|

市場調查報告書

商品編碼

1822566

專業紙巾市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Professional Tissue Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

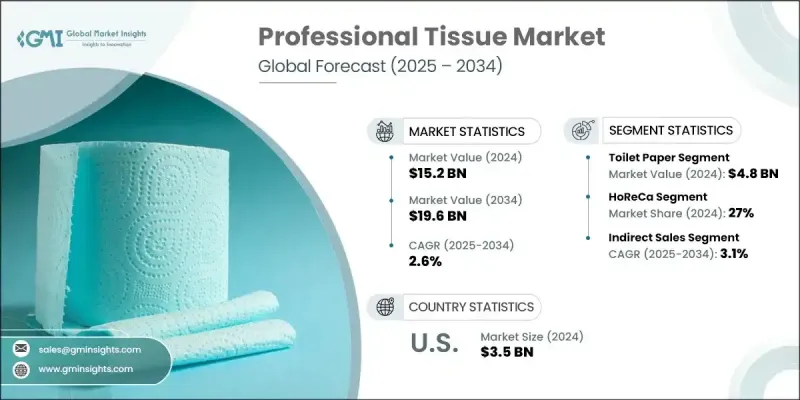

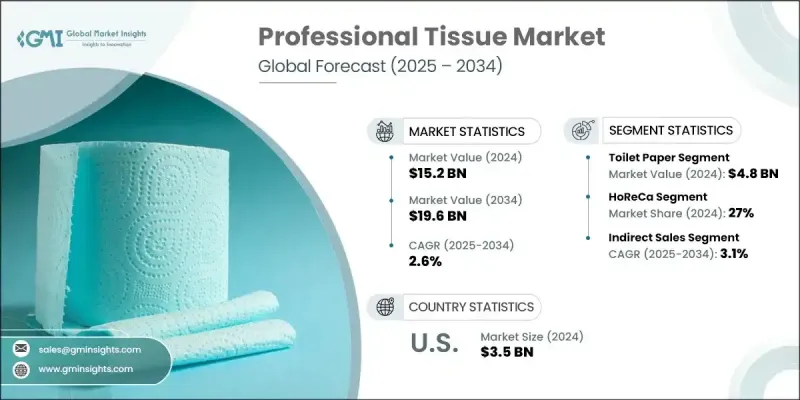

2024 年全球專業紙巾市場價值為 152 億美元,預計到 2034 年將以 2.6% 的複合年成長率成長至 196 億美元。

醫療保健、飯店、餐飲和教育等行業衛生法規日益嚴格,導致對紙巾、衛生紙和餐巾紙等專業衛生紙產品的需求不斷增加。各機構將清潔度放在首位,以確保安全和合規。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 152億美元 |

| 預測值 | 196億美元 |

| 複合年成長率 | 2.6% |

衛生紙市場接受度不斷上升

2024年,衛生紙市場佔據了顯著佔有率,這得益於辦公大樓、機場、醫院和教育機構等人流量大的環境。持續的衛生維護需求,加上公共和商業場所客流量的增加,持續推動衛生紙銷售的成長。企業優先批量採購柔軟、容量大的捲筒衛生紙,以減少維護和補貨的頻率。供應商也紛紛推出無芯捲筒衛生紙和巨型紙盒等創新產品,進一步最佳化產品使用,減少浪費。

HoReCa獲得發展動力

2024年,飯店餐飲業(HoReCa)市場佔據了顯著佔有率,這得益於高品質專業衛生紙產品的支撐。面向顧客的環境需要兼具功能性和美觀性的衛生解決方案,包括餐巾紙、手巾紙和麵巾紙。營運商正在尋求兼顧奢華與永續性的產品,這促使衛生紙供應商在不影響性能或外觀的前提下提供環保解決方案。

間接市場需求不斷成長

2024年,間接銷售領域佔據了顯著佔有率,這得益於分銷商、批發商和設施管理公司等中介機構的推動。該通路規模大、效率高,尤其適合涵蓋那些可能無法直接從製造商採購的中小企業。間接銷售領域因其能夠服務分散的市場、提供客製化解決方案和靈活的供應模式而持續成長。

區域洞察

北美將成為推動力地區

2024年,北美專業衛生紙市場佔據了相當大的佔有率,這得益於人們衛生意識的提升、商業基礎設施的擴張以及日益嚴格的衛生標準。醫療保健、教育、餐飲服務和辦公空間等行業推動了需求成長,這些產業都需要一致且安全的衛生解決方案。永續實踐的轉變進一步推動了成長,促使機構買家尋求可回收和FSC認證的產品。人們對健康和清潔的日益關注,已將衛生紙產品從商品轉變為關鍵的營運必需品。

專業紙巾市場的主要參與者有 Pro-Gest、Kimberly-Clark、CMPC、WEPA Hygieneprodukte、Cascades、寶潔、Metsa Tissue、Kruger、Renova、Sofidel、Lucart、Ontex、Industrie Celtex、Georgia-Pacific 和 Essity。

為了鞏固市場地位,專業衛生紙市場的公司正在採取永續發展創新、產品差異化和數位轉型相結合的策略。他們正在拓展環保產品線,使用再生材料、竹纖維和可生物分解包裝,以符合日益嚴格的環保法規和客戶期望。同時,許多公司正在開發分配系統,以減少浪費、改善衛生狀況並提升商業場所的品牌忠誠度。強大的經銷商網路、自動化生產投資以及整合的B2B訂購平台對於確保快速交付和營運效率至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 原料分析

- 貿易統計

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 衛生紙

- 單層

- 雙層

- 其他(三層等)

- 面紙

- 紙巾

- 捲毛巾

- 折疊毛巾

- 其他(中心拉毛巾等)

- 餐巾

- 濕紙巾

- 其他(藥用紙、廚房用紙等)

第6章:市場估計與預測:按來源,2021 - 2034

- 主要趨勢

- 原生紙漿

- 再生紙

- 其他

第7章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 衛生保健

- HoReCa

- 公司辦公室

- 工業和製造業

- 運輸與物流

- 公部門

- 教育

- 其他(設施管理等)

第9章:市場估計與預測:按配銷通路,2021 - 2034

- 主要趨勢

- 直銷

- 間接銷售

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Cascades

- CMPC

- Essity

- Georgia-Pacific

- Industrie Celtex

- Kimberly-Clark

- Kruger

- Lucart

- Metsa Tissue

- Ontex

- Procter & Gamble

- Pro-Gest

- Renova

- Sofidel

- WEPA Hygieneprodukte

The Global Professional Tissue Market was valued at USD 15.2 billion in 2024 and is estimated to grow at a CAGR of 2.6% to reach USD 19.6 billion by 2034.

Stricter hygiene regulations in sectors like healthcare, hospitality, food service, and education are increasing the demand for professional tissue products such as paper towels, toilet tissue, and napkins. Organizations are prioritizing cleanliness to ensure safety and compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.2 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 2.6% |

Rising Adoption of the Toilet Paper Segment

The toilet paper segment held a notable share in 2024, driven by high-traffic environments such as office buildings, airports, hospitals, and educational institutions. Consistent demand for hygiene maintenance, combined with increasing footfall in public and commercial spaces, continues to drive volume growth. Businesses are prioritizing bulk purchasing of soft, high-capacity rolls that reduce the frequency of maintenance and restocking. Suppliers are also responding with innovations such as coreless rolls and jumbo dispensers, further optimizing product usage and minimizing waste.

HoReCa to Gain Traction

The HoReCa segment generated a significant share in 2024, backed by premium-quality professional tissue products. Customer-facing environments require functional and aesthetically pleasing hygiene solutions, including napkins, hand towels, and facial tissues. Operators are seeking products that balance luxury and sustainability, pushing tissue suppliers to offer environmentally friendly solutions without compromising performance or presentation.

Increasing Demand for the Indirect Segment

The indirect sales segment held a notable share in 2024, fueled by intermediaries such as distributors, wholesalers, and facility management companies. This channel offers scale and efficiency, especially for reaching small and medium-sized enterprises that may not purchase directly from manufacturers. The indirect segment continues to grow due to its ability to serve fragmented markets, offering tailored solutions and flexible supply models.

Regional Insights

North America to Emerge as a Propelling Region

North America professional tissue market generated a sizeable share in 2024, driven by heightened awareness around hygiene, expanding commercial infrastructure, and increasingly stringent sanitation standards. Demand is fueled by sectors such as healthcare, education, food service, and office spaces-all requiring consistent and safe hygiene solutions. Growth is further supported by a shift toward sustainable practices, prompting institutional buyers to seek recycled and FSC-certified products. Rising focus on health and cleanliness has transformed tissue products from commodities to critical operational essentials.

Major players involved in the professional tissue market are Pro-Gest, Kimberly-Clark, CMPC, WEPA Hygieneprodukte, Cascades, Procter & Gamble, Metsa Tissue, Kruger, Renova, Sofidel, Lucart, Ontex, Industrie Celtex, Georgia-Pacific, and Essity.

To reinforce their market presence, companies in the professional tissue market are adopting a combination of sustainability innovation, product differentiation, and digital transformation. They are expanding eco-friendly product lines using recycled content, bamboo fiber, and biodegradable packaging to align with growing environmental regulations and customer expectations. In parallel, many are developing dispenser systems that reduce waste, enhance hygiene, and encourage brand loyalty in commercial spaces. Strong distributor networks, investments in automated production, and integrated B2B ordering platforms have become crucial in ensuring fast delivery and operational efficiency.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By product type

- 2.2.3 By source

- 2.2.4 By price

- 2.2.5 By end use industry

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Raw material analysis

- 3.9 Trade statistics

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's five forces analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Single ply

- 5.2.2 Double ply

- 5.2.3 Others (triple ply, etc.)

- 5.3 Facial tissues

- 5.4 Paper towels

- 5.4.1 Roll towels

- 5.4.2 Folded towels

- 5.4.3 Others (center-pull towels, etc.)

- 5.5 Napkins

- 5.6 Wet wipes

- 5.7 Others (medicinal paper, kitchen paper, etc.)

Chapter 6 Market Estimates & Forecast, By Source, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled paper

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use industry, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 HoReCa

- 8.4 Corporate offices

- 8.5 Industries & manufacturing

- 8.6 Transport & logistics

- 8.7 Public sector

- 8.8 Education

- 8.9 Others (facility management etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Cascades

- 11.2 CMPC

- 11.3 Essity

- 11.4 Georgia-Pacific

- 11.5 Industrie Celtex

- 11.6 Kimberly-Clark

- 11.7 Kruger

- 11.8 Lucart

- 11.9 Metsa Tissue

- 11.10 Ontex

- 11.11 Procter & Gamble

- 11.12 Pro-Gest

- 11.13 Renova

- 11.14 Sofidel

- 11.15 WEPA Hygieneprodukte