|

市場調查報告書

商品編碼

1801941

金屬切削工具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Metal Cutting Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

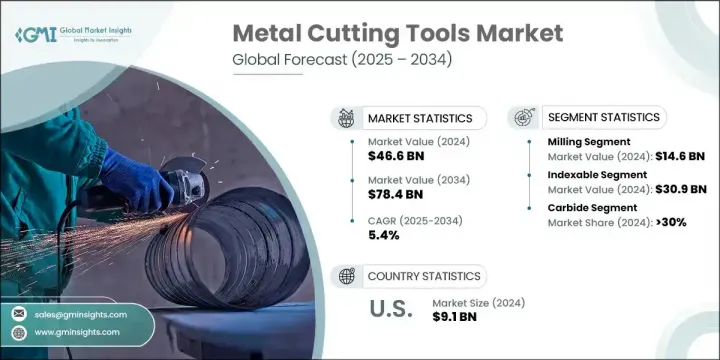

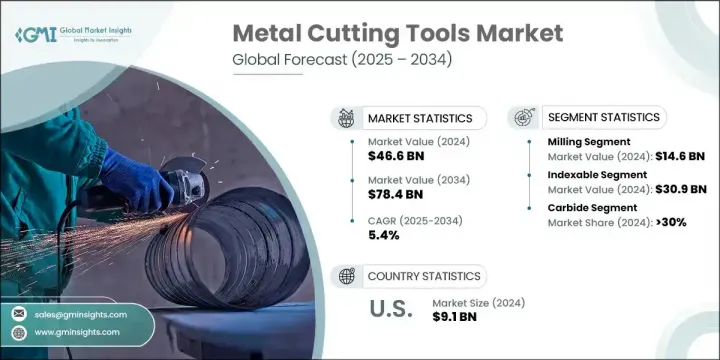

2024 年全球金屬切削刀具市場價值為 466 億美元,預計到 2034 年將以 5.4% 的複合年成長率成長至 784 億美元。隨著尖端 CNC 和多軸加工不斷發展,金屬切削刀具從簡單的獨立設備演變為智慧互聯的製造系統,市場發展勢頭強勁。隨著物聯網整合和自適應工具變得越來越普遍,現代機械師需要將自動化能力與資料分析和高精度技能相結合。向智慧製造環境的轉變推動了對高級技術培訓和持續技能提升的需求。亞太地區憑藉著強大的製造業基礎和政府主導的工業擴張,引領全球市場。該地區對 CNC 和智慧加工平台的快速採用正在提高各行各業的生產力並簡化產出。

尤其是在日本、印度和中國等國家,汽車和電子產品生產的大量投資顯著推動了對精密工具的需求。旨在促進工業現代化的政策激勵措施進一步加速了製造工廠的設備升級。銑削刀具憑藉其適應性強、材料去除率高以及與數控系統和多軸機床的兼容性,在金屬切削領域佔據主導地位。這些刀具廣泛應用於需要粗加工和精加工的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 466億美元 |

| 預測值 | 784億美元 |

| 複合年成長率 | 5.4% |

銑削刀具在2024年的市場規模為146億美元,預計到2034年將以6.6%的複合年成長率成長。銑削刀具憑藉其精度以及處理複雜形狀和表面光潔度的能力,在汽車和工業領域得到了廣泛的應用,這推動了其主導。銑削兼具靈活性和功能性,使其成為一次加工和二次加工過程中不可或缺的環節。

可轉位刀具在2024年創造了309億美元的市場規模,預計在2025-2034年期間的複合年成長率將達到5.8%。這類刀具的突出之處在於其採用可更換刀片,刀片可旋轉以露出新的切削麵,從而能夠減少停機時間和成本。這種設計無需頻繁重磨和設置,使其成為大規模生產場景中連續高速加工的理想選擇。重型設備製造和通用工程等行業受益於其耐用性和始終如一的性能。

美國金屬切削刀具市場佔87.5%的市場佔有率,2024年市場規模達91億美元。該國堅實的製造業基礎設施和CNC工具機的廣泛應用持續推動市場擴張。在工業自動化趨勢以及國防和汽車等行業強勁需求的推動下,美國仍然是精密刀具的主要生產國和主要消費國。監管支持和出口競爭力也為美國穩固的市場地位做出了貢獻。

影響全球金屬切削刀具市場的關鍵公司包括那智不二越 (Nachi-Fujikoshi)、艾默生 (Emerson)、瓦爾特 (Walter)、史丹利百得 (Stanley Black & Decker)、森拉天時 (Ceratizit)、山高工具 (Seco Tools)、特固合金 (TTopy)、Pintae (Thiae)、硬瓷質合金設Hardmetal)、博世 (Bosch)、Guhring、山特維克 (Sandvik)、OSG、阿特拉斯·科普柯 (Atlas Copco) 和馬帕爾 (Mapal)。為了鞏固其地位,金屬切削刀具市場的公司正在大力投資研發,以開發可提高精度、耐用性和加工速度的下一代刀具。他們正致力於整合人工智慧 (AI) 和數位監控,以增強刀俱生命週期管理和效能分析。領先的製造商正在擴大生產能力,並與當地企業組成合資企業,以進入新興市場。另一項核心策略是實現產品組合多樣化,包括智慧、可轉位和節能切削刀具。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按工具,2021-2034

- 主要趨勢

- 可轉位

- 堅硬的

第6章:市場估計與預測:依工藝,2021-2034

- 主要趨勢

- 銑削

- 鑽孔

- 無聊的

- 轉彎

- 研磨

- 其他

第7章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 碳化物

- 高速鋼

- 不銹鋼

- 陶瓷

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 汽車

- 航太與國防

- 石油和天然氣

- 普通加工

- 醫療的

- 電氣和電子產品

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Atlas Copco

- Bosch

- Ceratizit

- Emerson

- Guhring

- Iscar

- Kyocera

- Mapal

- Nachi-Fujikoshi

- OSG

- Sandvik

- Seco Tools

- Stanley Black & Decker

- Sumitomo Electric Hardmetal

- TaeguTec

- Walter

The Global Metal Cutting Tools Market was valued at USD 46.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 78.4 billion by 2034. The market is witnessing strong momentum as cutting-edge CNC and multi-axis machining continue to evolve metal cutting tools from simple standalone devices into smart, interconnected manufacturing systems. As IoT integration and adaptive tooling become more prevalent, modern-day machinists are now required to merge automation proficiency with data analytics and high-precision skills. This shift toward intelligent manufacturing environments is pushing demand for advanced technical training and continuous upskilling. Asia-Pacific leads the global market, propelled by a robust manufacturing base and government-led industrial expansion. The region's quick uptake of CNC and intelligent machining platforms is enhancing productivity and streamlining output across industries.

Heavy investments in automotive and electronics production, especially in countries like Japan, India, and China, are significantly boosting demand for precision tooling. Policy-driven incentives aimed at industrial modernization are further accelerating equipment upgrades across manufacturing plants. Milling tools dominate the metal cutting segment, owing to their adaptability, high material removal rates, and compatibility with CNC systems and multi-axis machines. These tools are widely deployed in applications that require both rough cutting and fine finishing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.6 Billion |

| Forecast Value | $78.4 Billion |

| CAGR | 5.4% |

Milling tools generated USD 14.6 billion in 2024 and are projected to grow at a CAGR of 6.6% through 2034. Their widespread use in automotive and industrial sectors drives this dominance, thanks to their accuracy and ability to handle intricate shapes and surface finishes. The combination of flexibility and functionality makes milling essential for both primary and secondary machining processes.

The Indexable tools generated USD 30.9 billion in 2024 and are expected to register a CAGR of 5.8% during 2025-2034. These tools stand out due to their ability to reduce downtime and costs by using replaceable inserts that can be rotated to expose fresh cutting surfaces. This design eliminates the need for frequent regrinding and setup, making indexable tools ideal for continuous, high-speed machining in mass production scenarios. Sectors like heavy equipment manufacturing and general engineering benefit from their durability and consistent performance.

United States Metal Cutting Tools Market held an 87.5% share, generating USD 9.1 billion in 2024. The country's solid manufacturing infrastructure and widespread adoption of CNC machinery continue to fuel market expansion. Backed by industrial automation trends and strong demand from sectors such as defense and automotive, the US remains both a leading producer and a major consumer of precision tooling. Regulatory support and export competitiveness also contribute to the country's solid market foothold.

Key companies shaping the Global Metal Cutting Tools Market include Nachi-Fujikoshi, Emerson, Walter, Stanley Black & Decker, Ceratizit, Seco Tools, TaeguTec, Kyocera, Iscar, Sumitomo Electric Hardmetal, Bosch, Guhring, Sandvik, OSG, Atlas Copco, and Mapal. To strengthen their presence, companies operating in the metal cutting tools market are investing heavily in R&D to develop next-generation tools that improve precision, durability, and machining speed. Focused efforts are being made to integrate AI and digital monitoring to enhance tool lifecycle management and performance analytics. Leading manufacturers are expanding production capabilities and forming joint ventures with local players to gain access to emerging markets. Diversifying product portfolios to include smart, indexable, and energy-efficient cutting tools is another core strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tool

- 2.2.3 Process

- 2.2.4 Material

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Tool, 2021-2034 ($Bn, Million Units)

- 5.1 Key trends

- 5.2 Indexable

- 5.3 Solid

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 ($Bn, Million Units)

- 6.1 Key trends

- 6.2 Milling

- 6.3 Drilling

- 6.4 Boring

- 6.5 Turning

- 6.6 Grinding

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Million Units)

- 7.1 Key trends

- 7.2 Carbide

- 7.3 High speed steel

- 7.4 Stainless steel

- 7.5 Ceramics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Million Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace & defense

- 8.4 Oil & gas

- 8.5 General machining

- 8.6 Medical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Atlas Copco

- 11.2 Bosch

- 11.3 Ceratizit

- 11.4 Emerson

- 11.5 Guhring

- 11.6 Iscar

- 11.7 Kyocera

- 11.8 Mapal

- 11.9 Nachi-Fujikoshi

- 11.10 OSG

- 11.11 Sandvik

- 11.12 Seco Tools

- 11.13 Stanley Black & Decker

- 11.14 Sumitomo Electric Hardmetal

- 11.15 TaeguTec

- 11.16 Walter