|

市場調查報告書

商品編碼

1801906

醫用膠帶市場機會、成長動力、產業趨勢分析及2025-2034年預測Medical Adhesive Tapes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

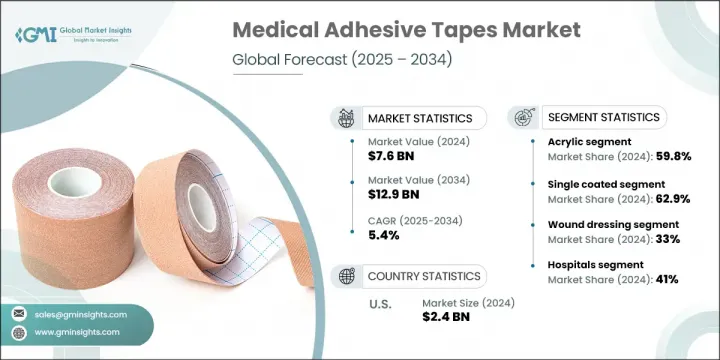

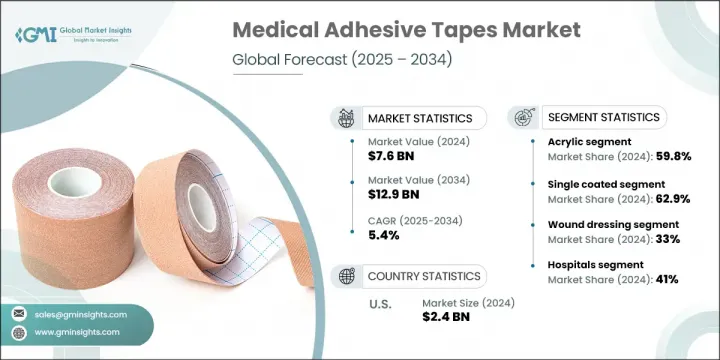

2024年,全球醫用膠帶市場規模達76億美元,預計到2034年將以5.4%的複合年成長率成長,達到129億美元。對高效傷口護理解決方案的需求不斷成長,主要源於慢性病發病率的上升、外科手術的激增以及創傷相關病例的顯著增加。醫用膠帶在現代醫療保健中發揮關鍵作用,用於固定繃帶、靜脈輸液管和醫療器械,在需要快速傷口處理的緊急治療中也發揮著重要作用。市場不斷發展,更加重視舒適性、皮膚相容性和客製化。

製造商正在開發先進的親膚低敏產品,以減少刺激並改善癒合效果。包括矽基和生物相容性材料在內的黏合劑創新正在重塑產品標準。患者個人化照護的轉變進一步影響了購買行為,其中考慮了敏感性、活動性和傷口部位等因素。 Flexcon Company、Paul Hartmann、Berry Global Group、Solventum 和 Lohmann GmbH 等主要參與者正透過優先考慮產品創新和臨床療效來塑造市場格局。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 76億美元 |

| 預測值 | 129億美元 |

| 複合年成長率 | 5.4% |

2024年,丙烯酸類醫用膠帶佔了59.8%的市場。其吸引力在於透氣性、耐熱防潮性以及短期和長期應用的兼容性。丙烯酸類膠黏劑能夠有效控制水汽滲透,有助於降低皮膚破損的風險,並創造更好的癒合環境。這種兼具舒適性和耐用性的膠帶使其成為傷口護理和外科手術的理想選擇。

2024年,單面膠帶佔據最大佔有率,達62.9%,因其易於使用且在不同表面具有一致的黏合性而備受青睞。這些膠帶適用於各種臨床用途,從固定導管、敷料到醫療器械,使其成為醫院和家庭護理環境中的可靠選擇。其透氣親膚的特性,加上防潮性能,使其能夠更安全、更快速地處理患者,這在快節奏的護理環境中至關重要。

2024年,美國醫用膠帶市場規模達24億美元。這一市場主導地位得益於其先進的醫療基礎設施和對可靠傷口護理產品日益成長的需求。老齡人口的成長以及糖尿病等疾病的高發生率是醫用膠帶使用量上升的主要原因。美國廣泛的醫療保健網路持續推動高性能膠帶的使用,這些膠帶能夠增強傷口癒合並提高患者舒適度。

積極參與全球醫用膠帶市場的主要公司包括強生、全錄輝、日東電工株式會社、麥克森公司、Dermarite Industries、Medline Industries、美敦力、艾利丹尼森公司、DermaMed Coatings Company、Nichiban、琳得科公司和康德樂。為了鞏固市場地位,醫用膠帶市場的公司正在採取各種成長策略。他們正在投資研發,以設計更先進、更安全、更透氣的黏合劑解決方案,以滿足不同的膚質和臨床需求。與醫療保健提供者的合作以及向高成長地區的擴張,可以擴大產品的覆蓋範圍。許多公司正專注於擴大製造能力和供應鏈,以滿足日益成長的全球需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 道路交通事故和其他創傷事件激增

- 慢性病盛行率不斷上升

- 外科手術數量不斷增加

- 新興經濟體醫療保健產業蓬勃發展

- 成長動力

產業陷阱與挑戰

- 原料成本高

- 嚴格的監管情景

- 市場機會

- 醫用膠帶技術創新不斷湧現

- 成長潛力分析

- 監管格局

- 技術進步

- 供應鏈分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 丙烯酸纖維

- 矽酮

- 橡皮

第6章:市場估計與預測:按黏合劑,2021 - 2034 年

- 主要趨勢

- 單面塗敷

- 雙面塗層

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 手術

- 傷口敷料

- 設備固定

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 專科診所

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Avery Dennison Corporation

- Berry Global Group

- Cardinal Health

- DermaMed Coatings Company

- Dermarite Industries

- Flexcon Company

- Johnson & Johnson

- Lintec Corporation

- Lohmann GmbH

- McKesson Corporation

- Medline Industries

- Medtronic

- Nichiban

- Nitto Denko Corporation

- Paul Hartmann

- Smith & Nephew

- Solventum

The Global Medical Adhesive Tapes Market was valued at USD 7.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 12.9 billion by 2034. Rising demand for efficient wound care solutions is largely fueled by the growing incidence of chronic diseases, a surge in surgical interventions, and a notable increase in trauma-related cases. Medical adhesive tapes play a critical role in modern healthcare for securing bandages, IV lines, and medical devices, and are essential in emergency treatments requiring prompt wound management. The market continues to evolve, with greater emphasis on comfort, skin compatibility, and customization.

Manufacturers are developing advanced skin-friendly and hypoallergenic options that reduce irritation and improve healing outcomes. Innovations in adhesives, including silicone-based and biocompatible materials, are reshaping product standards. The shift toward patient-specific care further influences purchasing behavior, with sensitivity, mobility, and wound site factors considered. Major players such as Flexcon Company, Paul Hartmann, Berry Global Group, Solventum, and Lohmann GmbH are helping shape the market landscape by prioritizing product innovation and clinical efficacy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 5.4% |

In 2024, the acrylic-based medical adhesive tapes accounted for a 59.8% share. Their appeal lies in their breathability, resistance to heat and moisture, and compatibility with both short-term and extended applications. The ability of acrylic adhesives to manage moisture vapor transmission helps reduce the risk of skin breakdown and supports better healing environments. This balance of comfort and durability makes them ideal for use in wound care and surgical settings.

The single-coated tapes held the largest share at 62.9% in 2024, favored for their easy application and consistent adhesion across different surfaces. These tapes are designed for a range of clinical uses, from securing tubing and dressings to medical devices, making them a reliable option in both hospital and home care settings. Their breathable and skin-friendly properties, combined with moisture resistance, allow for safer and quicker patient handling, which is critical in fast-paced care environments.

U.S. Medical Adhesive Tapes Market generated USD 2.4 billion in 2024. This dominance is driven by its advanced healthcare infrastructure and increasing demand for reliable wound care products. A growing elderly population and the high prevalence of conditions like diabetes are major contributors to rising usage. The country's extensive healthcare network continues to promote the use of high-performance tapes that offer enhanced healing and patient comfort.

Key companies actively involved in the Global Medical Adhesive Tapes Market include Johnson & Johnson, Smith & Nephew, Nitto Denko Corporation, McKesson Corporation, Dermarite Industries, Medline Industries, Medtronic, Avery Dennison Corporation, DermaMed Coatings Company, Nichiban, Lintec Corporation, and Cardinal Health. To strengthen their position, companies operating in the medical adhesive tapes market are adopting a variety of growth strategies. They are investing in R&D to engineer more advanced, skin-safe, and breathable adhesive solutions tailored to different skin types and clinical needs. Partnerships with healthcare providers and expansion into high-growth regions allow for improved product reach. Many are focusing on expanding manufacturing capabilities and supply chains to meet increasing global demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Adhesive trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in road accidents and other traumatic incidents

- 3.2.1.2 Increasing prevalence of chronic disorders

- 3.2.1.3 Rising number of surgical procedures

- 3.2.1.4 Growing healthcare sector in emerging economies

- 3.2.1 Growth drivers

Industry pitfalls and challenges

- 3.2.1.5 High cost of raw material

- 3.2.1.6 Stringent regulatory scenario

- 3.2.2 Market opportunities

- 3.2.2.1 Rising technological innovations in medical tapes

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.6 Supply chain analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Acrylic

- 5.3 Silicone

- 5.4 Rubber

Chapter 6 Market Estimates and Forecast, By Adhesive, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single coated

- 6.3 Double coated

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Surgery

- 7.3 Wound dressing

- 7.4 Device fixation

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Avery Dennison Corporation

- 10.2 Berry Global Group

- 10.3 Cardinal Health

- 10.4 DermaMed Coatings Company

- 10.5 Dermarite Industries

- 10.6 Flexcon Company

- 10.7 Johnson & Johnson

- 10.8 Lintec Corporation

- 10.9 Lohmann GmbH

- 10.10 McKesson Corporation

- 10.11 Medline Industries

- 10.12 Medtronic

- 10.13 Nichiban

- 10.14 Nitto Denko Corporation

- 10.15 Paul Hartmann

- 10.16 Smith & Nephew

- 10.17 Solventum