|

市場調查報告書

商品編碼

1822638

太陽眼鏡市場機會、成長動力、產業趨勢分析及2025-2034年預測Sunglasses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

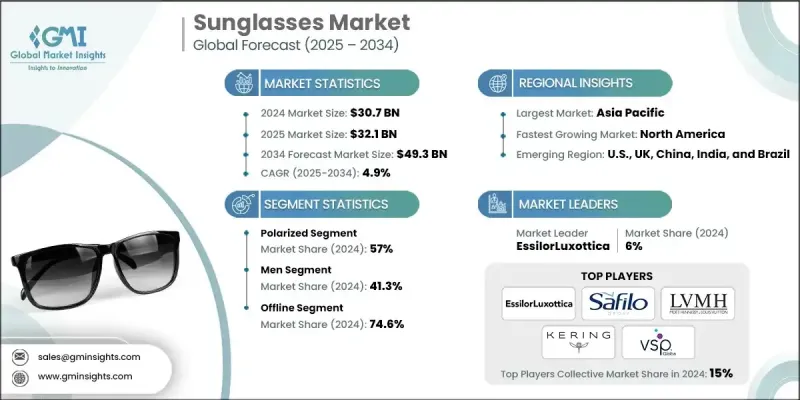

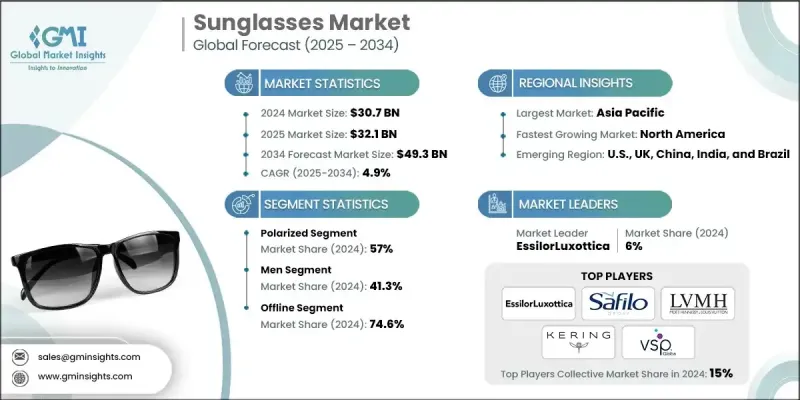

根據 Global Market Insights Inc. 發布的報告,2024 年全球太陽眼鏡市場規模估計為 307 億美元,預計將從 2025 年的 321 億美元成長到 2034 年的 493 億美元,複合年成長率為 4.9%。

消費者越來越意識到紫外線 (UV) 對眼睛健康的危害,這推動了對經認證的紫外線防護太陽眼鏡的需求。這種轉變使太陽眼鏡不再只是時尚配件,更是不可或缺的健康保健產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 307億美元 |

| 預測值 | 493億美元 |

| 複合年成長率 | 4.9% |

偏光鏡片的普及率不斷上升

2024年,偏光鏡片市場佔據了顯著佔有率,因為消費者越來越重視護眼和視覺清晰度,尤其是在戶外活動時。偏光鏡片有助於減少水面、路面和雪地等反射表面的眩光,使其成為駕駛、運動和旅行的理想選擇。隨著人們對紫外線傷害和數位眼睛疲勞的認知不斷提高,越來越多的消費者開始轉向高性能眼鏡,即使在休閒場合也是如此。

男性需求不斷成長

2024年,受功能性需求和不斷升級的時尚意識的共同推動,男士太陽眼鏡市場收入可觀。越來越多的男士將太陽眼鏡視為一種時尚宣言,同時也注重耐用的設計和鏡片技術,以支持通勤、運動和旅行等日常活動。領先品牌正積極響應這一趨勢,推出客製化系列,將陽剛之氣與UV400防護、防刮塗層和偏光鏡片等技術特性結合。

線下消費偏好上升

2025-2034年,線下零售市場將維持可觀的複合年成長率。包括眼鏡連鎖店、時尚精品店和百貨公司在內的實體店,將繼續吸引那些尋求親身體驗和個人化服務的顧客。對於首次購買或購買高階產品的消費者來說,能夠試穿不同風格並獲得專家推薦尤其重要。旅遊零售和季節性快閃店也為線下零售提供了助力。

區域洞察

亞太地區將成為利潤豐厚的地區

2024年,亞太地區太陽眼鏡市場佔據了相當大的佔有率,這得益於可支配收入的提高、中產階級人口的擴大以及人們對眼部健康的意識的增強。中國、印度和韓國等國家憑藉其蓬勃發展的時尚產業和年輕的消費族群,正在刺激太陽眼鏡的需求。此外,該地區較高的日照強度和城市污染水平也促使消費者尋求具有功能性防護功效的眼鏡。國際和本土品牌都在大力投資產品在地化、網紅行銷和店內擴張,以搶佔市場佔有率。

太陽眼鏡市場的主要參與者有 Michael Kors Holdings、Fielmann、Oakley、Zenni Optical、Marchon Eyewear、Warby Parker、EssilorLuxottica、Quay Australia、VSP Global、Marcolin、LVMH Moet Hennessy Louis Vuitton、Safilo Group、Johnson & Johnson Vision Care、LVMH Moet Hennessy Louis Vuitton、Safilo Group、Johnson & Johnson Vision Care、Luxottica Group Kering、Luxov。

為了鞏固在全球太陽眼鏡市場的佔有率,各大公司正在實施一系列產品創新、全通路擴張和品牌合作的措施。許多公司正在推出採用可回收或可生物分解材料的環保系列,以順應永續發展趨勢。時尚前衛的設計,加上偏光、光致變色和藍光過濾等先進的鏡片技術,幫助品牌兼顧風格和功能。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 消費者越來越重視眼睛健康和紫外線防護

- 時尚和生活方式的吸引力日益增強

- 電子商務與全通路零售的擴張

- 產業陷阱與挑戰

- 競爭激烈,市場飽和

- 經濟敏感度和波動的可支配收入

- 機會

- 人們越來越關注眼睛健康和紫外線防護。

- 對環保太陽眼鏡的需求

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼:9004100000)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:太陽眼鏡市場估計與預測:按類型,2021-2034

- 主要趨勢

- 偏振

- 非極化

第6章:太陽眼鏡市場估計與預測:按鏡框材質,2021-2034

- 主要趨勢

- 塑膠

- 金屬

- 其他

第7章:太陽眼鏡市場估計與預測:按鏡片材料,2021-2034

- 主要趨勢

- CR-39(烯丙基二甘醇碳酸酯)

- 聚碳酸酯

- 聚氨酯

- 其他(玻璃等)

第8章:太陽眼鏡市場估計與預測:按塗層,2021-2034

- 主要趨勢

- 抗反射塗層

- 防刮塗層

- 防紫外線

- 藍光濾鏡

- 其他

第9章:太陽眼鏡市場估計與預測:依設計風格,2021-2034

- 主要趨勢

- 全框

- 半框

- 無框

第 10 章:太陽眼鏡市場估計與預測:按價格,2021-2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 11 章:太陽眼鏡市場估計與預測:按應用,2021-2034 年

- 主要趨勢

- 運動的

- 時尚

- 安全/防護(如工業、實驗室)

- 處方眼鏡

- 老花眼鏡

- 駕駛眼鏡

第 12 章:太陽眼鏡市場估計與預測:按最終用途,2021-2034 年

- 主要趨勢

- 男士

- 女性

- 男女通用的

- 孩子們

第 13 章:太陽眼鏡市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 專賣店

- 大賣場/超市

- 零售商

第 14 章:太陽眼鏡市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 15 章:公司簡介

- EssilorLuxottica

- Fielmann

- Johnson & Johnson Vision Care

- Luxottica Group

- Kering SA

- LVMH Moet Hennessy Louis Vuitton

- Marchon Eyewear

- Marcolin

- Michael Kors Holdings

- Oakley

- Quay Australia

- Safilo Group

- VSP Global

- Warby Parker

- Zenni Optical

The global sunglasses market was estimated at USD 30.7 billion in 2024 and is expected to grow from USD 32.1 billion in 2025 to USD 49.3 billion by 2034, at a CAGR of 4.9%, according to the report published by Global Market Insights Inc.

Consumers are becoming increasingly aware of the harmful effects of ultraviolet (UV) rays on eye health, driving demand for sunglasses that offer certified UV protection. This shift is positioning sunglasses not just as fashion accessories but also as essential health and wellness products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.7 Billion |

| Forecast Value | $49.3 Billion |

| CAGR | 4.9% |

Rising Adoption of Polarized Lenses

The polarized segment held a notable share in 2024 as consumers increasingly prioritize eye protection and visual clarity, especially during outdoor activities. Polarized lenses help reduce glare from reflective surfaces like water, roads, and snow, making them highly desirable for driving, sports, and travel. As awareness around UV damage and digital eye strain continues to rise, more consumers are shifting toward high-performance eyewear, even in casual settings.

Increasing Demand Among Men

The men segment generated notable revenues in 2024, fueled by a blend of functional needs and evolving fashion consciousness. Men increasingly view sunglasses as a style statement, while also valuing durable designs and lens technology that supports everyday activities like commuting, sports, and travel. Leading brands are responding with tailored collections that combine masculine aesthetics with technical features such as UV400 protection, anti-scratch coatings, and polarized lenses.

Rising preference for Offline

The offline segment will grow at a decent CAGR during 2025-2034. Brick-and-mortar outlets, including optical chains, fashion boutiques, and department stores, continue to attract customers seeking hands-on product experience and personalized service. The ability to try on different styles and receive expert recommendations is particularly important for first-time buyers or premium product purchases. Offline retail is also bolstered by travel retail and seasonal pop-up stores.

Regional Insights

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific sunglasses market held a sizeable share in 2024, driven by rising disposable incomes, expanding middle-class populations, and increased awareness of eye health. Countries like China, India, and South Korea are fueling demand with their growing fashion industries and youthful consumer bases. Additionally, the region's high levels of sun exposure and urban pollution are pushing consumers toward protective eyewear with functional benefits. Both international and local brands are investing heavily in product localization, influencer marketing, and in-store expansion to capture market share.

Major players in the sunglasses market are Michael Kors Holdings, Fielmann, Oakley, Zenni Optical, Marchon Eyewear, Warby Parker, EssilorLuxottica, Quay Australia, VSP Global, Marcolin, LVMH Moet Hennessy Louis Vuitton, Safilo Group, Johnson & Johnson Vision Care, Luxottica Group, and Kering SA.

To strengthen their presence in the global sunglasses market, companies are implementing a mix of product innovation, omnichannel expansion, and brand collaborations. Many are launching eco-friendly collections using recycled or biodegradable materials to align with sustainability trends. Fashion-forward designs, coupled with advanced lens technologies like polarization, photochromic adaptation, and blue light filtering, help brands meet both style and function expectations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Frame material

- 2.2.4 Lens material

- 2.2.5 Coating

- 2.2.6 Design style

- 2.2.7 Price

- 2.2.8 Application

- 2.2.9 End use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer focus on eye health and UV protection

- 3.2.1.2 Growing fashion and lifestyle appeal

- 3.2.1.3 Expansion of e-commerce and omnichannel retailing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition and market saturation

- 3.2.2.2 Economic sensitivity and fluctuating disposable income

- 3.2.3 Opportunities

- 3.2.3.1 Rising focus on eye health and UV protection.

- 3.2.3.2 Demand for eco-friendly sunglasses

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 9004100000)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Sunglasses Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Polarized

- 5.3 Non-polarized

Chapter 6 Sunglasses Market Estimates & Forecast, By Frame Material, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Others

Chapter 7 Sunglasses Market Estimates & Forecast, By Lens Material, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 CR-39 (allyl diglycol carbonate)

- 7.3 Polycarbonate

- 7.4 Polyurethane

- 7.5 Others (glass, etc.)

Chapter 8 Sunglasses Market Estimates & Forecast, By Coating, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Anti-reflective coating

- 8.3 Scratch-resistant coating

- 8.4 UV protection

- 8.5 Blue light filtering

- 8.6 Others

Chapter 9 Sunglasses Market Estimates & Forecast, By Design Style, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Full rim

- 9.3 Half rim

- 9.4 Rimless

Chapter 10 Sunglasses Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Sunglasses Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Sports

- 11.3 Fashion

- 11.4 Safety/protective (e.g., industrial, lab)

- 11.5 Prescription eyewear

- 11.6 Reading glasses

- 11.7 Driving glasses

Chapter 12 Sunglasses Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Men

- 12.3 Women

- 12.4 Unisex

- 12.5 Children

Chapter 13 Sunglasses Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce

- 13.2.2 Company websites

- 13.3 Offline

- 13.3.1 Specialty store

- 13.3.2 Hypermarket/supermarket

- 13.3.3 Retailers

Chapter 14 Sunglasses Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 EssilorLuxottica

- 15.2 Fielmann

- 15.3 Johnson & Johnson Vision Care

- 15.4 Luxottica Group

- 15.5 Kering SA

- 15.6 LVMH Moet Hennessy Louis Vuitton

- 15.7 Marchon Eyewear

- 15.8 Marcolin

- 15.9 Michael Kors Holdings

- 15.10 Oakley

- 15.11 Quay Australia

- 15.12 Safilo Group

- 15.13 VSP Global

- 15.14 Warby Parker

- 15.15 Zenni Optical