|

市場調查報告書

商品編碼

1822635

工業用燃氣渦輪機市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

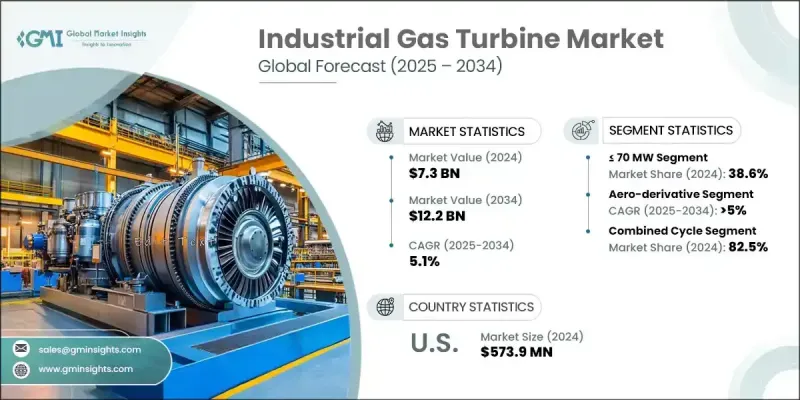

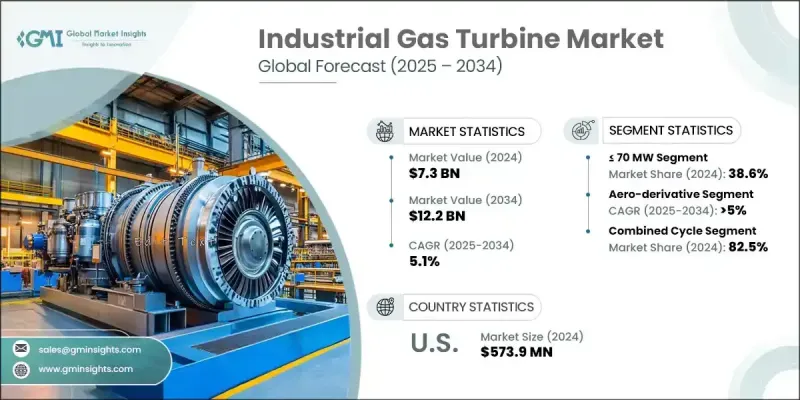

2024 年全球工業燃氣渦輪機市場價值為 73 億美元,預計到 2034 年將以 5.1% 的複合年成長率成長至 122 億美元。

隨著再生能源的不斷擴張,對快速響應備用電源的需求推動了對能夠快速提升發電量的燃氣渦輪機的需求。當太陽能和風能發電量不穩定時,這些燃氣渦輪機在確保電網穩定方面發揮著至關重要的作用。燃煤電廠的逐步淘汰,加上現有基礎設施的可用性,預計將加速燃氣渦輪機的更換和改造項目,尤其是在發展中經濟體。燃氣渦輪機能夠提供穩定、靈活的發電能力,使其成為日益受多變性影響的現代能源系統中的戰略資產。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 73億美元 |

| 預測值 | 122億美元 |

| 複合年成長率 | 5.1% |

工業燃氣渦輪機是高性能引擎,旨在為各行各業輸送電力或機械動力。它們採用布雷頓循環,壓縮空氣,將其與燃料混合,然後燃燒,形成高速氣流穿過渦輪葉片,產生旋轉能。由於暖氣和運輸行業的電氣化趨勢,對電網穩定資產的需求不斷成長,這推動了對靈活燃氣渦輪機解決方案的投資。資料中心的持續發展和城市電力擁塞也支持在正常運作時間至關重要的商業或工業場所安裝燃氣渦輪機。同時,越來越多的人支持將氫氣作為更清潔的燃料替代品,以及使燃氣渦輪機能夠使用氫氣或混合燃料的升級,這些都增強了先進的、面向未來的燃氣渦輪機技術的應用。

2024年,裝置容量小於等於70兆瓦的風力渦輪機佔了38.6%的市場佔有率,預計到2034年將以5%的複合年成長率成長。這個細分市場受益於人們對分散式電力解決方案日益成長的興趣,這些解決方案旨在為工業園區和偏遠社區等局部區域輸送電力。在尖峰負載和備用發電角色中部署的增加也促進了細分市場的擴張,尤其是在小型公用事業提供者和工業營運商中。

聯合循環風電市場在2024年佔了82.5%的市場佔有率,預計2025年至2034年的複合年成長率將達到4.5%。在再生能源併網率較高的地區,向開式循環風電的轉變尤其顯著,因為它們具有快速啟動能力,有助於在再生能源間歇期穩定電網。開式循環風電的營運彈性使其成為平衡短期供需波動的不可或缺的工具,尤其是在清潔能源規模化發展的情況下。

美國工業用燃氣渦輪機市場佔53.3%的佔有率,2024年市場規模達5.739億美元。美國公用事業公司擴大轉向燃氣渦輪機,以增強電力可靠性並應對再生能源產量的波動。以燃氣發電系統取代舊式燃煤發電的趨勢持續升溫,尤其是在那些積極推行脫碳目標的州。航改型燃氣渦輪機在軍事設施、機場和工業設施等分散式發電領域的需求也日益成長,因為這些領域的電網獨立性日益受到關注。

影響全球工業燃氣渦輪機市場的主要參與者包括西門子能源、斗山、Vericor、MAN 能源解決方案、Flex 能源解決方案、三菱重工、MTU 航空引擎、索拉透平、瓦錫蘭、IHI 株式會社、哈爾濱電氣、貝克休斯、GE Vernova、JSC 聯合引擎、BBharat 重型電氣、Destce、Dests、Bululululultra綠色能源、川崎重工和南京汽輪馬達。工業燃氣渦輪機市場的領先公司正在透過氫兼容技術和燃料靈活的透平系統加速創新。策略投資集中在低排放燃燒系統和數位性能最佳化平台的研發。原始設備製造商也在對老舊的透平機組進行改造,升級燃燒器和控制系統,以滿足清潔能源目標。與公用事業和政府機構的合作使人們能夠參與展示氫能和氨基解決方案的示範計畫。此外,公司正在擴大其全球服務網路,以提供長期維護和性能契約,提高客戶保留率。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 製造能力評估

- 供應鏈彈性和風險因素

- 配電網路分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 工業用燃氣渦輪機成本結構分析

- 價格趨勢分析

- 按地區

- 按容量

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 - 2034

- 主要趨勢

- ≤70兆瓦

- > 70 兆瓦 - 300 兆瓦

- ≥300兆瓦

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 航改型

- 重負

第7章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 開放循環

- 複合循環

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 發電

- 石油和天然氣

- 其他製造業

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 俄羅斯

- 義大利

- 德國

- 法國

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 阿爾及利亞

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals

- Capstone Green Energy

- Destinus Energy

- Doosan

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- IHI Corporation

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MTU Aero Engines

- Nanjing Turbine and Electric Machinery

- Rolls Royce

- Siemens Energy

- Solar Turbines

- Vericor

- Wartsila

The Global Industrial Gas Turbine Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 12.2 billion by 2034.

As renewable energy sources continue to expand, the need for rapid response backup power is fueling demand for gas turbines capable of quick ramp-ups. These turbines play a critical role in ensuring grid stability when solar and wind output is inconsistent. The gradual phase-out of coal plants, combined with the availability of legacy infrastructure, is expected to accelerate turbine replacement and repowering projects, particularly across developing economies. Their ability to provide firm, flexible generation makes gas turbines a strategic asset in modern energy systems increasingly defined by variability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 5.1% |

Industrial gas turbines are high-performance engines built to deliver electricity or mechanical power across various industrial sectors. They operate on the Brayton cycle by compressing air, mixing it with fuel, and combusting it to create high-speed gas flow through turbine blades, producing rotational energy. The rising demand for grid-stabilizing assets due to electrification trends in heating and transport sectors is advancing investments in flexible gas turbine solutions. The ongoing surge in data center development and urban power congestion also supports turbine installations at commercial or industrial sites where uptime is vital. Meanwhile, growing support for hydrogen as a cleaner fuel alternative and upgrades enabling turbines to run on hydrogen or blended fuels are strengthening the case for advanced, future-ready gas turbine technologies.

The turbines with <= 70 MW capacity held 38.6% share in 2024 and is anticipated to grow at a CAGR of 5% through 2034. This segment benefits from rising interest in distributed power solutions aimed at delivering electricity to localized zones, including industrial parks and remote communities. Increased deployment in peak-load and standby generation roles is also contributing to segment expansion, especially among small-scale utility providers and industrial operators.

The combined cycle segment held 82.5% share in 2024 and is forecast to grow at 4.5% CAGR from 2025 to 2034. The shift toward open cycle turbines is notable in regions with high renewable integration, as they provide fast-start capabilities to help stabilize the grid during periods of renewable intermittency. Their operational flexibility makes them an indispensable tool for balancing short-term supply and demand fluctuations, especially as clean energy sources scale.

United States Industrial Gas Turbine Market held a 53.3% share, generating USD 573.9 million in;2024. Utilities in the country are increasingly turning to gas turbines to reinforce power reliability and respond to fluctuating renewable output. The trend of replacing old coal assets with gas-fired systems continues to gain momentum, particularly in states pursuing aggressive decarbonization goals. Aeroderivative turbines are also seeing increased demand for decentralized power generation across military installations, airports, and industrial facilities where grid independence is a growing concern.

Major players shaping the Global Industrial Gas Turbine Market include Siemens Energy, Doosan, Vericor, MAN Energy Solutions, Flex Energy Solutions, Mitsubishi Heavy Industries, MTU Aero Engines, Solar Turbines, Wartsila, IHI Corporation, Harbin Electric, Baker Hughes, GE Vernova, JSC United Engine, Bharat Heavy Electricals, Destinus Energy, Rolls Royce, Ansaldo Energia, Capstone Green Energy, Kawasaki Heavy Industries, and Nanjing Turbine and Electric Machinery. Leading companies in the industrial gas turbine market are accelerating innovation through hydrogen-compatible technologies and fuel-flexible turbine systems. Strategic investments are focused on R&D for low-emission combustion systems and digital performance optimization platforms. OEMs are also engaging in retrofitting older turbine fleets with upgraded burners and control systems to meet clean energy targets. Partnerships with utilities and government bodies enable access to demonstration projects showcasing hydrogen and ammonia-based solutions. Further, companies are expanding their global service networks to offer long-term maintenance and performance contracts, increasing customer retention.;

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Product trends

- 2.5 Technology trends

- 2.6 Application trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial gas turbine

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 70 MW

- 5.3 > 70 MW - 300 MW

- 5.4 ≥ 300 MW

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Power generation

- 8.3 Oil & gas

- 8.4 Other manufacturing

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Russia

- 9.3.3 Italy

- 9.3.4 Germany

- 9.3.5 France

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Egypt

- 9.5.4 Algeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Ansaldo Energia

- 10.2 Baker Hughes

- 10.3 Bharat Heavy Electricals

- 10.4 Capstone Green Energy

- 10.5 Destinus Energy

- 10.6 Doosan

- 10.7 Flex Energy Solutions

- 10.8 GE Vernova

- 10.9 Harbin Electric

- 10.10 IHI Corporation

- 10.11 JSC United Engine

- 10.12 Kawasaki Heavy Industries

- 10.13 MAN Energy Solutions

- 10.14 Mitsubishi Heavy Industries

- 10.15 MTU Aero Engines

- 10.16 Nanjing Turbine and Electric Machinery

- 10.17 Rolls Royce

- 10.18 Siemens Energy

- 10.19 Solar Turbines

- 10.20 Vericor

- 10.21 Wartsila