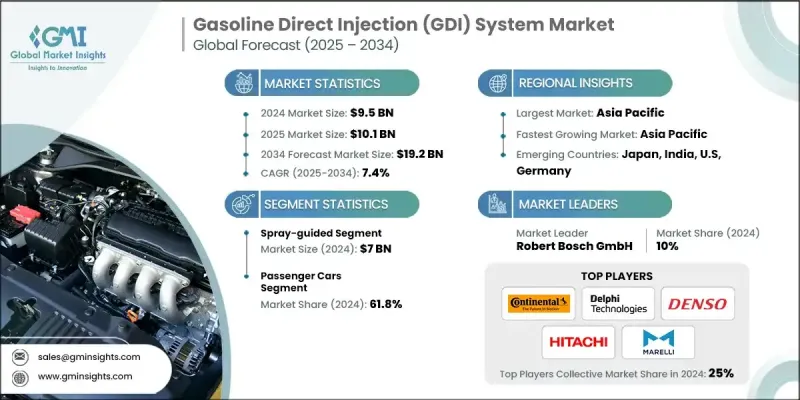

2024 年全球汽油直噴 (GDI) 系統市場價值為 95 億美元,預計在 GDI 技術的持續創新和消費者對高性能汽車日益成長的推動下,該市場將以 7.4% 的複合年成長率成長,到 2034 年達到 192 億美元。 GDI 系統的進步,例如增強的燃油噴射器和改進的燃燒控制,正在提高引擎效率和性能。同時,消費者越來越優先考慮具有卓越動力、反應能力和燃油經濟性的汽車。對高性能、高效能汽車的這種日益成長的需求推動了 GDI 系統的採用。 2024 年 1 月,GB Remanufacturing, Inc. 透過推出 17 個新零件(包括密封套件、多件裝、噴射器和高級密封件更換工具包)增強了其汽油直噴計劃。此舉凸顯了該產業對維護和升級 GDI 系統的日益重視。

汽油直噴系統產業佔有率按組件、應用和地區細分。到 2032 年,燃油噴射器市場有望實現顯著成長,這得益於其在提高引擎性能和燃油效率方面的關鍵作用。燃油噴射器確保將燃油精確輸送到燃燒室,從而實現更好的燃燒控制並最大限度地減少排放。隨著汽車製造商擴大採用 GDI 技術來遵守嚴格的燃油效率和排放標準,對先進燃油噴射器的需求正在上升。商用車市場將為 GDI 系統產業帶來可觀的收益,這得益於重型應用中對省油、高性能引擎日益成長的需求。 GDI 系統以其更高的燃油經濟性和更低的排放而聞名,非常適合需要強勁引擎並遵守嚴格環保標準的商用車。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 95億美元 |

| 預測值 | 192億美元 |

| 複合年成長率 | 7.4% |

隨著全球物流和運輸業的擴張,商用車對先進引擎技術的追求進一步擴大了汽油直噴 (GDI) 系統的採用。預計到2032年,亞太地區汽油直噴系統市場將保持顯著佔有率,這得益於該地區蓬勃發展的汽車產業以及對節能汽車日益成長的需求。主要汽車製造商的入駐以及尖端引擎技術的迅速採用推動了這一成長。此外,政府計劃的燃油效率和減排措施進一步促進了GDI系統的普及。憑藉其強大的製造業基礎和快速的技術進步,亞太地區在全球汽油直噴 (GDI) 系統領域佔據著舉足輕重的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 節能高性能汽車的普及率不斷提高

- 嚴格的排放法規

- 技術進步

- 產業陷阱與挑戰

- 積碳問題

- 排放問題

- 機會

- 先進控制系統的整合

- 與替代燃料的兼容性

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 壁面引導

- 噴霧引導

第6章:市場估計與預測:按組件,2021 - 2034

- 主要趨勢

- 燃油幫浦

- 燃油噴射器

- 電子控制單元

- 燃油導軌

- 其他

第7章:市場估計與預測:按車輛類型,2021 - 2034 年

- 主要趨勢

- 傳統汽油動力汽車

- 油電混合車

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 輕型商用車

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Aisin Seiki Co Ltd

- BorgWarner Inc

- Continental AG

- Delphi Technologies

- Denso

- Hitachi

- Infineon Technologies AG

- Keihin Corporation

- Marelli

- Park Ohio Holdings Corp

- PHINIA

- Robert Bosch GmbH

- Stanadyne LLC

- Standard Ignition

- TI Fluid Systems

The Global Gasoline Direct Injection (GDI) System Market was valued at USD 9.5 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 19.2 billion by 2034 driven by continuous innovations in GDI technology and rising consumer preference for high-performance vehicles. Advancements in GDI systems, such as enhanced fuel injectors and improved combustion control, are driving greater engine efficiency and performance. Concurrently, consumers are increasingly prioritizing vehicles that deliver superior power, responsiveness, and fuel economy. This heightened demand for high-performance, efficient vehicles is propelling the adoption of GDI systems. In January 2024, GB Remanufacturing, Inc. bolstered its Gasoline Direct Injection program by introducing 17 new parts, including seal kits, multi-packs, injectors, and a premium seal replacement tool kit. This move underscores the industry's growing emphasis on maintaining and upgrading GDI systems.

The gasoline direct injection system industry share is segmented by component, application, and region. By 2032, the fuel injectors segment is poised for significant growth, thanks to their pivotal role in enhancing engine performance and fuel efficiency. Fuel injectors ensure precise fuel delivery into the combustion chamber, leading to better combustion control and minimized emissions. With automakers increasingly turning to GDI technology to adhere to stringent fuel efficiency and emission standards, the demand for advanced fuel injectors is on the rise. The commercial vehicle segment is set to offer substantial gains to the GDI system industry, driven by the escalating demand for fuel-efficient, high-performance engines in heavy-duty applications. GDI systems, known for their enhanced fuel economy and lower emissions, are perfectly suited for commercial vehicles that need robust engines while adhering to strict environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $19.2 Billion |

| CAGR | 7.4% |

As global logistics and transportation sectors expand, the push for advanced engine technologies in commercial vehicles amplifies the adoption of GDI systems. Through 2032, the Asia Pacific gasoline direct injection system market is expected to maintain a significant share, fueled by the region's thriving automotive sector and a growing appetite for fuel-efficient vehicles. The growth is driven by the presence of major automotive manufacturers and the swift adoption of cutting-edge engine technologies. Additionally, government initiatives championing fuel efficiency and emissions reduction further catalyze the uptake of GDI systems. With its robust manufacturing foundation and rapid technological advancements, Asia Pacific stands as a pivotal player in the global gasoline direct injection (GDI) system arena.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Component

- 2.2.4 Vehicle type

- 2.2.5 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of energy-efficient and high-performance vehicles

- 3.2.1.2 Stringent emission regulations

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Carbon buildup concerns

- 3.2.2.2 Emission concerns

- 3.2.3 Opportunities

- 3.2.3.1 Integration of advanced control systems

- 3.2.3.2 Compatibility with alternative fuels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Wall-guided

- 5.3 Spray-guided

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Fuel pump

- 6.3 Fuel injector

- 6.4 Electronic control unit

- 6.5 Fuel rail

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Vehicle Type, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Conventional gasoline-powered vehicles

- 7.3 Hybrid vehicles

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.3 Light commercial vehicles

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aisin Seiki Co Ltd

- 10.2 BorgWarner Inc

- 10.3 Continental AG

- 10.4 Delphi Technologies

- 10.5 Denso

- 10.6 Hitachi

- 10.7 Infineon Technologies AG

- 10.8 Keihin Corporation

- 10.9 Marelli

- 10.10 Park Ohio Holdings Corp

- 10.11 PHINIA

- 10.12 Robert Bosch GmbH

- 10.13 Stanadyne LLC

- 10.14 Standard Ignition

- 10.15 TI Fluid Systems