|

市場調查報告書

商品編碼

1822636

動物飼料蛋白市場機會、成長動力、產業趨勢分析及2025-2034年預測Animal Feed Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

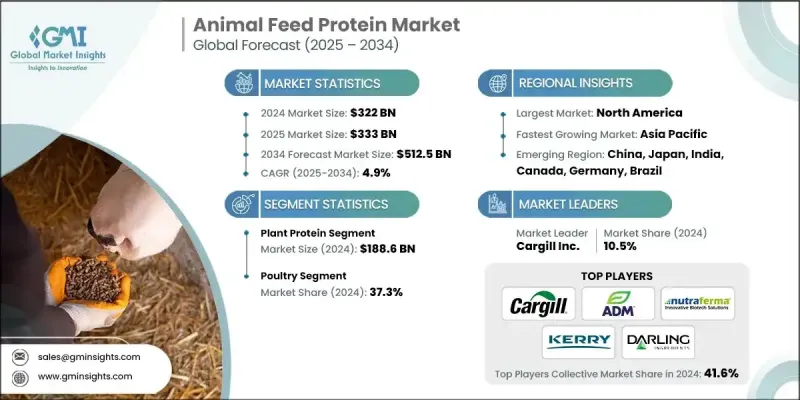

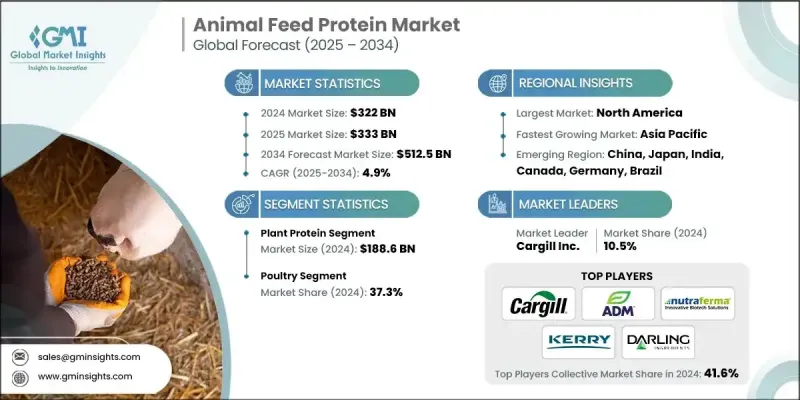

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球動物飼料蛋白市場規模估計為 3,220 億美元,預計將從 2025 年的 3,330 億美元成長到 2034 年的 5,125 億美元,複合年成長率為 4.9%。

隨著全球人口成長和收入提高,尤其是在發展中國家,肉類和乳製品的需求不斷成長。這推動了對高品質動物飼料蛋白的需求,以支持牲畜的健康生長和生產力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3220億美元 |

| 預測值 | 5125億美元 |

| 複合年成長率 | 4.9% |

植物性蛋白質的採用率不斷上升

植物蛋白領域在2024年佔據了顯著的佔有率,這得益於其成本效益高、供應充足和永續的採購。豆粕、菜籽油和豌豆蛋白等原料因其高營養價值和易於消化的特點,被廣泛應用於多種牲畜。各公司正在投資非基因改造和有機植物蛋白的開發,以及旨在改善胺基酸組成和提高生物利用度的加工創新,以實現有針對性的動物健康效益。

家禽業將獲得發展

2024年,家禽市場佔據了永續的佔有率,這得益於全球對雞肉和雞蛋的高需求,因為雞肉和雞蛋價格實惠且富含瘦肉蛋白。大規模商業化養殖和人均家禽消費量的增加推動了市場的成長。主要行業參與者正專注於客製化飼料配方,以提高飼料轉換率並降低疾病風險。策略包括結合酶強化蛋白混合物和針對特定地區的營養計劃,以滿足肉雞、蛋雞和種雞的獨特需求。

區域洞察

北美將成為利潤豐厚的地區

2024年,北美動物飼料蛋白市場收入可觀,這得益於其成熟的畜牧業、高漲的肉類和乳製品消費需求以及先進的農業實踐。在北美營運的公司正在採取前瞻性策略,包括與飼料廠合併、擴大生產設施以及對永續蛋白質替代品的研發投資。此外,精準營養和數位化飼料管理系統也受到重視,旨在提高動物生產性能並減少投入浪費。

動物飼料蛋白市場的主要參與者包括 Angel Yeast、Deep Branch Biotechnology、Archer Daniels Midland Company (ADM)、Ynsect、Nutraferma LLC、CHS Inc.、Unibio Group、Innovafeed、杜邦 (EI DuPont De Nemours and Company)、Darling Ingredients、Kerry Group、Carpill Inc.、La Nemours and Company)、Darling Ingredients、Kerry Group、Carpill Inc.、Lakmands, Biopat。

為了鞏固市場地位,動物飼料蛋白產業的公司正在追求創新、合作和永續發展的結合。許多公司正在拓展替代蛋白來源,例如藻類和昆蟲蛋白,以豐富產品組合併減少對傳統原料的依賴。與畜牧農場和營養研究中心建立策略聯盟,有助於根據實際需求客製化產品開發。此外,企業正在利用數位工具提供數據驅動的飼養解決方案,以最大限度地提高效率。如今,品牌推廣工作也強調可追溯性和生態認證,以符合不斷變化的消費者和監管期望。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品,2021-2034

- 主要趨勢

- 植物蛋白

- 動物性蛋白質

- 替代蛋白質

第6章:市場估計與預測:依牲畜,2021-2034

- 主要趨勢

- 家禽

- 豬

- 牛

- 水產養殖

- 寵物食品

- 馬

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Cargill Inc.

- Archer Daniels Midland Company (ADM)

- DuPont (EI DuPont De Nemours and Company)

- Kerry Group

- Nutraferma LLC

- Darling Ingredient

- Lallemand Inc.

- Angel Yeast

- Imcopa Food Ingredients BV

- CHS Inc.

- Crescent Biotech

- Deep Branch Biotechnology

- Unibio Group

- Innovafeed

- Ynsect

The global animal feed protein market was estimated at USD 322 billion in 2024 and is expected to grow from USD 333 billion in 2025 to USD 512.5 billion by 2034, at a CAGR of 4.9%, according to the latest report published by Global Market Insights Inc.

As global populations grow and incomes rise, especially in developing countries, the demand for meat and dairy products increases. This drives the need for high-quality animal feed protein to support healthy livestock growth and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $322 Billion |

| Forecast Value | $512.5 Billion |

| CAGR | 4.9% |

Rising Adoption of Plant Protein

The plant protein segment held a notable share in 2024, driven by its cost-effectiveness, abundant availability, and sustainable sourcing. Ingredients like soybean meal, canola, and pea protein are widely used for their high nutritional value and ease of digestion across multiple livestock species. Companies are investing in non-GMO and organic plant-based protein development, as well as in processing innovations that improve amino acid profiles and enhance bioavailability for targeted animal health benefits.

Poultry to Gain Traction

The poultry segment held a sustainable share in 2024, supported by high global demand for chicken meat and eggs due to their affordability and lean protein content. The market growth is fueled by large-scale commercial farming operations and increasing per capita poultry consumption. Key industry players are focusing on tailored feed formulations that boost feed conversion ratios and reduce disease risks. Strategies include incorporating enzyme-enhanced protein blends and region-specific nutrition plans to meet the unique requirements of broilers, layers, and breeders.

Regional Insights

North America to Emerge as a Lucrative Region

North America animal feed protein market generated notable revenues in 2024, backed by a well-established livestock sector, high consumer demand for meat and dairy, and advanced agricultural practices. Companies operating in North America are adopting forward-looking strategies, including mergers with feed mills, expansion of production facilities, and R&D investments in sustainable protein alternatives. Emphasis is also being placed on precision nutrition and digital feed management systems to enhance animal performance and reduce input waste.

Major players in the animal feed protein market are Angel Yeast, Deep Branch Biotechnology, Archer Daniels Midland Company (ADM), Ynsect, Nutraferma LLC, CHS Inc., Unibio Group, Innovafeed, DuPont (E.I. DuPont De Nemours and Company), Darling Ingredients, Kerry Group, Cargill Inc., Lallemand Inc., Crescent Biotech, and Imcopa Food Ingredients B.V.

To strengthen their market presence, companies in the animal feed protein sector are pursuing a combination of innovation, partnerships, and sustainability. Many are expanding into alternative protein sources-like algae and insect protein-to diversify their offerings and reduce reliance on traditional raw materials. Strategic alliances with livestock farms and nutrition research centers help tailor product development to real-world needs. Additionally, players are leveraging digital tools to provide data-driven feeding solutions that maximize efficiency. Branding efforts now also emphasize traceability and eco-certifications to align with evolving consumer and regulatory expectations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Livestock

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Plant protein

- 5.3 Animal protein

- 5.4 Alternative protein

Chapter 6 Market Estimates & Forecast, By Livestock, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Poultry

- 6.3 Swine

- 6.4 Cattle

- 6.5 Aquaculture

- 6.6 Petfood

- 6.7 Equine

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 Cargill Inc.

- 8.2 Archer Daniels Midland Company (ADM)

- 8.3 DuPont (E.I. DuPont De Nemours and Company)

- 8.4 Kerry Group

- 8.5 Nutraferma LLC

- 8.6 Darling Ingredient

- 8.7 Lallemand Inc.

- 8.8 Angel Yeast

- 8.9 Imcopa Food Ingredients B.V.

- 8.10 CHS Inc.

- 8.11 Crescent Biotech

- 8.12 Deep Branch Biotechnology

- 8.13 Unibio Group

- 8.14 Innovafeed

- 8.15 Ynsect